Schoolteachers, commonly underappreciated and underpaid, have actually long been culture’s unhonored heroes. Despite their moderate wages, lots of instructors are silently constructing considerable wide range. According to a research study task by Ramsey Solutions called the “National Study of Millionaires,” lots of instructors are locating their means right into the millionaires’ club.

Don’t Miss:

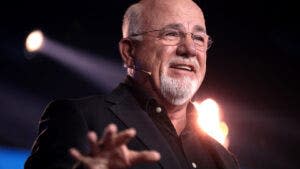

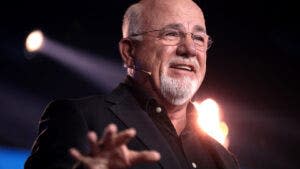

Dave Ramsey, a highly regarded voice in individual money and chief executive officer of Ramsey Solutions, brought this shocking pattern to the spotlight. “You don’t have to make a huge income to build wealth,” Ramsey stated. “You can’t earn your way out of stupidity.” His words emphasize an unusual truth: Many millionaires are low income earners however clever organizers.

See Also: The variety of ‘401(k)’ Millionaires is up 43% from last year — Here are three ways to join the club.

According to the U.S. Bureau of Labor Statistics, teachers are on the list of careers most likely to have millionaires, with an average annual salary of $61,690, just behind engineers and accountants. Meanwhile, despite their hefty paychecks, physicians don’t even crack the top five.

Based on a survey of 10,000 millionaires, the report found that most of them did not come from well-off families. A staggering 79% did not inherit their fortune. Instead, they invested wisely – eight of ten had a 401(k). Interestingly, three-quarters of them did not hold high-paying jobs, thus dispelling the myth that wealth is reserved for the superrich.

Trending: Warren Buffett flipped his neighbor’s $67,000 life savings into a $50 million fortune — How much is that worth today?

“These people are systematic,” Ramsey said. “They work with plans and play by the rules.” He highlighted the importance of well-planned spending and investing habits, stating that 85% of millionaires use a shopping list, with 28% consistently sticking to it.

Noting that many are working hard to build up their savings, Ramsey said that some of the attractive offers are certificates of deposit (CDs) with good interest rates and fixed terms.

Another avenue that Ramsey emphasized is high-yield savings accounts, which can yield returns exceeding 4%. “A high-yield savings account is a no-brainer if you’re serious about growing your money. It’s about making your money work for you,” he remarked.

Trending: A billion-dollar investment strategy with minimums as low as $10 — you can become part of the next big real estate boom today.

He also touched on how passion affects financial outcomes. “Don’ t take a work even if it pays,” he said. “You should certainly make even more cash if you’re doing something you enjoy. You’re proficient at it, you care, you’re innovative.” However, he warned versus the idea that a high income assurances wide range.

Moderate- revenue earners, like instructors, can make sufficient cash to become rich with cautious preparation. “You don’t have to have a gigantic paycheck to have a secure financial future,” Ramsey stated.

Ramsey’s understandings reach the clinical area, where lots of medical professionals fight with financial debt and postponed financial investments in spite of their large salaries.

Brent Lacey, the host of “The Scope of Practice” podcast, reverberated with this belief, mentioning that medical professionals commonly lose out on years of prospective financial investments as a result of the weight of trainee finances. “After enduring so much sacrifice, they believe it’s finally their turn to enjoy their earnings,” Lacey mentioned, contrasting this with his granny, a thrifty public teacher that retired with a lot of money.

Read Next:

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Stock Market Game with the # 1 “news & everything else” trading device: Benzinga Pro – Click right here to begin Your 14-Day Trial Now!

Get the current supply evaluation from Benzinga?

This write-up ‘You Can’t Earn Your Way Out of Stupidity’: Dave Ramsey On Why $60K-Earning Teachers Often Become Millionaires initially showed up onBenzinga com

© 2024Benzinga com. Benzinga does not give financial investment guidance. All legal rights booked.