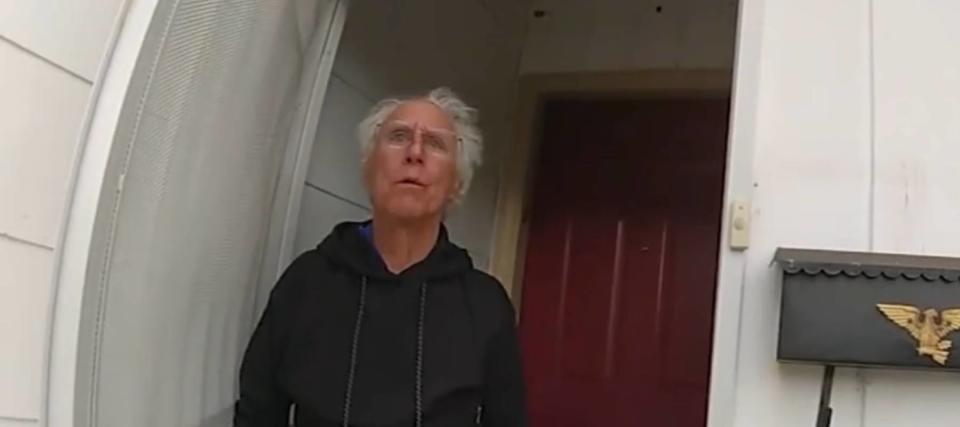

On top of shedding his life financial savings to fraudsters, Chester Frilich of Concord, California is dealing with a tax obligation expense of over $30,000 which might finish in him shedding his home.

As reported by ABC7 News, his troubles started when he got a telephone call from someone declaring to be from Xfinity, that asserted his account was made use of to publish adult video clips. An hour later on, he learnt through “Jason Brown” with the Federal Trade Commission, detailing every one of his bank card and informing him he was under examination for cord fraudulence.

Don’t miss out on

-

Commercial realty has actually defeated the securities market for 25 years– yet just the very abundant might get in. Here’s exactly how also normal capitalists can end up being the property manager of Walmart, Whole Foods or Kroger

-

Car insurance coverage costs in America are via the roof covering– and just worsening. But 5 mins might have you paying as low as $29/month

-

These 5 magic cash relocations will certainly enhance you up America’s web worth ladder in 2024– and you can finish each action within mins. Here’s exactly how

In order to get rid of the problems, the fraudsters impersonating the FTC stated they would certainly assist him relocate his cash to a “secure account,” which entailed him sending out countless bucks of gold and money via messengers and UPS. He used several accounts, consisting of Certificate of Deposit (CD) and individual retirement account accounts, to send out over $200,000 in funds prior to the authorities notified him that it was all a fraud. By making use of those accounts to send out cash, Frilich accumulated a tax obligation problem of around $30,000, which will certainly finish in the internal revenue service placing a lien on his home if he can not foot the bill or exercise a plan with the company.

While shedding cash in a fraud is terrible, obtaining punished in addition to it makes it also worse. How can you secure on your own from tax obligation troubles as you attempt to prevent fraudulence?

Why very early withdrawal fines issue

While most financial institution and spending accounts are created to hold “liquid” possessions– specified as money or possessions that can be transformed to pay rapidly and quickly– some accounts are structured to efficiently “lock down” cash to pay rate of interest and returns over a prolonged time period and are ruled out “liquid.” Examples consist of both sorts of accounts Frilich drew cash from: Certificate of Deposit (CD) accounts and Individual Retirement Accounts (IRAs).

Both are created to maintain cash secured for a prolonged time period, yet in various methods. A CD is used by financial institutions or cooperative credit union as a cost savings alternative, where customers accept transfer their cash for a particular time period prior to they can make a withdrawal. CD terms can vary anywhere from one month right to 5 years. IRAs are financial investment accounts created to assist you conserve cash for your retired life. The earliest one can take out cash from an individual retirement account uncreative is when the account owner transforms 59 1/2.

Anyone taking out cash from either of those accounts prior to they grow will certainly encounter fines. Under government regulation, financial institutions are permitted to bill fines for very early withdrawal of CDs. While the minimal charge is 7 days of easy rate of interest if the withdrawal is done within 6 days of down payment, a bigger charge can request very early withdrawal at any kind of various other time throughout the term. In enhancement to financial institution fines, returns gained on CDs is gross income, and have to be reported on your tax obligations for the year it was taken out.

The regulations for IRAs are a little bit extra complicated. Account owners can make withdrawals scot-free under specific permitted exemptions, such as the birth or fostering of a kid, recuperating from an all-natural catastrophe, or making use of the cash for certified college expenditures. In all various other scenarios, a withdrawal is not just consisted of as component of your gross earnings tax obligation at the end of the year, yet is additionally based on an added 10% tax obligation charge. In both scenarios, Frilich encounter tax obligation fines that would certainly schedule with his tax return. Because he could not pay the complete tax obligation expense in time, the internal revenue service claims they can place a lien on the home to safeguard the federal government’s rate of interest in his residential property. And not just can that be difficult, it can harm your credit report and remain on your credit score record for several years.

Read extra: Car insurance coverage prices have actually surged in the United States to a spectacular $2,150/ year– yet you can be smarter than that. Here’s exactly how you can conserve on your own as long as $820 every year in mins (it’s 100% cost-free)

Protecting on your own from both frauds and tax obligation fines

Before sending out cash to any individual, it’s essential to guarantee you recognize that the recipient is, and where the cash is going. Government acting frauds generally begin with someone calling you claiming they’re from a company and you require to provide cash quickly, or something negative will certainly take place.

The Federal Trade Commission stresses that federal government firms will certainly never ever phone call, e-mail, or message to inquire or cash. Additionally, if somebody claims they’re from a firm and provides you settlement from a previous fraud, provides to attach to your computer system to safeguard your reimbursement, or provides to send you a look for over the contested quantity with the assurance to send it back, it’s most likely a reimbursement fraud. Before accepting anything, hang up and do your study to guarantee you’re not a target for burglary.

Scammers might attempt to develop authority by utilizing details from a target’s (unlawfully gotten) credit score record. One method to shield on your own from credit score record strikes is via a credit score freeze. A freeze is a totally free solution used by all 3 credit rating coverage firms (Equifax, Experian, and TransUnion), which secures down accessibility to your record to brand-new demands. While it can shield your individual details, you will certainly require to thaw your credit rating if you are getting a brand-new charge card or funding.

Finally, Frilich claims his greatest blunder was panicking when called by the fraudsters, and authorizing a non-disclosure arrangement which avoided him from understanding that they genuinely were. The FTC claims if you understand you’re being scammed, removed interactions with the fraudsters right away, and begin doing troubleshooting to avoid more strikes. This consists of getting in touch with the settlement supplier to attempt and turn around any kind of cash sent out, transforming your savings account and charge card numbers, producing brand-new usernames and passwords for any kind of online accounts a fraudster could have accessibility to, and doing safety scans to get rid of any kind of accessibility they might need to your computer system or cellular phone.

And, certainly, make sure to report the occurrence to the FTC.

What to check out following

This short article gives details just and must not be interpreted as guidance. It is supplied without service warranty of any kind of kind.

-1748938084015_d.png?w=100&resize=100,70&ssl=1)