For the lion’s share of 2 years, the bulls have actually been strongly in control onWall Street A durable united state economic climate, combined with enjoyment bordering the increase of expert system (AI), have actually aided raise the eternal Dow Jones Industrial Average ( DJINDICES: ^ DJI), standard S&P 500 ( SNPINDEX: ^ GSPC), and growth-focused Nasdaq Composite ( NASDAQINDEX: ^ IXIC) to numerous record-closing highs in 2024.

However, positive outlook isn’t global when it concerns spending. Some of one of the most famous and commonly complied with billionaire cash supervisors, consisting of Berkshire Hathaway‘s ( NYSE: BRK.A)( NYSE: BRK.B) Warren Buffett, Appaloosa’s David Tepper, and Fundsmith’s Terry Smith, have actually been sending out a threatening caution to Wall Street with their trading task.

Some of Wall Street’s leading capitalists are pulling back to the sidelines

Although no cash supervisor is a carbon duplicate of an additional, Buffett, Tepper, and Smith are reduced from comparable fabrics. While they might have various locations of competence or meddle financial investment locations the various other 2 might not– e.g., David Tepper has a tendency to be a little bit of a contrarian and isn’t terrified to purchase troubled possessions, consisting of financial obligation– all 3 have a tendency to be patient capitalists that concentrate on finding undervalued/underappreciated firms that can be held for extended periods in their corresponding funds. It’s a truly basic formula that’s functioned well for all 3 billionaire capitalists.

When Form 13Fs are submitted with the Securities and Exchange Commission each quarter, expert and daily capitalists group to these records to see which supplies, markets, fields, and patterns have actually been stimulating the passion of Wall Street’s brightest financial investment minds. However, the current round of 13Fs had a shock for capitalists that very closely comply with the trading task of Buffett, Tepper, and Smith.

The June- finished quarter noted the 7th successive quarter that Warren Buffett was an internet vendor of supplies. Jettisoning greater than 389 million shares of leading holding Apple throughout the 2nd quarter, and north of 500 million shares, in accumulation, becauseOct 1, 2023, has actually brought about an advancing $131.6 billion in web supply sales because the begin of October 2022.

Despite supporting that capitalists not wager versus America, and highlighting the worth of long-lasting investing, Buffett’s temporary activities have not associated his long-lasting principles.

But he’s not the only one.

David Tepper’s Appaloosa liquidated June with a 37-security financial investment profile worth around $6.2 billion. During the 2nd quarter, Tepper and his group included in 9 of these settings and lowered or entirely offered his fund’s risk in 28 others, consisting of Amazon, Microsoft, Meta Platforms, andNvidia Tepper unloaded 3.73 million shares of Nvidia, corresponding to greater than 84% of Appaloosa’s prior setting.

U.K. supply picker extraordinaire Terry Smith finished June with a 40-stock profile worth approximately $24.5 billion. He included in his risks in simply 3 of these 40 supplies– Fortinet, Texas Instruments, and Oddity Tech— while minimizing his fund’s setting in the various other 37.

These person and traditionally confident capitalists are sending out a message that’s undoubtedly clear: Value is tough ahead by now on Wall Street.

Stocks are traditionally costly– which’s a trouble

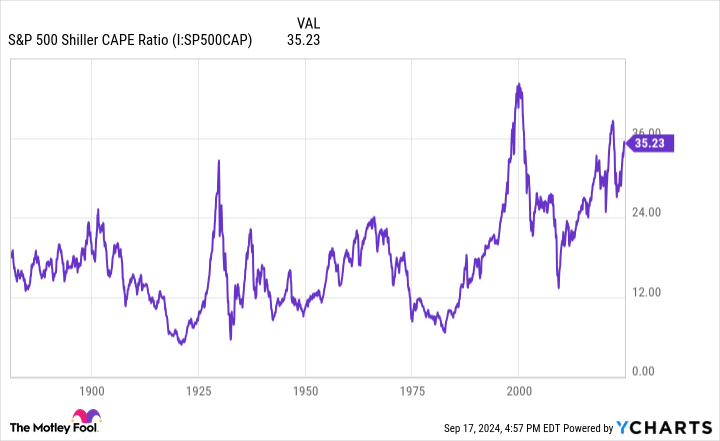

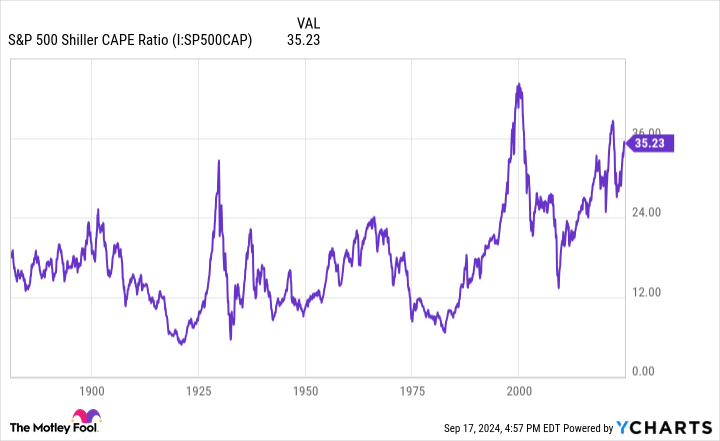

Although “value” is an entirely subjective term, one evaluation device indicate supplies going to among their most costly degrees in background, going back to the 1870s. I’m speaking about the S&P 500’s Shiller price-to-earnings (P/E) proportion, which is likewise referred to as the cyclically readjusted price-to-earnings proportion (CAPE proportion).

Most capitalists are possibly acquainted with the standard P/E proportion, which splits a business’s share cost right into its trailing-12-month incomes per share (EPS). While the P/E proportion has a tendency to function rather well for fully grown organizations, it fails for development supplies that reinvest a great deal of their capital. It can likewise be detrimentally influenced by one-off occasions, such as the COVID-19 lockdowns.

The Shiller P/E proportion is based upon ordinary inflation-adjusted EPS over the last one decade. Taking a years’s well worth of incomes background right into account indicates temporary occasions do not detrimentally influence this evaluation design.

As of the closing bell onSept 16, the S&P 500’s Shiller P/E stood at 36.27, which is simply listed below its 2024 high of approximately 37, and greater than double the 153-year standard of 17.16, when back-tested to 1871.

To be reasonable, the Shiller P/E has actually invested a lot of the last thirty years over its historical standard because of 2 variables:

-

The web equalized the accessibility to details, which offered daily capitalists much more self-confidence to take threats.

-

Interest prices invested greater than a years at or near historical lows, which motivated capitalists to load right into higher-multiple development supplies that can take advantage of reduced loaning expenses.

But when taken a look at in its entirety, there are just 2 various other durations throughout background where the S&P 500’s Shiller P/E sustained a greater degree throughout a booming market. It came to a head at 44.19 in December 1999, simply before the dot-com bubble bursting, and briefly covered 40 throughout the very first week of January 2022.

Following the dot-com bubble optimal, the S&P 500 lost simply timid of fifty percent of its worth, while the Nasdaq Composite shed greater than three-quarters prior to discovering its ground. Meanwhile, the 2022 bearish market saw the Dow Jones, S&P 500, and Nasdaq Composite all shed at the very least 20% of their worth.

In 153 years, there have actually just been 6 events where the S&P 500’s Shiller P/E has actually gone beyond 30 throughout a booming market, consisting of today. Following all 5 previous circumstances, the minimum disadvantage in the S&P 500 has actually been 20%, with the Dow Jones Industrial Average shedding as high as 89% throughout the Great Depression.

The factor is that expanded supply appraisals can just be maintained for as long. Even though Warren Buffett would certainly never ever wager versus America, and Terry Smith is constantly looking for underestimated possessions, neither billionaire cash supervisor really feels urged to place their funding to function. In reality, Berkshire Hathaway was resting on a document $276.9 billion in cash money at the end of June, and Buffett still isn’t a customer of supplies … aside from shares of his very own business.

In short, a few of Wall Street’s most-successful long-lasting, value-seeking capitalists desire little to do with the stock exchange now, and it’s an extremely clear caution that capitalists must be focusing on.

Where to spend $1,000 now

When our expert group has a supply idea, it can pay to pay attention. After all, Stock Advisor’s complete ordinary return is 762%– a market-crushing outperformance contrasted to 167% for the S&P 500. *

They simply exposed what they think are the 10 ideal supplies for capitalists to purchase now …

See the 10 supplies “

*Stock Advisor returns since September 16, 2024

John Mackey, previous chief executive officer of Whole Foods Market, an Amazon subsidiary, belongs to The Motley Fool’s board of supervisors. Randi Zuckerberg, a previous supervisor of market advancement and spokesperson for Facebook and sis to Meta Platforms CHIEF EXECUTIVE OFFICER Mark Zuckerberg, belongs to The Motley Fool’s board of supervisors. Sean Williams has settings in Amazon andMeta Platforms The Motley Fool has settings in and suggests Amazon, Apple, Berkshire Hathaway, Fortinet, Meta Platforms, Microsoft, Nvidia, andTexas Instruments The Motley Fool suggests the complying with alternatives: lengthy January 2026 $395 contact Microsoft and brief January 2026 $405 contactMicrosoft The Motley Fool has a disclosure plan.

Billionaires Warren Buffett, David Tepper, and Terry Smith Are Sending a Very Clear Warning to Wall Street– Are You Paying Attention? was initially released by The Motley Fool