We just recently put together a listing of the 20 Trending AI Stocks on Latest News and Ratings. In this write-up, we are mosting likely to have a look at where Arm Holdings plc (NASDAQ: ARM) stands versus the various other trending AI supplies.

S&P 500 to Reach 6,000 by Year-End Amid AI Boom and Earnings Growth

Joining CNBC’s Squawk Box to review the most up to date market patterns, Mary Ann Bartels of Sanctuary Wealth continues to be favorable on 2024, anticipating the S&P 500 to strike 6,000 by year-end. As the Fed alters to a much easier financial plan and company earnings remain to expand, the primary financial investment planner thinks the marketplace will certainly preserve its rally as we come close to November and December.

As these days, the S&P is around 3% timid of striking 6,000. This is just 8 months after it overshadowed 5,000 for the very first time. Monday, October 14 verified to be a brand-new document for the S&P, noting the advancing market’s 2nd wedding anniversary. The landmark stands for a remarkable healing over the last 2 years when supply rates rose regardless of recurring economic crisis issues and raised rates of interest.

S&P 500 getting to all-time highs comes among positive outlook on Wall Street as the third-quarter profits period starts. With company profits verifying resistant among high prices and regulating rising cost of living, and capitalists stacking right into supplies positioned to profit one of the most from the generative AI fad- the marketplace view continues to be favorable as investors expect solid monetary outcomes and proceeded development in technology-driven markets.

Artificial Intelligence- connected supplies have actually been leading the S&P 500 and Nasdaq greater. On October 14, the S&P 500 and Dow Jones Industrial Average both got to all-time highs, closing 0.8% and 0.5%, specifically. Meanwhile, the Nasdaq obtained 1% and came close to a document of its very own. Despite these current gains, high assessments will apparently posture an obstacle for ongoing development, with experts keeping in mind that this might be an indication that the advancing market might be nearing its end.

Read a lot more regarding these advancements by accessing 10 Unsexy AI Stocks According to Goldman Sachs and 10 Buzzing AI Stocks According to Goldman Sachs.

Strategists additionally warn that progressing, proceeded gains will certainly rely on determining markets with solid profits development. As Artificial Intelligence is positioned to substantially affect future market efficiency, the emphasis will certainly change to AI’s effect on productivity throughout numerous sectors. According to Citi equity planner Scott Chronert, for AI to proceed driving market gains, “you’ve got to have more companies delivering on the AI promise via margins and profitability metrics.”

At the very same time, it is additionally real that recurring disputes in the Middle East, upcoming United States governmental political elections, and all-natural calamities might posture threats to the marketplace’s climb. Nevertheless, recurring AI technology and a durable economic climate are still on behalf of more gains. In light of this, Solita Marcelli, Chief Investment Officer for Americas at UBS Global Wealth Management, more notes just how third-quarter outcomes might function as a stimulant for market gains as capitalists concentrate on technology basics and AI.

“We remain to anticipate raised volatility for modern technology supplies in the close to term,” the note states. “However, we remain positive on the tech sector as well as the outlook for artificial intelligence (AI). Against this backdrop, we believe volatility should be utilized to build long-term AI exposure.”

According to the bank, October has historically been a turbulent month for tech stocks, citing how monthly realized volatility for the Nasdaq 100 over the past 40 years has been 26% in October, while other months have an average of 22%. Regardless, strong AI fundamentals and the upcoming earnings season will reaffirm positive growth trajectories.

It is further stated that the overall AI semiconductor industry is expected to grow sharply, reaching $168 billion by the end of the year. Tech and AI companies are also anticipated to “beat and raise” assumptions for the September quarter. Furthermore, the recurring change to smaller sized, a lot more effective AI chips will certainly drive considerable efficiency enhancements, sustaining more financial investment in the industry.

Read a lot more regarding these advancements by accessing 30 Most Important AI Stocks According to BlackRock and Beyond the Tech Giants: 35 Non-Tech AI Opportunities.

Our Methodology

For this write-up, we chose AI supplies by brushing via newspaper article, supply evaluation, and news release. These supplies are additionally prominent amongst hedge funds.

Why are we curious about the supplies that hedge funds stack right into? The factor is easy: our study has actually revealed that we can exceed the marketplace by mimicing the leading supply choices of the very best bush funds. Our quarterly e-newsletter’s approach picks 14 small-cap and large-cap supplies every quarter and has actually returned 275% given that May 2014, defeating its criteria by 150 portion factors ( see even more information right here).

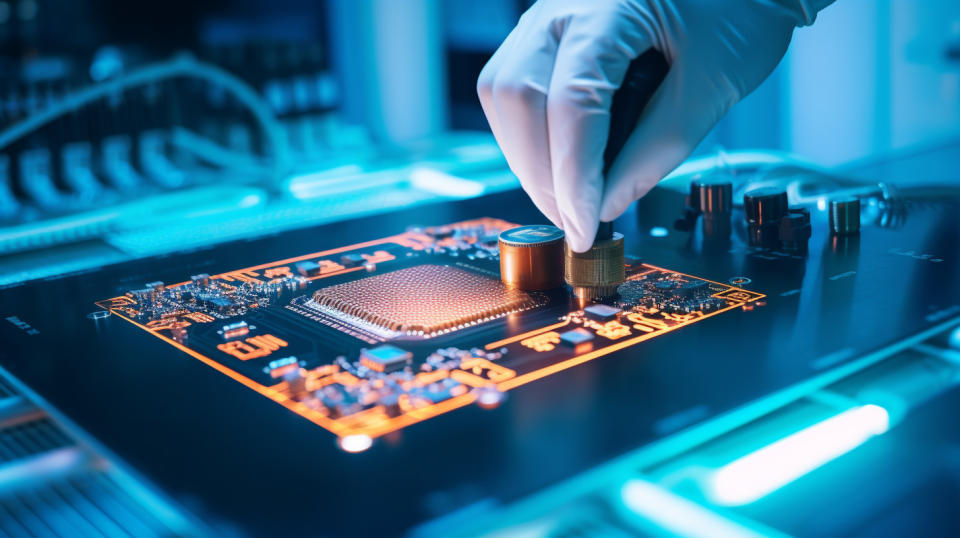

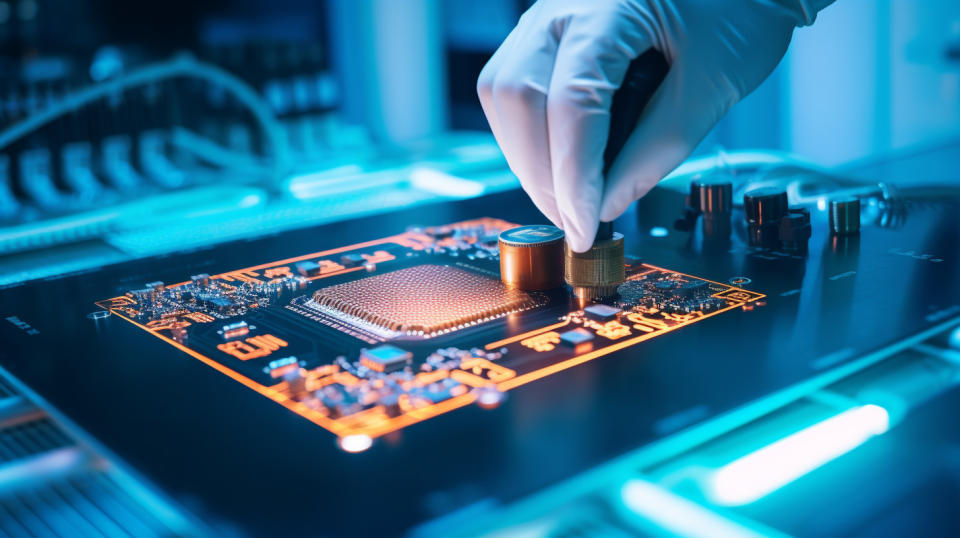

A close-up of a specialist’s hands servicing an innovative semiconductor substratum.

Arm Holdings plc (NASDAQ: ARM)

Number of Hedge Fund Holders: 38

Arm Holdings plc (NASDAQ: ARM) is a British semiconductor and software application style firm that makes and produces semiconductor modern technology and various other associated items. The firm showcases management in mobile and AI modern technology with items like the Axion cpu, Ethos- U85, and Windows onArm With a solid designer network and increasing market visibility, it is placed as a vital computer system throughout numerous sectors.

A year back, Arm Holdings plc (NASDAQ: ARM) presented Arm Total Design, a community of sector leaders teaming up to speed up and streamline the growth of Arm Neoverse CSS-based systems. Doubling in dimension and driving technology in AI and silicon growth, Arm Total Design has actually stimulated an international partnership with crucial companions, leading to “real-world CSS-powered solutions for GenAI computing”.

In most current information by ARM, Arm Holdings plc (NASDAQ: ARM), Samsung Foundry, ADVERTISEMENTTech nology, and Rebellions are signing up with pressures to offer market an AI CPU chiplet system. This system will certainly be targeting cloud, HPC, and AI/ML training and reasoning work, integrating Rebellions’ REBEL AI accelerator developed with a Neoverse CSS V3-powered calculate chiplet from advertisementTech nology to be applied with Samsung Foundry 2nm Gate-All-Around (GAA) progressed procedure modern technology. The system intends to provide matchless efficiency and ideal power effectiveness, with an approximated 2-3x effectiveness benefit for GenAI work (Llama3.1 405B criterion LLMs).

“AI and HPC designs require technology solutions that deliver maximum performance, high transistor density, and energy efficiency. Samsung Foundry’s 2nm GAA process is designed precisely to satisfy the most stringent HPC and AI design requirements, and we’re excited to leverage the flexibility of Arm CSS and the power of the Arm Total Design ecosystem to deliver an AI CPU chiplet platform, which will further accelerate adoption of our leading-edge technology and design solutions for hyperscalers and cloud service providers.”

-Taejoong Song, Vice President and Head of Foundry Business Development at Samsung Electronics.

Overall ARM rates 18th on our listing of the trending AI supplies on most current information and scores. While we recognize the capacity of ARM as a financial investment, our sentence depends on the idea that some AI supplies hold higher assurance for supplying greater returns, and doing so within a much shorter duration. If you are trying to find an AI supply that is a lot more appealing than ARM yet that professions at much less than 5 times its profits, have a look at our record regarding the most inexpensive AI supply

READ NEXT: $ 30 Trillion Opportunity: 15 Best Humanoid Robot Stocks to Buy According to Morgan Stanley and Jim Cramer Says NVIDIA ‘Has Become A Wasteland’.

Disclosure:None This write-up is initially released at Insider Monkey