There are all kind of misconceptions affixed to nearly every facet of individual money, from spending to your credit rating. Retirement is an additional typical style packed with cash misconceptions. If you’re not cautious, this sort of false information may cost you a comfy retired life.

Find Out: How Long $1 Million in Retirement Will Last in Every State

Try This: 7 Reasons You Shouldn’ t Retire Before Speaking to a Financial Advisor

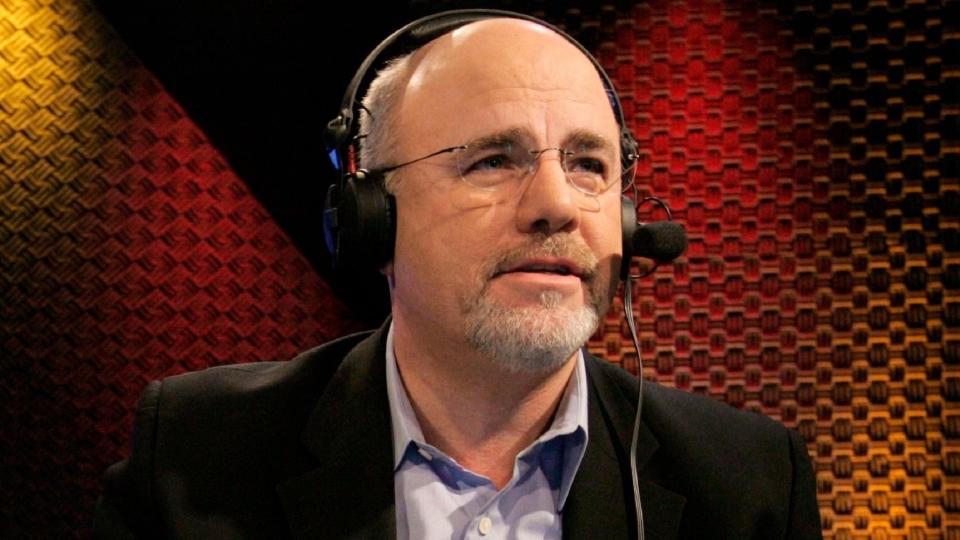

Money professional Dave Ramsey unmasked several of one of the most prominent retired life misconceptions on his siteRamsey Solutions It’s time to quit thinking these 6 retired life misconceptions.

Earning easy earnings does not require to be tough. You can begin today.

You’ll Live Off Social Security Alone

According to the article on Ramsey Solutions, retired people get an ordinary regular monthly earnings of $1,657 fromSocial Security If retired people relied upon this earnings alone, they would just get $19,900 yearly– and this quantity can not spend for a comfy retired life.

While it holds true retired people do get Social Security advantages when they retire, these advantages are not developed to money your whole retired life way of life. It’s approximately you to begin developing a durable retired life profile today.

Read Next: I’m an Economist: Here’s My Prediction for Social Security if Trump Wins the 2024 Election

You’ll Have Enough Money To Retire If You Invest Up to Your 401( k) Match

Maxing out your work environment 401( k) is a fantastic method to begin spending for your retired life. However, you must not quit spending just since you got to the suit.

The article on Ramsey Solutions suggests spending 15% of your earnings right into retired life. You can do this a couple of various means, depending upon if you have a typical 401( k) or Roth 401( k).

Those with a typical 401( k) are suggested by Ramsey Solutions to add approximately their company’s suit in their 401( k) and deal with a specialist to spend the remainder right into a Roth INDIVIDUAL RETIREMENT ACCOUNT.

If you have a Roth 401( k), it’s suggested you spend the complete 15% right into your work environment pension.

You’ll Work Through Retirement

This misconception includes a please note fromRamsey Solutions Retirees that do function when they’re retired will certainly do it since they intend to function. If they do not intend to and if they have actually monetarily established themselves up for a comfy retired life ahead of time, they will not need to do it.

Medicare Covers All of Your Medical Expenses

One of the most significant costs in retired life is health care. While retired people are qualified for Medicare once they get to age 65, it is not developed to cover every one of your health care costs.

Retirees will certainly require to spend for deductibles, copays and any type of lasting treatment costs, according to the Ramsey Solutions article.

To aid protect your retired life and battle any type of abrupt health care prices, retired people are suggested by Ramsey Solutions to enroll in lasting treatment insurance coverage once they get to age 60.

Retirees must likewise increase their retired life financial savings and spend cash right into a Health Savings Account (HSA) to aid spend for any type of clinical costs.

It’s Too Late To Save for Retirement

Says that? There is constantly time to conserve for retired life and expand your retired life financial savings.

If you’re dealing with a much shorter time perspective, Ramsey Solutions suggests spending 25% of your earnings yearly up until you get to age 67.

You Can Financially Guess Your Way to Retirement

It’s a quite huge misconception to assume you can monetarily intend your method right into retired life by yourself. Instead of trying to do it yourself your retired life monetary preparation trip, Ramsey suggests functioning together with a financial investment specialist.

Why should you deal with a pro? An financial investment specialist can assess your monetary prepare for retired life with you and identify if you get on the appropriate track. If you require to adapt to come back on course, they can share which transforms to make based upon their know-how– and not your guesstimates.

Moreover, dealing with a specialist permits you to ask any type of concerns you might have regarding retired life, obtain the responses you require and prepare for the following phase of your life with self-confidence.

More From GOBankingRates

This short article initially showed up on GOBankingRates.com: Dave Ramsey: 6 Biggest Retirement Myths You Shouldn’ t Believe