All eyes will certainly get on Federal Reserve Chairman Jay Powell when he introduces what the Fed is preparing to do with rate of interest throughout itsSept 17 and 18 conference. It’s an inevitable final thought that there will certainly go to the very least some price cut, however no one recognizes just how much. As an outcome, some customers might hold back on acquisitions up until after prices begin to drop, something that might enormously profit a couple of business.

One supply that might go allegorical if the Fed cuts prices is Upstart ( NASDAQ: UPST) Upstart’s software program is an alternate to FICO ratings and is utilized mainly in individual and vehicle financings, 2 locations that have not viewed as much need given that rate of interest increased.

Upstart utilizes AI to examine credit reliability

Upstart’s different financing version analyzes customers in different ways than a credit history. It utilizes different aspects that aren’t usually utilized in FICO ratings to much better examine a consumer’s credit reliability. It likewise utilizes expert system (AI) to do this, which can assist eliminate predisposition from authorizing financings. The outcomes are rather raw: Upstart has 53% less defaults than a conventional version at the very same authorization prices.

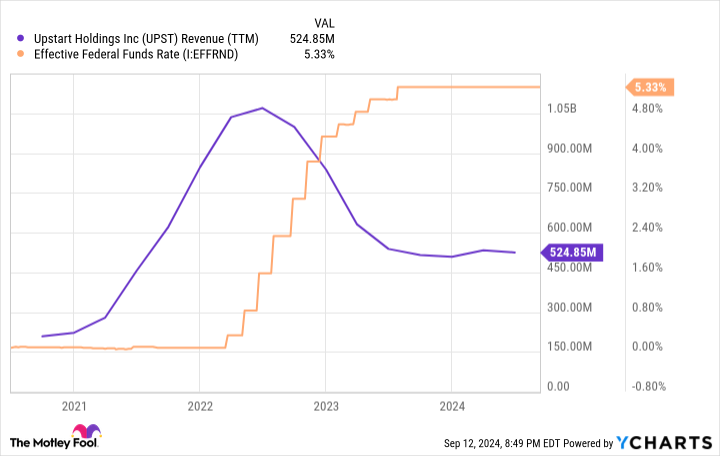

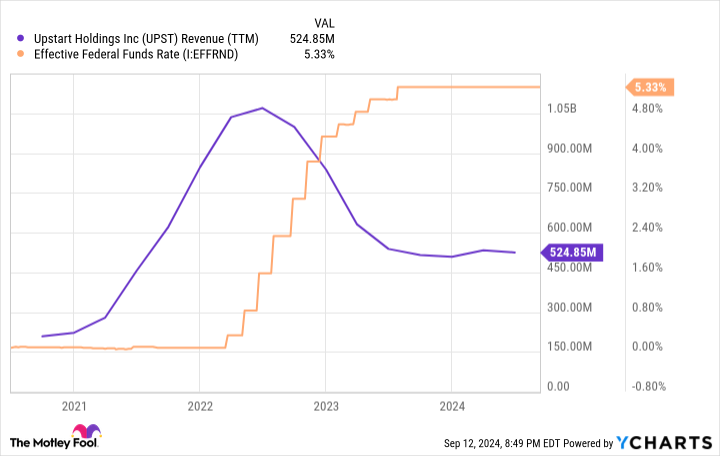

Upstart has a superb version, however the issue is that it isn’t in control of its very own fate. Because its company is connected to the rate of interest atmosphere, it can grow and breast together with those prices. Just a couple of years earlier, it had a $1 billion yearly income run price. Now, the number rests at regarding fifty percent of that quantity.

But those reduced income quarters are basically the inverse of the efficient government funds price, so this increases the concern: Can Upstart go back to importance if the Fed cuts prices?

Upstart’s company hasn’t succeeded with greater prices

The issue with Upstart is that its company requires booms to endure. As stated over, Upstart’s financing experience is concentrated on the individual and vehicle car loan room. These prices are frequently considerably more than the government funds price as a result of the boosted threat of these financings that the lending institution tackles. As an outcome, when prices are as high as they are currently, there is little need. However, if the Fed lowers prices, customers might be most likely to handle some financings if they can obtain a reduced price than formerly.

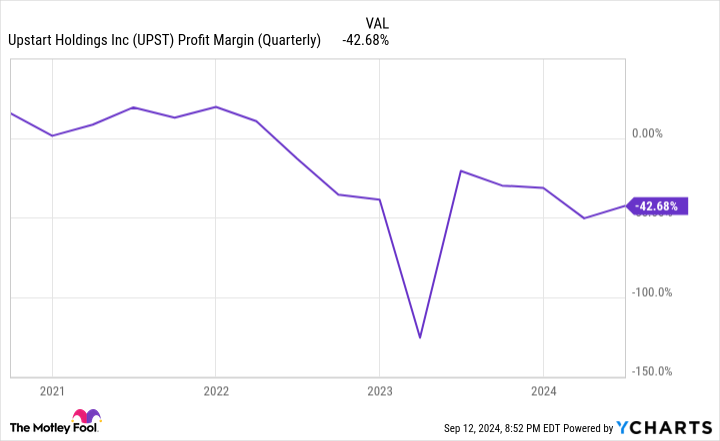

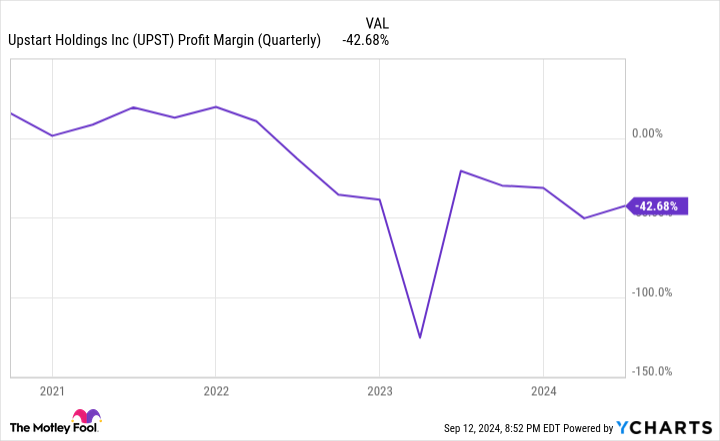

Unfortunately, Upstart has actually ended up being deeply unlucrative given that its company took a nose dive many thanks to high rate of interest.

Although the business’s income has actually remained rather consistent, it has actually done little to come to be a lot more effective and reduce its losses. This is a huge caution flag for me, as it reveals that it needs to have these reduced rate of interest durations in order to endure.

That is a mark of a firm that isn’t developed for the long-term. If Upstart were partially rewarding in poor times however enormously rewarding in great times, I’d reassess, however this isn’t the situation.

Still, this does not indicate the supply will not see substantial gains as the Fed cuts prices. There is most likely suppressed need for individual and vehicle financings, as customers might have been staying clear of taking on financings as a result of greater prices than in current times. As an outcome, Upstart’s company will likely remove, and the supply might do the same.

Unless monitoring makes some adjustments from the past boom, Upstart might battle once again years in the future. The supply might be acquired below if it alters right. But if it sticks to its old methods (which it has actually corrected the previous couple of quarters), it might duplicate its issues a couple of years from currently.

Should you spend $1,000 in Upstart today?

Before you get supply in Upstart, consider this:

The Motley Fool Stock Advisor expert group simply determined what they think are the 10 finest supplies for capitalists to get currently … and Upstart had not been among them. The 10 supplies that made it might create beast returns in the coming years.

Consider when Nvidia made this checklist on April 15, 2005 … if you spent $1,000 at the time of our suggestion, you would certainly have $729,857! *

Stock Advisor supplies capitalists with an easy-to-follow plan for success, consisting of support on constructing a profile, routine updates from experts, and 2 brand-new supply choices monthly. The Stock Advisor solution has greater than quadrupled the return of S&P 500 given that 2002 *.

See the 10 supplies “

*Stock Advisor returns since September 16, 2024

Keithen Drury has placements inUpstart The Motley Fool has placements in and suggestsUpstart The Motley Fool has a disclosure plan.

1 Stock Down 91% That Could Go Parabolic if the Fed Cuts Rates was initially released by The Motley Fool