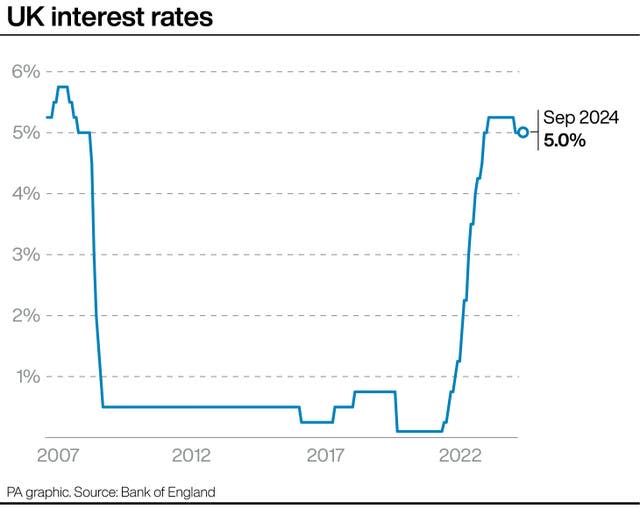

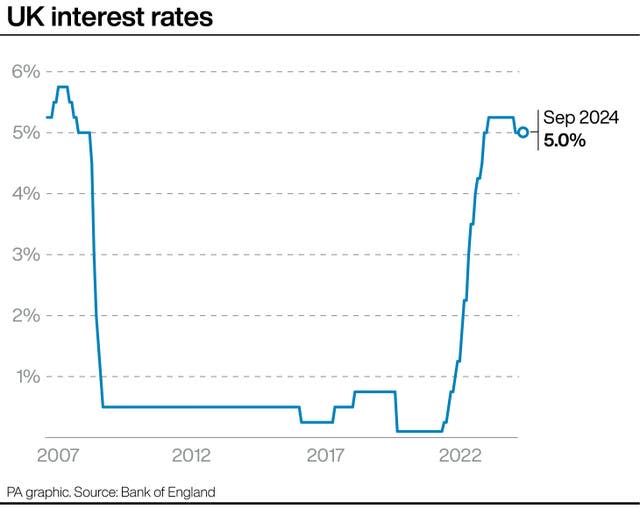

The Bank of England has actually stated rate of interest might boil down “gradually over time” after choosing to maintain them the same at 5% on Thursday.

Economists assume the following cut to loaning prices might come when policymakers following fulfill in November.

Here the information company takes a look at what the choice indicates and whether prices might be reduced once more quickly.

— What occurred to rate of interest on Thursday?

The Bank of England’s Monetary Policy Committee (MPC) maintained the base rates of interest the same at 5%.

Eight of the 9 participants on the MPC elected to maintain prices the exact same, with one participant liking to reduce them to 4.75%.

Last month, the reserve bank lowered prices from 5.25%– a landmark minute as it stood for the very first time they had actually been reduced because 2020.

Andrew Bailey, the Bank’s guv, stated on Thursday: “The economy has been evolving broadly as we expected.

“If that continues, we should be able to reduce rates gradually over time.”

— What does it really suggest?

The base price affects the cost that financial institutions bill consumers for home loans and financings.

It is made use of as a device to manage rising cost of living throughout the UK.

Hikes recently have actually left home mortgage prices a lot more than was typical for the majority of the last years.

However, home mortgage prices have actually been bordering down in current weeks after the Bank started a predicted cycle of rate of interest cuts.

Sam Richardson, replacement editor of customer system Which? Money, stated: “The Bank’s decision to hold rates where they are won’t come as a surprise, but will nevertheless still be a disappointment to homeowners coming towards the end of their fixed-term deal who would have been hoping for downward movement in the market.”

He stated that while the current choice indicates prices are “unlikely to rise beyond the current levels, the pace of rate cuts is now likely to slow down”.

— Are rates still rising?

Yes, yet at a price that the Bank of England is a lot more comfy with.

Consumer Prices Index (CPI) rising cost of living hit 2% in May and June this year, the Bank’s target degree, prior to bordering approximately 2.2% in July and August, according to main numbers.

However, the MPC emphasized that it required to ensure that anything taxing rising cost of living was “squeezed out of the system” totally.

Mr Bailey stated it is “vital that inflation stays low”.

— When will rate of interest boil down once more?

Some economic experts assume that the Bank of England signified in its messaging on Thursday that maybe in a setting to reduce rate of interest once more when the MPC following fulfills in November.

This is due to the fact that brand-new financial information might provide it a lot more self-confidence that rising cost of living is remaining to enter the appropriate instructions.

Janet Mui, head of market evaluation at RBC Brewin Dolphin, stated: “It is fair to expect that the Bank of England will be able to keep cutting rates over the course of the next 12 to 18 months, but at a gradual and modest pace.”

“The next cut is largely expected to be November,” she stated, yet emphasized that the Bank’s decision-making will certainly hinge on the current financial information.

Andrew Goodwin, primary UK economic expert for Oxford Economics, stated an additional price reduced in November was “almost certain”, as the MPC has actually stated that it would certainly decrease prices slowly unless there were any kind of shocks to the economic climate.

&w=324&resize=324,235&ssl=1)