No one suches as to consider what occurs after they pass away, however there are some subjects you simply can not pay for to prevent.

This is specifically real when it pertains to your pension plan.

After all, you have actually invested your life striving to accumulate that cash, so if the most awful occurs, you wish to guarantee it mosts likely to individuals you respect.

For most private pension schemes your continuing to be pot can be handed down to your recipients. For the state pension plan, it’s a bit a lot more difficult.

Here, Telegraph Money takes you via what you require to recognize:

What occurs to your pension plan when you pass away?

Passing away will certainly indicate various points for various sorts of pension plans. For instance, exclusive pension plan settlements are not the like state pension plan settlements, and also the kind of exclusive pension plan you have will certainly be a significant consider establishing what occurs after you pass away.

When you die you will certainly either have the ability to hand down your pension plans to a recipient or it might quit completely, depending upon what kind of pension plan it is and exactly how it runs.

For most exclusive pension plan plans, your continuing to be pot can be handed down to your recipients. For the state pension plan, it’s a bit a lot more difficult.

A great initial step is seeing to it you recognize what kind of pension plan you have– you can learn what occurs per kind of pension plan listed below.

Types of pension plans

Here, we will certainly take you via the various sorts of pension plan and what it can indicate for exactly how your own operates fatality.

State pension plan

Your state pension plan will normally quit when you pass away. However, if you leave a better half, partner or civil companion they might have the ability to obtain several of your allocation or obtain an uplift to their own. Various aspects impact this such as your age, whether you pass away prior to or after state pension plan age, and if they remarry or create a brand-new civil collaboration prior to they get to state pension plan age themselves.

If your companion got to state pension plan age prior to April 6, 2016, they might have the ability to enhance their very own state pension plan or acquire additional settlements based upon your National Insurance document. If you delayed your state pension plan and had not asserted it when you passed away, they can acquire this also.

If they get to state pension plan age hereafter, the regulations are much less charitable. They can not cover up their state pension plan (unless they’re a woman and meet certain conditions) or obtain your delayed quantity if you passed away prior to asserting it. However, they could still have the ability to acquire several of your state pension plan, based on specific problems. There are great deals of points to take into consideration.

Jackie Spencer, head of cash and pension plans plan and method at the Money and Pensions Service stated: “If you die, your civil partner or spouse may be able to increase their basic state pension by up to £156.20 a week [increasing to £169.50 from April 2024]. This is dependent on what they are receiving as their basic state pension and your National Insurance contributions. They will also need to be over state pension age.

“If you are not married or in a civil partnership when you die it may also be possible for your estate to claim up to three months of your basic state pension, which will go to the beneficiaries. This is only if you had not claimed your pension.

“There may also be some other money in the form of additional state pension, a protected payment, or extra state pension, or lump sum. This depends on whether you were in a marriage or civil partnership before 6 April 2016 and some other criteria.”

The Government gives a useful tool that you can tailor to your circumstances

Workplace pension plan

What occurs to your office pension plan after you pass away depends upon what kind of pension plan it is. There are 2 major kinds; specified payment pension plan and specified advantage or last wage pension plan.

Defined payment pension plans

In a defined contribution pension (often called a “money purchase scheme”), you accumulate a “pot” with your payments and those from your company that is after that spent for you. The dimension of that pot when you retire establishes the degree of earnings you can obtain.

Ms Loveridge stated: “If you die before drawing this pension, the whole pot can usually be passed on to your beneficiaries.”

While a specified payment plan does not need to be connected to your work, it commonly is.

Tom Selby, the head of retired life plan at AJ Bell, stated: “If you have a defined contribution pension, such as a Sipp (self-invested personal pension), you can nominate as many people as you like to inherit your retirement pot, or portion of your pot.”

Final wage pension plans

The regulations are various for last wage pension plan plans, additionally called defined benefit schemes, where the pension plan is based upon your wage and the length of time you have actually helped your company. They are becoming rarer these days however around 700,000 individuals throughout the UK still have one.

What occurs when you pass away will certainly rely on the regards to your pension plan, which might vary depending upon the carrier. Different careers are additionally component of various pension plan plans that include their very own regulations, such as the authorities, the NHS and educators.

Your strategy might remain to pay to a partner, dependant kids, handicapped kid of any kind of age or others that are monetarily depending on you. Your strategy might additionally consist of various other advantages that will certainly be paid to a recipient as a round figure, such as a fatality in solution advantage. However, this will certainly additionally be established by your carrier.

You ought to contact your carrier to make certain you more than happy with what you’re leaving. Commonly, if you have no dependants, all settlements will certainly quit when you pass away.

Drawdown pension plan

When you get to regular pension plan age (presently 66), you have the exact same choices– withdraw it as a round figure, utilize it to acquire an annuity or proceed with a drawdown. If you opt for a drawdown pension, you can take cash from your pot as and when you require it. Meanwhile, the remainder of the quantity remains spent and remains to get worth.

If you pass away, your recipients will certainly have accessibility to your pension plan and they have the exact same choices. However, some funds do not enable recipients to drawdown cost savings similarly as the initial proprietor so they might need to move your fund to a carrier that does.

Options for recipients

Your recipient will normally require to call your pension plan carrier and educate them you have actually died.

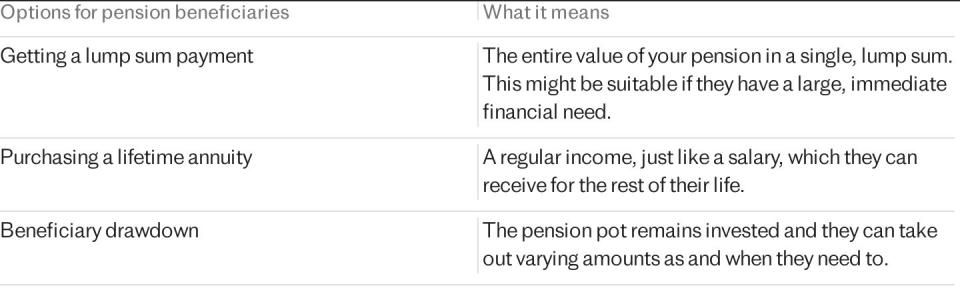

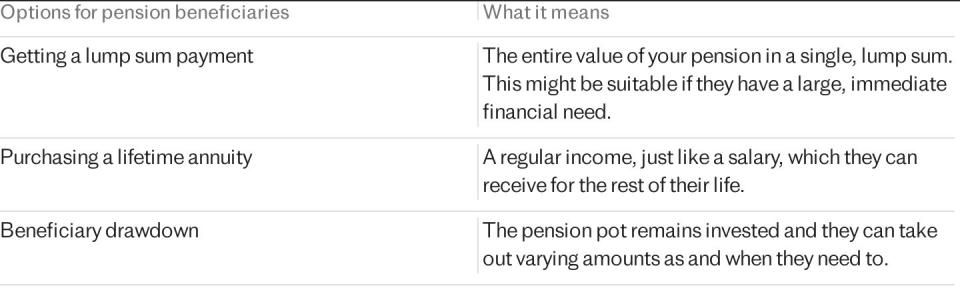

If you passed away prior to you attracted it they will certainly have a selection to make: take it as a round figure, utilize it to acquire an annuity or run it as a recipient drawdown. The complete listing of choices for recipients is set out in the table listed below.

Who can be a recipient?

A recipient is the individual or individuals that will certainly obtain your pension plan funds when you pass away.

Sue Loveridge, economic organizer at Quilter stated: “This can be anyone you want, though is typically a spouse, your children or other dependents.”

Exactly that profits often tends to be determined by what is called an “expression of wishes”.

Helen Morrissey, head of retired life evaluation at Hargreaves Lansdown, stated: “This form allows you to name who you would like to receive death benefits. Administrators and trustees will refer to them when dealing with your pension.”

It’s critical to maintain your ‘expression of wishes’ creates upgraded to guarantee your strategies are performed. However, current study from the Money and Pensions Service revealed that in 5 individuals really did not recognize that they would certainly chosen to obtain any one of their exclusive pension plans.

Ms Morrissey included: “If these are not kept updated there is a risk your benefits could, for example, get paid out to an ex-partner rather than your current one. This can cause huge financial pressures.”

It’s essential to take another look at these types complying with crucial life occasions, such as marital relationship and separation, to make certain the best individual advantages.

Tax ramifications for recipients

Beneficiaries of your pension plan might require to prepare for the tax obligation ramifications of what they obtain. Inheritance tax obligation does not normally put on your pension plan as it’s ruled out component of your taxed estate. If you pass away prior to the age of 75 your recipients will not normally need to pay earnings tax obligation either. This is as lengthy as the cash is accessed within 2 years.

If the cash is accessed afterwards, or you pass away after 75, they’ll need to pay their regular price of earnings tax obligation.

Previously, there was an extra tax obligation fee for anything recipients obtained from a pension plan over the Lifetime Allowance of ₤ 1,073,100. This was gotten rid of from April 6, 2023.

However, they will certainly still require to pay earnings tax obligation on anything they obtain over this quantity. This puts on a round figure also, where they’ll pay earnings tax obligation on anything over ₤ 268,275.

What if there are no recipients?

If there are no recipients, your pension plan carrier will certainly choose. If you have a near relative your pension plan will normally most likely to them. If you do not, it enters into your estate– and responsible for estate tax.

Conclusion: What you ought to do to prepare your pension plan

Ultimately, the choice of what occurs to your pension plan after you pass away is your own so make certain you have your picked recipients taped.

However, be conscious that pension plans can be made complex at the very best of times, especially when it happens the pot on others. Once you’re gone your enjoyed ones can be limited by the selections you have actually made.

It’s constantly worth thinking about expert suggestions to guarantee your pension plan riches is handed down in accordance with your desires.

Frequently Asked Questions

Can my partner acquire my pension plan?

Yes, your pension plan carrier will certainly ask you to call recipients that will certainly obtain your pension plan funds when you pass away.

The recipient can be any person you pick including your partner, kids or any kind of dependents.

How can I guarantee my pension plan mosts likely to my picked recipient?

You will normally select your recipients when you sign up with a pension plan plan. However, you can transform your mind at any moment. Just contact your carrier, either by phone, blog post or browsing through to your online account. It will not cost you anything and you can transform them whenever you such as.

If you do not call any person, your pension plan carrier will certainly choose. If you have a near relative it will normally most likely to them. If you do not, it enters into your estate– and responsible for estate tax.

You can additionally choose to leave it to a charity.

When the moment comes, your pension plan will not belong to your estate– so it’s not covered by your will. Your carrier isn’t legitimately bound by your desires, however will certainly take them right into account.

Can I make use of a pension plan to decrease estate tax?

As your pension plan will not go through estate tax this can be a good way to avoid it when handing down cash to your recipients. This is especially beneficial if you have a big estate, since the life time allocation has been eliminated

Dean Butler, taking care of supervisor of retail straight at Standard Life, stated: “Despite ongoing speculation, the Government has so far stayed clear of reducing or abolishing inheritance tax. While this will come as a disappointment to some, there are other ways to protect the money you hope to pass to your loved ones.

“Pensions are perhaps chief among these – as well as being incredibly tax efficient, it’s a little-known fact that most sit outside your estate and so they’re not liable for inheritance tax. Following the removal of the lifetime allowance, people have the ability to save significant sums and benefit from tax-free growth of their savings within a pension.”

What occurs to my annuity when I pass away?

An annuity strategy transforms your pension plan cost savings right into a surefire earnings for a collection quantity of time, or permanently. Your recipients’ choices will certainly rely on what you picked when you purchased the annuity, so it’s something you ought to analyze thoroughly.

If you bought a solitary life annuity, settlements normally will quit when you pass away. However, you can choose attachments that offer proceeding settlements for a collection duration or a round figure to your chosen recipient.

Some individuals buy a joint life annuity, which gives routine settlements for them and somebody else. Usually this is your partner and lasts till you both pass away, however it can additionally be a kid till they get to the age of 23. Payments will normally stop after that.