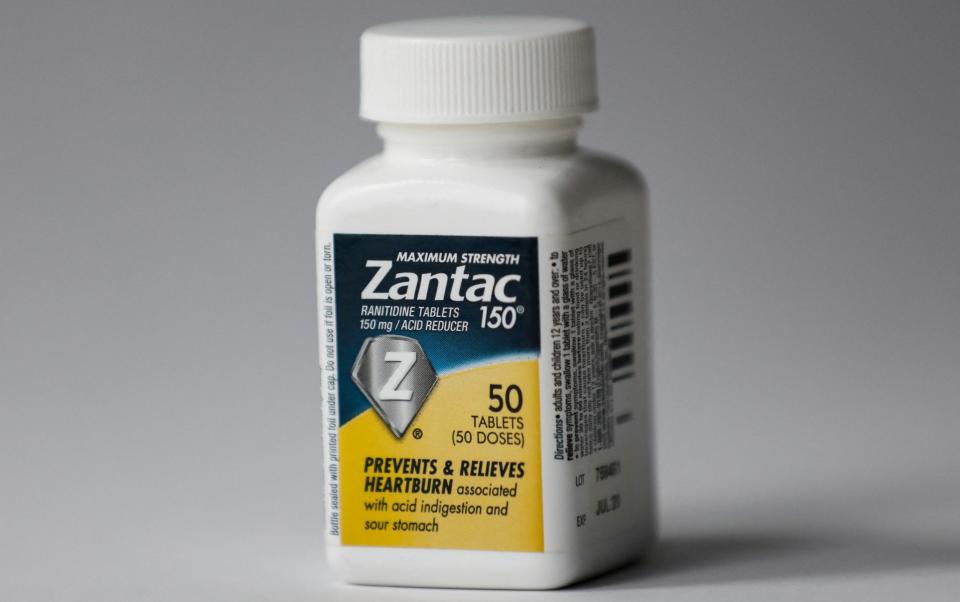

Tens of hundreds of Americans are in line to share $2.2bn (£1.7bn) after GSK agreed a settlement over claims its indigestion drug precipitated cancers.

The British drug large has agreed to pay as much as $2.2bn to settle tens of hundreds of US lawsuits claiming its heartburn drug Zantac precipitated most cancers.

The firm mentioned it had struck a settlement take care of 10 regulation corporations that symbolize greater than 90pc of authorized claims associated to the medication.

The regulation corporations have unanimously really useful that their shoppers settle for the phrases of the settlement. If endorsed, the settlement would resolve round 80,000 instances. It is predicted to be carried out by the center of subsequent yr.

Each authorized case represents not less than one plaintiff, although in observe some instances might have been mixed. A easy division assuming every case represented only one individual would counsel every individual suing GSK is in line for $27,500.

GSK mentioned: “While the scientific consensus remains that there is no consistent or reliable evidence that ranitidine [the generic name for Zantac] increases the risk of any cancer, GSK strongly believes that these settlements are in the best long-term interests of the company and its shareholders as they remove significant financial uncertainty, risk and distraction associated with protracted litigation.”

As nicely as settling the vast majority of state courtroom instances on Wednesday, GSK mentioned it had additionally struck a deal to pay $70m to resolve a separate Zantac grievance.

As a part of the settlement offers, GSK has not admitted any legal responsibility. It is predicted to pay the prices of the settlements by way of its current sources.

The Zantac dispute stems from 2019, when US watchdogs pulled it from sale due to “unacceptable levels” of possible cancer-causing elements within the drugs. At the time, GSK offered Zantac as a prescription drug within the UK nevertheless it stopped as a precaution following the US resolution.

GSK and different sellers of the medication have at all times maintained that options Zantac might trigger most cancers had been “inconsistent with the science”. The British drug large has pointed to previous analysis by regulators within the EU and US that has failed to ascertain a causal affiliation.

However, GSK has been dogged by considerations over looming authorized payouts for years.

Morgan Stanley beforehand steered the Zantac instances might value GSK as a lot as $30bn to settle, though different analysts have since put the determine at someplace between $2bn and $8bn.

Concerns over Zantac have been blamed for holding GSK’s share worth depressed at a time of booming gross sales and income on the British drugmaker.

Earlier this yr virtually £7bn was wiped off GSK’s worth in someday after a choose in Delaware dominated that 70,000 lawsuits in opposition to the corporate associated to Zantac might transfer ahead.

Read the newest updates under.

07:09 PM BST

Signing off…

Thanks for becoming a member of us immediately.

Chris Price might be again from round 7am to cowl the newest within the markets however, within the meantime, you possibly can learn the full breadth of our business and economics reporting and commentary here.

07:06 PM BST

Fed fee setters acquire confidence over inflation, in line with minutes

Minutes of final month’s Federal Reserve rate-seting assembly have simply been launched.

They point out that “almost all” of the members had been gaining stronger confidence on beating inflation. The minutes say:

With regard to the outlook for inflation, virtually all members indicated they’d gained better confidence that inflation was transferring sustainably towards 2 %.

Participants cited numerous elements that had been prone to put persevering with downward strain on inflation.

These included an additional modest slowing in actual GDP progress, partially because of the Committee’s restrictive financial coverage stance; well-anchored inflation expectations; waning pricing energy; will increase in productiveness; and a softening in world commodity costs.

The minutes indicated {that a} “substantial majority” favoured a half a share level lower, which was carried out,

Earlier within the day, Dallas Fed president Lorie Logan warned over slicing rates of interest too shortly. She mentioned:

I proceed to see a significant threat that inflation might get caught above our 2pc purpose … the [Fed] mustn’t rush to cut back the fed funds goal to a ‘normal’ or ‘neutral’ stage however fairly ought to proceed regularly whereas monitoring the conduct of monetary situations, consumption, wages and costs.

06:17 PM BST

US regulation agency to pay British trainees £70k a yr amid expertise warfare

A US regulation agency will provide beginning salaries of not less than £70,000 to trainee solicitors at its London workplace as British rivals stay underneath strain within the warfare for expertise.

Davis Polk, which is headquartered in New York, has elevated salaries for its most inexperienced workers to £65,000 of their first yr, leaping to £70,000 of their second yr.

It marks a rise from the earlier trainee salaries of £60,000 and £65,000, respectively. Davis Polk additionally promised at hand trainee attorneys a £100,000 pay rise upon qualifying, bringing their third-year wage to £170,000.

The hefty sums are along with Davis Polk’s trainee advantages bundle, which incorporates sponsorship by way of regulation college and a six months’ secondment in both New York or Brussels.

The newest pay rise has set a report for entry-level salaries in London, the information web site Legal Cheek first reported.

05:54 PM BST

European shares bounce again from dismal Tuesday

European shares settled increased on Wednesday, bouncing from losses within the earlier session as traders focussed on upcoming rate of interest cuts and a key U.S. inflation report later this week.

The continent-wide Stoxx 600 index was up 0.6pc, with the cars and elements sector, which has lagged for many of the yr, amongst prime gainers with a 1.1pc bounce.

On the flipside, banks underperformed as Dutch lender ING dropped 2.5pc after Deutsche Bank downgraded the inventory to “hold”, calling 2024 a peak for capital returns and share buybacks.

The benchmark Stoxx 600 touched a two-week low on Tuesday, with China-exposed mining and luxurious sectors taking a beating as traders had been disenchanted by a scarcity of recent stimulus steps from Beijing.

Against a backdrop of a stagnating economic system, cooling worth pressures and a softening labour market, the Stoxx 600 index together with equities in main regional inventory markets are on monitor for positive aspects this yr.

Richard Flax, chief funding officer at Moneyfarm, mentioned:

Europe is buying and selling at a reduction relative to the U.S. and despite the fact that (financial) progress is lower than what you’d need, company profitability continues to be holding up in mixture phrases.

You’re going to see rate of interest cuts after which an acceleration in European progress over the subsequent 12 to 18 months.

05:46 PM BST

Wall Street rises forward of launch of Fed minutes

The essential Wall Street inventory indexes turned increased this afternoon as traders awaited the minutes of the Federal Reserve’s newest assembly.

The Dow Jones Industrial Average rose 0.8pc, the S&P 500 gained 0.6pc, and the Nasdaq Composite gained 0.5pc.

The S&P 500 touched a recent report excessive, with shares of Norwegian Cruise Line topping the benchmark index with a ten.8pc acquire after Citi upgraded its score to “buy”. Industry peer Carnival (which can also be traded in London) jumped 7.5pc.

Trading has been uneven by way of the week, with traders adjusting their rate-cut expectations, looking for new catalysts for a clearer market path. Their consideration will now flip to essential inflation knowledge on Thursday and the upcoming third-quarter company earnings season.

Minutes from the Fed’s September assembly, when policymakers kicked off financial coverage easing with a half a share level lower, are due at 7pm (UK time).

Tim Ghriskey, senior portfolio strategist at Ingalls & Snyder, mentioned:

The Fed minutes are at all times attention-grabbing, however they might be somewhat bit extra attention-grabbing this time given the final Fed assembly, although I don’t count on any surprises.

05:25 PM BST

British bosses in line for bumper paydays amid expertise exodus fears

Investors have paved the way in which for increased pay at Britain’s greatest firms amid fears of a talent exodus to the US.

The Investment Association (IA), a commerce physique representing £9.1 trillion of funds, on Wednesday printed a brand new set of pay pointers giving shareholders extra leeway to reward FTSE chief executives with higher pay.

The transfer represents a seachange within the City after years of shareholder rebellions over excessive pay. The rebellions had been partly blamed on restrictive voting insurance policies tying the arms of shareholders.

Changing the coverage might usher in a brand new period of larger awards and fewer investor rebellions.

Under the plan, the IA will introduce three broad “principles” on pay, giving traders better flexibility to vote by way of massive offers with out falling foul of the rules.

It is hoped the brand new ideas will enable fund managers to make selections on a case-by-case foundation and reward firm chief executives who do nicely.

The change is pushed by fears that London dangers changing into a worldwide backwater for expertise due to the higher pay packages on offer in the US.

05:18 PM BST

Bank of England will lower charges to 3pc by early 2026, say economists

The Bank of England will lower rates of interest to 3pc by early 2026 on account of inflation plunging to under its 2pc goal, main economists have mentioned.

Capital Economics mentioned the autumn might be larger than merchants’ predictions of charges falling from 5pc immediately to three.75pc by 2026.

The economists added:

In the second half of 2025, we expect CPI inflation will fall under the two.0pc goal and core inflation will ease from 3.6pc now to 2.0pc late in 2026 because the persistence of inflation fades.

We suppose it will immediate the BoE to chop rates of interest faster than the markets anticipate within the second half of 2025, maybe to three.00pc by early 2026 fairly than to three.75pc.

While gilt yields have risen not too long ago, we doubt it’s as a result of fiscal credibility considerations. If it was, sterling would have fallen extra considerably, prefer it did after the ‘mini-budget’.

If we’re proper that Bank Rate might be lower additional than traders count on, 10-year gilt yields will quickly fall once more, from 4.2pc now to three.5pc subsequent yr.

05:07 PM BST

FTSE closes up

The FTSE 100 closed up 0.7pc immediately.

The largest riser was paper large Mondi, up 4pc, adopted by British Gas proprietor Centrica, up 3.3pc.

At the opposite finish of the index, housebuilder Vistry fell 2pc, whereas rival Persimmon fell 0.6pc.

Meanwhile, the FTSE 250 rose 0.9pc.

The prime riser was Carnival, up 8.3pc, adopted by St James’s Place, up 5.9pc.

The greatest faller was funding belief Fidelity China Special Situations, down 1.8pc, adopted by actual property funding belief PRS Reit, down 1.5pc.

04:29 PM BST

Dollar pushes upwards as merchants wager on smaller cuts to rates of interest

The US greenback has been on an upward path immediately forward of the discharge of information from the Federal Reserve’s September resolution to slash rates of interest by half a share level.

It displays merchants’ confidence that the central financial institution is not going to proceed easing so aggressively.

While the minutes from the final Federal Open Market Committee assembly might present how heated the controversy was over the bigger than anticipated lower, it will likely be considerably old-fashioned after final Friday’s sturdy non-farm payroll knowledge precipitated markets to reprice near-term Fed fee lower expectations.

The greenback index, which measures the buck in opposition to a basket of currencies together with the pound and the euro, is up 0.21pc.

Traders are additionally watching a parade of Fed audio system on Wednesday and holding powder dry for Thursday’s launch of September’s client worth index (CPI).

04:21 PM BST

TikTok income surges amid heightened scrutiny

TikTok’s European gross sales have surged to over £3.5bn because the video sharing app continued its breakneck progress regardless of heightened scrutiny from regulators in Britain and on the continent.

Revenues at TikTok Information Technologies UK, which incorporates its UK, European and elements of its Latin American divisions, climbed 75pc to $4.6bn (£3.5bn)within the yr ending December 2023, up from $2.6bn. The UK department generates gross sales from promoting gross sales and dwell streaming.

However, the tech large’s working losses widened after it put aside $1bn as a provision for authorized claims referring to alleged privateness breaches within the Netherlands. The class motion claims are presently topic to an enchantment.

TikTok, owned by Beijing-headquartered Bytedance, is dealing with a regulatory crackdown in Europe as officers in Brussels launch proceedings in opposition to the app over claims it has an “addictive design” and may hurt kids’s psychological well being. TikTok has insisted it has “pioneered features and settings to protect teens”.

The social media app can also be dealing with the prospect of a ban within the US over nationwide safety fears because of its ties to China’s Bytedance. TikTok has at all times denied posing a safety menace and is difficult a US regulation in courtroom that calls for Bytedance divest the app or shut it down.

04:14 PM BST

FTSE up because it escapes pessimism about China

The FTSE 100 is up 0.5pc, and the FTSE 250 is up 0.8pc, because the market strikes on from yesterday’s worries in regards to the Chinese economic system.

Chinese shares have been unstable not too long ago, with traders first enthusiastic a few sequence of steps to kickstart home progress and had been then left deflated yesterday when a press convention didn’t present any additional measures.

Stephen Innes, a companion at SPI Asset Management, mentioned:

When the market’s expectations had been set sky-high for a 2-3 trillion yuan stimulus bundle and as a substitute acquired hit with a giant, fats zero, the get together was over earlier than it even started.

Investors at the moment are awaiting a Saturday briefing on fiscal coverage by finance minister Lan Fo’an for extra indications about official plans.

But analysts warned there was unlikely to be the massive “bazooka” stimulus akin to the help seen throughout the world monetary disaster.

Shehzad Qazi at China Beige Book mentioned Beijing was “opting for targeting stimulus – including allocating funds for projects previously announced”.

Hong Kong’s inventory market had soared greater than 20 % between the primary batch of introduced measures in late September and the beginning of this week.

The Hang Seng Index collapsed greater than 9 % on Tuesday – its worst day since 2008 – and shed one other one % Wednesday.

Shanghai ended 6.6pc decrease immediately.

03:57 PM BST

Oil costs hunch for a second day

Oil costs are presently down 1.8pc immediately, which additionally fell yesterday on account of fears in regards to the Chinese economic system.

Chris Beauchamp, chief market analyst at on-line buying and selling platform IG, mentioned:

Oil bulls have been unable to drive the value increased over the previous 48 hours, bereft of reports from the Middle East and now beset by a hefty rise in stock ranges.

A considerable Israeli response continues to be possible, but when it stops wanting oil and nuclear installations then we are able to count on additional promoting in Brent [crude] and [US benchmark] WTI.

03:50 PM BST

Rescuer of Thomas Cook branches posts rising income

The journey firm that purchased 555 Thomas Cook shops out of bankruptcy five years ago has posted rising income after they gambled on the way forward for the excessive road.

In accounts to the tip of April seen by The Telegraph, pre-tax income at Hays Travel rose 42pc to £73.4m, up from £51.6m a yr earlier. Total transaction worth, a measure of gross sales used within the journey trade, rose 16pc to £2.5bn.

Hays Travel, which had 190 outlets earlier than the deal, purchased Thomas Cook’s total retail property in October 2019 and aimed to re-employ its 2,500-strong workforce. The deal noticed its property develop to 745 nevertheless it has subsequently trimmed the quantity to 470.

Dame Irene Hays, the chairman, mentioned:

No one might have predicted a worldwide pandemic after we took on Thomas Cook, however even with hindsight I might do all of it once more. It’s because of the hassle and resilience of our Hays Travel colleagues and the various colleagues who joined us from Thomas Cook that we had been capable of take care of our prospects throughout lockdown, and had been right here to assist them journey once more, as quickly because the restrictions had been lifted.

03:32 PM BST

Global shares rise forward of Fed minutes

UK and Wall Street shares have risen as traders awaited new alerts on rates of interest from the minutes of the final assembly of the US Federal Reserve.

The FTSE 100 was up 0.4pc and the FTSE 250 gained 0.9pc in afternoon buying and selling, whereas the Dow Jones Industrial Average in New York gained 0.3pc.

Wall Street’s S&P 500 and Nasdaq Composite had been up 0.2pc whereas Europe’s essential inventory markets had been barely increased.

Oil costs fell for a second day amid experiences of rising US inventories and as Israel seems to be holding off – not less than for the second – from putting Iranian vitality installations.

Minutes from the Fed’s September assembly, due later immediately, might be examined for perception into the Fed’s considering.

With that, I’ll hand you over to Alex Singleton, who will information you thru to the night.

03:24 PM BST

Google pays double UK tax after surge in income

Google UK’s invoice to HMRC greater than doubled final yr after a bounce in company tax and a surge within the tech large’s income.

The web search large’s UK department paid a complete tax cost of £128.6m within the yr ending December 2023, in comparison with £59.1m a yr earlier.

The firm’s revenues elevated by a 3rd, as much as £373.8m from £282.9m, whereas its gross sales climbed by round £200m to greater than £2.8bn.

The division’s UK gross sales don’t symbolize the general dimension of its promoting enterprise in Britain, fairly its revenues account for advertising and marketing and R&D companies to the broader group.

Separately, revenues at Google’s UK-based Deepmind enterprise, which offers synthetic intelligence (AI) expertise to the tech large, climbed to over £1.5bn.

It comes as Google leans ever extra on the UK lab’s expertise, which has helped to energy its new AI search merchandise and chatbots.

03:10 PM BST

Germany hit by weak demand and excessive rates of interest

Germany’s economic system is heading for its first two-year recession in twenty years after it was weighed down by stubbornly weak home and overseas demand, excessive rates of interest and expensive vitality within the wake of Russia’s warfare in Ukraine.

Its woes had been highlighted by a spate of unhealthy information from the nation’s carmakers not too long ago, because the flagship trade struggles with rising manufacturing prices and fierce competitors from Chinese producers on electrical automobiles.

Volkswagen, Europe’s greatest auto producer, final month lower its annual outlook and mentioned it will for the primary time have to think about closing factories in Germany.

Rivals BMW and Mercedes-Benz have additionally lowered their outlook, citing falling Chinese demand.

The economic system ministry however expressed confidence {that a} rebound was simply across the nook, predicting the economic system would develop by 1.1pc in 2025 and 1.6pc in 2026.

Economy minister Robert Habeck mentioned the federal government’s proposed “growth initiative” had a key function to play within the anticipated financial revival.

OUCH! The German govt sees Germany contracting for 2nd consecutive yr. The govt revises down its GDP projection for 2024 from +0.3% to -0.2%. A decline in output in 2024—following a drop of 0.3% final yr—would mark solely 2nd occasion of consecutive years of shrinking GDP since… pic.twitter.com/Z3UQov2PLh

— Holger Zschaepitz (@Schuldensuehner) October 9, 2024

02:57 PM BST

Rayner guarantees to place ‘decency at heart’ of plans for housing

Decency might be put “at the heart” of the Government’s plan for housing, MPs heard, as Angela Rayner mentioned she wished each renter to have the ability to have a secure and safe house.

The Deputy Prime Minister and Housing Secretary mentioned Labour was prioritising its Renters Rights Bill because it criticised the earlier Conservative authorities for delaying their very own deliberate reforms.

Introducing the second studying of the Bill, Ms Rayner mentioned: “I hope the entire house will agree that everyone should live in a decent, safe and affordable home. Everyone should, but not everyone can.

“This is why I have put decency at heart of my plans for housing and taken the steps to ensure that all homes are warm and safe, and nowhere is that more needed than in the private rented sector.”

Ms Rayner added: “The Conservatives promised to pass a renters’ reform Bill in the 2019 manifesto. Yet in a desperate attempt to placate their backbenchers, they caved into vested interests, leaving tenants at the continued mercy of unfair section 21 eviction notices.

“They dithered, delayed and made excuse after excuse for their inaction.”

She mentioned since 2019 greater than 100,000 households have been topic to a no-fault eviction, with 26,000 being within the final yr alone.

“That is the inheritance that we need to fix,” she added.

02:39 PM BST

Wall Street slumps forward of Fed minutes

US inventory markets declined on the opening bell forward of the publishing of minutes from the final assembly of Federal Reserve policymakers which might make clear the long run path of rates of interest.

The Dow Jones Industrial Average slipped 0.1pc to 42,043.34 whereas the broad-based S&P 500 was flat at 5,749.10.

The tech-heavy Nasdaq Composite fell 0.2pc to 18,147.33.

02:28 PM BST

Netflix password crackdown drives report UK revenues

Netflix has posted report UK revenues after its crackdown on password sharing boosted subscriber numbers.

The US streaming large recorded revenues of almost £1.7bn within the UK in 2023, its greatest annual complete up to now and up from £1.5bn the earlier yr. Pre-tax income additionally surged by virtually 80pc to £61m, in line with newly-filed accounts.

Netflix pinned the report efficiency on progress in subscriber numbers after the streaming firm started cracking down on password sharing final yr.

This chart shows how streaming platforms’ prices compare.

02:06 PM BST

Bitcoin creator allegedly unmasked in HBO documentary

A documentary has claimed to have unmasked the mysterious creator of the cryptocurrency Bitcoin as a little-known Canadian software program developer.

A deliberate broadcast on HBO – Money Electric: The Bitcoin Mystery – will counsel that Peter Todd, who was concerned in early discussions across the improvement of Bitcoin, was its pseudonymous creator, Satoshi Nakamoto.

The true identification of Nakamoto, who invented the cryptocurrency, has remained a thriller for over 15 years.

Read on for details about the alleged creator of Bitcoin.

01:44 PM BST

Germany’s economic system to shrink this yr, says authorities

Germany’s economic system is on monitor to shrink for a second consecutive yr, Olaf Scholz’s authorities has warned, as Europe is “squeezed between China and the US”.

The Chancellor’s administration slashed its forecast for gross home product (GDP) this yr from 0.3pc progress to a 0.2pc contraction.

The German economic system shrank by 0.3pc final yr as its trade struggled to get better from the vitality disaster triggered by the warfare in Ukraine.

Vice Chancellor Robert Habeck, who can also be the economic system minister, mentioned that the nation has not seen highly effective progress since 2018 amid structural issues and wider world challenges.

He mentioned: “In the middle of the crises, Germany and Europe are squeezed between China and the US, and must learn to assert themselves.”

He added: “There has never yet been such a prolonged phase of weakness in the German economy.”

01:35 PM BST

Drivers face rise in petrol costs this month, warn economists

Drivers should pay extra on the petrol pumps this month, economists have warned, amid the rising battle within the Middle East.

Deutsche Bank mentioned it anticipated “upward momentum” for pump costs in October and November following the current spike in oil costs.

Brent crude briefly tipped again above $80 a barrel on Monday, having been under $70 earlier than Iran launched rockets at Israel final week.

As a consequence, inflation will common 2.6pc this yr, the financial institution mentioned.

The predicted rise in forecourt costs comes as the quantity paid by drivers for petrol has fallen by 15.5p because the begin of May, whereas diesel has dropped by 18.5p, in line with the RAC.

Sanjay Raja, chief UK economist at Deutsche Bank, mentioned: “Upward momentum will likely gather pace.

“The recent run of energy deflation will likely come to an end shortly.

“Indeed, pump prices are likely to reverse course in October, while dual fuel bills will see a hefty 10pc rise.”

01:17 PM BST

Inflation has fallen again under 2pc, say economists

Inflation has fallen again under the Bank of England’s 2pc goal, economists have mentioned, as policymakers are anticipated to ramp up the tempo of rate of interest cuts.

Deutsche Bank predicted that the buyer costs index fell again to 1.8pc in September, down from 2.2pc in August amid declining air fares and petrol costs, in addition to falling foods and drinks costs.

Such a drop would elevate strain on the Bank of England to chop rates of interest, particularly after Governor Andrew Bailey mentioned policymakers may turn out to be “more aggressive” about lowering borrowing prices if inflation information was good.

Sanjay Raja, chief UK economist at Deutsche Bank, mentioned:

Energy inflation contracted in September, as pump costs fell for a fourth consecutive month.

Our pump worth trackers level to a close to 3.5pc month on month drop in petrol costs for CPI.

12:53 PM BST

Boeing talks break down as strikes head for fourth week

Talks between Boeing and union officers have damaged down as strikes at its manufacturing websites head right into a fourth week.

The aerospace firm mentioned on Tuesday it withdrew its pay provide to round 33,000 US manufacturing facility employees, saying the union had not thought-about its proposals significantly after two days of talks.

The contract provide would have given putting employees 30pc raises over 4 years.

Boeing business airplanes head Stephanie Pope mentioned: “Unfortunately, the union did not seriously consider our proposals.”

She mentioned the union’s calls for had been “non-negotiable”, including: “Further negotiations do not make sense at this point.”

It comes as Boeing seeks to lift billions of {dollars} to shore up its steadiness sheet after a string of scandals – notably a midair blowout on a flight in January – knocked confidence within the aircraft maker.

12:33 PM BST

Former Glencore executives face trial on bribery expenses in 2027

A gaggle of former Glencore executives have been instructed they are going to stand trial in 2027 on bribery expenses.

Alex Beard, the previous head of oil on the commodities large, and Andy Gibson, ex-head of oil operations, are accused of conspiring to make corrupt funds to authorities officers and state-owned oil firm workers in Nigeria, Cameroon and the Ivory coast greater than a decade in the past.

Former Glencore workers Paul Hopkirk, Ramon Labiaga, Martin Wakefield and David Perez are charged with corruption.

Beard, who indicated at his first courtroom look final month that he’ll plead not responsible, was not formally requested to enter a plea at a short listening to at London’s Southwark Crown Court on Wednesday.

Beard, who’s probably the most high-profile commodity dealer to have been charged in Britain for alleged corruption, joined Glencore in 1995 from BP, the most important buying and selling desk at the moment, and was head of oil from 2007 till 2019, when he retired.

He helped Glencore turn out to be one of many prime three oil buying and selling firms, buying and selling as a lot as 7pc of the world’s oil in its heyday.

All six defendants are anticipated to formally enter pleas in October 2025 forward of a trial in mid-2027.

12:03 PM BST

US shares poised to edge decrease on the opening bell

Wall Street inched down in premarket buying and selling forward of the discharge of the minutes from the Federal Reserve’s final assembly.

Shares of Alphabet fell 1.4pc forward of the opening bell after the US Department of Justice mentioned it may ask a judge to break up Google, together with the Chrome web browser and Android working system.

Indexes closed increased on Tuesday, recovering from Monday’s selloff, with expertise shares main the positive aspects as US Treasury yields eased.

Trading has been uneven this week as traders reprice their expectations on rate of interest cuts.

US inflation figures might be launched on Thursday.

In premarket buying and selling, the Dow Jones Industrial Average and S&P 500 had been marginally down, with the Nasdaq 100 decrease by 0.1pc.

11:38 AM BST

Nearly half of world electrical energy ‘to be powered by renewables by end of decade’

Nearly half of the world’s electrical energy is ready to be powered by renewable vitality by 2030, in line with forecasts, however the landmark would nonetheless miss world targets.

The world is on target so as to add the equal energy capability of China, the European Union, India and the US mixed, about 5,500 gigawatts (GW), by way of renewables, the International Energy Agency mentioned.

However, the large forecast ramp-up of photo voltaic panels, wind generators and different inexperienced energy sources will nonetheless miss a purpose set final December by the UN of tripling world renewable capability by the tip of the last decade.

Fatih Birol, the IEA’s government director, mentioned the expansion in renewables was not simply being pushed by efforts to chop emissions, however by the truth that they provide “the cheapest option to add new power plants in almost all countries around the world”.

As a consequence, renewables progress is “moving faster than national governments can set targets for”, he mentioned.

Nonetheless, if international locations are going to hit the goal of tripling world renewables capability, Governments must ramp up efforts to hitch inexperienced energy sources to their energy grids.

This would imply constructing or upgrading 25 million kilometres of pylons, cables and different grid connections over the approaching years.

11:27 AM BST

UK fuel costs outstrip Europe amid scramble for provides forward of winter

UK fuel costs have turn out to be costlier than in Europe as Britain tries to restock provides following a slowdown in shipments earlier this yr.

British contracts for supply in November have been buying and selling about 2pc above the benchmark used on the Continent in current days.

Prices are increased than on the identical time final yr amid considerations that the UK market might face growing demand.

Nick Campbell, a managing director at Inspired, mentioned: “A prolonged cold snap could quickly drain UK storage facilities, hence the need to price at a premium to the continent.”

UK fuel costs are often cheaper than Europe throughout the summer season however generally turn out to be costlier in winter as Britain tries to safe additional provides for the colder months.

However, liquefied pure fuel shipments to the UK greater than halved in January to September in comparison with 2023 ranges, in line with ship-tracking knowledge compiled by Bloomberg.

Elizabeth Kunle, fuel market analyst at S&P Global, mentioned vessels with the super-chilled gasoline have been “favouring northwest European and Italian terminals over UK”.

Dutch front-month futures, the European benchmark, had been final down 0.2pc under €39 per megawatt hour. Meanwhile, the UK equal contract was down 1pc in direction of 96p per therm.

10:55 AM BST

Pound falls as fewer US fee cuts anticipated

The pound has continued its decline in opposition to the greenback as merchants count on fewer rate of interest cuts by the US Federal Reserve.

Sterling was down 0.1pc to $1.309 after a powerful jobs market report final week lowered the possibilities of a discount in borrowing prices in America subsequent month to 88pc.

Before US nonfarms payrolls got here in nicely above forecasts for September, cash markets had indicated there was a 35pc probability that the Fed would lower charges by half a share level, with 1 / 4 of a degree transfer priced in.

Now, merchants are a lot much less sure, and are uncertain that the Fed will lower charges twice extra this yr, as had beforehand been anticipated.

As a consequence, the Bloomberg Dollar Spot Index, a measure of the power of the US foreign money, is up for an eighth straight day and on monitor for its longest profitable streak since April 2022.

The foreign money has surged to its strongest stage since mid-August.

Against the euro, the pound was flat at 83.8p.

10:40 AM BST

Eurozone rates of interest ‘very likely’ to be lower subsequent week, says policymaker

The European Central Bank will very possible make its third rate of interest lower of the yr subsequent week as inflation is coming underneath management, certainly one of its policymakers has mentioned.

The odds of a fee lower on the ECB’s October 17 assembly rose after eurozone inflation slowed to 1.8pc in September, falling under its 2pc goal for the primary time since 2021.

Francois Villeroy de Galhau, who heads France’s central financial institution and sits on the ECB governing council, instructed franceinfo radio:

“Victory against inflation is in sight. A cut is very likely.”

He added: “By the way, it will not be the last.”

As to the scale of the lower, he mentioned the ECB was “used to acting gradually… without taking too large steps” – signalling that policymakers would once more go for a lower of 1 / 4 of a share level

The Frankfurt-based establishment launched an unprecedented streak of eurozone fee hikes starting in mid-2022 to tame runaway meals and vitality prices, which surged within the wake of the Covid pandemic and Russia’s invasion Ukraine.

10:25 AM BST

TfL pledges talks as employees vote over strikes

Transport for London has pledged to proceed speaking to unions about pay and situations following the specter of strikes.

The Transport Salaried Staffs Association (TSSA) is balloting its members on London Underground for industrial motion.

The union mentioned the Underground has made a suggestion which might see most grades obtain a below-inflation pay rise and is freezing most pay ranges, which it claims raises the potential of long-term, or indefinite, pay freezes.

TfL mentioned that, alongside an annual pay rise, with a better improve for these incomes lower than £40,000, it has additionally proposed extra enhancements together with elevated paternity go away.

A TfL spokesman mentioned:

We are disenchanted that the TSSA is balloting London Underground workers over pay, situations and pension preparations.

We have held quite a lot of constructive discussions with our commerce unions and have thought-about their suggestions on our pay provide.

We are will proceed to work with the unions to make sure that we attain a good settlement for our hardworking colleagues that can also be inexpensive and delivers for London.

10:07 AM BST

Oil costs choose up after hunch over China fears

The worth of oil has risen barely after its sharpest fall in a month on Tuesday amid fears that demand might be weak from China’s economic system.

Brent crude plunged 4.6pc after merchants had been left unimpressed by Beijing’s failure to present particulars on its plans to stimulate progress on the planet’s second largest economic system.

Today it rebounded barely, gaining 0.6pc however nonetheless belo $78 a barrel after tipping above $80 earlier within the week over considerations about widening battle within the Middle East.

Peter Branner, chief investments officer at Abrdn, mentioned: “Geopolitical uncertainty will shape this quarter and beyond with several major risks to our main scenario.

“One is further conflict escalation in the Middle East that sends oil prices and geopolitical risk premia substantially higher.”

Kathleen Brooks, analysis director at XTB, mentioned: “China stimulus fears and a lack of escalation in the direct attacks between Iran and Israel have calmed the oil markets for now, but they remain sensitive to headline risk.”

09:47 AM BST

CMC Markets jumps because it returns to revenue after job cuts

Trading platform CMC Markets swung again to revenue and has seen a surge in income over the past six months, following a interval of robust buying and selling and a cost-cutting programme.

The London-listed firm mentioned its internet working earnings is predicted to have risen 45pc to £180m for the six months to September 30.

CMC Markets, which was based by Tory peer Lord Peter Cruddas, has been making an attempt to maintain prices underneath management after it reported a £2m loss this time final yr.

That included slashing 200 jobs earlier this yr, equating to about 17pc of its workforce, by merging its help groups, streamlining reporting traces and automating some processes.

The “disciplined cost management” helped it push working prices down by 7pc, and swing again to a £51m revenue for the half-year.

The firm additionally suffered from a hunch in offers in 2023, with funding banks axing jobs and consolidation ramping up amongst City brokerages.

In response, it launched a number of new merchandise, together with a brand new business-to-business service, and expanded its funding platform into Singapore, the place it has an workplace.

Shares topped the FTSE 250 immediately as they rose 4.9pc.

09:27 AM BST

Tax raid fears set off hunch in enterprise confidence

Fears of tax rises within the Budget and the lack of winter gasoline funds for thousands and thousands have shattered enterprise and client confidence, in line with a number of influential new surveys that may elevate recent fears in regards to the economic system.

Business confidence suffered its first drop in a yr, in line with the Institute of Chartered Accountants in England and Wales’s (ICAEW) most up-to-date quarterly survey. Almost one enterprise in each three mentioned taxes had been a rising problem.

A separate report from NatWest confirmed enterprise exercise slowed in virtually each area of the nation in September in comparison with August because the “Autumn Budget dominates [the] outlook”.

Meanwhile, a survey by Which? discovered that client confidence has additionally been hammered, significantly by the choice to take away winter gasoline funds from most pensioners.

Only 17pc of individuals consider the economic system will get higher over the subsequent yr, whereas simply over half – 51pc – predict it is going to worsen, the buyer group discovered.

The gloom comes amid expectations of tax rises and public spending cuts on the upcoming Budget. The Chancellor, Rachel Reeves is extensively anticipated to extend capital positive aspects and inheritance tax in a Budget raid on enterprise and wealth.

Sebastian Burnside, chief economist at NatWest, mentioned companies had been ready to see how taxes, spending and borrowing selections affected the economic system.

He mentioned: “This is going to be a really big budget, both for the size of the fiscal hole the Chancellor says she needs to plug, and beyond the raw numbers we are going to learn a lot more about this Government’s approach to tackling the problems and issues it faces. Whenever you talk to any business it is either issue one or two that they bring up.”

09:12 AM BST

China justifies EU brandy restrictions as tariff row deepens

China mentioned its anti-dumping measures in opposition to brandies imported from the European Union are “legitimate trade remedy measures” as its row with the bloc over commerce tariffs intensifies.

French manufacturers equivalent to Hennessy and Remy Martin will face the restrictions, adopted simply days after the EU voted for tariffs on Chinese-made electrical automobiles (EVs), sparking its greatest commerce row with Beijing in a decade.

China’s commerce ministry mentioned preliminary findings of an investigation confirmed that dumping of brandy from the EU threatened “substantial damage” to home trade.

Today the ministry mentioned the bloc’s actions in opposition to Chinese EVs “seriously lack a factual and legal basis” and “clearly violate” World Trade Organisation (WTO) guidelines.

China has protested strongly to the WTO, it added.

Trade tensions have surged because the European Commission mentioned final week it would press ahead with tariffs on China-made EVs, even after Germany, the bloc’s largest economic system, rejected them.

Another signal of rising commerce pressure was the ministry’s remarks on Tuesday that an anti-dumping and anti-subsidy investigation into EU pork merchandise would ship “objective and fair” selections when it wraps up.

08:56 AM BST

FTSE 100 rebounds after China worries

UK shares rebounded from a one-month low brought on by the doubts about China’s economic system.

The blue-chip FTSE 100 moved 0.5pc increased, whereas the mid-cap FTSE 250 was up 0.5pc.

Among particular person shares, Rio Tinto’s UK-listed shares slipped as a lot as 0.9pc after the Australian miner mentioned it will purchase Arcadium Lithium in a $6.7bn (£5.1bn) all-cash deal to turn out to be the world’s third-largest lithium producer.

Mondi gained 3.6pc to prime the FTSE 100 after the paper and packaging firm agreed to purchase Schumacher Packaging’s German, Benelux and UK packaging property for €634m (£531.2m), together with debt, to broaden in Western Europe.

CMC Markets superior 6.2pc to steer the FTSE 250 after the buying and selling platform forecast a 45pc rise in first-half internet working earnings, buoyed by value cuts and sustained ranges of buying and selling exercise.

08:43 AM BST

Ministers ‘looking seriously’ at rail funding after ‘HS2-light’ steered

Transport Secretary Louise Haigh is wanting “very seriously” at tips on how to improve rail funding within the north, a Cabinet colleague mentioned amid experiences a “HS2-light” railway line might be constructed between Birmingham and Crewe.

Senior authorities figures are a proposal to increase the rail line in a cheaper approach than the unique scheme, in line with The Times.

Culture Secretary Lisa Nandy mentioned: “I think the difficulty that the Transport Secretary and the Chancellor have is that the last government seriously overcommitted to projects that they had no idea how they were going to fund from the public finances, and so it’s meant some very tough decisions.

“I can’t obviously pre-empt what’s going to be in the spending review, which the Chancellor will announce in a matter of weeks.

“But I know it’s something that the Transport Secretary is looking at very seriously.”

Asked a few report in The Times suggesting the road will go forward, Wigan MP Ms Nandy instructed Times Radio: “As a constituency MP, and also as a member of the Government, we would want to see far more investment in transport in the north of England, and far more ability for mayors and councils to be able to determine how that investment is spent.”

08:35 AM BST

China shares undergo worst fall since 1997

China shares suffered their worst day in 27 years as merchants had been left disenchanted by a scarcity of stimulus for the nation’s ailing economic system.

The Shenzhen Composite Index on China’s second change tumbled 8.6pc, or 181.45 factors, to 1,917.32, which was its sharpest fall since May 1997.

The Shanghai Composite Index dived 6.6pc, or 230.92 factors, to three,258.86, after racking up large positive aspects a day earlier following a week-long break.

The benchmark CSI 300 dropped by 7.1pc, which was its greatest fall since February 2020.

China’s 🇨🇳 CSI 300 Index — is tanking after an enormous drop yesterday. Investors aren’t satisfied that the federal government’s stimulus plans will assist.

Some suppose China is ready for the US election to behave, however many are pulling cash out of China and placing it into US tech shares… pic.twitter.com/a3W7HkJDLG

— Nicholas Mugalli (@ActualNickMugalli) October 9, 2024

08:25 AM BST

China to carry weekend briefing as shares plunge

China’s finance minister will maintain a briefing this weekend centered on fiscal coverage, Beijing authorities mentioned, after a pointy sell-off within the nation’s inventory markets.

Traders on the mainland and in Hong Kong had been left disenchanted by a information convention on Tuesday through which officers did not unveil any new stimulus and offered scant element on its plans for implementing the raft measures already flagged.

Lan Fo’an will use Saturday’s information convention to stipulate “countercyclical adjustment of fiscal policy to promote high-quality economic development”, Beijing introduced.

The world’s second-largest economic system has struggled to regain its footing because the lifting of pandemic measures on the finish of 2022.

Economists say extra direct state help is required to spice up flagging consumption and obtain the federal government’s official nationwide progress goal of about 5pc for this yr.

08:08 AM BST

FTSE 100 rebounds from sharp fall

The FTSE 100 started the day increased after steep falls on Tuesday triggered by worries about demand from the Chinese economic system.

The UK’s blue chip index rose 0.4pc to eight,222.84 whereas the midcap FTSE 250 gained 0.2pc to twenty,680.76.

07:58 AM BST

Revolution Beauty gross sales hunch because it clears previous inventory

Cosmetics model Revolution Beauty has revealed tumbling first half gross sales amid an overhaul however mentioned it’s set to return to progress in its fourth quarter because the turnaround begins to repay.

The group mentioned internet gross sales plunged by a fifth to £72m within the six months to August 31 because it simplified its product providing and ramped up clearance promotions to shift previous inventory.

It additionally revealed an £11.3m write off on previous inventory because it continues the shake up.

Underlying earnings, excluding the inventory write down, fell 11pc to £3.1m in its first half.

But the corporate mentioned gross sales for the full-year at the moment are set to fall at a slower tempo within the second half, with a return to progress within the last three months.

“This growth is expected to accelerate through 2025-26,” it mentioned.

Full-year underlying earnings are anticipated to be “at least in line with 2023-24”, as beforehand guided, it added.

07:42 AM BST

Marston’s gross sales develop because it offloads brewery enterprise

Marston’s noticed a 4.8pc rise in like-for-like gross sales over the previous yr, amid robust progress throughout each its foods and drinks divisions.

The group, which operates 1,339 pubs throughout the UK, mentioned gross sales even grew over the latest three months to the tip of September, regardless of unusually moist climate throughout the quarter.

Marston’s introduced in July that it has pulled out of brewing after 186 years after promoting the rest of its beer enterprise to Carlsberg for £206m.

It was introduced this week that its former Banks’s Brewery in Wolverhampton can be closed within the autumn of subsequent yr.

Chief government Justin Platt mentioned: “The strong revenue performance is very pleasing. This reflects the quality of the experiences we are providing for our guests as well as the continued focus and passion of our team.

“This performance, combined with our recent disposal of CMBC puts Marston’s in a strong position to drive value for our shareholders as a focused pub business.”

07:29 AM BST

US considers break-up of Google in landmark on-line search case

Google might be damaged up, the US Department of Justice has mentioned, after a landmark case which discovered it had constructed an unlawful monopoly over on-line looking out.

Its mother or father firm Alphabet could also be compelled to divest elements of its enterprise, equivalent to its Chrome browser and Android working system, the DoJ mentioned.

It comes after Judge Amit Mehta of the US district courtroom for the District of Columbia ruled in August that Google had unfairly blocked rivals by paying $26bn to turn out to be the default search engine on smartphones and net browsers.

The Justice Department mentioned: “Fully remedying these harms requires not only ending Google’s control of distribution today, but also ensuring Google cannot control the distribution of tomorrow.”

Google, which has greater than 90pc of the market share for world web searches, mentioned it plans to enchantment.

The firm mentioned in a company weblog publish that the proposals had been “radical” and mentioned they “go far beyond the specific legal issues in this case.”

07:16 AM BST

Rio Tinto to purchase lithium mining large in $6.7bn deal

Rio Tinto has introduced it is going to purchase US-based lithium producer Arcadium Lithium in a $6.7bn (£5.1bn) deal.

The all-cash takeover value $5.85 per share will remodel the London-listed miner into the world’s third-largest provider of lithium, which is utilized in a wide range of merchandise together with hybrid and electrical automotive batteries, laptops and telephones.

The acquisition has been unanimously accepted by each firms’ boards and is predicted to happen by the center of subsequent yr.

Rio Tinto chief government Jakob Stausholm mentioned: “Acquiring Arcadium Lithium is a significant step forward in Rio Tinto’s long-term strategy, creating a world-class lithium business alongside our leading aluminium and copper operations to supply materials needed for the energy transition.

“Arcadium Lithium is an outstanding business today and we will bring our scale, development capabilities and financial strength to realise the full potential of its Tier 1 portfolio.”

Arcadium Lithium boss Paul Graves mentioned: “We are confident that this is a compelling cash offer that reflects a full and fair long-term value for our business and de-risks our shareholders’ exposure to the execution of our development portfolio and market volatility.”

07:14 AM BST

China shares undergo worst fall since pandemic

China shares suffered their worst drops because the pandemic after merchants had been left disenchanted by Beijing’s plans to stimulate the world’s second largest economic system.

Shanghai shares tumbled 5.3pc in a single day after racking up large positive aspects a day earlier following a week-long break, whereas the Shenzhen Composite Index on China’s second change sank 6.7pc, or 140.07 factors, to 1,958.70.

The benchmark CSI 300 Index tumbled as a lot as 7.4pc, which was its greatest fall since 2020.

Stocks on the mainland and Hong Kong rocketed after China final month started asserting measures aimed toward boosting its flagging economic system, piling on greater than 20pc every.

However, a much-anticipated information convention in Beijing on Tuesday – after the Golden Week break – left merchants disenchanted as officers refused to unveil extra stimulus and offered scant element on the measures already pledged.

Stephen Innes of SPI Asset Management mentioned: “Let’s call it what it is — an abject failure — as Chinese shares opened sharply lower, sending a clear signal that the market is no longer buying half-hearted promises.”

Yeap Jun Rong of IG added: “A lack of new stimulus has been the cause of disappointment, with many market participants hoping that its fiscal policies will follow in the footstep of the financial ‘bazooka’ delivered in late-September, but there was clearly a step-down in yesterday’s announcement.”

06:57 AM BST

Good morning

Thanks for becoming a member of me. We start the day with a take a look at what is going on in China, the place shares have suffered heavy declines as merchants had been left unimpressed by Beijing’s efforts to kick begin the world’s second largest economic system.

Stocks in Shanghai, Shenzhen and Hong Kong had been all down closely, with the benchmark CSI 300 recording its worst drop since 2020.

5 issues to start out your day

1) Britain needs fresh approach to risk-taking, says FCA boss | Nikhil Rathi warns in opposition to ‘rules for the sake of it’ amid considerations watchdog has failed to spice up progress

2) Workers show preference for zero-hours contracts Rayner plans to ban | New analysis exhibits many younger individuals use roles as stepping stones to safe everlasting jobs

3) Why Reeves’s plans to turn on the spending taps could fail to boost the economy | Chancellor’s promised supercharge of funding dangers being ‘underspent’ by Whitehall

4) Shein overtakes Boohoo and closes gap on Asos as UK sales hit £1.6bn | Boom in gross sales at Chinese quick trend large lays groundwork for £50bn London itemizing

5) Drinkers warned over quality of French wine | Drinkers warned over high quality of wine after unhealthy climate hits harvest

What occurred in a single day

Shares in China slumped as particulars of financial stimulus plans from officers in Beijing did not dwell as much as traders’ expectations.

The Shanghai Composite misplaced 5.1pc to three,311.02 after it gained 4.6pc Tuesday when it reopened from a nationwide vacation.

The CSI300 Index, which tracks the highest 300 shares traded within the Shanghai and Shenzhen markets, fell by 5.6pc.

Stocks in Hong Kong fluctuated between positive aspects and losses, with the Hang Seng Index falling by 2.4pc to twenty,418.61. This decline adopted a plunge of over 9pc on Tuesday – its worst since 2008 – as merchants offered off shares after current rallies.

Stephen Innes of SPI Asset Management mentioned: “Let’s call it what it is — an abject failure — as Chinese shares opened sharply lower, sending a clear signal that the market is no longer buying half-hearted promises.”

In Tokyo, the Nikkei 225 index superior 0.6pc to 39,178.70. Shares of the Japanese retailer Seven & i Holdings soared greater than 10pc in early buying and selling after media reported that Canadian comfort retailer operator Alimentation Couche-Tard had elevated its takeover bid by about 20pc.

Japan’s parliament was as a result of be dissolved on Wednesday to pave the way in which for a basic election. Prime Minister Shigeru Ishiba is looking for to consolidate help after taking workplace final week, amid indicators the Liberal Democrats’ ruling coalition stays shaky after Ishiba’s predecessor, Fumio Kishida, stepped down following a slew of scandals among the many get together’s lawmakers.

Australia’s S&P/ASX 200 gained 0.2pc at 8,189.70. South Korea’s markets had been closed for a public vacation.

On Wall Street, rises in large tech corporations equivalent to Nvidia and Apple boosted the primary indexes, despite the fact that oil and mining shares pull downwards. The Dow Jones Industrial Average rose 0.3pc, to 42,080.37, the S&P 500 rose 1pc, to five,751.13, and the Nasdaq Composite rose 1.5pc, to 18,182.92.

The yield on benchmark 10-year US Treasury notes dipped to 4.02pc from 0.1pc late on Monday.