Too several securities market financiers fall short to produce high returns over the long term. Usually, the factor for their failing is not an absence of knowledge or initiative, however an underappreciation of the worth of simpleness when looking for to uncover the very best supplies for their profile.

Our reasoning for encouraging visitors to buy FTSE 250-listed Cranswick in July 2022, as an example, was not specifically made complex. We just felt it was a monetarily audio, high-grade company that had a strong lasting development approach. Furthermore, our companied believe it supplied great worth for cash adhering to a sharp autumn in its share cost.

Since our first suggestion, the farmer, manufacturer and vendor of a variety of foods consisting of sausages, prepared meats and dips has actually created a 55pc resources gain. This stands for a 42 percent factor outperformance of the FTSE 100 and is 43 percent factors in advance of the FTSE 250’s gain over the very same duration. When rewards obtained or stated given that our initial referral are consisted of, the supply has actually generated a 62pc overall return in bit greater than 2 years.

In Questor’s sight, the firm’s shares are positioned to supply more resources gains and index outperformance for mainly the very same factors as those provided at the time of our first referral.

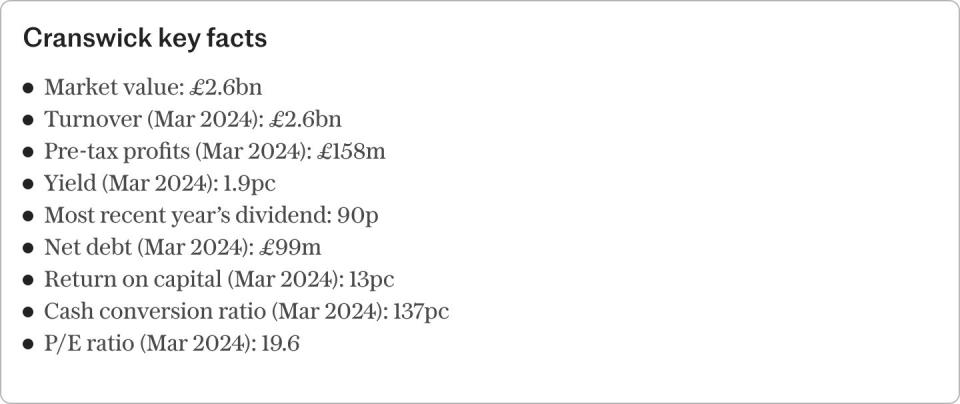

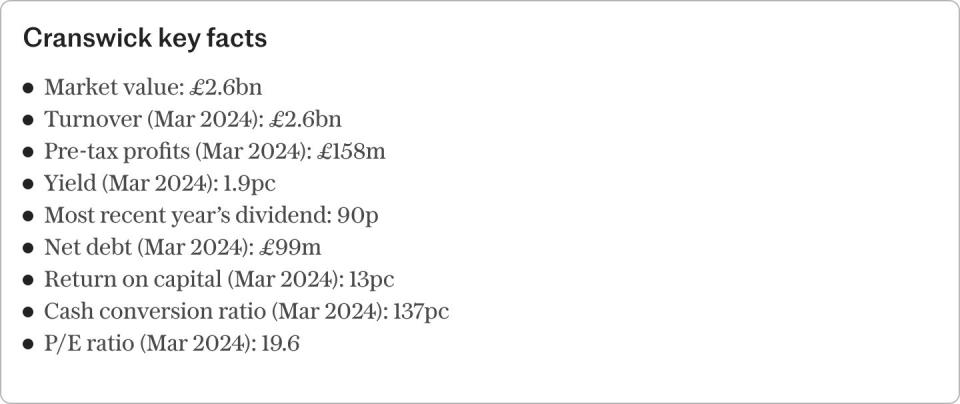

Notably, the firm’s monetary standing continues to be audio amidst an unpredictable duration for the UK and international economic climates. Its net gearing ratio totals up to 11pc, which is incredibly reduced compared to various other FTSE 350 companies, while internet passion cover of about 19 recommends the firm might quickly manage to make passion repayments on its financial debt must success come under stress in the close to term.

A strong annual report likewise indicates better extent for purchases. Indeed, the company invested around ₤ 46m in 2014 on 2 considerable acquisitions. Further purchases to improve its affordable setting would certainly be completely unsurprising– specifically if firm evaluations drop amidst an unpredictable financial expectation in the brief run.

The company’s return on equity of approximately 13pc in 2014, in spite of having extremely small financial debt degrees, reveals that it still has a clear affordable benefit, which must relate to increasing earnings over the long-term. Its up and down incorporated company design additionally distinguishes it from opponents and indicates it is much better able to manage abrupt adjustments in its operating atmosphere.

In its newest quarter, the company published a 6.7 computer increase in profits and mentioned that it gets on track to fulfill previous monetary assistance for the complete year. This column anticipates its monetary expectation to enhance over the coming years as a duration of small rising cost of living corresponds to much less higher stress on prices, thus sustaining revenue margins. Its success needs to likewise be enhanced by effectiveness and performance renovations being produced by continuous financial investment in automation.

Further rates of interest cuts, on the other hand, are most likely to catalyse need for the firm’s costs items. A continual autumn in the Bank Rate, when integrated with reduced rising cost of living, is most likely to imply increasing non reusable revenues in genuine terms once time delays have actually passed. In turn, this must motivate customers to end up being much less cost aware and enhance their determination to trade approximately a lot more costly optional things.

The company’s monetary potential customers continue to be positive many thanks to considerable development possibilities throughout a variety of items, consisting of fairly brand-new locations such as pet food and global markets.

Of program, Cranswick‘s considerable share cost increase given that our first suggestion indicates that it currently has a dramatically greater market assessment. Then, it had a fairly abundant price-to-earnings (P/E) ratio of 15.8. Now, its P/E proportion stands at an also greater 19.6.

Although this indicates there is much less extent for a higher rerating than at the time of our initial suggestion, the firm’s shares nonetheless remain to provide great worth for cash. The company has strong principles, as confirmed by its solid annual report and clear affordable benefit, while its development approach continues to be rational and is readied to be turbocharged by an enhancing operating atmosphere in the coming years.

Simply placed, every one of these variables must enable the supply to supply more resources gains and index outperformance over the coming years. Keep acquiring.

Questor claims: purchase

Ticker: CWK

Share cost at close: ₤ 47.65

Read the most recent Questor column on telegraph.co.uk every Sunday, Monday, Tuesday, Wednesday and Thursday from 8pm.

Read Questor’s rules of investment prior to you follow our ideas.