Millions of retired people are readied to obtain a 4pc rise in their state pension plan, worth ₤ 460, a year from April.

However, specialists have actually alerted that lots of pensioners will not really feel the influence of the three-way lock rise as means-testing winter fuel payments will certainly deny numerous approximately ₤ 300, leaving them with simply ₤ 160 even more.

Furthermore, for retired people that are greater price taxpayers, the worth of the regular ₤ 8.85 increase will certainly be deteriorated to around ₤ 5, according to Mike Ambery, retired life financial savings supervisor at Standard Life.

Under the triple lock, the state pension plan climbs every year in accordance with either September’s rising cost of living, wage development or 2.5 computer, whichever is the greatest.

With rising cost of living presently at around 2pc, it is risk-free to forecast that the advantage will certainly be boosted in accordance with today’s typical incomes development number of 4pc.

Labour’s choice to means-test winter months gas settlements will certainly deny 10 million pensioners of the advantage, leaving lots of having a hard time to warm their homes. Sir Keir Starmer encounters a face-off later on today when the choice comes prior to Parliament.

Furthermore, icy tax obligation braces indicate the rise will certainly press thousands extra pensioners right into paying tax obligation.

Alice Haine, individual financing expert at Bestinvest claimed: “Throw in frozen tax thresholds, with the full new state pension edging ever closer to surpassing the standard personal allowance of £12,570 – the point at which any income is liable for tax; the potential loss of the winter fuel allowance and the threat that housing secretary Angela Rayner may abolish a council tax break for households with only a single occupant and it’s easy to see why pensioners feel under siege.”

Pensioners that got to state pension plan age prior to April 6, 2016 will certainly get on the old state pension plan and will certainly obtain an uplift of ₤ 353.6 from April.

The rise will certainly take the yearly advantage to ₤ 9,167 a year.

11:15 AM BST

Thanks for adhering to today’s real-time blog site

That’s all from the Money blog site in the meantime. Thanks for adhering to the statement with us today.

Stay approximately day on the state pension plan and winter months gas allocation at Telegraph Money and share your ideas with us by emailing money@telegraph.co.uk.

10:38 AM BST

‘To tax pensioners would be just wrong’

Roger Jude, 80, claimed the state pension plan uplift was a “reasonable boost”, and is pleased the three-way lock continues to be undamaged.

However, he gets on the cusp of the greater price tax obligation limit, over which earnings is strained at 40pc. This indicates a huge portion of his pay increase will certainly be gnawed in tax obligation. Labour has actually dedicated to maintain limits iced up till a minimum of 2028.

Mr Jude claimed: “I just have to take the medicine, I don’t have much choice. [The threshold freeze] is not very welcome but there we are.”

He thinks Rachel Reeves made the incorrect selection in ditching winter months gas settlements for numerous pensioners, worth approximately ₤ 300.

“It’s a very poor decision – even the Labour party thinks so, although they dare not vote against Keir.

“I just hope when Reeves does her budget she’ll find a way not to tax pensioners. She’s got to raise money but to target that group of people is just wrong.”

10:27 AM BST

Old state pension plan to increase by simply ₤ 6.80 a week

Pensioners that got to state Pension age prior to April 6, 2016 will certainly get on the old state pension plan and will certainly obtain an uplift of ₤ 353.6 from April following year.

The rise will certainly take the yearly advantage to ₤ 9,167 a year.However, not every person on the old state pension plan obtains specifically the conventional price. In certain, lots of employees that remained in ‘contracted out’ work-related pension plan systems might obtain much less than the complete price and their work-related pension plans will commonly increase by no greater than rising cost of living, according to previous pension plans priest Steve Webb.

Some individuals on the old system that likewise have ‘additional’ state pension plan will certainly see that component of their pension plan increase just in accordance with rising cost of living, presently 2.2 computer.

10:03 AM BST

‘Labour has conned pensioners’

The Chancellor’s idea that retired people are much better off is a directly lie, composes the Telegraph’s head of cashBen Wilkinson

It’s rubbish for the Chancellor to recommend that pensioners will be £1,700 better off under Labour since in actual terms they have actually currently shed as long as ₤ 300.

Labour’s transfer to limit winter months gas settlements to those in invoice of pension plan credit score has actually currently been subjected of what it is– a breakout and fierce choice that could kill thousands of pensioners.

The celebration’s political election dedication to the three-way lock was constantly worthless– and Labour recognized it. After 2 years of overpriced rising cost of living, the damages triggered by the three-way lock was mainly done.

The rise to find in April just shows incomes overtaking rising cost of living, and the three-way lock is not likely to trigger the Treasury much problem over the following 4 years.

09:54 AM BST

More than fifty percent of state pension plan uplift shed to rising cost of living

The brand-new state pension plan is readied to increase ₤ 460 in 2025, “but more than half of this is to keep pace with rising prices” according to previous pension plans priest Steve Webb:

“Part of next April’s increase is simply to keep pace with rising prices. Based on the current inflation figure of 2.2pc, the new state pension would need to rise by just over £250 simply for pensioners to stand still.

Whilst an above-inflation increase of £460 will be welcomed, only the further £210 represents a real increase. And this is before allowing for the income tax which most pensioners will pay on their state pension rise. Those who lose £200 or £300 in Winter Fuel Payments will therefore still be worse off in real terms next April.

09:46 AM BST

How Labour could take away your state pension

With Labour promising not to increase taxes for “working people”, it is been afraid that Britain’s 12 million pensioners might be at the sharp end of Rachel Reeves’s “painful” October Budget.

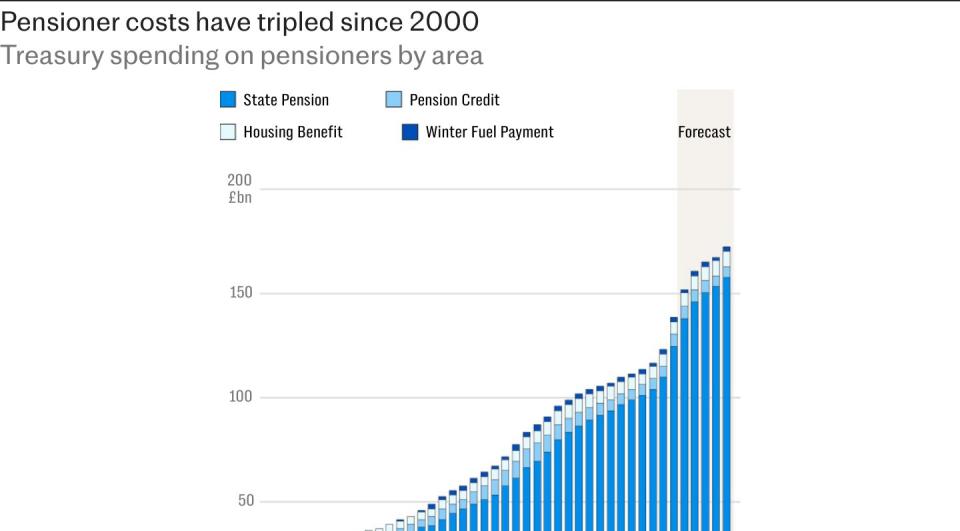

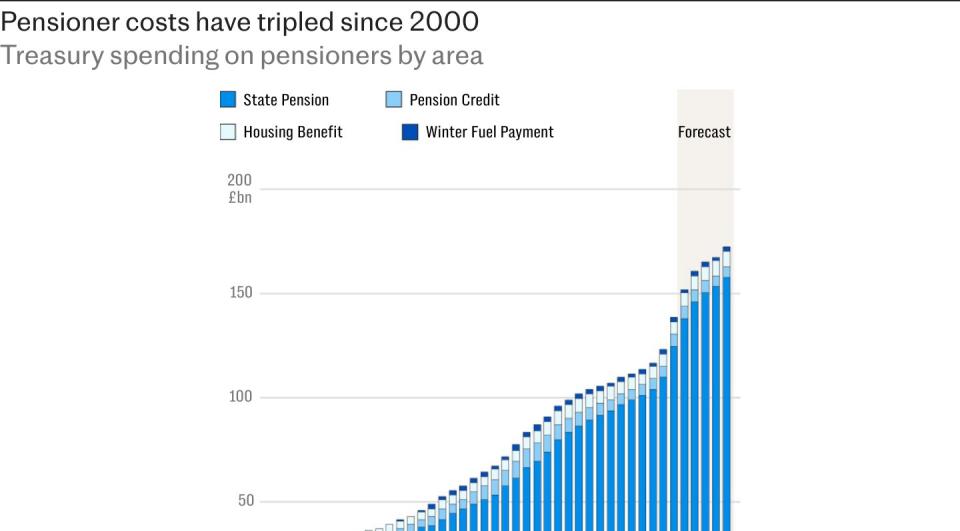

The state pension plan gives an economic safeguard for pensioners without various other earnings. It is likewise costly, setting you back the Treasury over ₤ 100bn each year– a number anticipated to continue climbing.

According to the Chancellor there is a ₤ 22bn “black hole” to connect, and specialists claim choices require to be made to reduce the country’s ballooning multi-billion extra pound state pension plan costs.

Senior cash press reporter Mattie Brignal has actually considered whether Labour might claw back the expense of the state pension plan, and how could such a raid cost you?

09:02 AM BST

Readers on the state pension plan increase

08:59 AM BST

Martin Lewis keeps in mind that just 1 in 4 pensioners obtain the ‘new’ state pension plan

Good information. The complete ‘brand-new’ state pension plan is to increase ₤ 460 a year next year as a result of the three-way lock. That is a genuine increase of concerning ₤ 200 over rising cost of living. Yet there are 2 points I’d mention in the context of the argument concerning the winter months gas settlement.

1. That begins followingApril This …

— Martin Lewis (@Martin SLewis) September 10, 2024

08:49 AM BST

4,000 might pass away without winter months gas settlement

Almost 4,000 pensioners might pass away if Labour scraps winter months gas settlements, according to the celebration’s very own research study.

A damning record released in 2017, when Keir Starmer remained in the darkness closet, asserted that restricting the allowance to pensioners on benefits would certainly set you back countless lives.

Money press reporter Tom Haynes has extra:

The evaluation by the Resolution Foundation brain trust was appointed by Labour in the run-up to the 2017 political election. It asserted 3,850 pensioners’ lives would certainly go to threat via being incapable to warm their homes.

The darkness chancellor, John McDonnell, claimed as “removing the winter fuel payments from millions of pensioners could leave thousands of the most vulnerable at even more risk this winter”, including that pensioners would struggle to heat their homes if the allocation was ditched.

08:29 AM BST

Winter gas settlements might take 4 years to get to pensioners

The variety of pensioners registering for pension credit has actually increased in 5 weeks after Chancellor Rachel Reeves introduced strategies to ditch global winter months gas settlements.

However, specialists alerted that in spite of the take-up, it might still take 4 years for all pensioners eligible for the settlement to use.

Money press reporter Madeleine Ross has the information:

As lots of as 880,000 pensioners that might be declaring the advantage do not, Department for Work and Pensions numbers recommend.

The plan, which was introduced on July 29, is readied to increase ₤ 1.4 bn. But if every one of the 880,000 pensioners that are qualified use, the Treasury would face a tax bill of £3.8bn, a record by Policy in Practice discovered.

Sir Keir Starmer likewise refuted that the Cabinet was divided over the cuts to the settlements, which had actually formerly been provided to all those over state pension plan age. Most obtained a settlement of ₤ 200, with those over the age of 80 obtaining ₤ 300.

08:03 AM BST

State pension plan disappoints minimal standard of life

The brand-new state pension plan is readied to tip over ₤ 3,000 except the quantity required for a minimal requirement of living at retired life, according to Interactive Investor.

The triple-lock pension plan promise shows that the state pension plan need to increase by 4pc to around ₤ 460 in April, in accordance with the typical incomes numbers. This would certainly take the complete state pension plan for guys birthed after 1951 and ladies birthed after 1953 to ₤ 11,962 in the 2025/26 tax obligation year.

This is ₤ 2,895 listed below the ₤ 14,857 (gross) required for a minimal standard of life, as specified by the Pensions and Lifetime Savings Association.

Myron Jobson, elderly individual financing expert, interactive financier, claimed:

“Our calculations offer a stark reminder that while the state pension is a vital component of retirement income, it falls short of covering even the minimum income needed to enjoy a comfortable retirement.

“Worryingly, our research has exposed a looming national pension emergency, with people at the crunch stage of their retirement planning not saving enough into their pensions to secure a comfortable living standard in retirement.”

07:50 AM BST

Over 2 million reduced earnings pensioners to shed winter months gas allocation

2.5 million older individuals on reduced revenues are readied to shed their winter months gas settlement as an outcome of the Government’s means-testing choice and will certainly have a hard time without it according to charity Age UK.

The real number might be also greater as the present price quote omits the unidentified variety of pensioners with greater revenues that are ill or handicapped and that encounter unavoidably high power expenses consequently.

-

1.6 million older individuals that are staying in hardship will certainly shed their winter months gas settlement as they are not obtaining any one of the certifying advantages.

-

An additional 900,000 older individuals whose revenues are simply over the hardship line will certainly likewise shed the settlement. These individuals have revenues which disappear than ₤ 55 each week over the hardship line.

The factor most of the 900,000 older individuals have revenues simply over the line is that they have a little work-related pension plan. They conserved throughout their functioning lives to attempt to guarantee they might take pleasure in an extra comfy retired life, however when the moment comes the unfairness of the pension credit ‘cliff-edge’ indicates they are still having a hard time monetarily.

07:42 AM BST

Loss of winter months gas leaves pensioners sensation ‘under siege’

Rachel Reeves, the Chancellor, introduced in July that winter months gas settlements of approximately ₤ 300 will certainly be gotten rid of from numerous pensioners, and will just be offered to those on pension plan credit score.

As an outcome, the ₤ 460 state pension plan uplift will certainly deserve simply ₤ 160 to most of those that are readied to shed the winter months allocation.

Alice Haine, individual financing expert at Bestinvest claimed:

“Pensioners who are set to lose the Winter Fuel Allowance might only find themselves £160 better off come April 2025 as the £300 deficit eats into a state pension increase.

“Throw in frozen tax thresholds, with the full new state pension edging ever closer to surpassing the standard personal allowance of £12,570 – the point at which any income is liable for tax; the potential loss of the winter fuel allowance and the threat that housing secretary Angela Rayner may abolish a council tax break for households with only a single occupant and it’s easy to see why pensioners feel under siege.”

07:31 AM BST

Higher price taxpayers see regular rise of simply ₤ 5

While those on the complete state pension plan will certainly see their regular earnings enhanced by ₤ 8.85 from April, greater price taxpayers will not really feel the complete advantage.

For pensioners paying the greater price of tax obligation, the worth of the regular ₤ 8.85 increase will certainly be deteriorated to around ₤ 5, according to Mike Ambery, retired life financial savings supervisor at Standard Life.

“However, a new state pension of £11,962.60 will also be 95pc of the personal allowance, currently frozen at £12,570 until 2028 – by contrast, in 2021/22 the new state pension was equivalent to 74pc of the allowance.

“This indicates pensioners will certainly require simply ₤ 607.40 of various other earnings prior to paying earnings tax obligation,” he said.

07:17 AM BST

Pay grew 4pc from May to June 2024

Pay excluding bonuses grew by 5.1% in the year to May to July 2024; including bonuses it was up 4.0%, though this comparison is affected by last year’s NHS and civil service one-off payments.

Read Labour market overview ➡️ pic.twitter.com/So7ERyAv1Q

— Office for National Statistics (ONS) (@ONS) September 10, 2024

07:13 AM BST

Pensions boost amid winter fuel backlash

The news comes as the Government faces ongoing backlash over its decision to scrap winter fuel payments as a universal benefit.

Ten million pensioners will lose up to £300 this winter after Chancellor Rachel Reeves announced the payment will only go to those who receive pension credit.

Last week, the Chancellor suggested pensioners can afford the cut, however figures show even the most vulnerable will be hit by the raid.

More than 1.5 million retirees living below the poverty line are set to lose the benefit.

A crunch vote on the issue is going ahead in Parliament today, with Labour braced for a rebellion within its own benches. The Telegraph’s politics blog will have all you need to know this afternoon.

07:03 AM BST

State pension to rise by £8.85 a week

Good morning,

Thank you for joining me bright and early. The state pension is expected to rise by 4pc from April based on the increase in average earnings in July, thanks to the triple lock guarantee.

Under the triple lock promise, the state pension rises each year in line with the highest of September’s inflation, wage growth or 2.5pc.

This works out as an extra £8.85 a week in the pockets of pensioners and an annual benefit of around £12,000.

However, the final decision on a pension increase will be made by secretary of state, Liz Kendall, < a href =” October rel =

target =(* )data-ylk =

course=”web linkThe ‘staggering’ figure needed to match the full state pension web link (* )rel =Savers target =” _ space

slk: also one of the most susceptible will certainly be struck by the raid.; elm: context_link; itc:0; sec: content-canvas State pension leaves retirees £5,000 short of basic living standard web link” href =Forecast rel =(* )target =” _ space

slk:How Labour could take away your state pension the three-way lock assurance,; elm: context_link; itc:0; sec: content-canvas (* )web linkMillions rel =Rachel Reeves target =” _ space Budget

slk: in advance ofWhy a Labour plot to means-test the state pension would be a disaster ‘s budget.; elm: context_link; itc:0; sec: content-canvas” > in advance ofThe Government’s budget plan.

5 points to begin your day (* )1)How pensioners could be targeted in Reeves’s Budget |From would certainly require to develop a considerable exclusive pot to change the fundamental earnings

Source link 2) (* )|(*) rise in settlements from three-way lock device will certainly do little to shut void (*) 1 )(*) |(*) of retired people run the risk of going to the sharp end of (*)’s impending (*) 4) (*) |(*) has actually been prompted to restrict qualification to make it extra monetarily lasting(*) 5) (*) |(*) means-tested advantages to a dual fatality tax obligation, retired people remain in the shooting line(*)