Southern Water is suggesting to pay ₤ 275m in rewards over the following 5 years while increasing almost ₤ 4bn of fresh financial obligation.

The business, which offers 4.7 m clients in Kent, Sussex and Hampshire, is intending to award investors while enhancing its internet financial obligation stack from ₤ 6bn to ₤ 8bn by 2030.

One of the major recipients of the returns payments will certainly be the business’s bulk proprietor, Macquarie.

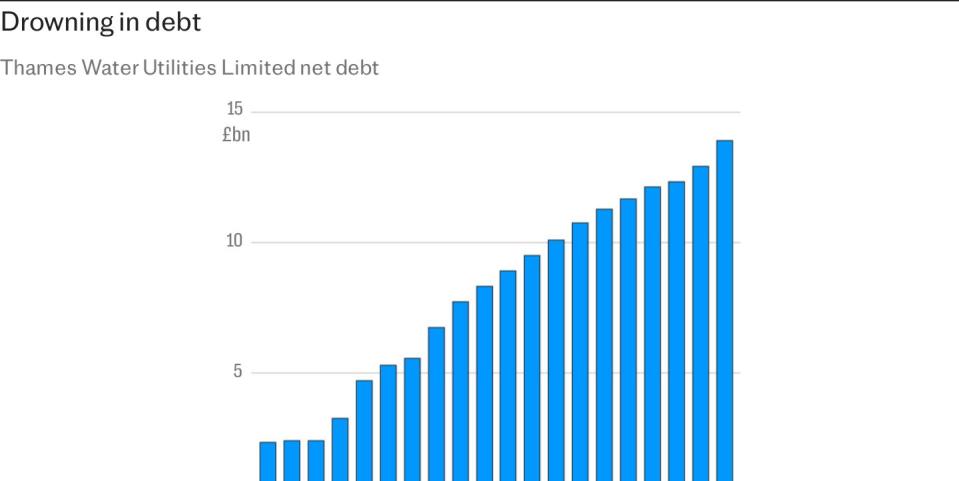

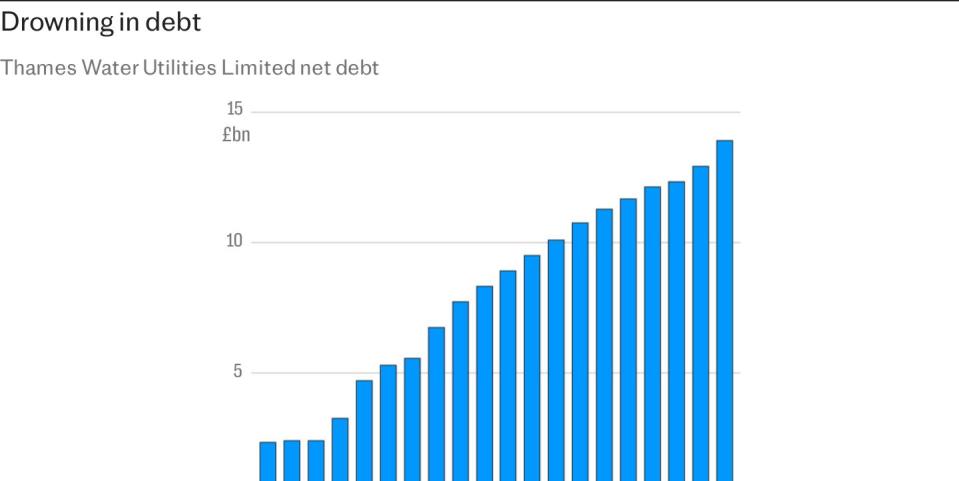

The Australian financial investment titan has actually formerly been criticised over its ownership of Thames Water between 2006 and 2017, a duration throughout which it increased the business’s loanings to ₤ 11bn and secured an approximated ₤ 2.7 bn of rewards.

Thames Water is currently in jeopardy of collapse under the weight of its huge financial obligation stack.

In its newest service strategy sent to Ofwat, Southern introduced strategies to pay rewards of ₤ 275m in between 2025 to 2030.

It has actually currently likewise notified financiers of its intent to touch bond markets for ₤ 3.8 bn of brand-new financial obligation in an effort to bolster its financial resources.

As well as increasing brand-new financial obligation, Southern claimed it would certainly likewise look for an additional ₤ 650m from investors led by Macquarie.

While increasing brand-new financial obligation will certainly boost the dimension of its annual report, it will certainly likewise concern managers with countless extra pounds extra in loaning expenses.

The capital-raising method is developed to enhance Southern’s financial resources as it enters into fight with regulatory authority Ofwat over how much it will be allowed to increase customer bills

Southern’s relocation comes versus a background of expanding worry over the energy industry’s unsteady financial resources, sustained by the possibility of Thames Water entering the Government’s special administration regime

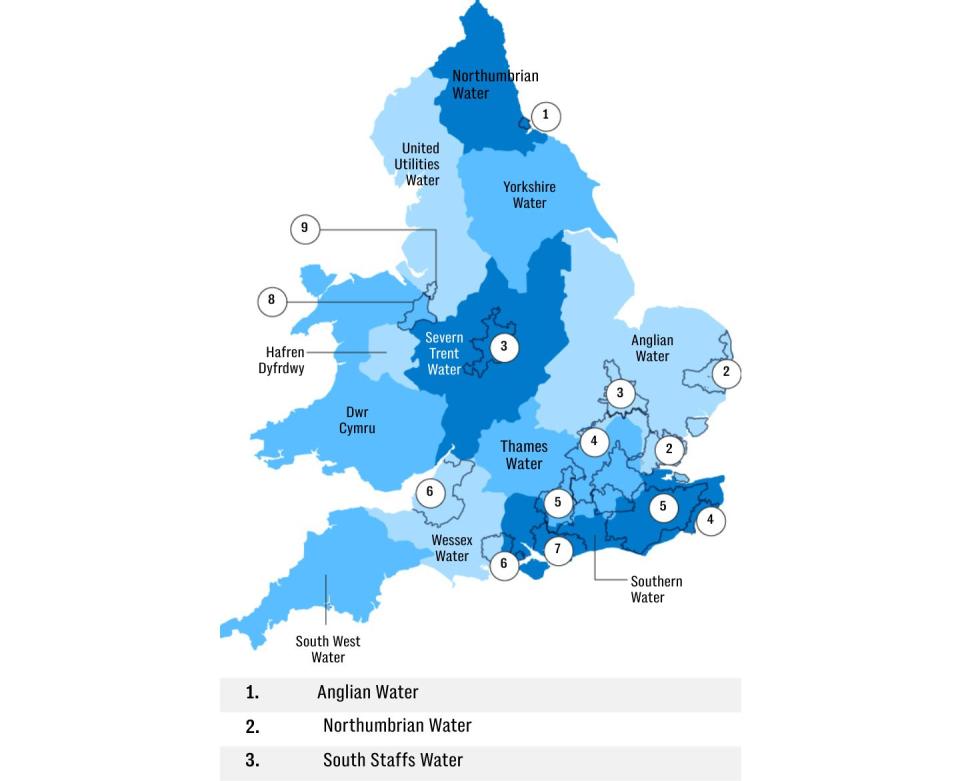

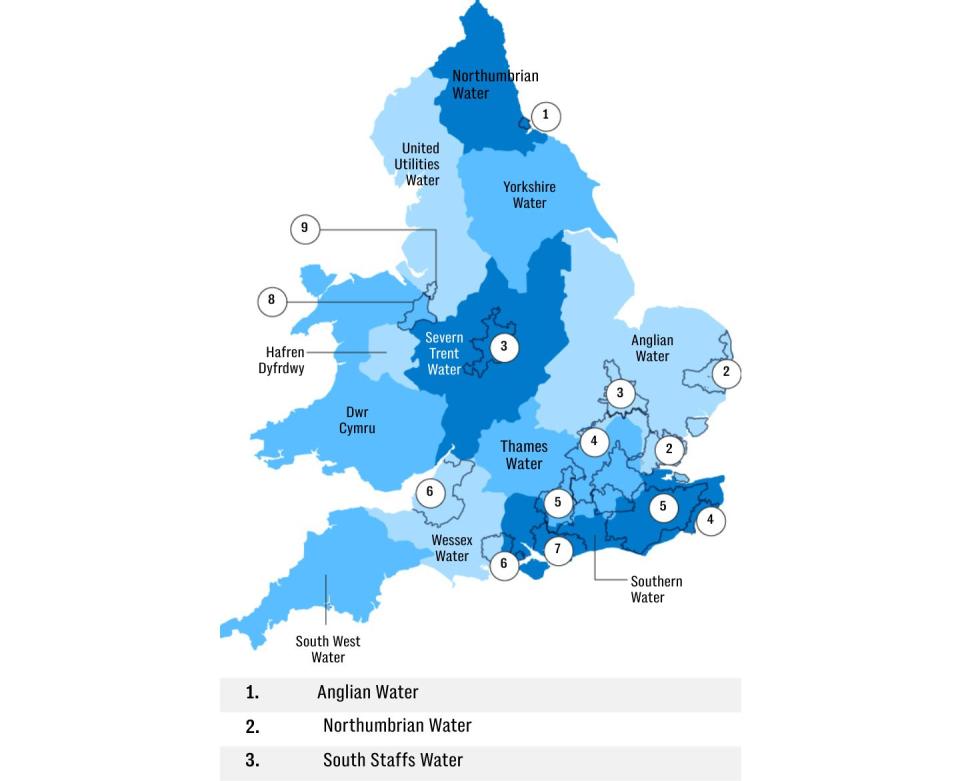

While Southern does not encounter an instant cash money problem like Thames, there are anxieties of pollution throughout the UK’s water industry if Ofwat rejects to permit a substantial rise in family costs.

Southern, in addition to Britain’s various other public utility, is presently bargaining with Ofwat to see just how much costs can climb over the following 5 years in a procedure called the 2024 cost testimonial (PR24).

The regulatory authority has actually informed Southern it can just boost costs to ₤ 603 every year yet Southern wants to increase them to £734 generally by 2030.

It protests this background that Southern has actually revealed its recommended ₤ 3.8 bn financial obligation raising.

Influential rankings company Moody’s in July claimed it was taking into consideration reducing Southern’s elderly financial obligation to scrap standing owing to anxieties over Ofwat’s decision on costs, which can hurt Southern’s capacity to pay financiers.

Bond markets have actually likewise transformed versus several of the business’s financial obligation in current months, with the return on Southern’s 2026 bonds increasing to 13.5 computer.

Southern requires to invest large amounts on boosting its network, yet this might be made harder if it falls under scrap region since it would certainly need to pay financial obligation financiers extra in loaning expenses.

Macquarie claimed it is intending to place an additional ₤ 650m right into Southern in between following year and 2030 to aid maintain its investment-grade ranking.

The relocation is anticipated to press Southern’s debt-to-equity proportion to listed below 70pc in 2027– a degree it requires to preserve in order to pay rewards under Ofwat’s regulations.

Southern’s money supervisor, Stuart Ledger, claimed: “Raising debt for investment and rolling over existing bonds is a normal part of business.

“Our exciting plan for the next five years calls for our biggest ever investment to deliver environmental protection and a resilient water future for the region.”

On the rewards, Mr Ledger included: “Our original PR24 submission included assumptions for dividend payments. Our revised plan has grown due to new regulatory drivers and now anticipates a further £650m equity injection to support delivery of our record-breaking investment, rather than dividend payments.

“The company does know that investors contribute to the company in expectation of a return and we hope to return to prudent dividends in line with our stated dividend policy that we highlight in our financeability disclosure.”