Rachel Reeves is readied to extra 2nd homeowner from a funding gains tax obligation raid in her first budget, according to records.

Second homes will certainly be left unblemished since elevating the levy on them can wind up setting you back the Treasury cash, The Times reported.

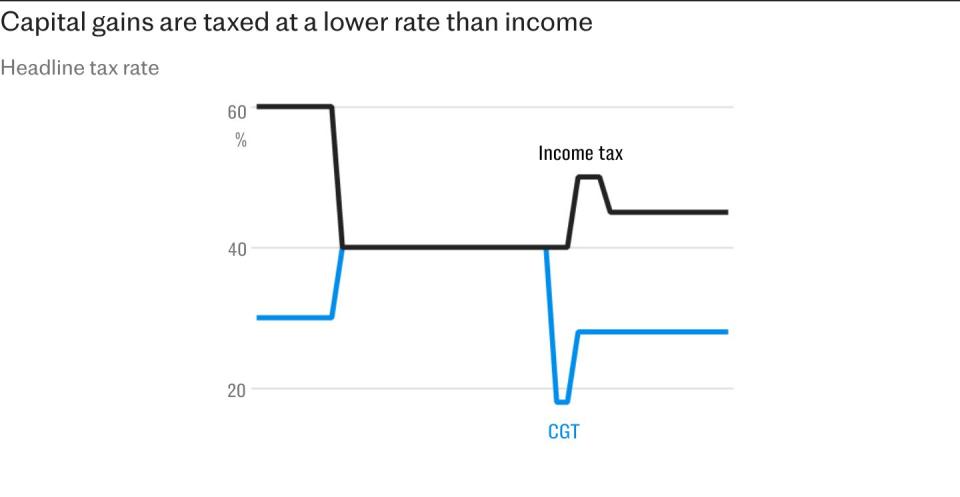

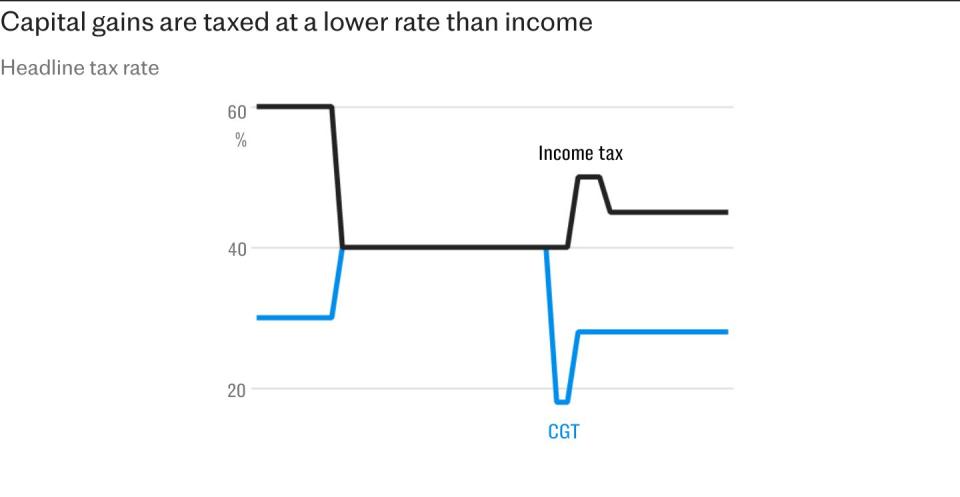

She is rather positioned to elevate the existing 20 percent price imposed on the sale of shares and can target various other possessions, while some alleviations in the existing system are likewise anticipated to be axed.

The step is anticipated to elevate a quantity in the “low billions”, a federal government resource informed the paper.

When the last federal government reduced the price on 2nd homes from 28 percent to 24 percent in its last spending plan, the Office for Budget Responsibility stated that doing so would certainly as a matter of fact elevate virtually ₤ 700 million since the variety of residential property deals would certainly raise.

Revenues from resources gains tax obligation can fluctuate widely since modifications in the behavior of a really handful of individuals can have a big effect.

Just 12,000 people pay two thirds of the £15 billion a year increased from resources gains tax obligation.

HMRC has actually approximated that raising resources gains tax obligation by 10 factors would certainly decrease Treasury profits.

“Very large tax rate rises can reduce exchequer yield due to taxpayer behavioural impacts,” it stated.

The Institute for Fiscal Studies has actually stated that any kind of boosts in resources gains tax obligation must be come with by reforms to the system, such as by billing the levy on possessions after individuals pass away.

Just 12,000 individuals pay two-thirds of the ₤ 15billion a year increased from resources gains tax obligation.

More than fifty percent of all resources gains connects to the sale of shares, while simply 12 percent is from the sale of residential property.

Last month Lord Wolfson, the president of Next, offered ₤ 29 countless his shares in the homewares titan, leading City experts to guess that the sell-offs were an effort to offer them prior to any kind of raid.

Sir Keir Starmer, the head of state, has actually signified that the federal government will certainly raise resources gains tax obligation however turned down records it can increase to as high as 39 percent.

He stated that the recommendations of such a huge surge were “wide of the mark”.

It comes as Ms Reeves prepares to release the biggest Budget tax raid in history in her maiden Budget later on this month.

It will certainly include as high as ₤ 35bn of tax obligation surges – one of the most on document in cash money terms – as she secures her dedication to finishing “austerity” and tries to make sure divisions prevent real-terms cuts in costs.

There is likewise supposition that the spending plan will certainly consist of the initial rise in gas task for 13 years.

Ministers have actually likewise declined to dismiss elevating companies nationwide insurance policy in a step that is readied to elevate substantial amounts.

Critics insurance claim elevating company NICs would certainly breach the spirit of Labour’s statement of belief- which promised not to elevate earnings tax obligation, nationwide insurance policy or barrel.