Rachel Reeves’s strategy to substantially raise loaning in the Budget risks pushing up mortgage rates, according to the Treasury’s evaluation.

An main modelling workout recommends that the Chancellor’s strategies to revise Britain’s monetary regulations can raise the expense of financial obligation for customers and organizations.

The Treasury term paper alerts that a “fiscal loosening” of simply one percent of GDP can result in a “peak increase in interest rates” of as much as 1.25 portion factors.

The record takes place to caution that every rise in yearly loaning of ₤ 25 billion can raise rates of interest by in between 0.5 and 1.25 portion factors.

It is commonly anticipated that Ms Reeves will use her October 30 Budget to ease borrowing rules, an action that can open as much as ₤ 50 billion of costs.

Treasury resources verified that the plan paper, which was released in December and is entitled “The impact of borrowing on interest rates”, mirrors the division’s existing reasoning.

It comes equally as home loan prices were starting to cool down, with some bargains dropping listed below 4 percent for the time in months.

Central rates of interest presently stand at 5 percent, yet a surge to 6.25 percent would certainly include around ₤ 200 a month to a common home loan.

Jeremy Hunt, the previous Chancellor, stated on Saturday evening: “The consistent advice I received from Treasury officials was always that increasing borrowing meant interest rates would be higher for longer – and punish families with mortgages.

“That would be a hammer blow and lead to mortgage misery for many people just at the moment the Bank of England is expected to bring interest rates back down.”

Mr Hunt has actually required the Office for Budget Responsibility to be enabled to obstruct such a choice. This is in spite of the UK’s financial obligation just recently rising to 100 percent of gdp for the very first time given that the 1960s.

On Saturday, Ms Reeves dropped her best tip yet that she means to raise borrowing to fund a multi-billion-pound capital programme, promising to “invest, invest, invest”.

It complies with cautions from Sir Keir Starmer that his event’s very first Budget “is going to be painful”, and it is anticipated that the Chancellor will raise some taxes in an effort to connect a £22 billion black hole she asserts to have actually located in the general public funds.

It is assumed this can consist of a raid on funding gains tax obligation, estate tax or a tax obligation on pension plans.

Economists stated a few of the impacts of greater loaning had actually currently been“priced in” Yields on the 10-year gilt went to 4.13 percent when markets shut on Friday, the highest possible given that late July, partially mirroring worries that Ms Reeves means to increase loaning in the Budget.

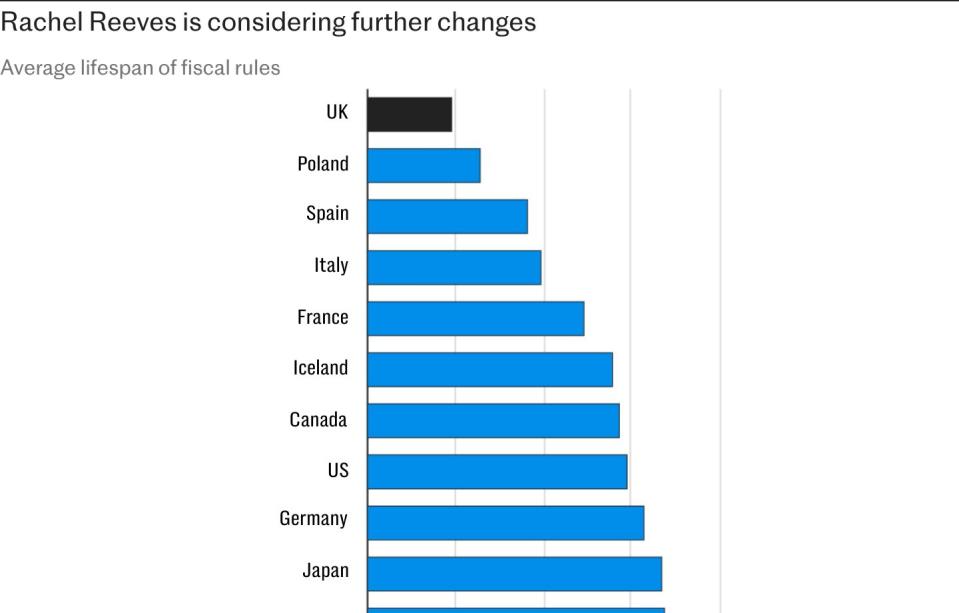

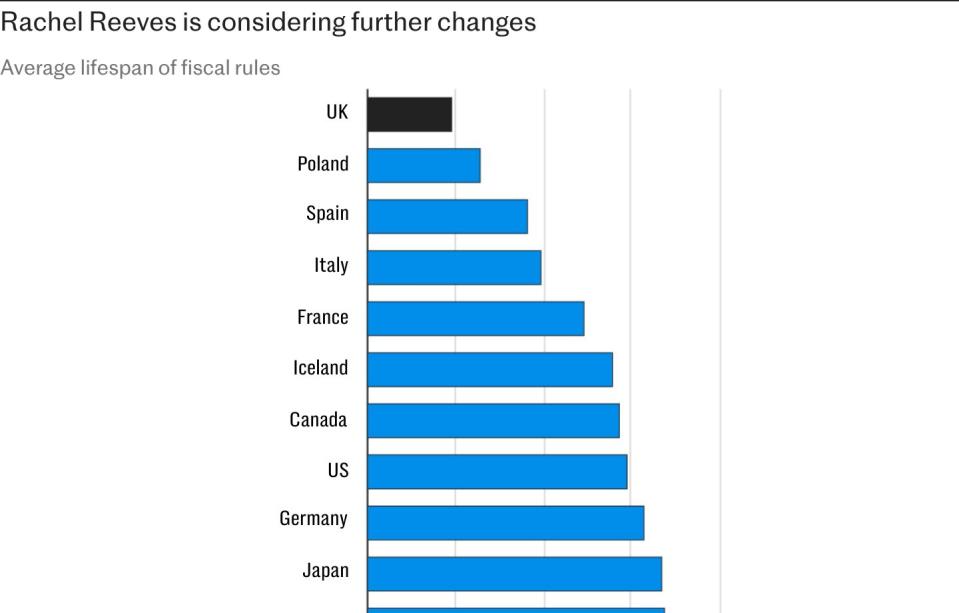

However, the Institute for Fiscal Studies (IFS) additionally advised Ms Reeves’s “opportunistic” attempt to fiddle with Britain’s fiscal rules took the chance of triggering a rise in rates of interest.

The think-tank has actually stated that any kind of transfer to modify the Chancellor’s self-imposed monetary regulations “would not be without risks” which obtaining an added ₤ 50 billion in 2028-29 can have a “material impact on interest rates”.

Carl Emmerson, replacement supervisor of the IFS, stated: “If you borrow a lot you are taking more of a risk that interest rates will be higher in response. One lesson for Rachel Reeves is to be cautious about borrowing because there is a risk to interest rates.

“Some will have savings and will endure higher interest rates on their savings. The main risk you would worry about is people’s mortgages being a bit more expensive.”

Mr Emmerson included that the effect on home loans would certainly depend upon the degree to which the added loaning was made use of to money either “current” or “capital” expense.

“If you inject money into an economy, there is more cash going around which could cause inflation and the Bank of England will respond with higher interest rates. This would happen if they saw a giveaway Budget that they felt wasn’t going to be beneficial to the supply side of the economy,” he stated.

“But if you make some investments that perhaps encourage the private sector to invest, improve the growth rate and increase capacity of the economy to produce, you then won’t have the Bank of England’s concern that it is inflationary and that higher interest rates are needed.”

The Treasury’s evaluation does not take into consideration steps with “supply-side benefits” and keeps in mind that the effect on rates of interest would certainly be smaller sized “where those policies do have a material benefit for the supply side”.

The main recommendations from the Treasury warns that an “unanticipated increase in spending, or reduction in taxation, that is funded by additional government borrowing, will increase the level of demand in the economy, thereby increasing inflationary pressures, which may lead to an inflation-targeting central bank increasing interest rates”.

A Treasury representative stated: “This analysis is clear that the relationship between fiscal plans, inflation and interest rates is complicated and can change significantly over time. The Chancellor has repeatedly said she will not play fast and loose with the public finances and will protect working people.”