The Government has actually been required to refute that Rachel Reeves is preparing to elevate resources gains tax obligation to as high as 39 percent.

The Chancellor has actually unlocked to increasing resources gains tax obligation (CGT) to connect a great void of as much as ₤ 25 billion, however has actually been advised that raising the price by excessive would certainly backfire and shed the Treasury crucial earnings.

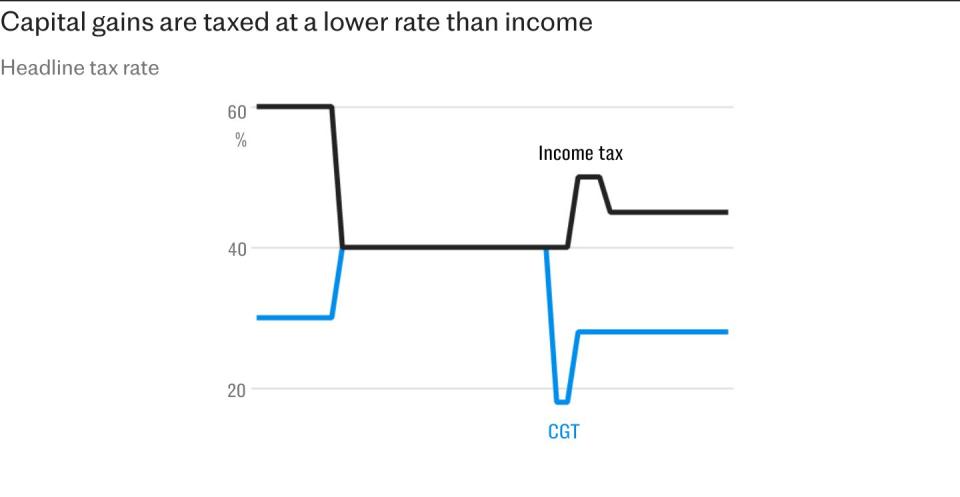

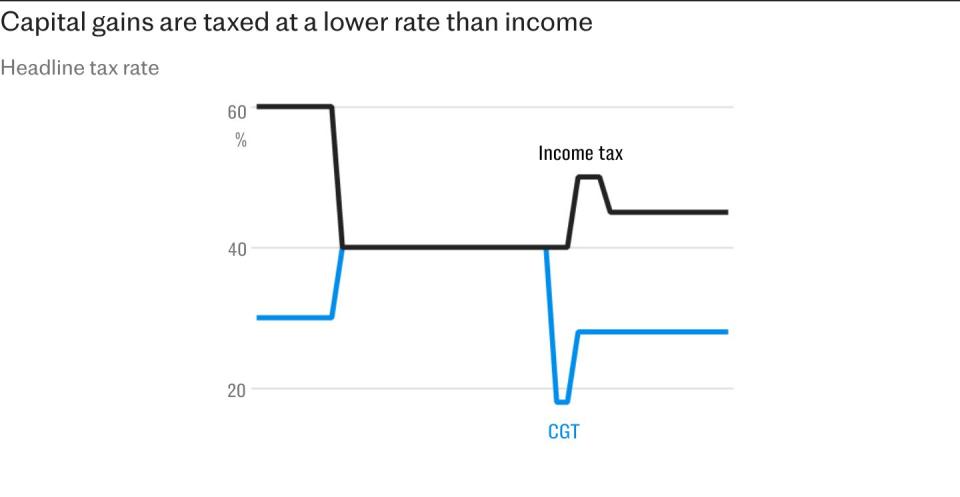

Capital gains tax obligation is paid on the earnings made on the sales of possessions, with the present prices for many people varying from 10 percent to 24 percent.

However, Treasury authorities were reported by The Guardian to have actually designed a variety of possible surges, consisting of pressing prices to in between 33 and 39 percent.

Sources near to the Chancellor rejected the records, and a Treasury representative claimed: “This reporting is not based on government modelling – we do not recognise it. This is pure speculation.”

A federal government resource claimed the Treasury had actually dismissed increasing the levy to such a high degree, however did not refute maybe raised to greater than 30 percent.

The greatest price is presently 28 percent– much less than the leading price of earnings tax obligation of 45 percent – and is billed on gains from lugged rate of interest for mutual fund supervisors.

Higher- price taxpayers pay 24 percent on gains from the sale of 2nd homes and 20 percent on gains from sales of shares and organizations. Basic- price taxpayers are billed 18 percent and 10 percent specifically.

Some in Labour have actually asked for the prices of both kinds of tax obligation to be equalised at 45 percent for added price taxpayers.

Higher- price taxpayers pay 40 percent on earnings over ₤ 50,271, while additional-rate payers are billed 45 percent on anything over ₤ 125,141.

Earlier today, the Institute for Fiscal Studies claimed the Chancellor might require to discover ₤ 25 billion of tax obligation boosts to maintain costs climbing with nationwide earnings.

The Guardian claimed the Chancellor had actually asked the Office for Budget Responsibility to examine just how much cash might be elevated from the resources gains tax obligation boosts.

Briefing keeps in mind on the modelling apparently claimed it was difficult to forecast just how taxpayers would certainly respond to greater resources gains tax obligation prices.

HM Revenue & & Customs generated a document quantity in CGT in August this year, gaining ₤ 197million.

So much this year, property owners and investors have paid £76 million greater than in 2023, according to HMRC numbers.

In 2022/23, the taxman elevated greater than ₤ 14 billion in CGT, paid by 360,000 taxpayers on earnings of ₤ 80.6 billion.

However, a tax obligation walk may not elevate the earnings that the Chancellor hopes.

Official approximates released by HMRC in August reveal that a 10 portion factor rise in the greater price of CGT would certainly shed the Exchequer ₤ 2 billion of earnings in 2027/28.

This is due to the fact that capitalists transform their behavior to stay clear of greater levies, consisting of selling their assets before any rate hikes.

Robert Salter, at book-keeping Blick Rothenberg, claimed that a 39 percent price would certainly be “punitive”.

“Moving it to 39 per cent will in the long term be damaging to the UK economy,” he claimed. “It will disincentivise investment in the UK and result in owners and companies just not selling their assets.”

In its statement of belief, Labour assured it would certainly not elevate tax obligations on “working people”, worsening worries that riches tax obligations, such as CGT and inheritance tax (IHT) would certainly be targeted rather.

The Institute for Fiscal Studies additionally called last month for Ms Reeves to junk an alleviation that eliminates CGT fees on fatality, a relocate claimed would certainly elevate ₤ 2 billion a year for the Treasury.

Helen Miller, the brain trust’s head of tax obligation, claimed at the time: “It is a bad tax relief and I would love it if the Government scrapped it.”

Simon Gammon, handling companion at Knight Frank Finance, claimed a boost would certainly see a wave of second homes and rental properties offered in advance of any type of target date.

He claimed: “We’ve seen in the past that changes in taxation can have a very distortive effect on sales rates.”