Next president Lord Wolfson has actually marketed a ₤ 29m risk in the high road titan in advance of an anticipated capital gains tax (CGT) raid in the Budget following month.

Lord Wolfson, a Conservative peer, marketed 290,000 shares in Next in between last Friday and Tuesday of this week, with the shares worth an overall of ₤ 29.2 m, according to brand-new filings.

Prior to the sale, he held around 1.4 m shares worth around ₤ 141m, equivalent to a 1.2 computer risk.

Next decreased to discuss the disposal. Shares dropped by around 2pc adhering to the news.

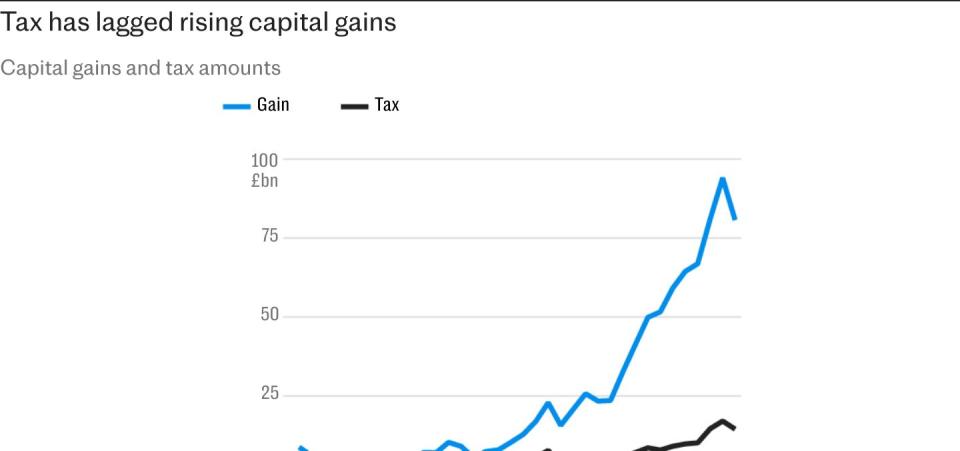

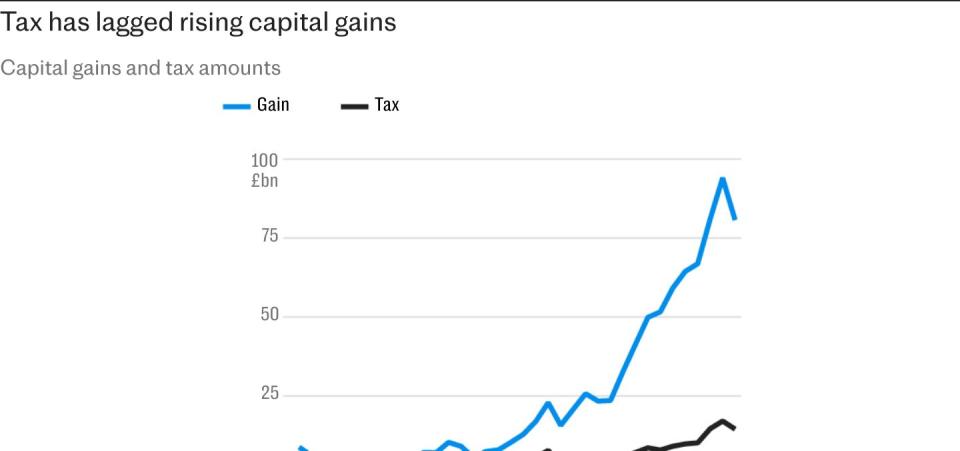

It comes as Rachel Reeves is anticipated to target funding gains tax obligation in her maiden Budget following month, possibly also equalising it with revenue tax obligation where greater income earners pay 40pc or 45pc.

Higher- price taxpayers are billed 24pc on revenues made from the sale of 2nd homes and 20pc for various other properties. Basic- price taxpayers pay 18pc and 10pc specifically.

The Chancellor has until now refused to rule out capital gains reforms in the Budget on Oct 30.

It has actually motivated financiers to offer while prices are still fairly charitable, according to specialists.

Duncan Mitchell-Innes, of law office TWM Solicitors, stated: “With many people expecting a rise in capital gains tax, there has been a surge in sales of assets in recent weeks.”

HM Revenue & & Customs gained from document CGT invoices in August as swathes of proprietors and financiers marketed up, according to numbers released recently.

In overall, ₤ 197m of CGT was paid last month, the highest degree for August considering that at the very least 2008.

The share sale by Lord Wolfson notes the 3rd time he has actually done so to bring his holding back to around ₤ 100m well worth of shares.

It adheres to a share rate rally at Next with its supply rising by 123pc considering that October 2022.

Next’s share rate has actually been improved by a string of upgrades to its revenue projections, as the merchant has actually made out much better than competitors throughout the expense of living situation.

Earlier this month, Next stated it was anticipating full-year revenues ahead in ₤ 15m more than its previous projections. Pre- tax obligation revenues are readied to be available in simply under ₤ 1bn, it recommended, buoyed by more powerful sales overseas.

Next stated the increase complied with a “convergence” of global style preferences, with even more individuals enjoying streaming solutions such as Netflix, Amazon Prime and TikTok. It stated this was urging consumers to attempt clothing that were preferred in various other nations.

&w=324&resize=324,235&ssl=1)