I’m a large follower of making use of reward supplies as a method to make additional earnings. But not all dividend-paying firms are dependable. Vodafone let down me lately by lowering its 10% return in fifty percent, motivating me to offer my risk in the firm.

Now I’m a lot more cautious concerning the earnings supplies I buy. Currently, my leading 3 choices are Phoenix Group (LSE: PHNX), British American Tobacco ( LSE: BATS) and Legal & &General ( LSE: LGEN).

Here’s why I assume they deserve capitalists taking into consideration.

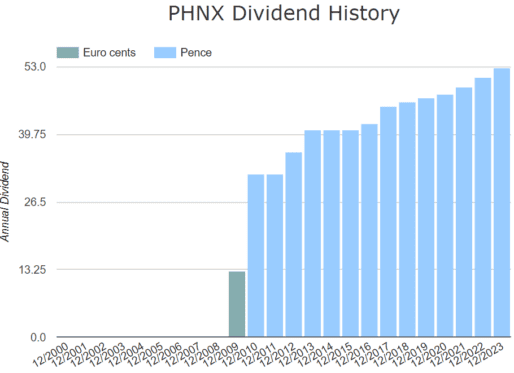

Phoenix Group

Phoenix Group’s 9.5% return might quickly be the highest possible on the FTSE 100 after Vodafone falls to 5.2%. The insurance firm hasn’t been paying rewards for long however has actually raised them yearly for the previous 6 years.

As among the UK’s most significant insurance policy companies, it deals with rigid competitors from Legal & & General andPrudentialUnfortunately, there’s one blazing concern, it’s presently unlucrative. Years of reduced profits have actually risen its financial debt as well, which is currently nearly increase its equity.

That does not seem extremely appealing.

But a current increase in profits’s assisted press the firm back in the direction of success. It’s most likely to come to be lucrative once again following year, with profits possibly getting to ₤ 280m by the end of 2025.

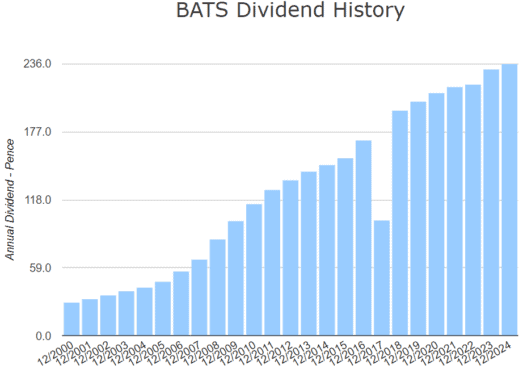

British American Tobacco

With an 8.5% return, British American Tobacco might quickly be the fourth-highest FTSE 100 return after Burberry reduced its reward. Barring a short decrease in 2017, it’s been paying a dependable and enhancing reward for over two decades.

Currently, it’s unlucrative however projection profits development offers it an ahead price-to-earnings (P/E) proportion of 8.3. And with future capital anticipated to enhance, the shares are approximated to be underestimated by nearly 60%.

But cigarette’s a passing away market so it’s difficult to have way too much confidence in the firm’s long-lasting leads. Not to point out the ethical ramifications.

However, British American Tobacco is concentrated on changing in the direction of tobacco-free items as tighter guidelines intimidate its profits. Its Vuse item is one of the most prominent vaping brand name worldwide, according to the firm. It’s proactively legislating for more stringent guidelines and restrictions on non reusable vapes and child-appeal flavours to help in reducing minor smoking cigarettes.

Legal & & General

At 8.9%, Legal &General’s the 3rd highest possible return on the FTSE 100, a little listed below fellow insurance firm M&G. But as a simply income-focused supply, it does not supply a lot in the method of rate development. It’s just up 1.6% in the previous 5 years.

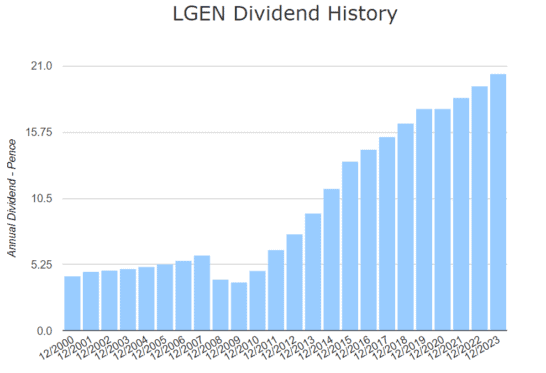

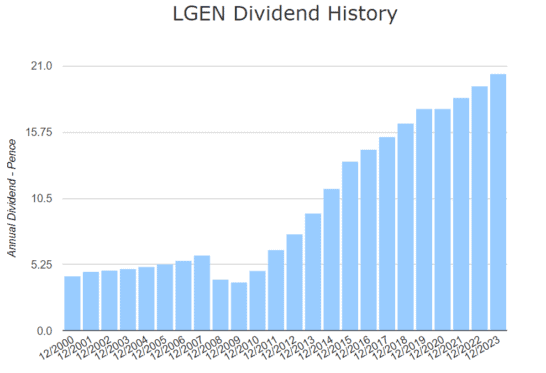

Payments are super-reliable though, having actually raised constantly given that 2009 with just a short time out in 2020. Its rewards flaunt a compound yearly development price (CAGR) of 13.3%, with the return anticipated to get to 10% in the following 3 years.

Like Phoenix, reduced profits have actually pressed its P/E proportion approximately 48 and left it with a great deal of financial debt. If projections are proper, enhanced profits might bring it closer to the market standard of 11. But with a financial obligation tons two times its market-cap, it’s a lengthy method to go.

If it weren’t for the stunning record of paying rewards, I ‘d possibly provide it a miss out on. But in this instance, I assume the benefit’s worth the danger.

The blog post Looking to earn income through passive investing? Here are 3 top dividend stocks to consider showed up initially on The Motley Fool UK.

More analysis

Mark Hartley has settings in British American Tobacco P.l.c., Legal & & General Group Plc, and (* ). Phoenix Group Plc UK has actually advised The Motley Fool P.l.c., British American Tobacco, M & g Burberry Group Plc, Plc, andPrudential PlcVodafone Group Public shared on the firms stated in this post are those of the author and as a result might vary from the main suggestions we make in our membership solutions such as Views, Share Advisor andHidden Winners Pro at Here our team believe that taking into consideration a varied variety of understandings makes The Motley Fool UK 2024us better investors.

Motley Fool

&w=100&resize=100,70&ssl=1)