Even prior to P&O Ferries’ proprietor took out of Monday’s International Investment Summit, Sir Keir Starmer had a battle on his hands to make the occasion meet its star-studded invoicing.

In resistance, Labour had actually guaranteed to hold a worldwide top within 100 days of involving power. However, the prophecies really did not look great.

JP Morgan’s president Jamie Dimon was also active. Billionaire capitalist Steve Schwarzman, creator of Blackstone, had various other strategies.

The action by DP World– the Dubai- based proprietor of P&O Ferries– to quit the summit and pause a £1bn investment has actually included in the grief.

In the accumulate to the occasion, which will certainly be held at the Guildhall in the City of London, a lot of the insurance coverage has actually concentrated on which Wall Street execs were intending to jet in– and those that were to be notably missing.

Yet in Whitehall, the emphasis has actually been as a lot on Paris as New York.

“The French always put on a bit of a show. The name of the game is to make sure we do it better than France,” states one federal government authorities. “These guys don’t come over to sit in a big room in uncomfortable chairs to listen to six or seven hours of panel discussions.”

When Rachel Reeves and Sir Keir Starmer provide their stump speeches concerning why the globe’s cash supervisors must place their money right into Britain, they recognize they will certainly be up versus their old European competing throughout the Channel.

“The Americans will compare what we do in the UK to Paris,” one investor tensions. An exec at a United States firm whose president is welcomed states the French variation is taken into consideration a “model in how you organise these events”.

At the yearly Choose France tops that President Emmanuel Macron developed in 2018, capitalists are welcomed to the Palace of Versailles to satisfy directly with Macron.

Investors claim they locate it much easier to handle France due to the fact that Macron grabs the phone, with leading president getting messages straight from him welcoming them to the Palace of Versailles.

In raw contrast, billionaires anticipated to be at a beverages function at Lancaster House near Buckingham Palace on Sunday were fluctuating concerning flying over simply 2 days prior to the occasion.

After suffering problems involving with the Tories, capitalists were wishing for a slicker beginning under a brand-newGovernment Instead, there has actually been irritation concerning the cumbersome timing of the occasion– held weeks prior to Rachel Reeves’s expected tax raid in her first Budget— and an absence of organisation.

In the week leading up to the top, some guests apparently obtained out-of-office feedbacks to immediate concerns from organisers, that additionally unintentionally exposed the e-mail addresses of visitors in an e-mail concerning the occasion.

The Government only simply handled to appoint an investment minister days prior to the opening function– Poppy Gustafsson, founder of Darktrace, the Mike Lynch- backed cybersecurity firm that was marketed to an American personal equity customer at the beginning of this month.

Ministers will certainly be really hoping that the prestige of the occasion will certainly get rid of any kind of memory of these very early stress.

After beverages on Sunday evening, the top will formally begin the following day in the City ofLondon The occasion will certainly be compered by Bridgerton starlet Adjoa Andoh and function audio speakers consisting of previous England football supervisorGareth Southgate A supper will certainly comply with in St Paul’sCathedral Goldman principal David Solomon, Google’s ex-boss Eric Schmidt and BlackRock principal Larry Fink are amongst those anticipated to participate in.

The Government is wanting to draw in a thrill of money. However, it has actually endured a significant strike after ports large DP World pulled a scheduled announcement of £1bn worth of investments complying with objection by replacement leader Angela Rayner of its subsidiary P&O Ferries.

Britain frantically requires the financial investment top to prosper.

The nation has actually been lower or second-bottom of the G7 organization tables for complete economic climate financial investment throughout companies, homes and the general public field for years.

Lord Harrington, that was appointed by Jeremy Hunt to lead the record right into the UK’s international financial investment, located in 2014 that the UK was “disorganised, risk-averse, siloed and inflexible”, with economic choices pushed to a “series of semi-arm’s-length institutions”.

“What’s let us down in the past is the delivery,” Harrington states. “We raise expectations very well, we’re very good at it, but it’s the operational delivery of it that we need the reorganisation of government to do.”

Investors looking for to back Britain frequently locate themselves passed in between divisions, in comparison to Macron’s initiatives to provide a personal solution.

“We need to be more proactive, not just reactive,” statesHarrington “I’m hoping that we have an industrial strategy that will say ‘we can’t do everything, we’re not the United States, but we can work out what sectors we wish to excel in’.”

Ministers are anticipated to validate a new “concierge service” for investors at the summit, which intends to deal with a few of the functional concerns that have actually afflicted federal government.

The risks are high. An absence of financial investment is viewed as a basic defect in our stammering economic climate. Not just does it keep back development, yet it is an essential consider harming performance development as bad facilities, pricey real estate and under-capitalised companies avoid employees from reaching their possibility.

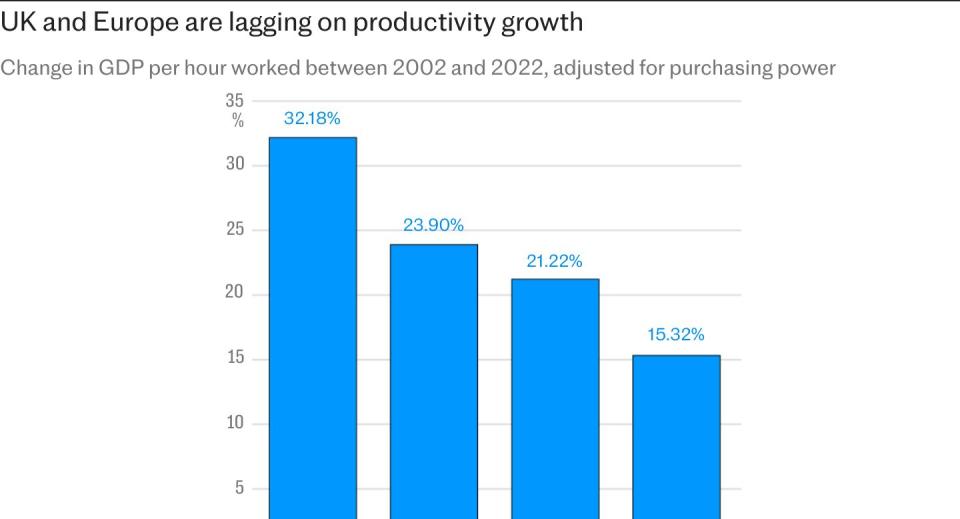

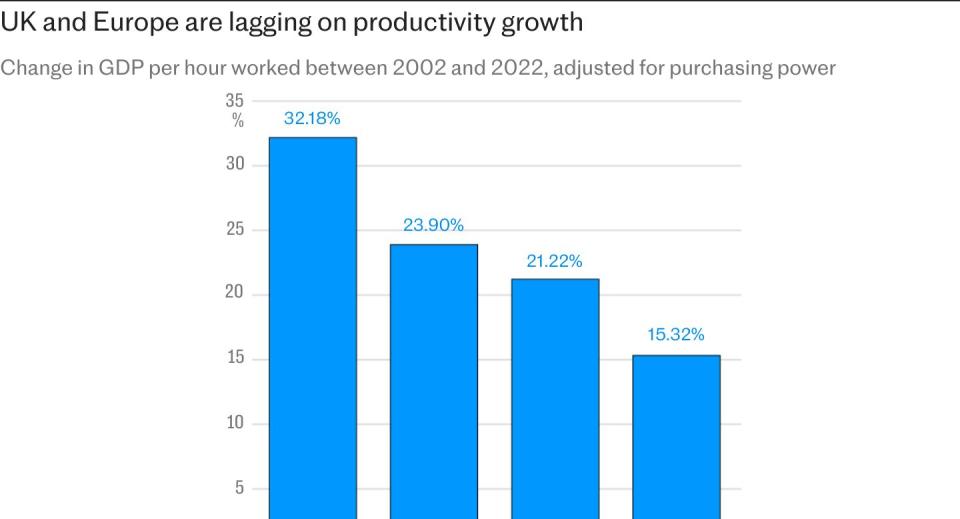

Productivity has actually been a significant trouble considering that the 2008 economic situation. In the 11 years prior to the collision, performance expanded by greater than 25pc. In the years and a fifty percent ever since, it has actually bordered up by much less than 6pc.

Benjamin Nabarro, an economic expert at Citi, states that international straight financial investment in facilities tasks such as roadways, trains and ports remains in numerous means better to financial investment by the Government, not the very least due to the fact that it implies the Treasury does not need to increase obtaining to obtain Britain structure.

A much less valued element is the added performance international capitalists offer companies inBritain International cash includes technological expertise, added calls for profession, and frequently much better administration abilities also, states Yael Selfin, the primary economic expert at KPMG UK.

“It is not just the know-how or practice of production, it is also the know-how of other markets, which you can potentially reach out for supply chains or for exports,” she states. “There is a correlation of a rise in productivity and more exposure to outside markets.”

A research by the ONS revealed that firms in Britain with a substantial international possession risk got on typical nearly 75pc even more efficient than comparable rivals that were not in invoice of worldwide financial investment.

Nabarro states obtaining those much more efficient international companies to purchase the UK will certainly be crucial to rebooting development.

“That, historically, has been an important engine of UK productivity growth in terms of sharing best practice and driving those productivity improvements,” he states.

“A really good example of this in the UK is the automotive sector, where firms like Nissan have invested heavily in trying to share expertise with their domestic supply chain, and that is because they have an interest in those firms becoming more productive.”

Still, some in the City have their questions regarding whether the occasion will certainly have any kind of effect.

“The event is probably likely to be showy and ineffective,” shrugs Jon Moulton, the previous Tory event benefactor that started turn-around fund Better Capital.

As the occasion starts, Reeves and Starmer will certainly be wishing they can confirm him incorrect.

&w=100&resize=100,70&ssl=1)