Joe Biden’s loaning splurge on internet absolutely no programs has actually aided sustain a $2.1 trillion (₤ 1.6 trillion) enter international financial debt, as cautions install over unsustainable federal government costs.

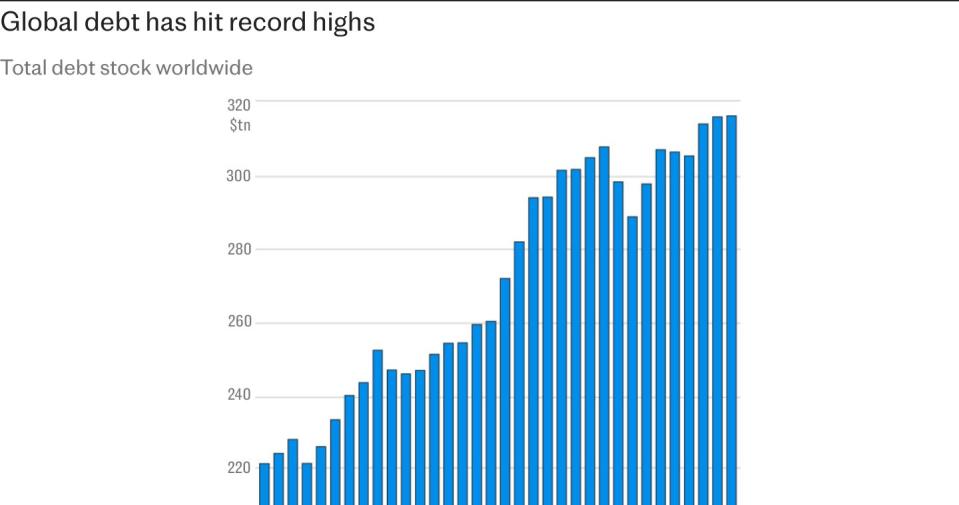

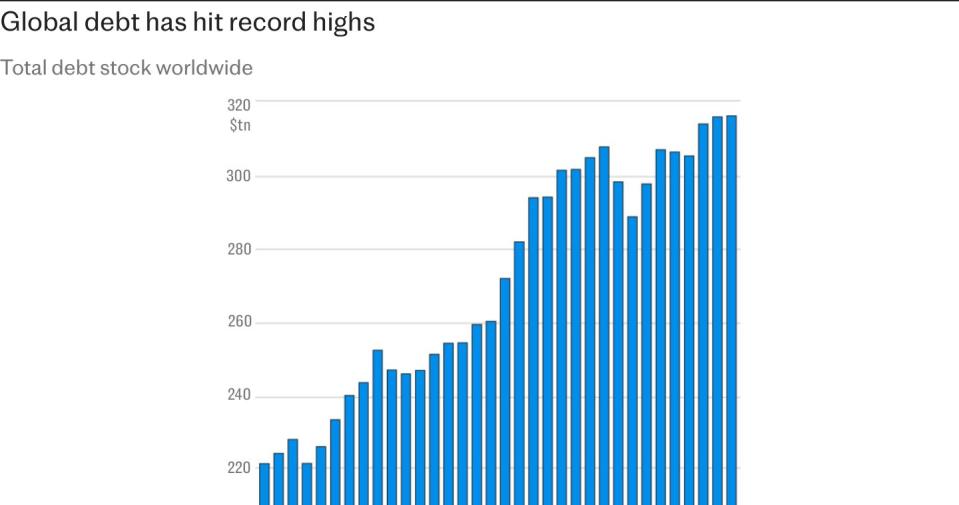

Global financial debt rose to $312 trillion in the initial 6 months of the year, as the globe’s biggest economic situation filled up on loaning.

The Institute of International Finance, which released the numbers, advised that the failure of politicians to reduce financial debt degrees was a risk to efficiency and development.

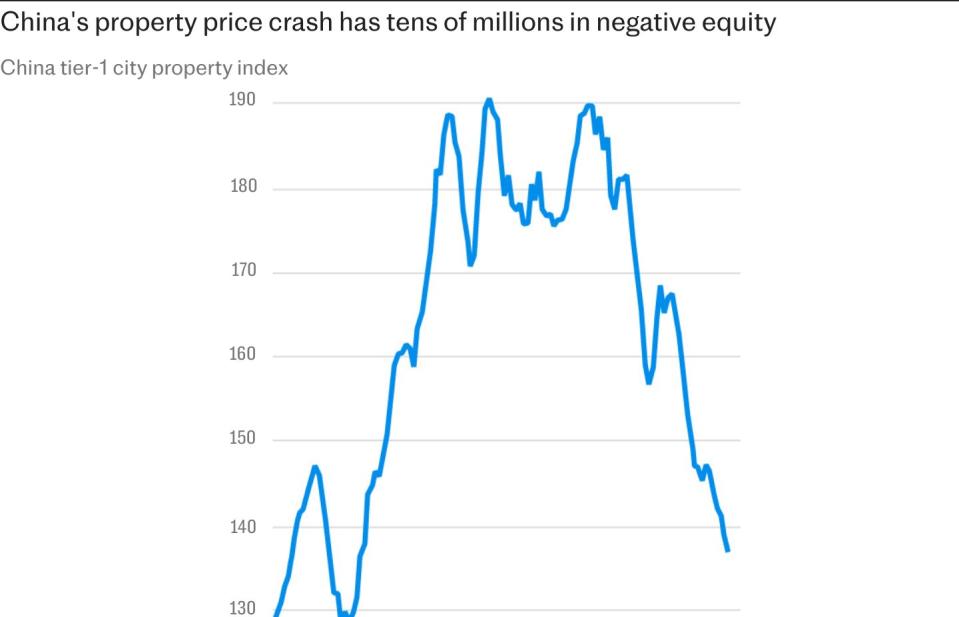

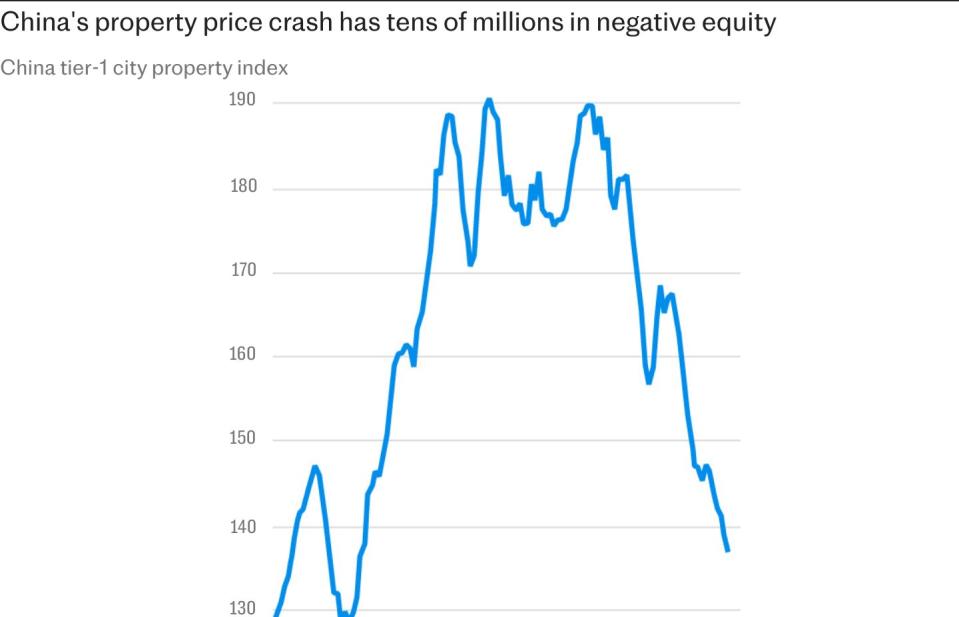

The United States and China were the greatest chauffeurs of the rise in international financial debt, the IIF claimed, as Xi Jinping fought to prop up the economic situation adhering to a residential property collision and years of rigorous lockdown constraints.

In the United States, Joe Biden has overseen debt levels rise from 117.6 computer to 118.9 computer in a year.

The United States Congress guard dog this year advised the head of state that the United States took the chance of dealing with a Liz Truss- design shock if untreated loaning proceeded.

Mr Biden’s Inflation Reduction Act is anticipated to set you back $1.2 trillion (₤ 900bn) over ten years, according toGoldman Sachs Net absolutely no is a core slab of the program, with $390bn set aside to deal with environment adjustment and $60bn being invested in tidy power efforts, consisting of the promo of solar and wind power.

In China, national debt about the dimension of the economic situation increased to 86.3 computer from 79.9 computer in the initial fifty percent of the year.

It comes as Mr Xi has actually had a hard time to revitalize development after a frustrating article-Covid rebound.

An imploding property sector and debt-straddled city governments have actually contributed to China’s problems, as it has actually had a hard time to strike its development targets.

The change to internet absolutely no is most likely to escalate rising financial debt degrees, the IIF advised.

It claimed the “new era of industrial policies to combat climate change” indicated national debt around the world was predicted to climb by 58pc to $145 trillion by 2030.

It gets on track to strike $440 trillion by 2050.

The IIF advised that currently alarming efficiency development took the chance of worsening as debt-bloated governments reveal little willpower to transform.

It claimed it had considerable worries over the “apparent lack of political will to address rising sovereign debt levels” in both abundant and poorer nations.

It highlighted exactly how federal governments have actually stepped in over the previous twenty years to fortify public financial resources in times of dilemma, caution of “the misallocation of resources toward low-productivity projects”.

It comes in the middle of considerable difficulties presented by aging demographics, it kept in mind.

Separately on Wednesday, the World Economic Forum advised that high financial debt degrees are a significant danger to security in abundant nations.

The United States deals with financial debt maintenance expenses of $870bn this year, exceeding its whole protection spending plan of $822bn.

Such worries followed federal governments in numerous nations took place a loaning splurge to handle the pandemic and in Europe consequently the power dilemma.

Falling rate of interest will just sustain obtaining even more after the Federal Reserve delivered its first cut last week, the IIF claimed.