A policymaker at the Bank of England has actually claimed rate of interest require to remain greater for longer in order to “purge” the threats to UK rising cost of living.

Catherine Mann, an economic expert and participant of the Bank’s rate-setting board, elevated problems over variables that might suggest cost surges stay over the authorities 2% target degree for longer.

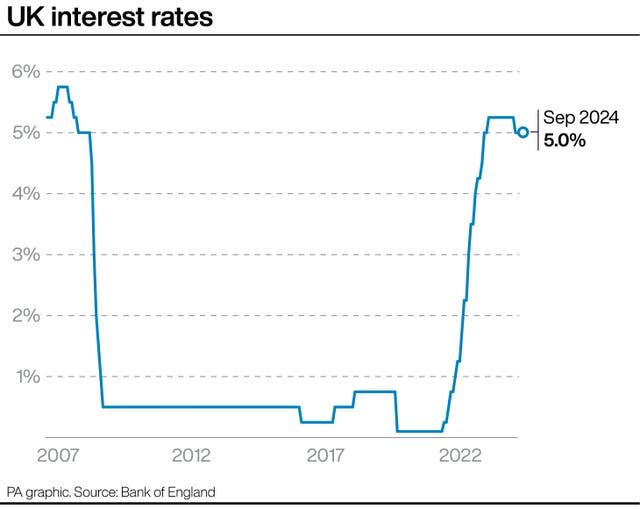

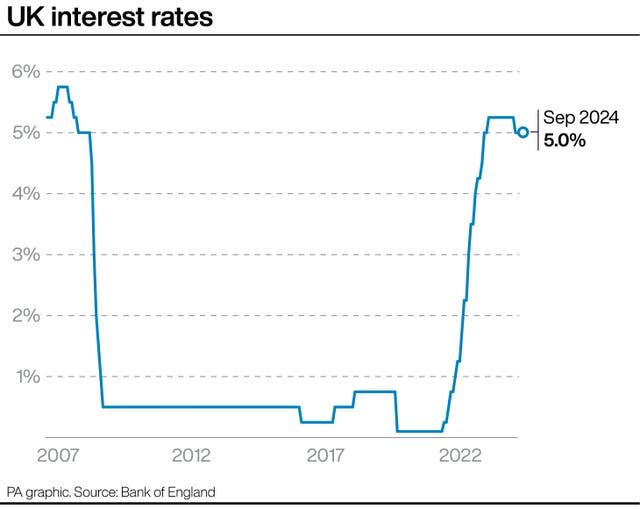

Her statements come a day after the reserve bank elected to maintain the UK base price on hold at 5%.

Governor Andrew Bailey appeared a note of care when he claimed it is “vital that inflation stays low”, suggesting the board required to be “careful not to cut too fast or by too much”.

It adhered to prices being reduced from 5.25% last month, the initial decrease considering that the beginning of the Covid pandemic in 2020.

Ms Mann, that is just one of the a lot more hawkish participants of the Monetary Policy Committee (MPC), favouring an extra limiting plan, claimed she was especially worried concerning solutions rising cost of living.

This tracks cost surges throughout the solutions industry and has actually been viewed very closely by policymakers.

In a speech provided at a seminar in Lithuania, she claimed: “To summarise, I am concerned that structural factors underpin an unsustainable path for the UK economy with embedded and sticky services inflation to render inflation above-target for longer and, yet at the same time, stagnant real activity.”

She claimed that, “there would appear to be more upside risks to overall inflation” in the UK.

Ms Mann, that was among the 8 participants of the nine-person MPC to elect to hold prices at 5% on Thursday, clarified her decision-making.

“There is a further accumulation of evidence of consumer weakness across products and particularly middle-income deciles, as housing costs are a larger fraction of their consumption basket,” she claimed.

This suggests that even more families are being pressed by greater rental fees and home mortgage expenses.

Ms Mann claimed she did “contemplate” a price reduced in August, “as the bite from housing costs was becoming deeper and more widespread”.

But, in the long run, she was amongst the participants electing to maintain prices the exact same as a result of the threats to rising cost of living continuing to be at the Bank’s target degree.

“Policy therefore needs to remain restrictive for longer to purge these behaviours,” she claimed.