The Bank of England is positioned to maintain rate of interest at 5% after sending out a “clear message” that it would certainly stagnate as well rapidly to reduce loaning expenses.

Most economic experts assume that rate-setters on the Monetary Policy Committee (MPC) will certainly maintain the UK rates of interest on hold on Thursday.

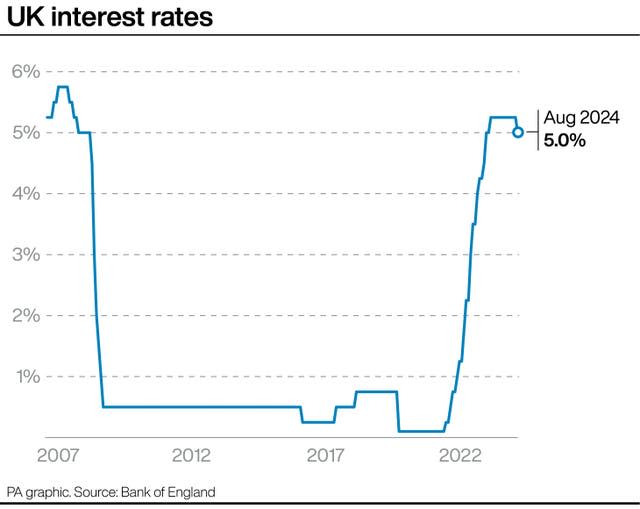

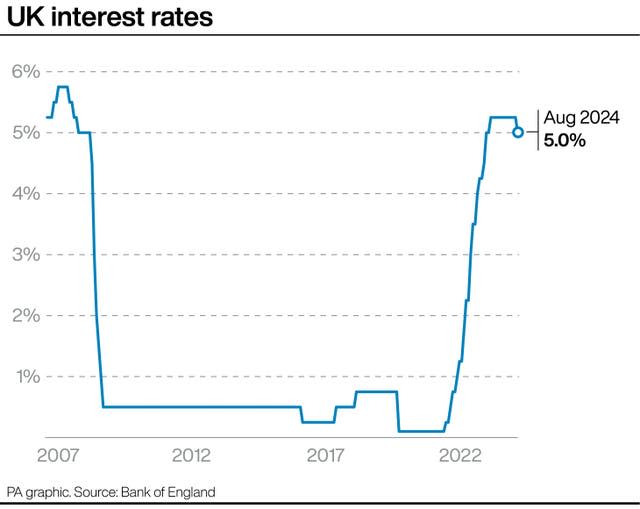

This would certainly maintain the Bank’s base price– which impacts rate of interest on loaning and conserving– at the highest degree considering that 2008, throughout the international economic situation.

The reserve bank cut prices from 5.25% in August, executing the very first decrease considering that 2020 and supplying great information to pressed consumers throughout the nation.

Governor Andrew Bailey claimed it had the ability to do so since inflationary stress had “eased enough”.

However, he emphasized that policymakers “need to be careful not to cut interest rates too quickly or by too much”.

Matt Swannell, primary financial advisor at the EY Item Club, claimed the MPC “sent a clear message that back-to-back rate cuts were unlikely” unless succeeding financial information was weak than anticipated.

He claimed the current main information, which revealed Consumer Prices Index (CPI) rising cost of living continued to be at 2.2% in August, would certainly not suffice to trigger the Bank to begin reducing prices faster.

Sanjay Raja, primary UK economic expert for Deutsche Bank, concurred that the rising cost of living numbers “won’t be enough to trigger a surprise rate cut” on Thursday.

“Instead, the MPC will likely take this as a positive sign that underlying price pressures are easing, and could warrant a further dial down of restrictive policy in November, when it conducts its next forecast update,” he claimed.

“The MPC will also have more information on the fiscal outlook, with the autumn Budget slated for October 30.”

Rob Wood, primary UK economic expert for Pantheon Macroeconomics, concurred that August’s rising cost of living analysis “gives the MPC little reason to rush to cut interest rates again”, with the information remaining near its assumptions.

He claimed one more month of reducing rates in the solutions field, which is seen carefully by the Bank, would certainly provide rate-setters much more “comfort”.

Meanwhile, the Bank of England might remember of the European Central Bank (ECB) choice to reduce rate of interest in the Eurozone recently, the 2nd decrease straight.

The ECB’s rate-setting council reduced the major down payment price from 3.75% to 3.5% at the conference.

Elsewhere, the United States’s Federal Reserve might execute its very first cut to the country’s rate of interest on Wednesday night.