The common UK home worth hit a two-year excessive in August, up 0.3% on the earlier month, in keeping with new information from Halifax.

The constructing society stated the everyday property now prices £292,505, in keeping with its mannequin, which makes use of information from throughout the UK.

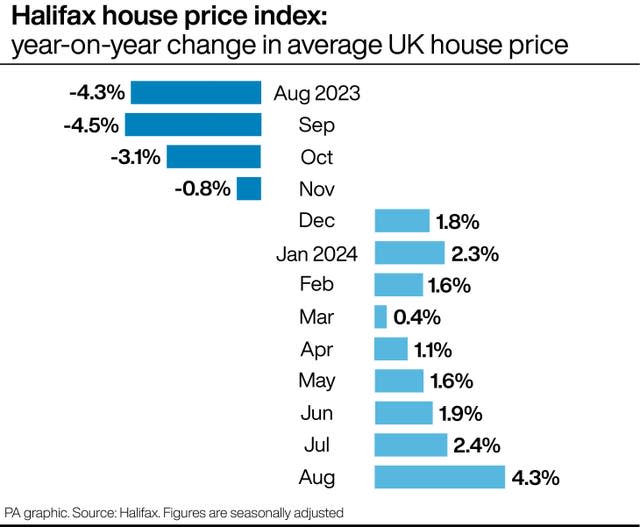

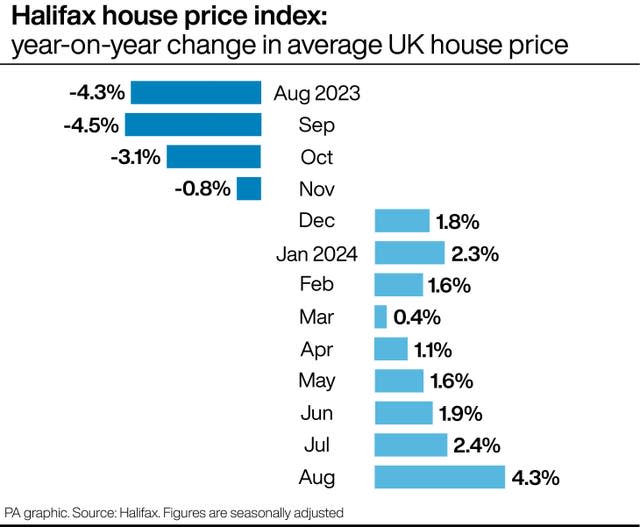

August’s small month-to-month rise comes after a sooner 0.9% improve in July, however year-on-year costs are up 4.3%, Halifax added, the strongest charge since November 2022.

Amanda Bryden, head of mortgages at Halifax, stated: “Recent price rises build on a largely positive summer for the UK housing market.

“Prospective homebuyers are feeling more confident thanks to easing interest rates.

“That optimism is reflected in the latest mortgage approval figures, now at their highest level in almost two years.”

The common property is simply £1,000 in need of the report worth set in Halifax’s home worth index of £293,507 in June 2022.

Ms Bryden continued: “While this is welcome news for existing homeowners, affordability remains a significant challenge for many potential buyers still adjusting to higher mortgage costs.

“However with market activity picking up and the possibility of further interest rate reductions to come, we expect house prices to continue their modest growth through the remainder of this year.”

It comes after the Bank of England voted to chop the bottom rate of interest by 1 / 4 level firstly of August to five%, which some specialists stated has given patrons extra confidence.

The strongest progress got here in Northern Ireland, which noticed home costs rise 9.8% yearly. Wales additionally got here in at 5.5%.

The most costly common properties had been nonetheless present in London, now averaging £536,056, up 1.5% on a 12 months in the past.

Jeremy Leaf, north London property agent and trade veteran, referred to as the figures “solid, not spectacular”.

Mark Harris, chief govt of mortgage dealer SPF Private Clients, added that the mortgage market “remains volatile”.

He added: “However, unlike a few months ago, the difference now is that mortgage rates are falling rather than rising, which is good news for affordability.”