When taking into consideration returns supplies on the FTSE 250, it could appear sensible to buy the one with the highest possible return. However, the return alone indicates really little.

Buying a supply with a 10% return does not ensure it’ll pay 10% on the financial investment. It could just pay 5%– or absolutely nothing in any way. This is since returns change frequently however repayments happen just a couple of times a year.

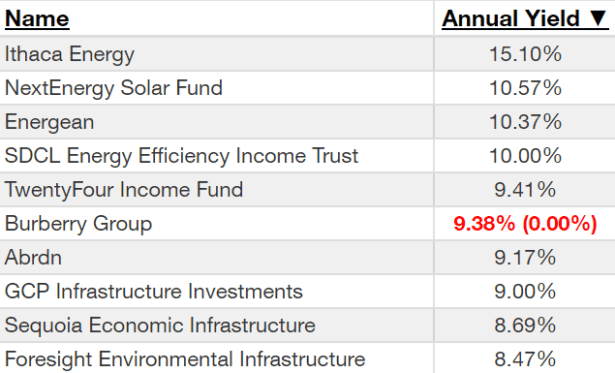

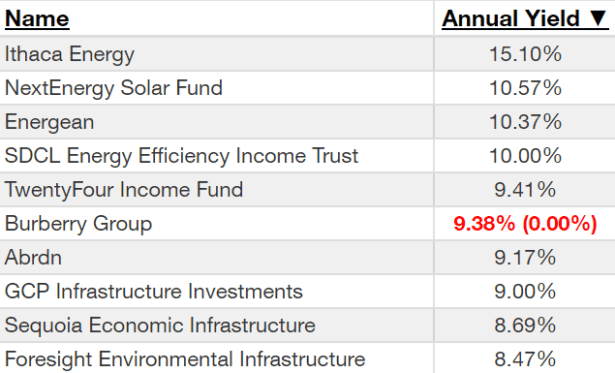

The table listed below programs the existing leading 10 yielders on the index.

Some capitalists intend to get a supply on the ex-dividend day to safeguard a payment at that percent. But the return can be decreased or reduced totally prior to the following one, negating the supply’s lasting worth.

So an excellent returns supply is one with a lengthy performance history of regularly paying rewards to its investors.

Other elements to take into consideration

A great returns supply isn’t just concerning the return. Also take into consideration:

Identifying worth

In the FTSE 250 leading 10 by return, just Burberry, Abdn, GCP Infrastructure Fund and TwentyFour Income Fund (LSE: TFIF) have a 10-year or much longer background of repayments. Burberry reduced its rewards totally this year and Abdn decreased them dramatically afterCovid GCP has a reasonably steady repayment background however a payment proportion of 406%.

That leaves TwentyFour Income Fund, which buys safeties backed by underlying properties like car loans.

First and primary, this offers some dangers. If customers default on these car loans, it can adversely influence the fund’s efficiency. At the very same time, if customers settle their car loans early, the fund might get much less revenue than prepared for. Additional dangers consist of rates of interest changes that can harm the rate and reduced liquidity that can lower marketing power.

The fund’s rate has actually been fairly steady for the previous ten years, varying in between 100p and 120p. It hasn’t supplied any type of considerable returns in regards to share rate however has actually preserved a return over 6% for a lot of that duration. I believe that makes it adequately trustworthy to take into consideration as an enhancement to an easy revenue profile.

After a poor 2022, it published favorable full-year 2023 lead toJuly These consisted of a NAV overall return of 18.10% and a fourth-quarter returns of 3.96 p per share. This brought the overall returns for the year to a massive 9.96 cent per share– a record-breaking high considering that its launch in 2013.

The business’s chairman connected this success to its wise financial investment method, concentrating on higher-yielding, floating-rate, asset-backed safeties in the after that climbing rates of interest atmosphere. Its dedication to sharing the riches with investors appears, as it regularly pays practically all excess financial investment revenue yearly.

While TwentyFour seems the very best in the leading 10 dividend-payers on the FTSE 250 by return, I believe there are far better alternatives. If I were seeking to get returns shares on the index, I would certainly take into consideration Greencoat UK Wind, Primary Health Properties or TP ICAP— each trustworthy supplies with returns in between 7% to 8%.

The blog post All above 8%, which of the FTSE 250’s top 10 dividend stocks by yield is the ‘best’? showed up initially on The Motley Fool UK.

More analysis

Mark Hartley has placements in Primary Health Properties Plc andTp Icap Group Plc The Motley Fool UK has actually advised Burberry Group Plc, Greencoat Uk Wind Plc, Primary Health Properties Plc, andTp Icap Group Plc Views revealed on the firms stated in this short article are those of the author and for that reason might vary from the main suggestions we make in our membership solutions such as Share Advisor, Hidden Winners andPro Here at The Motley Fool our company believe that taking into consideration a varied variety of understandings makes us better investors.

Motley Fool UK 2024