The London securities market’s a terrific area to look for low-cost supplies to purchase. The FTSE 100 alone’s loaded with dazzling deals complying with an extended period of underperformance.

I’m preparing a checklist of worth shares to purchase for my very own Stocks and Shares ISA. Here are 2 presently capturing my focus.

Phoenix Group

Phoenix Group ( LSE: PHNX) provides outstanding worth throughout a variety of metrics. City experts assume incomes right here will certainly skyrocket 41% year on year in 2024. This leaves the fnancial solutions service trading on a price-to-earnings (PEG) proportion of 0.5. Any analysis listed below 1 suggests a supply’s underestimated.

At the exact same time, Phoenix’s potential returns return appear at an amazing 9.6%. This makes it among the largest possible returns payers on the FTSE 100 now and, to me, its most appealing marketing factor.

Investors require to be skeptical when picking high-yield returns supplies. If a firm’s supply cost has actually gone down considerably because of bad efficiency or monetary problems, the return will certainly look unnaturally high.

Enormous money incentives are likewise usually unsustainable, which can lead to frustrating returns for lasting financiers.

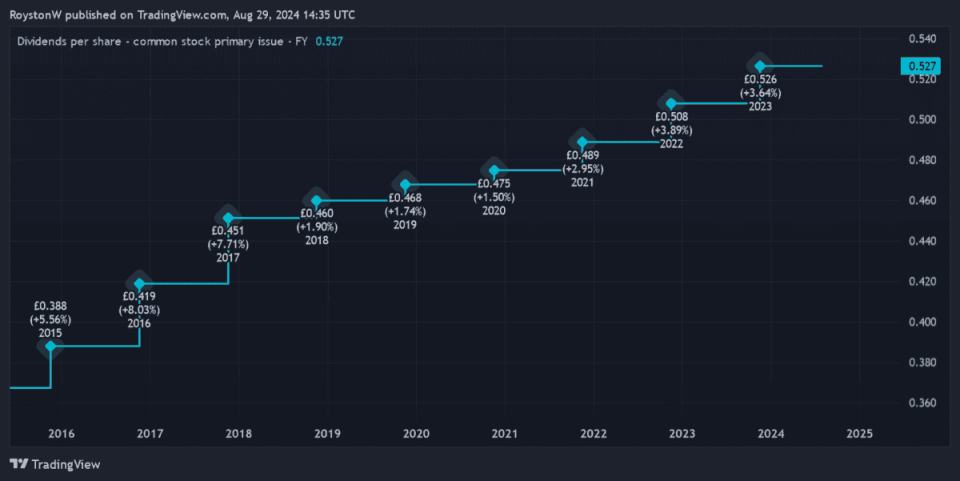

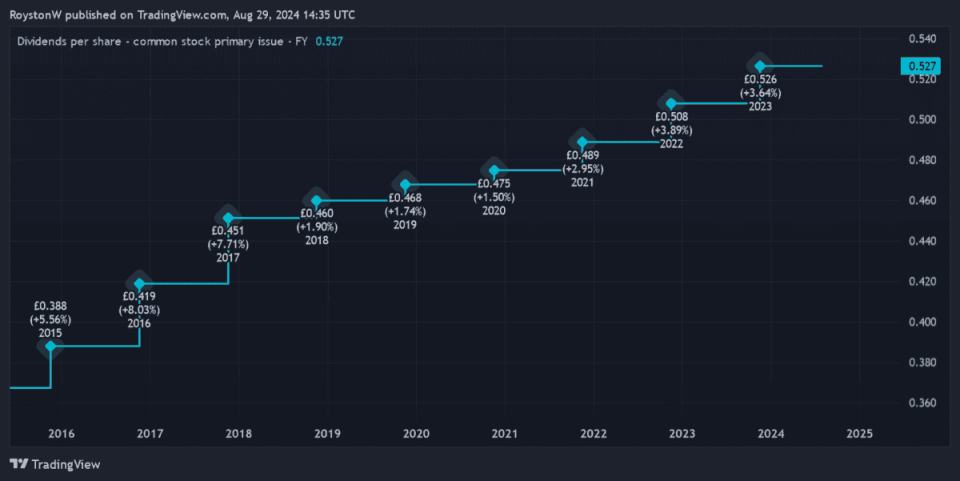

I do not think Phoenix stands for a catch for revenue financiers nonetheless. As the graph listed below programs, the business has a superb performance history of paying a big and expanding returns.

And City experts anticipate this pattern to proceed which, subsequently, presses the return on Phoenix’s shares to a superior 10.2% for 2026.

So why are City experts so favorable? A solid earnings overview’s one, driven by increasing pension plans require as the UK populace progressively ages.

Phoenix’s outstanding monetary structure’s one more factor to be positive. The company’s Solvency II resources proportion was a durable 176% sinceDecember Its annual report will certainly get an additional increase also, if it makes a decision to place its SunLife department up for sale.

The business’s procedures are very conscious rates of interest adjustments. But, on equilibrium, I assume it can confirm to be a leading enhancement to my profile.

Associated British Foods

Powered by rising sales at its Primark worth retail department, City experts assume Associated British Foods (LSE: ABF) will certainly rocket 35% this year. As an outcome, the business trades on an onward PEG proportion of 0.5.

We all understand that competitors in the fashion/lifestyle retail field’s tough. It’s a hazard that possible financiers right here require to take seriously.

But Primark’s obtained solid brand name power and a terrific performance history of presenting shops and items that customers like. It’s why like-for-like incomes increased 2.1% in the 6 months to March, regardless of challenging market problems.

I’m not simply excited by Primark’s capacity to maintain bring in clients either. Work to boost margins likewise remains to repay, with these increasing to 11.3% in the initial fifty percent, up from 8.3% a year previously. This moved operating earnings 45% greater in the duration.

I think Associated British Foods has substantial lasting financial investment possibility as Primark increases. It had 440 shops in procedure since March, many thanks to brand-new shop openings in the United States andEurope Although its items aren’t readily available on line, it goes to the very least investing in Click & & Collect to harness the shopping boom.

I assume it’s a terrific supply for value-hungry financiers like me to take into consideration.

The message 2 of the best FTSE 100 value stocks to buy in September? showed up initially on The Motley Fool UK.

More analysis

Royston Wild has no setting in any one of the shares stated. The Motley Fool UK has actually advisedAssociated British Foods Plc Views revealed on the firms stated in this write-up are those of the author and for that reason might vary from the main referrals we make in our membership solutions such as Share Advisor, Hidden Winners andPro Here at The Motley Fool our team believe that thinking about a varied series of understandings makes us better investors.

Motley Fool UK 2024