Investing in FTSE 250 shares can be a superb means to generate income. This prominent UK index is loaded with mid-cap business with outstanding development capacity, and yearly returns right here have actually expanded by double-digit percents usually.

Here are 2 leading supplies and an exchange-traded fund (ETF) I would certainly acquire to target beast riches if I had extra money to spend.

The fund

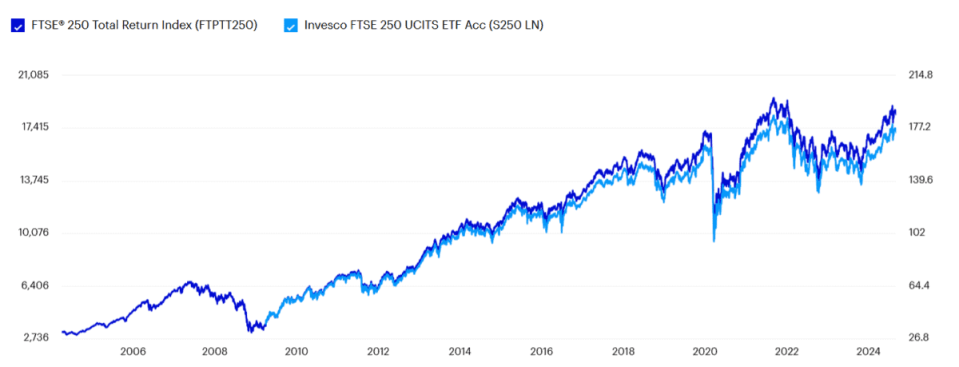

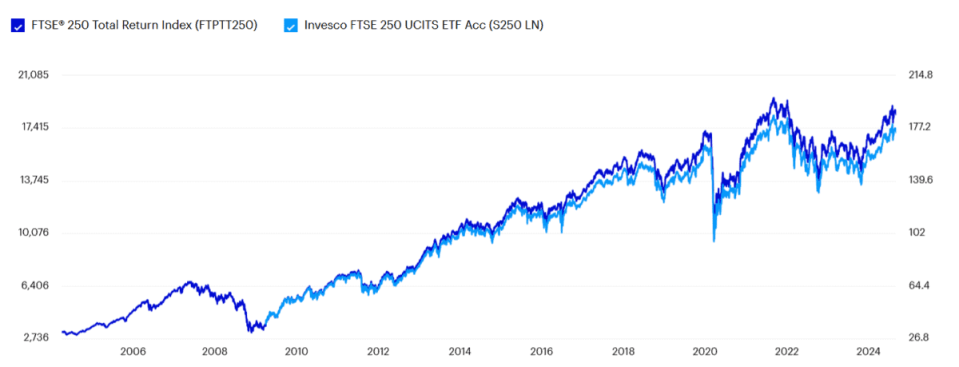

The easiest means to obtain direct exposure to the mid-cap index is by buying an ETF. With a continuous cost of simply 0.12%, the Invesco FTSE 250 UCITS ETF Acc‘s (LSE:S250) one of the cheapest ways to go about this.

As you’ d anticipate, this automobile carefully simulates the efficiency of the FTSE 250. However, as a result of concerns like fund costs, tracking mistakes, money variations, and the timing of returns reinvestments, it’s supplied a somewhat even worse return than the more comprehensive index.

This is an usual threat of buying ETFs. However, a typical yearly return of 10.68% because its launch in 2009’s absolutely excellent.

Owning a fund such as this provides me direct exposure to thousands of development chances. It additionally permits me to successfully spread out threat.

But just like any kind of index, the FTSE 250’s loaded with losers along with celebrities, therefore the poor efficiency of some supplies can indicate I worsen returns than if I would certainly simply gotten particular specific shares.

The support celebrity

With this in mind, I would certainly could take into consideration getting Babcock International ( LSE: BAB) shares to go for index-beating returns.

This is many thanks partially to its triviality versus various other significant UK support field shares. It professions on an onward price-to-earnings (P/E) proportion of 11.4 times. By contrast, BACHELOR’S DEGREE System, Rolls-Royce and Chemring profession on multiples of 19.4 times, 28.2 times and 19.9 times specifically.

Theoretically, Babcock’s triviality today might make it an excellent competitor for strong rate gains gradually, as the marketplace acknowledges its worth and re-rates its shares.

I would certainly additionally acquire Babcock as it has a superb possibility to enhance incomes (and its share rate) as support investing ratchets up. An 9% renovation in its agreement stockpile in 2015 demonstrates how business is confiscating this chance.

Fears of expanding dispute in Europe, the Middle East and perhaps in other places indicate arms spending plans need to remain to expand. Remember however, Babcock’s earnings development might take a hit if supply chain concerns in the support market lingers.

The dream hero

Games Workshop‘s (LSE:GAW) another FTSE 250 stock I believe could deliver outstanding returns. As a shareholder and a keen hobbyist, I understand the enormous growth potential with this UK share.

The fantasy wargaming giant’ s share rate has actually soared 1,700% over the last years, mirroring rising need for its dream wargaming items. I do not assume it’s done yet either.

Lucrative markets in North America and Asia have a lot more to expand, and Games Workshop’s broadening its shop estate to record this chance.

Products like Warhammer 40,000 are viewed as the gold criterion in this fast-growing leisure activity. It suggests business takes pleasure in sensational revenue margins– its gross margin expanded to 69.4% in the twelve month toMay Their high charm additionally suggests sales continue to be durable also throughout financial declines.

Rising competitors and enhanced counterfeiting stand for a trouble. But on equilibrium, I think Games Workshop continues to be an excellent supply to take into consideration.

The article 2 FTSE 250 shares and an ETF I think could deliver spectacular long-term wealth! showed up initially on The Motley Fool UK.

More analysis

Royston Wild has placements inGames Workshop Group Plc The Motley Fool UK has actually suggested BAE Systems, Games Workshop Group Plc, and Rolls-Royce Plc Views revealed on the business pointed out in this short article are those of the author and consequently might vary from the main referrals we make in our registration solutions such as Share Advisor, Hidden Winners andPro Here at The Motley Fool our team believe that taking into consideration a varied series of understandings makes us better investors.

Motley Fool UK 2024