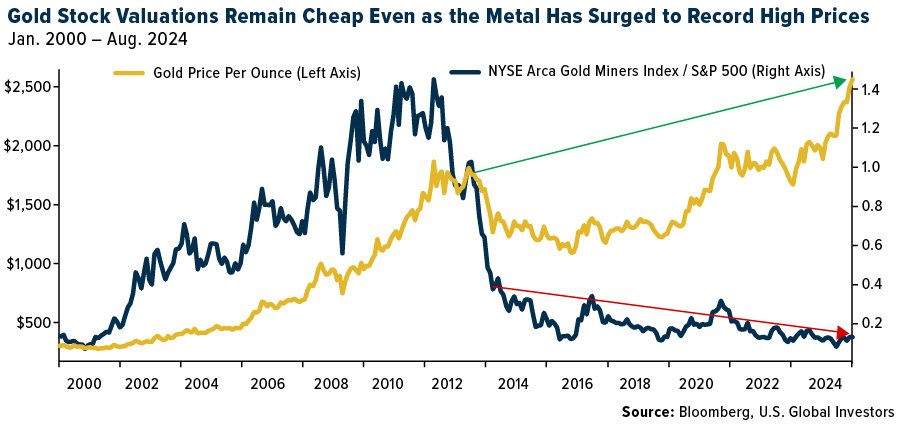

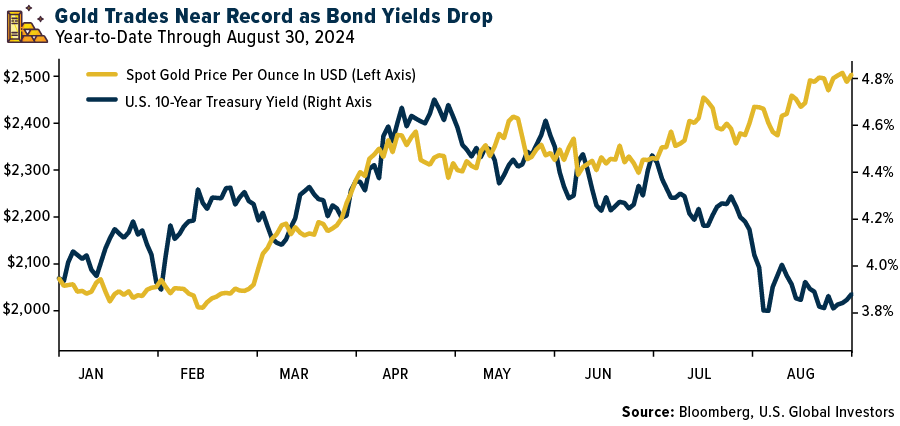

As I write this, gold continues to commerce above $2,500 an oz after surging previous the psychologically essential degree for the primary time ever in mid-August. For seasoned gold mining buyers, this ought to be a second of validation. After all, the yellow metallic has lengthy been seen as the final word hedge towards financial uncertainty.

And but, regardless of the bull run, gold shares—these corporations that mine, course of and promote the metallic—are buying and selling at traditionally low valuations relative to the market.

This obvious disconnect gives contrarian buyers a unprecedented alternative.

Rising Yields and the Gold Selloff Explained

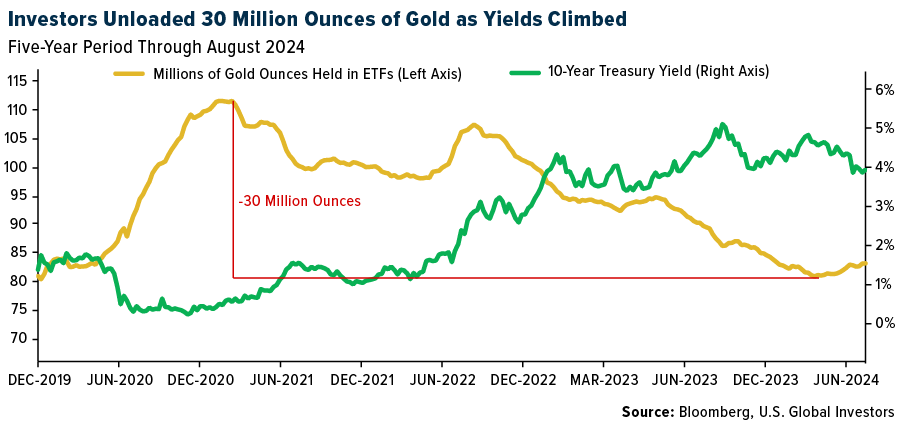

But first, why is that this taking place? The main wrongdoer for this disparity, I consider, lies within the influence of rates of interest and central banks’ gold-buying spree. The actual, inflation-adjusted 10-year Treasury yield rose from a low of round -1.2% in August 2021 to just about 2.5% in October 2023, and for a lot of buyers, notably these in Western nations, rising yields are a sign to promote non-interest-bearing gold.

That’s precisely what occurred. From the tip of 2020 to May 2024, exchange-traded funds (ETFs) backed by bodily gold shed roughly 30 million ounces, over 1 / 4 of their whole holdings, as yield-seeking buyers pared again their positions.

What some buyers might have ignored, I’m afraid, is the long-term potential of the very belongings they had been letting go of. Gold shares, in contrast to the bodily metallic, supply not only a hedge but in addition a way of collaborating within the upside of gold costs. Put one other manner, when gold costs have gone up, gold shares have traditionally tended to rise much more.

Right now, I consider these shares are providing an unprecedented mixture of low valuations and excessive potential returns.

A Contrarian Take on Gold Stocks

As contrarians, we perceive that the perfect time to speculate is usually when sentiment is at its lowest. And sentiment round gold equities is fairly low proper now.

But historical past tells us that this might be the right time to purchase. As you might be able to inform within the chart above, we’re seeing a reversal of the gold ETF selloff. Since mid-May, buyers have added about 2.3 million ounces of gold, in accordance with Bloomberg information; holdings now stand at their highest degree since February of this 12 months.

This might be just the start. If actual curiosity fall considerably, the tide may flip in favor of gold and gold equities.

$3,000 Gold by Mid-2025?

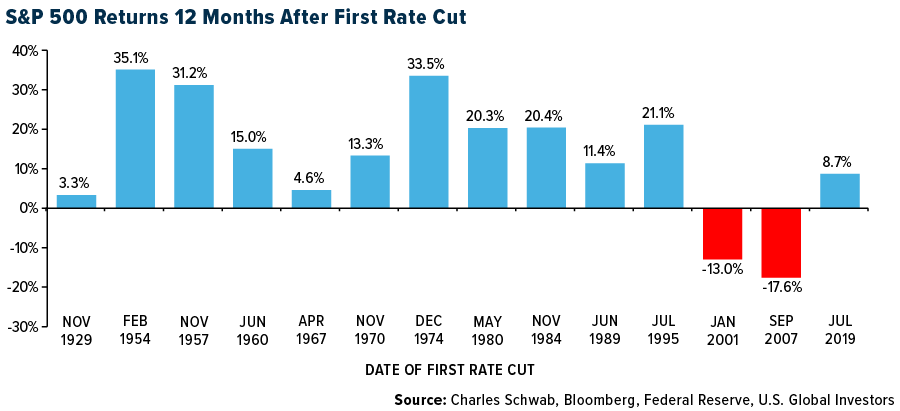

Historically, gold’s largest good points have occurred when the Federal Reserve cuts rates of interest amid financial uncertainty. Although there’s no apparent disaster on the horizon, markets are pricing in a 25-basis level minimize at every of the following two Fed conferences in September and November, with a larger cut expected in December.

If the Fed follows via, we may see gold costs not solely keep their present ranges however soar to new heights. UBS is looking for $2,700 gold by mid-2025; Citigroup, Goldman Sachs and Bank of America all see the metal hitting $3,000.

Stock Market Trends After the First Fed Rate Cut

That’s to not say you must dump all of your equities in favor of gold, particularly because the Fed is on the verge of easing. Charles Schwab just lately confirmed what shares did prior to now when charges fell, and buyers might need to take word.

The inventory market traded up 12 out of 14 times—or 86% of the time—a 12 months after the Fed made its preliminary minimize in a brand new easing cycle. Schwab factors out that the 2 back-to-back unfavorable intervals had been predicated on extraordinary circumstances: the dotcom bubble in 2001 and the housing disaster in 2007. Past efficiency is not any assure of future outcomes, but it surely’s price contemplating.

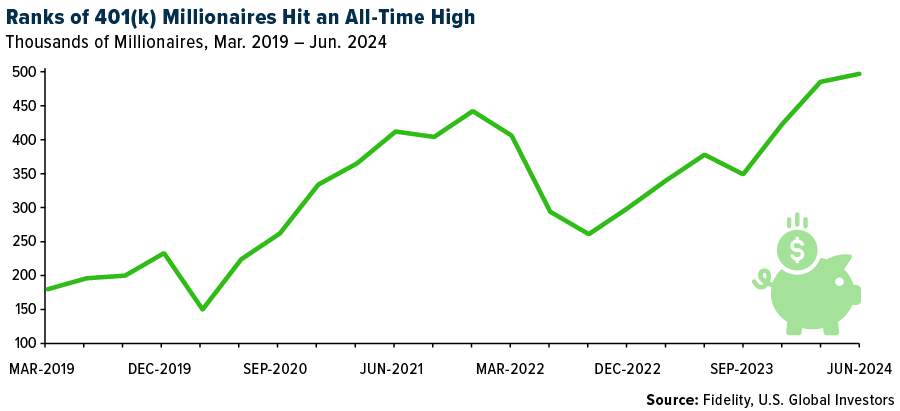

This is good news for normal buyers, together with the report variety of “401(k) millionaires”—buyers who’ve $1 million or extra of their retirement accounts. According to Fidelity, there are actually nearly half one million such millionaires… and rising!

Similarly, our ABC Investment Plan permits buyers to fund their retirement extra affordably. The ABC Investment Plan is an automated funding plan that makes use of some great benefits of dollar-cost averaging—an funding approach that allows you to make investments a set quantity in a particular funding at common intervals—along with monetary self-discipline that can assist you work in the direction of your monetary targets.

ENROLL BY CLICKING HERE

As all the time, I encourage you to do your individual analysis, think about your threat tolerance and seek the advice of together with your monetary advisor. But from the place I stand, the chance in gold equities is one which shouldn’t be ignored.

Index Summary

- The main market indices completed principally down this week. The Dow Jones Industrial Average gained 0.94%. The S&P 500 Stock Index fell 0.14%, whereas the Nasdaq Composite fell 0.92%. The Russell 2000 small capitalization index misplaced 0.41% this week.

- The Hang Seng Composite gained 8.01% this week; whereas Taiwan was up 0.50% and the KOSPI fell 1.01%.

- The 10-year Treasury bond yield rose 12 foundation factors to three.92%.

Airlines and Shipping

Strengths

- The finest performing airline inventory for the week was Trip.com, up 11.8%. Southwest Airlines introduced the return of its limited-time tier acceleration promotion this week in a press launch, making it simpler for Rapid Rewards members to earn tier standing via 2025.

- More broadly over the previous 12 months, the influence of longer commerce routes has had a optimistic influence on freight charges as a result of improve in ton-miles. Reduced capability within the Panama Canal, rerouting of ships because of assaults within the Red Sea, in addition to the conflict in Ukraine and within the Middle East, have all prolonged routes and boosted charges. These components look like the first drivers of the power within the ISI survey versus last demand for the merchandise.

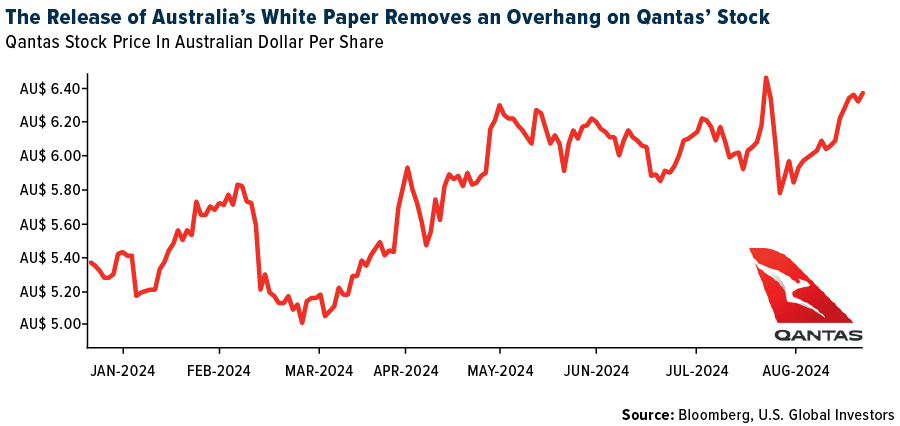

- The Australia Government’s Aviation White Paper particulars 56 initiatives to information long-term coverage. Overall, UBS’s first learn is that the proposed modifications are much less vital than some buyers had feared. The group expects minimal impacts to Qantas’ earnings within the subsequent 5 years.

Weaknesses

- The worst performing airline inventory for the week was Spirit, down 7.9%. Azul is concentrated on renegotiating the Lessor Equity Structure previous to elevating debt towards its cargo enterprise, with chapter submitting/renegotiating lease charges not within the plan. Moreover, these negotiations are unbiased of a possible merger with GOL, in accordance with Raymond James.

- Stifel feels a lot of the cargo visitors has rerouted away from the Gulf of Aden with sailings down 74%. However, not all ship sorts have reacted equally, with nearly all LNG ships having moved away, 89% of container ships, and 64% of dry bulk ships. Tanker visitors, nevertheless, is barely down 42% because the potential for outsized income is just too nice for some to disregard.

- Mexican home visitors dropped 3.6% year-over-year for the primary half of 2024 because of capability constraints attributable to P&W engine inspections, stories UBS, which is impacting primarily Volaris, and ought to be accomplished solely by 2026. Meanwhile, worldwide visitors has been marginally decelerating and U.S. airways reported Latin America yields have been dropping by double-digits, presumably indicating submit pandemic pent-up demand normalization.

Opportunities

- TSA expects the busiest Labor Day journey interval on report, in accordance with Morgan Stanley. Passenger volumes are projected to be up 8.5% versus final 12 months as TSA anticipates that it’ll display screen over 17 million folks over the lengthy weekend. Travel continues to be sturdy this 12 months as the highest 10 busiest journey days on report have occurred since May.

- ZIM expects regular seasonality tendencies this 12 months with a optimistic peak season and buildup within the U.S. stock ranges. However, the corporate is unsure concerning the sustainability of the current pick-up in demand, which is both linked to an early peak season or a extra sustained demand uptick, in accordance with Bank of America.

- For Ryanair, the €700 million buyback has been accomplished forward of schedule, stories RBC, and the corporate introduced a follow-on buyback of €800 million in fiscal 12 months 2025 (estimated). Including dividend funds, it will take money returns to >10% of the market cap in FY25E. There might be upside to the group’s assumption of €1 billion of buybacks in FY26E with capex stepping all the way down to €1.1 billion.

Threats

- According to Bank of America, American Airlines’ schedules mirror this moderation, with November and December system capability lowered by 330 foundation factors (bps) and 270bps, respectively. Cuts had been targeted on short-haul flying, with home capability lowered by 420/370bps in November/December, whereas Latin American capability was lowered by 270/150bps.

- The draw back dangers for transport, in accordance with JP Morgan, embody share costs falling even when freight charges don’t instantly fall when Middle East circumstances ease and the Red Sea route seems to be restored. In addition, the financial institution notes slowing North American cargo motion and sharp yen appreciation.

- Ryanair instructed Bloomberg that it plans to develop its capability by 8% this winter, although it’s too early to forecast demand ranges, they stated. Ryanair might miss its annual goal to hold 200 million passengers, relying on the extent of the delays in deliveries of Boeing’s 737 Max jets.

Luxury Goods and International Markets

Strengths

- Brunello Cucinelli, an Italian luxury-fashion agency, reported earnings earlier than curiosity and taxes of 104.6 million euros ($117 million), in contrast with the 87.7 million euros it booked within the year-earlier interval. The result’s broadly in keeping with analysts’ views. The firm maintained its guidnacne for a ten% gross sales development in 2024 and 2025, regardless of slower demand for luxurious items in a few of its rivals.

- Diageo, a multinational alcoholic beverage firm headquartered in London, efficiently priced €1.9 billion in fixed-rate euro-denominated bonds, indicating robust investor confidence and offering the corporate with substantial funds for normal company functions.

- Resorttrust, a number one firm in Japan that gives luxurious resort memberships, lodges, golf programs and extra, was the perfect perfoerming S&P Global Luxury inventory, gaining 6.2%. Shares gained within the native foreign money for 9 consecutive days, marking their longest profitable streak in 10 years.

Weaknesses

- Shares of PVH firm dropped after its monetary outcomes had been launched. The firm reported an earnings beat however guided the following quarter’s earnings per share beneath the road estimate. Revenue in worldwide companies decreased 4% in comparison with the prior 12 months, primarily because of weak point in Asia Pacific, China and Australia.

- Burberry is ready to exit the FTSE 100 Index because of a big share value drop, ending its 15-year presence and reflecting challenges in its model revamp and demand slowdown.

- Cettire, a web-based market, was the worst-performing S&P Global Luxury inventory, shedding 28.3% prior to now 5 days. The firm misplaced nearly 20% ot its market share on Thursday after the corporate reported diappointing monetary outcomes.

Opportunities

- Ferrari shares have risen 40% this 12 months and are anticipated to see additional value appreciation, in accordance with Morgan Stanley. The firm has minimal publicity to China, with lower than 7% of its income coming from the area. Additionally, Ferrari has a powerful base of repeat patrons and collectors, with 75% of recent vehicles offered to present prospects. As a consequence, the brokerage has raised its value goal for Ferrari from $400 to $520.

- Mumbai has turn out to be the second-fastest-growing property market globally. The metropolis recorded a 13% improve in prime residential costs year-over-year, whereas Manila was the fastest-growing market, with property costs surging by 26%. In Europe, Stockholm confirmed the strongest efficiency, in accordance with the Prime Global Cities Index, which tracks residential costs throughout 44 cities worldwide.

- The Rolex Rainbow Daytona watch from the Nineteen Nineties will go on sale in November on the Phillips public sale home, with a price ticket that would attain $3.5 million. The watch is believed to be the first-ever instance of a rainbow watch produced by Rolex utilizing multi-colored sapphire gems. Although demand for costly watches has slowed down, uncommon and distinctive fashions from Swiss manufacturers proceed to draw curiosity. Last 12 months, the identical public sale home, Phillips, offered a gold Rolex 6270 Cosmograph Daytona from 1988 for practically 4 million Swiss francs.

Threats

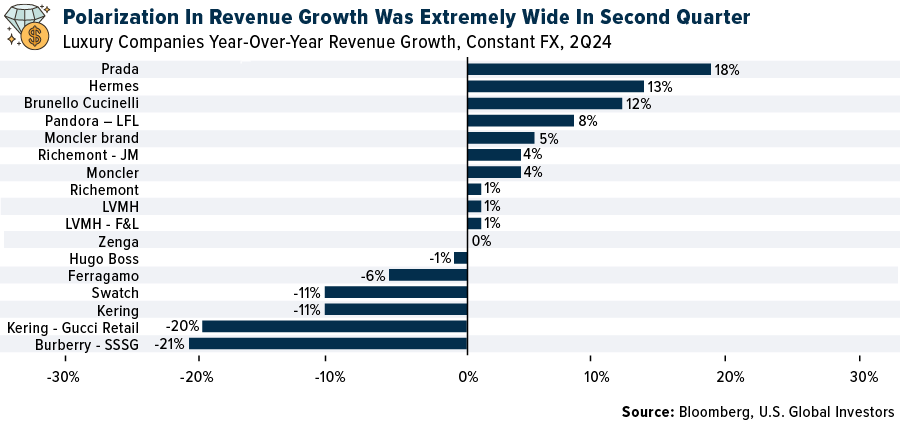

- In the second quarter, luxurious income development was flat, in comparison with a 2% improve within the first quarter of this 12 months, in accordance with BofA’s luxurious analysis agency. The firm highlighted weaker spending tendencies in China, noting that manufacturers most uncovered to the Chinese market skilled the most important income declines. There is a big distinction in income efficiency, with the highest manufacturers attaining a lot larger revenues than the bottom-performing ones, exhibiting an expansion of about 40%.

- Harmony Auto Holdings, which operates dealerships for 14 luxurious automobile manufacturers in China, together with BMW, Ferrari and Lexus, has introduced a company-wide wage discount as an emergency measure to handle operational losses from the continuing value conflict amongst home automobile makers. The wage of the chairman and vice chairmen will probably be minimize by 50%, whereas the president, vice chairman and different senior managers will face a 35% discount. Middle administration salaries will probably be decreased by 25%, and different employees members will see a 15% lower of their pay.

- Shares of Remy Cointreau and Pernod Ricard gained as China stated it received’t impose momentary tariffs on brandy imports from the European Union, however nonetheless may put measures at a later date. Meanwhile, the EU has been pushing forward with plans to impose tariffs on Chinese made EVs. The bloc is ready to publish a last verdict on these levies by October 30, until each events attain an settlement.

Energy and Natural Resources

Strengths

- The finest performing commodity for the week was sugar, rising 5.38%, on the specter of huge fires in Brazil the place circumstances are dry, and crops might be worn out. Oil superior at first of the week after Libya’s japanese authorities stated it’s going to halt exports, constructing on tensions within the Middle East after Israeli strikes on Hezbollah targets in southern Lebanon raised issues of a broader battle, Bloomberg stories. However, oil slumped by the tip of the week with OPEC+ anticipated to lift manufacturing within the fourth quarter.

- About 100 miles east of Roswell, a dusty nook of New Mexico with extra cattle than folks is quietly buttressing the U.S.’s world oil dominance, writes Bloomberg. After pumping much less crude within the years main as much as the pandemic than prime counties in neighboring Texas, New Mexico’s Lea County has been quickly gaining floor. Output there has expanded sooner than in another U.S. county, the article explains, final 12 months changing into the primary to ever produce greater than 1 million barrels per day, in accordance with vitality analysis agency Enverus. EOG Resources, ConocoPhillips, Chevron, Coterra Energy and Occidental Petroleum are massive producers within the Delaware Basin of New Mexico and West Texas.

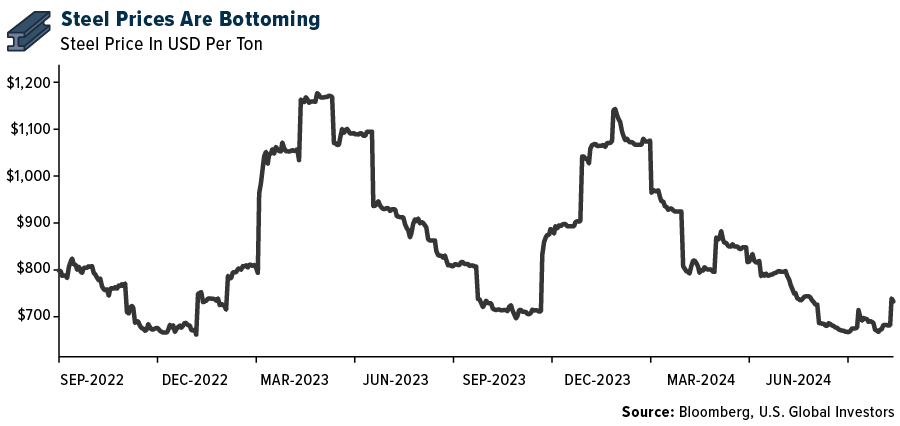

- U.S. uncooked metal mill utilization charges elevated to 80.2% within the week, up from 79.0% the earlier week, the American Iron and Steel Institute reported. Production in the course of the week totaled 1.782 million tons, up 1.6% from the week earlier than when manufacturing was 1.754 million tons. Production elevated 2.3% from the corresponding week a 12 months in the past.

Weaknesses

- The worst performing commodity for the week was lead, dropping 4.67%, on weak demand. Refiners traded down and are actually down practically 10% since June 30 and >30% since peaking on April 5. East Coast 321 cracks at <$15 per barrel are down >$5 per barrel prior to now two weeks and are starting to method five-year lows, in accordance with JPMorgan.

- China doesn’t paint a vibrant image for refining margins. Cnooc Ltd., Sinopec and PetroChina Co. all reported that their refining margins tumbled – making that sector one of many industrial financial system’s worst performers, Bloomberg stories.

- Fitch Ratings has downgraded the Long-Term Issuer Default Rating (IDR) for Albemarle Corporation and its issuing subsidiaries to ‘BBB-‘ from ‘BBB’ on expectations for sustained overcapacity and lower-for-longer pricing within the lithium business.

Opportunities

- Chile’s copper-mining business is rising from an intense interval of wage negotiations, signaling a diminished threat of additional disruptions in a rustic that accounts for 1 / 4 of world provide. Over the weekend, about 300 hanging employees at a Lundin Mining Corp.-operated mine went again to work. Per week earlier, the primary union on the big Escondida mine run by BHP Group ratified a labor pact following a three-day stoppage. Antofagasta Plc reached an early wage cope with the primary union at its Centinela facility, finishing the agency’s talks for the 12 months, in accordance with Bloomberg. Labor unrest could also be within the rear-view mirror for now.

- Bank of America strategists have made a secular name on swapping out your 40% bond allocation from the standard 60% shares/40% bonds portfolio to 40% commodities. The “commodity secular bull market in the 2020s is just getting started as debt, deficits, demographics, reverse-globalization, AI & net zero policies are all inflationary,” wrote BofA strategists Jared Woodard and Michael Hartnett.

- If you need to perceive the shifting sands in Australia’s assets sector, do a fast key phrase search on the slide deck that accompanies BHP’s revenue consequence. The phrase “copper” seems 78 instances. The phrases “iron ore” simply 14 instances. Such a statistic might sound trivial, but it surely speaks to a unprecedented shift within the development narrative of BHP chief govt Mike Henry – and an essential second for an Australian financial system that has lengthy ridden on the miracle of the Chinese growth, in accordance with the Financial Review.

Threats

- A legislative change is threatening to unravel one of many world’s most secure bets in renewable vitality, a Chilean incentive program that lured corporations backed by BlackRock Inc. and JPMorgan Chase & Co, stories Bloomberg. President Gabriel Boric’s administration is looking for to lift funds by altering a pricing mechanism for small electrical energy mills that has attracted billions of {dollars} of funding in primarily solar energy.

- The authorities of Canada introduced that it’s implementing 25% tariffs on metal and aluminum imports from China, efficient October 15, 2024, in accordance with Morgan Stanley.

- As reported by Bloomberg, Wall Street is starting to bitter on the outlook for crude subsequent 12 months, with Goldman Sachs Group and Morgan Stanley reducing value forecasts as world provides improve, together with probably from OPEC+. The two banks now foresee world benchmark Brent averaging lower than $80 a barrel in 2025, with Goldman’s revised forecast minimize to $77, whereas Morgan Stanley sees futures starting from $75 to $78.

Bitcoin and Digital Assets

Strengths

- Of the cryptocurrencies tracked by CoinMarketCap, the perfect performer for the week was Akash Network, rising 5.33%.

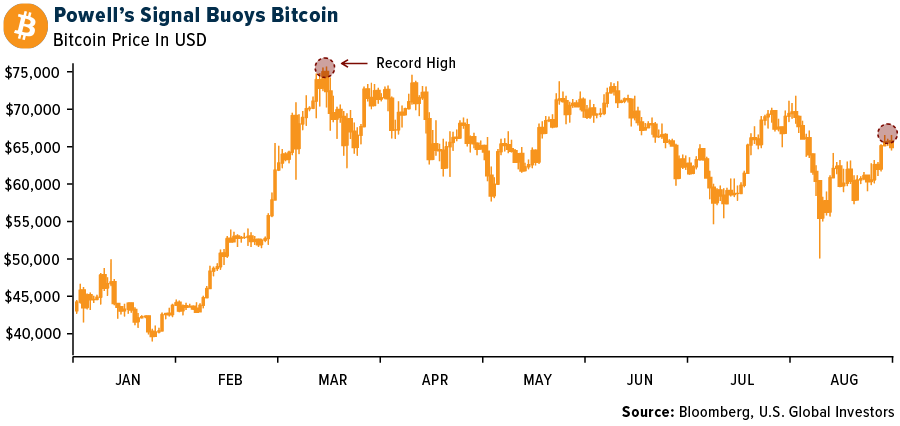

- Bitcoin touched $65,000 for the primary time in about three weeks, writes Bloomberg, aided by revived demand for U.S. spot Bitcoin ETFs and indicators that the Federal Reserve is ready to loosen financial coverage. Bitcoin rose as a lot as 1.2% to start out the week and has since fallen again barely, nearer to $60,000 on Friday.

- Digital asset supervisor ParaFi Capital, backed by KKR co-founder Henry Kravis, raised $120 million to put money into general-partner stakes in different crypto funds, stories Bitcoin.com. The purpose is to construct a portfolio of 30 to 50 stakes over the following three to 5 years because the crypto-fund panorama grows.

Weaknesses

- Of the cryptocurrencies tracked by CoinMarketCap, the worst performer for the week was Notcoin, down 22.55%.

- The detention of Telegram founder Pavel Durov has shaken the crypto enterprise capital sector, writes Bloomberg, notably those that invested in Toncoin, a token linked to the Telegram app. The token’s worth has plummeted amid issues over the app’s future because of Durov’s authorized troubles.

- Binance Japan’s CEO, Takeshi Chino, indicated that launching a stablecoin in Japan by the tip of the 12 months is difficult, with a dollar-denominated stablecoin now seemingly delayed till the primary half of 2025.

Opportunities

- Despite current setbacks with exchanges withdrawing functions, there’s a 70% probability the SEC will approve choices on spot Bitcoin ETFs by May, following extra enter from the OCC and CFTC.

- MakerDAO, one of many oldest decentralized finance platforms, is rebranding as Sky to draw extra mainstream customers. The platform has plans to launch new tokens and simplify the consumer expertise as a part of its broader development technique.

- Solayer Labs, the developer of the Solana restaking protocol, raised $12 million in a seed funding spherical led by Polychain Capital, bringing its valuation to $80 million. Solayer Labs goals to increase its group, combine new protocols, and ultimately launch a local token.

Threats

- The U.S. SEC has settled with crypto lending platform Abra after charging the startup with promoting unregistered securities to shoppers and working as an unregistered funding firm, stories Bloomberg. Plutus Lending LLC agreed to settle with the SEC with out admitting or denying the company’s allegations.

- Big legislation corporations have earned over $750 million in authorized charges from cryptocurrency-related bankruptcies since 2022, with the work nearing completion as most circumstances wrap up. This contains main circumstances like FTX, Genesis and Terraform Labs.

- OpenSea has obtained a Wells Notice from the SEC, signaling potential authorized motion over allegations that the NFTs on its platform are unregistered securities, making it the most recent crypto firm to face regulatory scrutiny.

Defense and Cybersecurity

Strengths

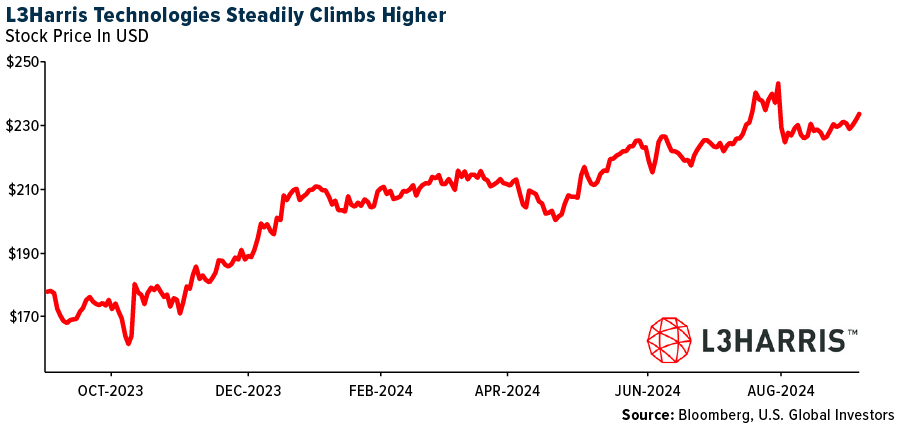

- L3Harris Technologies was awarded a $587.39 million Navy contract for the design, manufacturing and supply of digital warfare check articles and prototypes, supporting the Next Generation Jammer Low Band program, with completion anticipated by August 2029.

- BAE Systems has been awarded a $177.8 million Navy contract for the restore, upkeep and modernization of the USS Halsey, with potential extensions rising the contract worth to $225.6 million. The work is anticipated to be accomplished by April 2026 in San Diego, California.

- The finest performing inventory this week was Aerovironment Inc., rising 9.78%, after profitable a report $990 million Army contract, resulting in a inventory improve and elevated value goal from analysts.

Weaknesses

- Russia launched over 100 missiles and practically as many drones in an enormous assault on Ukraine’s energy infrastructure, inflicting widespread blackouts and leaving at the least three lifeless. Ukraine’s President Zelenskiy known as for elevated Western navy help amid ongoing Russian efforts to cripple civilian infrastructure earlier than winter.

- This week, France arrested Pavel Durov, the creator of the Telegram app, issuing an arrest warrant proper as his aircraft landed in Paris. Later, they introduced ahead a collection of prices, seemingly primarily based on his refusal to cooperate and supply entry codes to the app for French authorities companies. The United Arab Emirates reacted extraordinarily negatively, freezing the acquisition of Rafael fighter jets price a complete of $17 billion and demanding Pavel Durov’s fast launch. Several socially vital political figures additionally reacted sharply, calling this an assault on freedom of speech, political imprisonment, and the imposition of censorship.

- The worst-performing inventory this week was Archer Aviation, dropping 10.99%. The decline adopted information of elevated competitors in the identical phase, which can negatively influence future expectations.

Opportunities

- Northrop Grumman’s ATHENA sensor, a next-gen missile warning system providing 360-degree situational consciousness and superior risk detection, has been chosen by the U.S. Army for the primary part of the Improved Threat Detection System program. This will showcase its capabilities in enhancing plane safety and integrating with present countermeasure methods.

- Zelensky introduced that profitable assessments of a brand new ballistic missile developed in Ukraine have been carried out. Additionally, Ukraine now meets 98% of its navy wants for small, cheap drones via home manufacturing.

- Lockheed Martin and General Dynamics are forming a three way partnership to supply missile engines, addressing provide chain bottlenecks attributable to Northrop Grumman and L3Harris’s manufacturing limitations, which may considerably profit their companies.

Threats

- Boeing introduced that two astronauts stranded on the International Space Station (ISS) will stay in house for an extra six months because of points with the Starliner spacecraft and can return to Earth through SpaceX’s Dragon as an alternative.

- Zelensky acknowledged that Ukraine is not going to prolong the contract for the transit of fuel from Russia to Europe via Ukraine, which may considerably influence the provision chain.

- Following a large-scale Israeli airstrike focusing on Hezbollah in southern Lebanon, which prompted retaliatory missile hearth, tensions within the Middle East briefly deescalated. However, the specter of a broader regional battle involving Iran stays excessive as ceasefire negotiations between Israel and Hamas proceed amid ongoing low-level clashes.

Gold Market

This week gold futures closed the week at $2,535.00, down $x11.30 per ounce, or 0.44%. Gold shares, as measured by the NYSE Arca previous Miners Index, ended the week decrease by 1.43%. The S&P/TSX Venture Index got here in off 1.75%. The U.S. Trade-Weighted Dollar rose 0.95%.

Strengths

- The finest performing treasured metallic for the week was palladium, up 1.67%, maybe on Ford mentioning the size again of its EV growth program. According to Goldman, Zijin reported 1H24A recurring revenue of Rmb15.7 billion, up 51% year-over-year, above the financial institution’s estimates because of operational enchancment with larger realized ASP and lower-than-expected price.

- Gold’s record-setting rally above $2,500 an oz seems to have additional to run because the Federal Reserve prepares to cut charges, conventional drivers comparable to decrease yields return, and Western buyers pile again in. “Everybody thought the Fed was going to be the last to cut, but now they’re getting in line,” stated Jay Hatfield, chief govt officer of Infrastructure Capital Advisor.

- According to Scotia, Endeavour Mining introduced that it has reached a settlement settlement with Lilium Mining with respect to the delayed cost and subsequent authorized proceedings arising from the 2023 sale of Endeavour’s Boungou and Wahgnion mines in Burkina Faso. Pursuant to the settlement, Lilium will switch the possession of the Boungou and Wahgnion mines to the State of Burkina Faso, and Endeavour will obtain upfront and deferred money consideration totaling $60 million, plus a 3% royalty.

Weaknesses

- The worst performing treasured metallic for the week was platinum, down 3.64%, on little information. According to UBS, Zhaojin mining introduced its H124 outcomes, with internet revenue attributable to shareholders of Rmb553m (119% year-over-year) which missed expectations of Rmb700m.

- Gold Road reported its first half 2024 outcomes with an underlying EBITDA of $94 million, 8% weaker year-over-year and decrease than Bank of America’s expectations. The underlying internet revenue of $43 million was 15% decrease than BofA’s expectations.

- According to UBS, at Hochschild Mining, the Mara Rosa mine achieved business manufacturing on May 13. However, mechanical availability points and contractor delays have meant manufacturing is delayed. Although all points are actually resolved with manufacturing to extend within the second half of the 12 months, manufacturing will probably be on the decrease finish of steerage and will probably be up to date with third quarter outcomes.

Opportunities

- Harmony Gold Mining beat its manufacturing goal for fiscal 2024 on larger grades and stated earnings jumped on surging gold costs. The South African miner of the dear metallic expects to report earnings per share of at the least 72 U.S. cents for the 12 months ended June 30, which might be a 64% improve from fiscal 2023’s 44 cents. This is pushed by a 6% improve in gold manufacturing to 1.56 million ounces, in accordance with Dow Jones.

- Opportunities for Torex Gold, in accordance with Scotia, embody nearing completion of the transformational $950 million Media Luna Au-Cu venture for startup early subsequent 12 months, in addition to free money move inflection in 2025. A capital return program may be initiated subsequent 12 months.

- Bloomberg reported that Bitcoin has underperformed in August, stimmed by ebbing liquidity and lingering worries over the potential for governments to unload their Bitcoin. Kaiko, a number one crypto business information group, estimated the U.S. administration holds about 203,220 Bitcoin, adopted by China’s 190,000, the UK’s 61,200 and 46,350 for Ukraine. Governments seize tokens in prison circumstances, whereas Ukraine is believed to have obtained donations to assist fund its protection towards Russia’s invasion. Meanwhile, Mt. Gox has roughly 46,170 tokens left to distribute, Kaiko stated. The buying and selling backdrop has additionally turn out to be more difficult within the U.S. Bitcoin ETF sector, in accordance with JPMorgan strategists. That’s primarily based, partly, on a metric often known as the Hui-Heubel ratio, which purports to offer insights into liquidity by measuring the variety of trades it takes to maneuver costs. “It is striking that this metric has been deteriorating for all spot-Bitcoin ETFs since March, pointing to overall deterioration of spot Bitcoin ETF liquidity over the past six months,” the JPMorgan group together with Nikolaos Panigirtzoglou stated. Any Bitcoin liquidation below these circumstances may pressure cash to flee to gold bullion.

Threats

- Major Chinese copper and gold producer Zijin Mining Group stated a slowing world financial system, geopolitical tensions, and useful resource nationalism may limit its abroad deal-making ambitions. The firm flagged unfavorable components sooner or later probably impacting “the company’s revenue, profits, merger and acquisitions of new overseas projects,” in accordance with Bloomberg.

- According to UBS, there’s 8% draw back threat to ahead consensus earnings, on common, for South African gold producers. If spot commodity costs prevail, they calculate draw back threat for the SA diversifieds (-5%), PGM miners (-19%) on a median market cap-weighted foundation.

- Predictive Discovery’s share value dropped essentially the most in three years with a surge in quantity as the federal government of Guinea introduced the suspending of allow functions and the processing of present permits as they conduct a mining title evaluate. Predictive Discovery completed the week down 15%.

U.S. Global Investors, Inc. is an funding adviser registered with the Securities and Exchange Commission (“SEC”). This doesn’t imply that we’re sponsored, really helpful, or authorized by the SEC, or that our skills or {qualifications} the least bit have been handed upon by the SEC or any officer of the SEC.

This commentary shouldn’t be thought of a solicitation or providing of any funding product. Certain supplies on this commentary might include dated data. The data offered was present on the time of publication. Some hyperlinks above could also be directed to third-party web sites. U.S. Global Investors doesn’t endorse all data provided by these web sites and isn’t answerable for their content material. All opinions expressed and information offered are topic to alter with out discover. Some of those opinions might not be acceptable to each investor.

Holdings might change every day. Holdings are reported as of the newest quarter-end. The following securities talked about within the article had been held by a number of accounts managed by U.S. Global Investors as of (06/30/2024):

Southwest Airlines

Qantas Airways

American Airlines

Ryanair Holdings PLC

Pernod Ricard

Ferrari

Brunello Cucinelli

ConocoPhillips

EOG Resources

Occidental Petroleum

Lundin Gold

BHP Group

Endeavour Mining

Hochschild Mining

Harmony Gold Mining

Trip.com

Spirit Airlines

General Dynamics

The Boeing Co.

Prada SpA

Hermes International SCA

Brunello Cucinelli SpA

Moncler SpA

Cie Financiere Richemont SA

LVMH

Hugo Boss AG

Kering SA

Burberry Group PLC

*The above-mentioned indices aren’t whole returns. These returns mirror easy appreciation solely and don’t mirror dividend reinvestment.

The Dow Jones Industrial Average is a price-weighted common of 30 blue chip shares which can be typically leaders of their business. The S&P 500 Stock Index is a widely known capitalization-weighted index of 500 widespread inventory costs in U.S. corporations. The Nasdaq Composite Index is a capitalization-weighted index of all Nasdaq National Market and SmallCap shares. The Russell 2000 Index® is a U.S. fairness index measuring the efficiency of the two,000 smallest corporations within the Russell 3000®, a widely known small-cap index.

The Hang Seng Composite Index is a market capitalization-weighted index that includes the highest 200 corporations listed on Stock Exchange of Hong Kong, primarily based on common market cap for the 12 months. The Taiwan Stock Exchange Index is a capitalization-weighted index of all listed widespread shares traded on the Taiwan Stock Exchange. The Korea Stock Price Index is a capitalization-weighted index of all widespread shares and most well-liked shares on the Korean Stock Exchanges.

The Philadelphia Stock Exchange Gold and Silver Index (XAU) is a capitalization-weighted index that features the main corporations concerned within the mining of gold and silver. The U.S. Trade Weighted Dollar Index offers a normal indication of the worldwide worth of the U.S. greenback. The S&P/TSX Canadian Gold Capped Sector Index is a modified capitalization-weighted index, whose fairness weights are capped 25 % and index constituents are derived from a subset inventory pool of S&P/TSX Composite Index shares. The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded corporations concerned primarily within the mining for gold and silver. The S&P/TSX Venture Composite Index is a broad market indicator for the Canadian enterprise capital market. The index is market capitalization weighted and, at its inception, included 531 corporations. A quarterly revision course of is used to take away corporations that comprise lower than 0.05% of the burden of the index, and add corporations whose weight, when included, will probably be better than 0.05% of the index.

The S&P 500 Energy Index is a capitalization-weighted index that tracks the businesses within the vitality sector as a subset of the S&P 500. The S&P 500 Materials Index is a capitalization-weighted index that tracks the businesses within the materials sector as a subset of the S&P 500. The S&P 500 Financials Index is a capitalization-weighted index. The index was developed with a base degree of 10 for the 1941-43 base interval. The S&P 500 Industrials Index is a Materials Index is a capitalization-weighted index that tracks the businesses within the industrial sector as a subset of the S&P 500. The S&P 500 Consumer Discretionary Index is a capitalization-weighted index that tracks the businesses within the shopper discretionary sector as a subset of the S&P 500. The S&P 500 Information Technology Index is a capitalization-weighted index that tracks the businesses within the data expertise sector as a subset of the S&P 500. The S&P 500 Consumer Staples Index is a Materials Index is a capitalization-weighted index that tracks the businesses within the shopper staples sector as a subset of the S&P 500. The S&P 500 Utilities Index is a capitalization-weighted index that tracks the businesses within the utilities sector as a subset of the S&P 500. The S&P 500 Healthcare Index is a capitalization-weighted index that tracks the businesses within the healthcare sector as a subset of the S&P 500. The S&P 500 Telecom Index is a Materials Index is a capitalization-weighted index that tracks the businesses within the telecom sector as a subset of the S&P 500.

The Consumer Price Index (CPI) is without doubt one of the most widely known value measures for monitoring the value of a market basket of products and providers bought by people. The weights of elements are primarily based on shopper spending patterns. The Purchasing Manager’s Index is an indicator of the financial well being of the manufacturing sector. The PMI index is predicated on 5 main indicators: new orders, stock ranges, manufacturing, provider deliveries and the employment atmosphere. Gross home product (GDP) is the financial worth of all of the completed items and providers produced inside a rustic’s borders in a particular time interval, although GDP is normally calculated on an annual foundation. It contains all non-public and public consumption, authorities outlays, investments and exports much less imports that happen inside an outlined territory.

The S&P Global Luxury Index is comprised of 80 of the most important publicly traded corporations engaged within the manufacturing or distribution of luxurious items or the availability of luxurious providers that meet particular investibility necessities.

The Financial Times Stock Exchange 100 Index, additionally known as the FTSE 100 Index, FTSE 100, FTSE, or, informally, the “Footsie”, is the United Kingdom’s best-known inventory market index of the 100 most extremely capitalized blue chips listed on the London Stock Exchange.