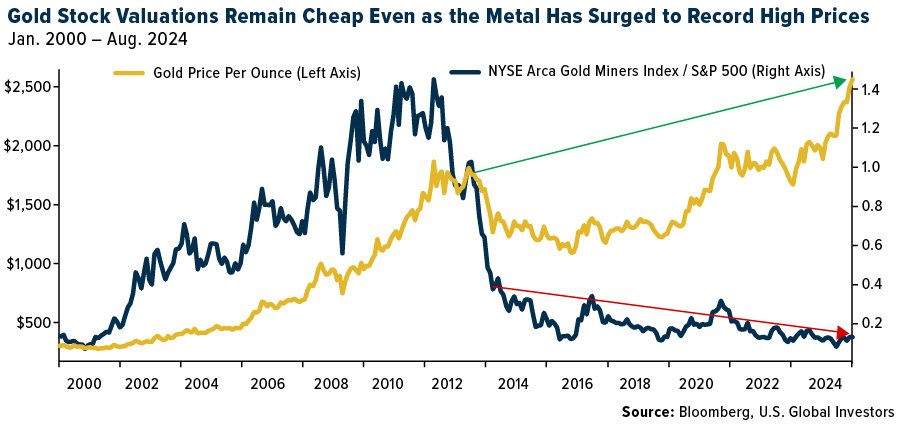

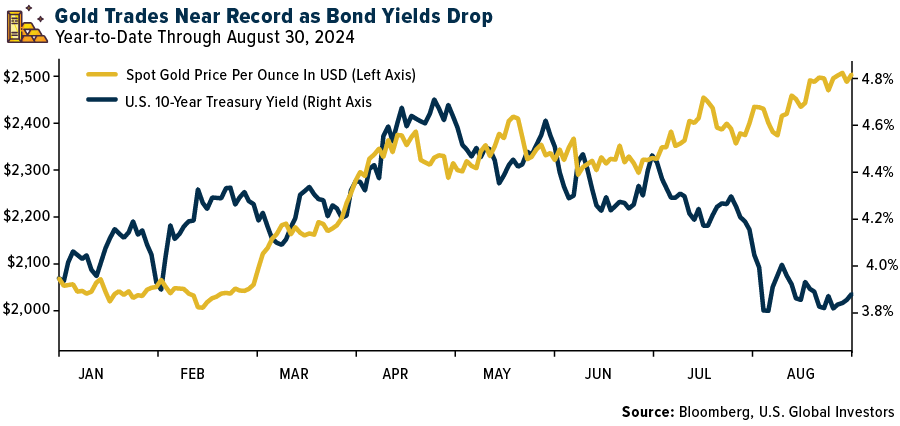

As I write this, gold continues to commerce above $2,500 an oz. after surging previous the psychologically necessary degree for the primary time ever in mid-August. For seasoned gold mining buyers, this needs to be a second of validation. After all, the yellow steel has lengthy been seen as the final word hedge in opposition to financial uncertainty.

And but, regardless of the bull run, gold shares—these firms that mine, course of and promote the steel—are buying and selling at traditionally low valuations relative to the market.

This obvious disconnect affords contrarian buyers a unprecedented alternative.

Rising Yields and the Gold Selloff Explained

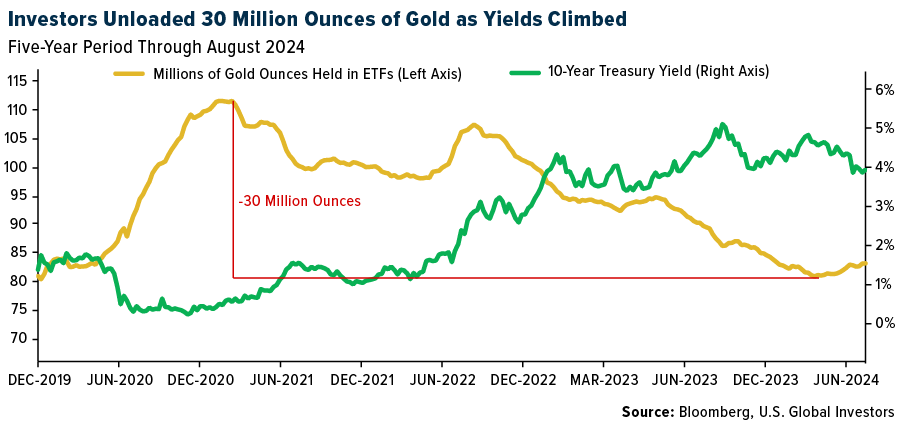

But first, why is that this taking place? The main perpetrator for this disparity, I imagine, lies within the affect of rates of interest and central banks’ gold-buying spree. The actual, inflation-adjusted 10-year Treasury yield rose from a low of round -1.2% in August 2021 to just about 2.5% in October 2023, and for a lot of buyers, significantly these in Western international locations, rising yields are a sign to promote non-interest-bearing gold.

That’s precisely what occurred. From the top of 2020 to May 2024, exchange-traded funds (ETFs) backed by bodily gold shed roughly 30 million ounces, over 1 / 4 of their complete holdings, as yield-seeking buyers pared again their positions.

What some buyers might have ignored, I’m afraid, is the long-term potential of the very property they had been letting go of. Gold shares, not like the bodily steel, provide not only a hedge but additionally a method of taking part within the upside of gold costs. Put one other means, when gold costs have gone up, gold shares have traditionally tended to rise much more.

Right now, I imagine these shares are providing an unprecedented mixture of low valuations and excessive potential returns.

A Contrarian Take on Gold Stocks

As contrarians, we perceive that the perfect time to take a position is usually when sentiment is at its lowest. And sentiment round gold equities is fairly low proper now.

But historical past tells us that this might be the proper time to purchase. As you could possibly inform within the chart above, we’re seeing a reversal of the gold ETF selloff. Since mid-May, buyers have added about 2.3 million ounces of gold, in line with Bloomberg information; holdings now stand at their highest degree since February of this 12 months.

This might be only the start. If actual curiosity fall considerably, the tide might flip in favor of gold and gold equities.

$3,000 Gold by Mid-2025?

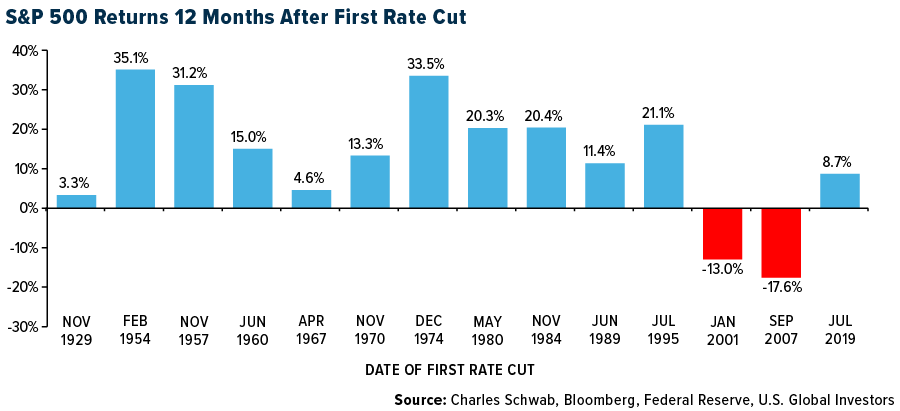

Historically, gold’s largest beneficial properties have occurred when the Federal Reserve cuts rates of interest amid financial uncertainty. Although there’s no apparent disaster on the horizon, markets are pricing in a 25-basis level lower at every of the following two Fed conferences in September and November, with a larger cut expected in December.

If the Fed follows by, we might see gold costs not solely preserve their present ranges however soar to new heights. UBS is asking for $2,700 gold by mid-2025; Citigroup, Goldman Sachs and Bank of America all see the metal hitting $3,000.

Stock Market Trends After the First Fed Rate Cut

That’s to not say it’s best to dump all of your equities in favor of gold, particularly because the Fed is on the verge of easing. Charles Schwab not too long ago confirmed what shares did up to now when charges fell, and buyers might need to take be aware.

The inventory market traded up 12 out of 14 times—or 86% of the time—a 12 months after the Fed made its preliminary lower in a brand new easing cycle. Schwab factors out that the 2 back-to-back adverse intervals had been predicated on extraordinary circumstances: the dotcom bubble in 2001 and the housing disaster in 2007. Past efficiency isn’t any assure of future outcomes, however it’s value contemplating.

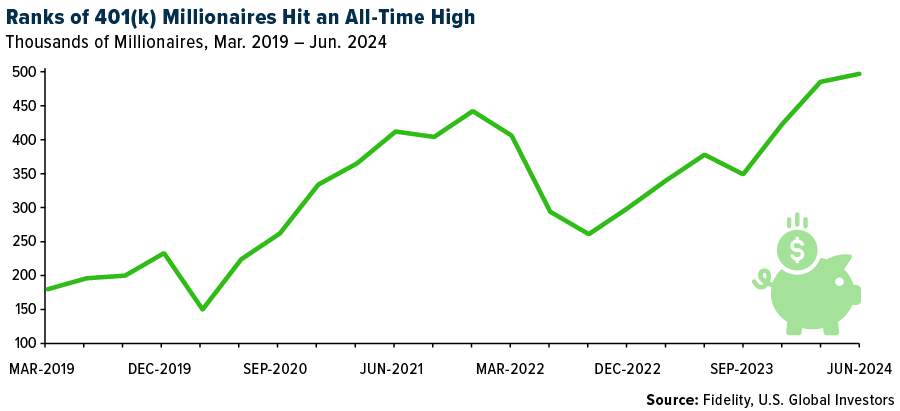

This is good news for common buyers, together with the report variety of “401(k) millionaires”—buyers who’ve $1 million or extra of their retirement accounts. According to Fidelity, there at the moment are nearly half 1,000,000 such millionaires… and rising!

Similarly, our ABC Investment Plan permits buyers to fund their retirement extra affordably. The ABC Investment Plan is an computerized funding plan that makes use of some great benefits of dollar-cost averaging—an funding approach that allows you to make investments a set quantity in a selected funding at common intervals—along with monetary self-discipline that can assist you work in the direction of your monetary objectives.

ENROLL BY CLICKING HERE

As all the time, I encourage you to do your personal analysis, contemplate your danger tolerance and seek the advice of along with your monetary advisor. But from the place I stand, the chance in gold equities is one which shouldn’t be ignored.

Index Summary

- The main market indices completed principally down this week. The Dow Jones Industrial Average gained 0.94%. The S&P 500 Stock Index fell 0.14%, whereas the Nasdaq Composite fell 0.92%. The Russell 2000 small capitalization index misplaced 0.41% this week.

- The Hang Seng Composite gained 8.01% this week; whereas Taiwan was up 0.50% and the KOSPI fell 1.01%.

- The 10-year Treasury bond yield rose 12 foundation factors to three.92%.

Airlines and Shipping

Strengths

- The greatest performing airline inventory for the week was Trip.com, up 11.8%. Southwest Airlines introduced the return of its limited-time tier acceleration promotion this week in a press launch, making it simpler for Rapid Rewards members to earn tier standing by 2025.

- More broadly over the previous 12 months, the affect of longer commerce routes has had a optimistic affect on freight charges because of the enhance in ton-miles. Reduced capability within the Panama Canal, rerouting of ships as a consequence of assaults within the Red Sea, in addition to the battle in Ukraine and within the Middle East, have all prolonged routes and boosted charges. These elements seem like the first drivers of the power within the ISI survey versus ultimate demand for the merchandise.

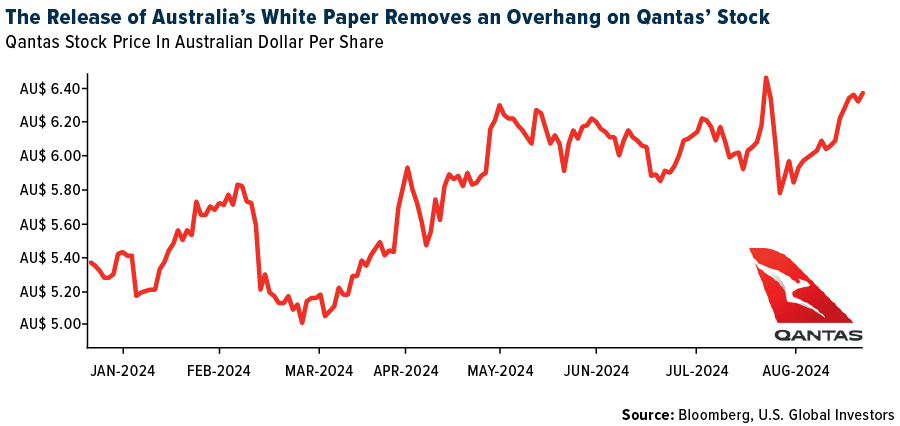

- The Australia Government’s Aviation White Paper particulars 56 initiatives to information long-term coverage. Overall, UBS’s first learn is that the proposed adjustments are much less vital than some buyers had feared. The group expects minimal impacts to Qantas’ earnings within the subsequent 5 years.

Weaknesses

- The worst performing airline inventory for the week was Spirit, down 7.9%. Azul is targeted on renegotiating the Lessor Equity Structure previous to elevating debt in opposition to its cargo enterprise, with chapter submitting/renegotiating lease charges not within the plan. Moreover, these negotiations are impartial of a possible merger with GOL, in line with Raymond James.

- Stifel feels many of the cargo site visitors has rerouted away from the Gulf of Aden with sailings down 74%. However, not all ship varieties have reacted equally, with nearly all LNG ships having moved away, 89% of container ships, and 64% of dry bulk ships. Tanker site visitors, nonetheless, is simply down 42% because the potential for outsized earnings is just too nice for some to disregard.

- Mexican home site visitors dropped 3.6% year-over-year for the primary half of 2024 as a consequence of capability constraints attributable to P&W engine inspections, studies UBS, which is impacting primarily Volaris, and needs to be accomplished solely by 2026. Meanwhile, worldwide site visitors has been marginally decelerating and U.S. airways reported Latin America yields have been dropping by double-digits, probably indicating publish pandemic pent-up demand normalization.

Opportunities

- TSA expects the busiest Labor Day journey interval on report, in line with Morgan Stanley. Passenger volumes are projected to be up 8.5% versus final 12 months as TSA anticipates that it’s going to display screen over 17 million individuals over the lengthy weekend. Travel continues to be strong this 12 months as the highest 10 busiest journey days on report have occurred since May.

- ZIM expects regular seasonality traits this 12 months with a optimistic peak season and buildup within the U.S. stock ranges. However, the corporate is unsure in regards to the sustainability of the current pick-up in demand, which is both linked to an early peak season or a extra sustained demand uptick, in line with Bank of America.

- For Ryanair, the €700 million buyback has been accomplished forward of schedule, studies RBC, and the corporate introduced a follow-on buyback of €800 million in fiscal 12 months 2025 (estimated). Including dividend funds, this can take money returns to >10% of the market cap in FY25E. There might be upside to the group’s assumption of €1 billion of buybacks in FY26E with capex stepping right down to €1.1 billion.

Threats

- According to Bank of America, American Airlines’ schedules replicate this moderation, with November and December system capability lowered by 330 foundation factors (bps) and 270bps, respectively. Cuts had been targeted on short-haul flying, with home capability lowered by 420/370bps in November/December, whereas Latin American capability was lowered by 270/150bps.

- The draw back dangers for transport, in line with JP Morgan, embrace share costs falling even when freight charges don’t instantly fall when Middle East circumstances ease and the Red Sea route appears to be restored. In addition, the financial institution notes slowing North American cargo motion and sharp yen appreciation.

- Ryanair instructed Bloomberg that it plans to develop its capability by 8% this winter, although it’s too early to forecast demand ranges, they mentioned. Ryanair might miss its annual goal to hold 200 million passengers, relying on the extent of the delays in deliveries of Boeing’s 737 Max jets.

Luxury Goods and International Markets

Strengths

- Brunello Cucinelli, an Italian luxury-fashion agency, reported earnings earlier than curiosity and taxes of 104.6 million euros ($117 million), in contrast with the 87.7 million euros it booked within the year-earlier interval. The result’s broadly in step with analysts’ views. The firm maintained its guidnacne for a ten% gross sales progress in 2024 and 2025, regardless of slower demand for luxurious items in a few of its rivals.

- Diageo, a multinational alcoholic beverage firm headquartered in London, efficiently priced €1.9 billion in fixed-rate euro-denominated bonds, indicating robust investor confidence and offering the corporate with substantial funds for common company functions.

- Resorttrust, a number one firm in Japan that provides luxurious resort memberships, motels, golf programs and extra, was the perfect perfoerming S&P Global Luxury inventory, gaining 6.2%. Shares gained within the native foreign money for 9 consecutive days, marking their longest profitable streak in 10 years.

Weaknesses

- Shares of PVH firm dropped after its monetary outcomes had been launched. The firm reported an earnings beat however guided the following quarter’s earnings per share beneath the road estimate. Revenue in worldwide companies decreased 4% in comparison with the prior 12 months, primarily as a consequence of weak point in Asia Pacific, China and Australia.

- Burberry is ready to exit the FTSE 100 Index as a consequence of a major share value drop, ending its 15-year presence and reflecting challenges in its model revamp and demand slowdown.

- Cettire, a web-based market, was the worst-performing S&P Global Luxury inventory, dropping 28.3% up to now 5 days. The firm misplaced nearly 20% ot its market share on Thursday after the corporate reported diappointing monetary outcomes.

Opportunities

- Ferrari shares have risen 40% this 12 months and are anticipated to see additional value appreciation, in line with Morgan Stanley. The firm has minimal publicity to China, with lower than 7% of its earnings coming from the area. Additionally, Ferrari has a powerful base of repeat consumers and collectors, with 75% of recent vehicles bought to current prospects. As a end result, the brokerage has raised its value goal for Ferrari from $400 to $520.

- Mumbai has develop into the second-fastest-growing property market globally. The metropolis recorded a 13% enhance in prime residential costs year-over-year, whereas Manila was the fastest-growing market, with property costs surging by 26%. In Europe, Stockholm confirmed the strongest efficiency, in line with the Prime Global Cities Index, which tracks residential costs throughout 44 cities worldwide.

- The Rolex Rainbow Daytona watch from the Nineties will go on sale in November on the Phillips public sale home, with a price ticket that would attain $3.5 million. The watch is believed to be the first-ever instance of a rainbow watch produced by Rolex utilizing multi-colored sapphire gems. Although demand for costly watches has slowed down, uncommon and distinctive fashions from Swiss manufacturers proceed to draw curiosity. Last 12 months, the identical public sale home, Phillips, bought a gold Rolex 6270 Cosmograph Daytona from 1988 for almost 4 million Swiss francs.

Threats

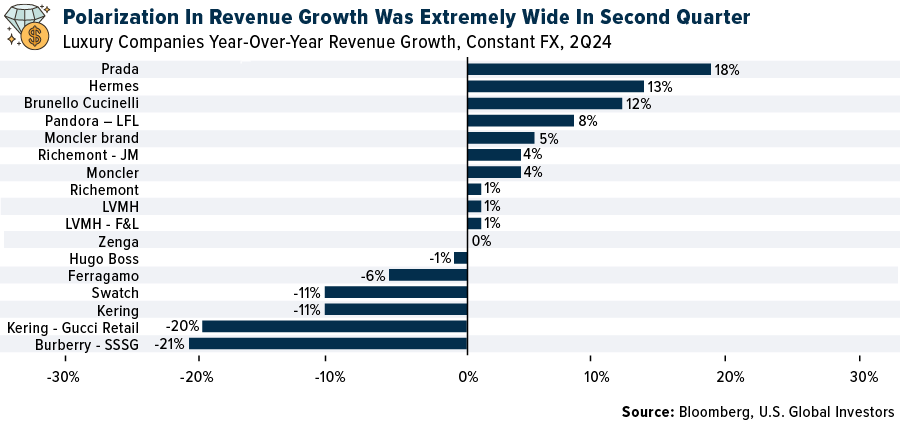

- In the second quarter, luxurious income progress was flat, in comparison with a 2% enhance within the first quarter of this 12 months, in line with BofA’s luxurious analysis agency. The firm highlighted weaker spending traits in China, noting that manufacturers most uncovered to the Chinese market skilled the most important income declines. There is a major distinction in income efficiency, with the highest manufacturers attaining a lot increased revenues than the bottom-performing ones, displaying a variety of about 40%.

- Harmony Auto Holdings, which operates dealerships for 14 luxurious automobile manufacturers in China, together with BMW, Ferrari and Lexus, has introduced a company-wide wage discount as an emergency measure to handle operational losses from the continued value battle amongst home automobile makers. The wage of the chairman and vice chairmen will probably be lower by 50%, whereas the president, vp and different senior managers will face a 35% discount. Middle administration salaries will probably be lowered by 25%, and different workers members will see a 15% lower of their pay.

- Shares of Remy Cointreau and Pernod Ricard gained as China mentioned it gained’t impose non permanent tariffs on brandy imports from the European Union, however nonetheless might put measures at a later date. Meanwhile, the EU has been pushing forward with plans to impose tariffs on Chinese made EVs. The bloc is ready to publish a ultimate verdict on these levies by October 30, except each events attain an settlement.

Energy and Natural Resources

Strengths

- The greatest performing commodity for the week was sugar, rising 5.38%, on the specter of large fires in Brazil the place circumstances are dry, and crops might be worn out. Oil superior initially of the week after Libya’s japanese authorities mentioned it’ll halt exports, constructing on tensions within the Middle East after Israeli strikes on Hezbollah targets in southern Lebanon raised considerations of a broader battle, Bloomberg studies. However, oil slumped by the top of the week with OPEC+ anticipated to lift manufacturing within the fourth quarter.

- About 100 miles east of Roswell, a dusty nook of New Mexico with extra cattle than individuals is quietly buttressing the U.S.’s world oil dominance, writes Bloomberg. After pumping much less crude within the years main as much as the pandemic than high counties in neighboring Texas, New Mexico’s Lea County has been quickly gaining floor. Output there has expanded sooner than in some other U.S. county, the article explains, final 12 months turning into the primary to ever produce greater than 1 million barrels per day, in line with power analysis agency Enverus. EOG Resources, ConocoPhillips, Chevron, Coterra Energy and Occidental Petroleum are giant producers within the Delaware Basin of New Mexico and West Texas.

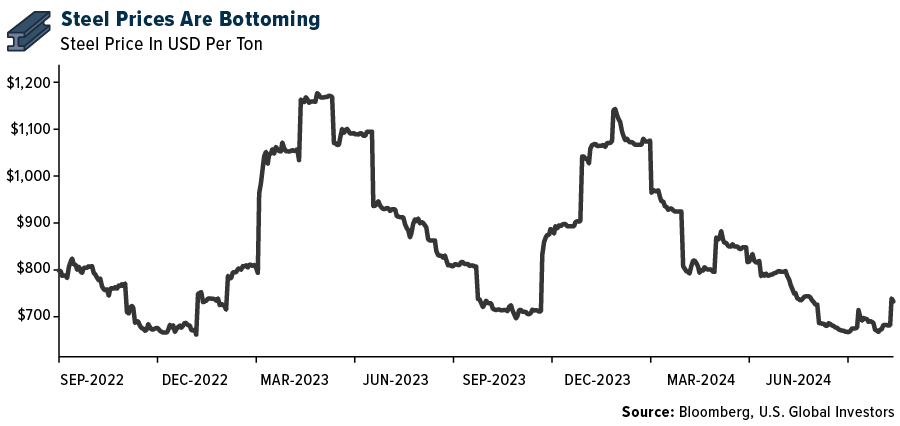

- U.S. uncooked metal mill utilization charges elevated to 80.2% within the week, up from 79.0% the earlier week, the American Iron and Steel Institute reported. Production through the week totaled 1.782 million tons, up 1.6% from the week earlier than when manufacturing was 1.754 million tons. Production elevated 2.3% from the corresponding week a 12 months in the past.

Weaknesses

- The worst performing commodity for the week was lead, dropping 4.67%, on weak demand. Refiners traded down and at the moment are down almost 10% since June 30 and >30% since peaking on April 5. East Coast 321 cracks at <$15 per barrel are down >$5 per barrel up to now two weeks and are starting to strategy five-year lows, in line with JPMorgan.

- China doesn’t paint a vivid image for refining margins. Cnooc Ltd., Sinopec and PetroChina Co. all reported that their refining margins tumbled – making that sector one of many industrial financial system’s worst performers, Bloomberg studies.

- Fitch Ratings has downgraded the Long-Term Issuer Default Rating (IDR) for Albemarle Corporation and its issuing subsidiaries to ‘BBB-‘ from ‘BBB’ on expectations for sustained overcapacity and lower-for-longer pricing within the lithium trade.

Opportunities

- Chile’s copper-mining trade is rising from an intense interval of wage negotiations, signaling a diminished danger of additional disruptions in a rustic that accounts for 1 / 4 of world provide. Over the weekend, about 300 putting staff at a Lundin Mining Corp.-operated mine went again to work. Per week earlier, the principle union on the large Escondida mine run by BHP Group ratified a labor pact following a three-day stoppage. Antofagasta Plc reached an early wage take care of the principle union at its Centinela facility, finishing the agency’s talks for the 12 months, in line with Bloomberg. Labor unrest could also be within the rear-view mirror for now.

- Bank of America strategists have made a secular name on swapping out your 40% bond allocation from the standard 60% shares/40% bonds portfolio to 40% commodities. The “commodity secular bull market in the 2020s is just getting started as debt, deficits, demographics, reverse-globalization, AI & net zero policies are all inflationary,” wrote BofA strategists Jared Woodard and Michael Hartnett.

- If you need to perceive the shifting sands in Australia’s assets sector, do a fast key phrase search on the slide deck that accompanies BHP’s revenue end result. The phrase “copper” seems 78 occasions. The phrases “iron ore” simply 14 occasions. Such a statistic might sound trivial, however it speaks to a unprecedented shift within the progress narrative of BHP chief govt Mike Henry – and an necessary second for an Australian financial system that has lengthy ridden on the miracle of the Chinese growth, in line with the Financial Review.

Threats

- A legislative change is threatening to unravel one of many world’s most secure bets in renewable power, a Chilean incentive program that lured firms backed by BlackRock Inc. and JPMorgan Chase & Co, studies Bloomberg. President Gabriel Boric’s administration is in search of to lift funds by altering a pricing mechanism for small electrical energy turbines that has attracted billions of {dollars} of funding in primarily solar energy.

- The authorities of Canada introduced that it’s implementing 25% tariffs on metal and aluminum imports from China, efficient October 15, 2024, in line with Morgan Stanley.

- As reported by Bloomberg, Wall Street is starting to bitter on the outlook for crude subsequent 12 months, with Goldman Sachs Group and Morgan Stanley decreasing value forecasts as world provides enhance, together with doubtlessly from OPEC+. The two banks now foresee world benchmark Brent averaging lower than $80 a barrel in 2025, with Goldman’s revised forecast lower to $77, whereas Morgan Stanley sees futures starting from $75 to $78.

Bitcoin and Digital Assets

Strengths

- Of the cryptocurrencies tracked by CoinMarketCap, the perfect performer for the week was Akash Network, rising 5.33%.

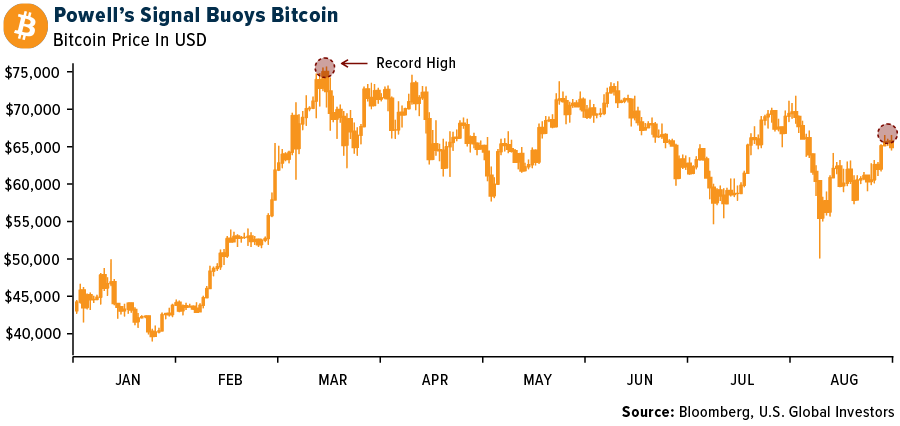

- Bitcoin touched $65,000 for the primary time in about three weeks, writes Bloomberg, aided by revived demand for U.S. spot Bitcoin ETFs and indicators that the Federal Reserve is ready to loosen financial coverage. Bitcoin rose as a lot as 1.2% to begin the week and has since fallen again barely, nearer to $60,000 on Friday.

- Digital asset supervisor ParaFi Capital, backed by KKR co-founder Henry Kravis, raised $120 million to spend money on general-partner stakes in different crypto funds, studies Bitcoin.com. The intention is to construct a portfolio of 30 to 50 stakes over the following three to 5 years because the crypto-fund panorama grows.

Weaknesses

- Of the cryptocurrencies tracked by CoinMarketCap, the worst performer for the week was Notcoin, down 22.55%.

- The detention of Telegram founder Pavel Durov has shaken the crypto enterprise capital sector, writes Bloomberg, significantly those that invested in Toncoin, a token linked to the Telegram app. The token’s worth has plummeted amid considerations over the app’s future as a consequence of Durov’s authorized troubles.

- Binance Japan’s CEO, Takeshi Chino, indicated that launching a stablecoin in Japan by the top of the 12 months is difficult, with a dollar-denominated stablecoin now doubtless delayed till the primary half of 2025.

Opportunities

- Despite current setbacks with exchanges withdrawing functions, there’s a 70% probability the SEC will approve choices on spot Bitcoin ETFs by May, following further enter from the OCC and CFTC.

- MakerDAO, one of many oldest decentralized finance platforms, is rebranding as Sky to draw extra mainstream customers. The platform has plans to launch new tokens and simplify the consumer expertise as a part of its broader progress technique.

- Solayer Labs, the developer of the Solana restaking protocol, raised $12 million in a seed funding spherical led by Polychain Capital, bringing its valuation to $80 million. Solayer Labs goals to increase its staff, combine new protocols, and ultimately launch a local token.

Threats

- The U.S. SEC has settled with crypto lending platform Abra after charging the startup with promoting unregistered securities to customers and working as an unregistered funding firm, studies Bloomberg. Plutus Lending LLC agreed to settle with the SEC with out admitting or denying the company’s allegations.

- Big legislation companies have earned over $750 million in authorized charges from cryptocurrency-related bankruptcies since 2022, with the work nearing completion as most instances wrap up. This consists of main instances like FTX, Genesis and Terraform Labs.

- OpenSea has obtained a Wells Notice from the SEC, signaling potential authorized motion over allegations that the NFTs on its platform are unregistered securities, making it the most recent crypto firm to face regulatory scrutiny.

Defense and Cybersecurity

Strengths

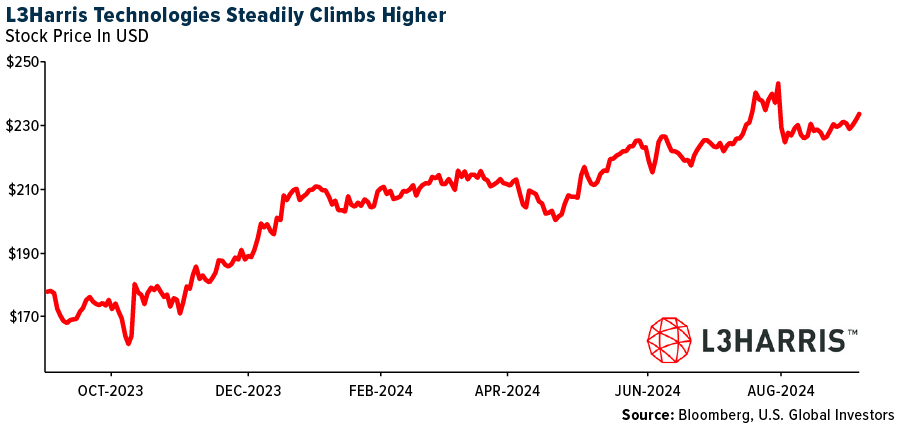

- L3Harris Technologies was awarded a $587.39 million Navy contract for the design, manufacturing and supply of digital warfare check articles and prototypes, supporting the Next Generation Jammer Low Band program, with completion anticipated by August 2029.

- BAE Systems has been awarded a $177.8 million Navy contract for the restore, upkeep and modernization of the USS Halsey, with potential extensions rising the contract worth to $225.6 million. The work is anticipated to be accomplished by April 2026 in San Diego, California.

- The greatest performing inventory this week was Aerovironment Inc., rising 9.78%, after profitable a report $990 million Army contract, resulting in a inventory improve and elevated value goal from analysts.

Weaknesses

- Russia launched over 100 missiles and almost as many drones in a large assault on Ukraine’s energy infrastructure, inflicting widespread blackouts and leaving a minimum of three lifeless. Ukraine’s President Zelenskiy known as for elevated Western navy help amid ongoing Russian efforts to cripple civilian infrastructure earlier than winter.

- This week, France arrested Pavel Durov, the creator of the Telegram app, issuing an arrest warrant proper as his aircraft landed in Paris. Later, they introduced ahead a collection of fees, doubtless primarily based on his refusal to cooperate and supply entry codes to the app for French authorities companies. The United Arab Emirates reacted extraordinarily negatively, freezing the acquisition of Rafael fighter jets value a complete of $17 billion and demanding Pavel Durov’s fast launch. Several socially vital political figures additionally reacted sharply, calling this an assault on freedom of speech, political imprisonment, and the imposition of censorship.

- The worst-performing inventory this week was Archer Aviation, dropping 10.99%. The decline adopted information of elevated competitors in the identical phase, which can negatively affect future expectations.

Opportunities

- Northrop Grumman’s ATHENA sensor, a next-gen missile warning system providing 360-degree situational consciousness and superior risk detection, has been chosen by the U.S. Army for the primary part of the Improved Threat Detection System program. This will showcase its capabilities in enhancing plane safety and integrating with current countermeasure programs.

- Zelensky introduced that profitable assessments of a brand new ballistic missile developed in Ukraine have been performed. Additionally, Ukraine now meets 98% of its navy wants for small, cheap drones by home manufacturing.

- Lockheed Martin and General Dynamics are forming a three way partnership to provide missile engines, addressing provide chain bottlenecks attributable to Northrop Grumman and L3Harris’s manufacturing limitations, which might considerably profit their companies.

Threats

- Boeing introduced that two astronauts stranded on the International Space Station (ISS) will stay in house for a further six months as a consequence of points with the Starliner spacecraft and can return to Earth by way of SpaceX’s Dragon as a substitute.

- Zelensky acknowledged that Ukraine is not going to prolong the contract for the transit of fuel from Russia to Europe by Ukraine, which might considerably affect the availability chain.

- Following a large-scale Israeli airstrike focusing on Hezbollah in southern Lebanon, which prompted retaliatory missile fireplace, tensions within the Middle East briefly deescalated. However, the specter of a broader regional battle involving Iran stays excessive as ceasefire negotiations between Israel and Hamas proceed amid ongoing low-level clashes.

Gold Market

This week gold futures closed the week at $2,535.00, down $x11.30 per ounce, or 0.44%. Gold shares, as measured by the NYSE Arca outdated Miners Index, ended the week decrease by 1.43%. The S&P/TSX Venture Index got here in off 1.75%. The U.S. Trade-Weighted Dollar rose 0.95%.

Strengths

- The greatest performing treasured steel for the week was palladium, up 1.67%, maybe on Ford mentioning the dimensions again of its EV enlargement program. According to Goldman, Zijin reported 1H24A recurring revenue of Rmb15.7 billion, up 51% year-over-year, above the financial institution’s estimates as a consequence of operational enchancment with increased realized ASP and lower-than-expected value.

- Gold’s record-setting rally above $2,500 an oz. appears to have additional to run because the Federal Reserve prepares to cut charges, conventional drivers similar to decrease yields return, and Western buyers pile again in. “Everybody thought the Fed was going to be the last to cut, but now they’re getting in line,” mentioned Jay Hatfield, chief govt officer of Infrastructure Capital Advisor.

- According to Scotia, Endeavour Mining introduced that it has reached a settlement settlement with Lilium Mining with respect to the delayed cost and subsequent authorized proceedings arising from the 2023 sale of Endeavour’s Boungou and Wahgnion mines in Burkina Faso. Pursuant to the settlement, Lilium will switch the possession of the Boungou and Wahgnion mines to the State of Burkina Faso, and Endeavour will obtain upfront and deferred money consideration totaling $60 million, plus a 3% royalty.

Weaknesses

- The worst performing treasured steel for the week was platinum, down 3.64%, on little information. According to UBS, Zhaojin mining introduced its H124 outcomes, with web revenue attributable to shareholders of Rmb553m (119% year-over-year) which missed expectations of Rmb700m.

- Gold Road reported its first half 2024 outcomes with an underlying EBITDA of $94 million, 8% weaker year-over-year and decrease than Bank of America’s expectations. The underlying web revenue of $43 million was 15% decrease than BofA’s expectations.

- According to UBS, at Hochschild Mining, the Mara Rosa mine achieved industrial manufacturing on May 13. However, mechanical availability points and contractor delays have meant manufacturing is not on time. Although all points at the moment are resolved with manufacturing to extend within the second half of the 12 months, manufacturing will probably be on the decrease finish of steering and will probably be up to date with third quarter outcomes.

Opportunities

- Harmony Gold Mining beat its manufacturing goal for fiscal 2024 on increased grades and mentioned earnings jumped on surging gold costs. The South African miner of the valuable steel expects to report earnings per share of a minimum of 72 U.S. cents for the 12 months ended June 30, which might be a 64% enhance from fiscal 2023’s 44 cents. This is pushed by a 6% enhance in gold manufacturing to 1.56 million ounces, in line with Dow Jones.

- Opportunities for Torex Gold, in line with Scotia, embrace nearing completion of the transformational $950 million Media Luna Au-Cu challenge for startup early subsequent 12 months, in addition to free money circulate inflection in 2025. A capital return program may be initiated subsequent 12 months.

- Bloomberg reported that Bitcoin has underperformed in August, stimmed by ebbing liquidity and lingering worries over the potential for governments to unload their Bitcoin. Kaiko, a number one crypto trade information group, estimated the U.S. administration holds about 203,220 Bitcoin, adopted by China’s 190,000, the UK’s 61,200 and 46,350 for Ukraine. Governments seize tokens in prison instances, whereas Ukraine is assumed to have obtained donations to assist fund its protection in opposition to Russia’s invasion. Meanwhile, Mt. Gox has roughly 46,170 tokens left to distribute, Kaiko mentioned. The buying and selling backdrop has additionally develop into more difficult within the U.S. Bitcoin ETF sector, in line with JPMorgan strategists. That’s primarily based, partially, on a metric often known as the Hui-Heubel ratio, which purports to offer insights into liquidity by measuring the variety of trades it takes to maneuver costs. “It is striking that this metric has been deteriorating for all spot-Bitcoin ETFs since March, pointing to overall deterioration of spot Bitcoin ETF liquidity over the past six months,” the JPMorgan staff together with Nikolaos Panigirtzoglou mentioned. Any Bitcoin liquidation beneath these circumstances might power cash to flee to gold bullion.

Threats

- Major Chinese copper and gold producer Zijin Mining Group mentioned a slowing world financial system, geopolitical tensions, and useful resource nationalism might limit its abroad deal-making ambitions. The firm flagged adverse elements sooner or later doubtlessly impacting “the company’s revenue, profits, merger and acquisitions of new overseas projects,” in line with Bloomberg.

- According to UBS, there’s 8% draw back danger to ahead consensus earnings, on common, for South African gold producers. If spot commodity costs prevail, they calculate draw back danger for the SA diversifieds (-5%), PGM miners (-19%) on a median market cap-weighted foundation.

- Predictive Discovery’s share value dropped probably the most in three years with a surge in quantity as the federal government of Guinea introduced the suspending of allow functions and the processing of current permits as they conduct a mining title assessment. Predictive Discovery completed the week down 15%.

U.S. Global Investors, Inc. is an funding adviser registered with the Securities and Exchange Commission (“SEC”). This doesn’t imply that we’re sponsored, beneficial, or authorised by the SEC, or that our skills or {qualifications} the least bit have been handed upon by the SEC or any officer of the SEC.

This commentary shouldn’t be thought of a solicitation or providing of any funding product. Certain supplies on this commentary might include dated info. The info supplied was present on the time of publication. Some hyperlinks above could also be directed to third-party web sites. U.S. Global Investors doesn’t endorse all info provided by these web sites and isn’t chargeable for their content material. All opinions expressed and information supplied are topic to alter with out discover. Some of those opinions will not be applicable to each investor.

Holdings might change every day. Holdings are reported as of the latest quarter-end. The following securities talked about within the article had been held by a number of accounts managed by U.S. Global Investors as of (06/30/2024):

Southwest Airlines

Qantas Airways

American Airlines

Ryanair Holdings PLC

Pernod Ricard

Ferrari

Brunello Cucinelli

ConocoPhillips

EOG Resources

Occidental Petroleum

Lundin Gold

BHP Group

Endeavour Mining

Hochschild Mining

Harmony Gold Mining

Trip.com

Spirit Airlines

General Dynamics

The Boeing Co.

Prada SpA

Hermes International SCA

Brunello Cucinelli SpA

Moncler SpA

Cie Financiere Richemont SA

LVMH

Hugo Boss AG

Kering SA

Burberry Group PLC

*The above-mentioned indices are usually not complete returns. These returns replicate easy appreciation solely and don’t replicate dividend reinvestment.

The Dow Jones Industrial Average is a price-weighted common of 30 blue chip shares which are typically leaders of their trade. The S&P 500 Stock Index is a widely known capitalization-weighted index of 500 widespread inventory costs in U.S. firms. The Nasdaq Composite Index is a capitalization-weighted index of all Nasdaq National Market and SmallCap shares. The Russell 2000 Index® is a U.S. fairness index measuring the efficiency of the two,000 smallest firms within the Russell 3000®, a widely known small-cap index.

The Hang Seng Composite Index is a market capitalization-weighted index that contains the highest 200 firms listed on Stock Exchange of Hong Kong, primarily based on common market cap for the 12 months. The Taiwan Stock Exchange Index is a capitalization-weighted index of all listed widespread shares traded on the Taiwan Stock Exchange. The Korea Stock Price Index is a capitalization-weighted index of all widespread shares and most popular shares on the Korean Stock Exchanges.

The Philadelphia Stock Exchange Gold and Silver Index (XAU) is a capitalization-weighted index that features the main firms concerned within the mining of gold and silver. The U.S. Trade Weighted Dollar Index gives a common indication of the worldwide worth of the U.S. greenback. The S&P/TSX Canadian Gold Capped Sector Index is a modified capitalization-weighted index, whose fairness weights are capped 25 p.c and index constituents are derived from a subset inventory pool of S&P/TSX Composite Index shares. The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded firms concerned primarily within the mining for gold and silver. The S&P/TSX Venture Composite Index is a broad market indicator for the Canadian enterprise capital market. The index is market capitalization weighted and, at its inception, included 531 firms. A quarterly revision course of is used to take away firms that comprise lower than 0.05% of the load of the index, and add firms whose weight, when included, will probably be larger than 0.05% of the index.

The S&P 500 Energy Index is a capitalization-weighted index that tracks the businesses within the power sector as a subset of the S&P 500. The S&P 500 Materials Index is a capitalization-weighted index that tracks the businesses within the materials sector as a subset of the S&P 500. The S&P 500 Financials Index is a capitalization-weighted index. The index was developed with a base degree of 10 for the 1941-43 base interval. The S&P 500 Industrials Index is a Materials Index is a capitalization-weighted index that tracks the businesses within the industrial sector as a subset of the S&P 500. The S&P 500 Consumer Discretionary Index is a capitalization-weighted index that tracks the businesses within the client discretionary sector as a subset of the S&P 500. The S&P 500 Information Technology Index is a capitalization-weighted index that tracks the businesses within the info expertise sector as a subset of the S&P 500. The S&P 500 Consumer Staples Index is a Materials Index is a capitalization-weighted index that tracks the businesses within the client staples sector as a subset of the S&P 500. The S&P 500 Utilities Index is a capitalization-weighted index that tracks the businesses within the utilities sector as a subset of the S&P 500. The S&P 500 Healthcare Index is a capitalization-weighted index that tracks the businesses within the healthcare sector as a subset of the S&P 500. The S&P 500 Telecom Index is a Materials Index is a capitalization-weighted index that tracks the businesses within the telecom sector as a subset of the S&P 500.

The Consumer Price Index (CPI) is without doubt one of the most widely known value measures for monitoring the worth of a market basket of products and providers bought by people. The weights of parts are primarily based on client spending patterns. The Purchasing Manager’s Index is an indicator of the financial well being of the manufacturing sector. The PMI index is predicated on 5 main indicators: new orders, stock ranges, manufacturing, provider deliveries and the employment surroundings. Gross home product (GDP) is the financial worth of all of the completed items and providers produced inside a rustic’s borders in a selected time interval, although GDP is often calculated on an annual foundation. It consists of all personal and public consumption, authorities outlays, investments and exports much less imports that happen inside an outlined territory.

The S&P Global Luxury Index is comprised of 80 of the most important publicly traded firms engaged within the manufacturing or distribution of luxurious items or the supply of luxurious providers that meet particular investibility necessities.

The Financial Times Stock Exchange 100 Index, additionally known as the FTSE 100 Index, FTSE 100, FTSE, or, informally, the “Footsie”, is the United Kingdom’s best-known inventory market index of the 100 most extremely capitalized blue chips listed on the London Stock Exchange.