Keep our information without advertisements and paywalls by making a contribution to sustain our job!

Notes from Poland is run by a small editorial team and is released by an independent, charitable structure that is moneyed via contributions from our viewers. We can refrain what we do without your assistance.

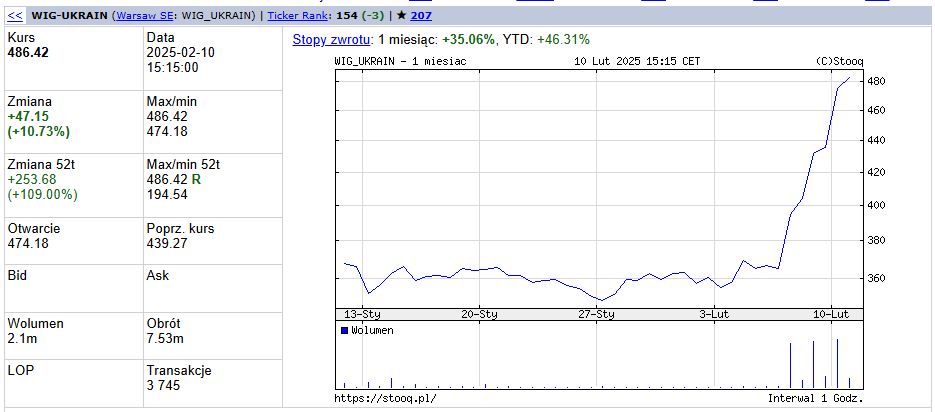

The share rates of Ukrainian business provided on the Warsaw Stock Exchange (GPW) have actually risen by almost 35% over the previous week, getting to degrees last seen prior to Russia’s 2022 intrusion, with experts recommending that financiers are banking on a prospective US-brokered tranquility strategy.

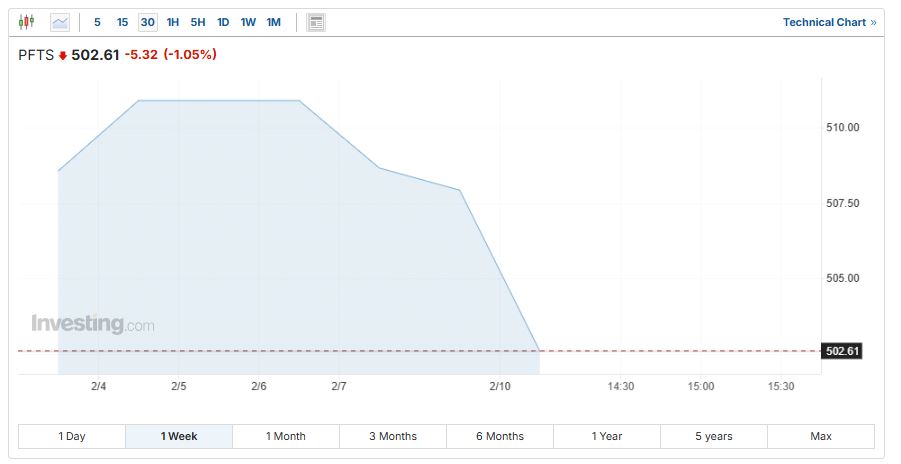

However, the gains of the 6 Ukrainian business provided on the GPW’s WIG-Ukraine index have actually not been matched by the primary index on Ukraine’s very own stock market, the PFTS, which has actually decreased by 1.6% considering that recently.

According to Polish company paper Puls Biznesu, financiers in the GPW are significantly considering a postwar repair initiative in Ukrainian- managed regions, together with feasible settlements on Ukraine’s inauguration to the European Union.

Sentiment has actually boosted after Trump asserted his group has actually made progression in settlements and has actually touched withRussian President Vladimir Putin Since taking workplace in January, he has actually vowed to protect a tranquility offer within his very first 100 days.

On Wednesday recently, Bloomberg reported that Donald Trump’s unique rep for Ukraine and Russia, Keith Kellogg, will certainly offer the strategy to allies, yet not openly, throughout a meeting in Munich on 14-16 February.

Kellogg, in a meeting with Newsmax, rejected records that he would certainly offer a tranquility strategy throughout the seminar yet suggested that he planned to hold various talks with European leaders in Munich and record back to Trump on his return.

Despite this, Ukrainian shares on the GPW began to climb on Thursday early morning recently, getting 34.79% by Tuesday early morning. Since the start of the year, the WIG-Ukraine has actually enhanced by 46.31%, according to information from economic details solution Stooq.

The WIG-Ukraine index is included GPW-listed business whose licensed workplace or head workplace lies in Ukraine or whose procedures are carried out to the best degree because nation.

It consists of 5 farming business– IMC, Agroton and KSG Agro, Astra Holding and Milkland– in addition to mining company Coal Energy.

The postwar repair of Ukraine will certainly bring Poland approximately 190 billion zloty (EUR38.9 bn), comparable to about 3.8% of its GDP, discovers a record

Poland’s current experience of financial combination with the EU makes it well positioned to assist, keep in mind the experts

— Notes from Poland (@notesfrompoland) October 7, 2022

Ukrainian business provided on various other worldwide stock market have actually likewise seen their share rates climb. MHP, the biggest Ukrainian manufacturer and merchant of fowl and plants, which is provided on the London Stock Exchange (LSE), has actually increased by simply over 13% considering that last Thursday.

Meanwhile, IT firm EPAM Systems, provided on the New York Stock Exchange (NYSE), climbed by 5% from Wednesday near to Friday night, information fromInvesting com program. The firm has actually shed several of its gains today, yet is still 2.4% over Wednesday night’s degrees.

This excitement, nonetheless, did not convert right into gains on Ukraine’s very own securities market, where the criteria PFTS index has actually dropped by 1.57% considering that Thursday, information fromInvesting com program.

Enthusiasm over a prospective tranquility strategy, nonetheless, did show up to improve Polish business on the GPW, as experts see this as a vital possibility for not just Ukrainian companies yet likewise Polish business with a solid existence in the Ukrainian market.

“This is especially true for construction companies and manufacturers of building materials with experience in Ukraine,” Jakub Szkopek, an expert at Erste Securities, informed Puls Biznesu

He pointed out Grupa Kęty, a manufacturer of aluminium elements, and building and construction firm Budimex as companies that stand to gain from Ukraine’s repair. Since Thursday, both business taped surges in their supply rates, with Grupa Kęty up by 5.9% and Budimex by 10.45%,

The WIG20, an index made up of the 20 biggest Polish business on the GPW, has actually likewise been increasing considering that Thursday, getting over 5%. Since the begining of the year, the WIG20 has actually increased by over 15%.

It got an extra increase on Monday from Prime Minister Donald Tusk’s statement– throughout a speech at the GWP– of a brand-new financial growth prepare forPoland This assisted the Polish leading index exceed its previous all-time high.

The strategy concentrates on 6 essential locations: financial investment in scientific research and research study, power change, contemporary innovations, port growth and train modernisation, a vibrant resources market, and company participation.

However, doubters kept in mind that Tusk’s statement consisted of an absence of certain brand-new plans that his federal government plans to seek in those locations.

Prime Minister @donaldtusk has actually detailed a financial strategy that he claims will certainly assist Poland action from “dreaming of catching up with the most developed countries” to rather knowing it is “possible to overtake those who until recently looked down on us”

— Notes from Poland (@notesfrompoland) February 10, 2025

Notes from Poland is run by a small editorial team and released by an independent, charitable structure that is moneyed via contributions from our viewers. We can refrain what we do without your assistance.

Main picture credit scores: Freepik

Alicja Ptak is elderly editor at Notes from Poland and a multimedia reporter. She formerly helped Reuters.

&w=324&resize=324,235&ssl=1)