Editor’s note: Seeking Alpha is pleased to invite Marek Malina as a brand-new adding expert. You can turn into one as well! Share your finest financial investment concept by sending your post for evaluation to our editors. Get released, make money, and unlock special SA Premium gain access to. Click here to find out more »

aluxum

In previous years, capitalists prevented little firms and concentrated their interest on big firms. That can be recognized. Bigger firms indicate even more safety and security, and large firms have actually likewise profited extra from the enjoyment around expert system.

However, I think that the years of underperformance of smaller sized supplies, stood for by the iShare s Russell 2000 ETF ( NYSEARCA: IWM), are involving an end. There are numerous factors for this declaration.

Small caps efficiency delays big caps

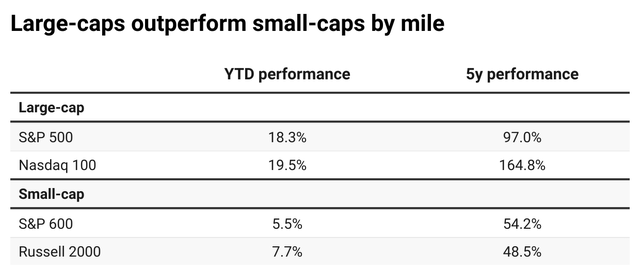

The efficiency of small-caps hence drags. The efficiency of the S&P 500 index is YTD +18.3% and the Nasdaq 100 also +19.5%. In comparison, the small-cap indices S&P 600 and Russell 2000 have a YTD efficiency of S&P 600 +5.5% and Russell 2000 +7.7%. The five-year lag is a lot more noticable. In 5 years, the S&P 500 expanded by +97.0% and the Nasdaq 100 by +164.8%. On the various other hand, S&P 600 just by +54.2% and Russell 2000 by +48.5%.

Comparison of indexes efficiency (Author)

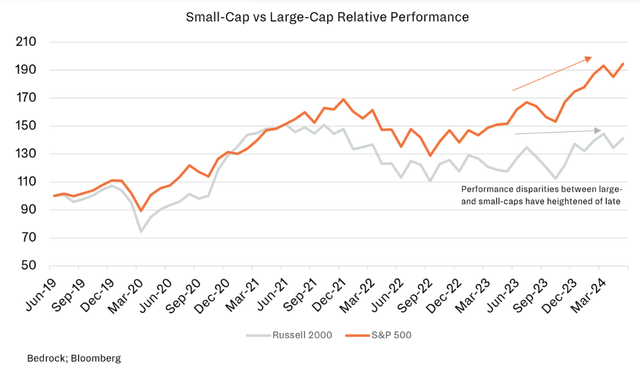

Small vs. Large Cap supplies loved one efficiency (Bedrock, Bloomberg)

Historically affordable

Thanks to the worst relative performance of Russell 20000 versus the S&P 500 in 23 years, the appraisal of small-caps got to traditionally reduced degrees In the last three decades, we have actually seen such a reduced loved one appraisal of little supplies versus big supplies just two times. During the dotcom bubble of 1999 to 2000 and throughout the monetary dilemma of 2007.

Why small-caps fall back?

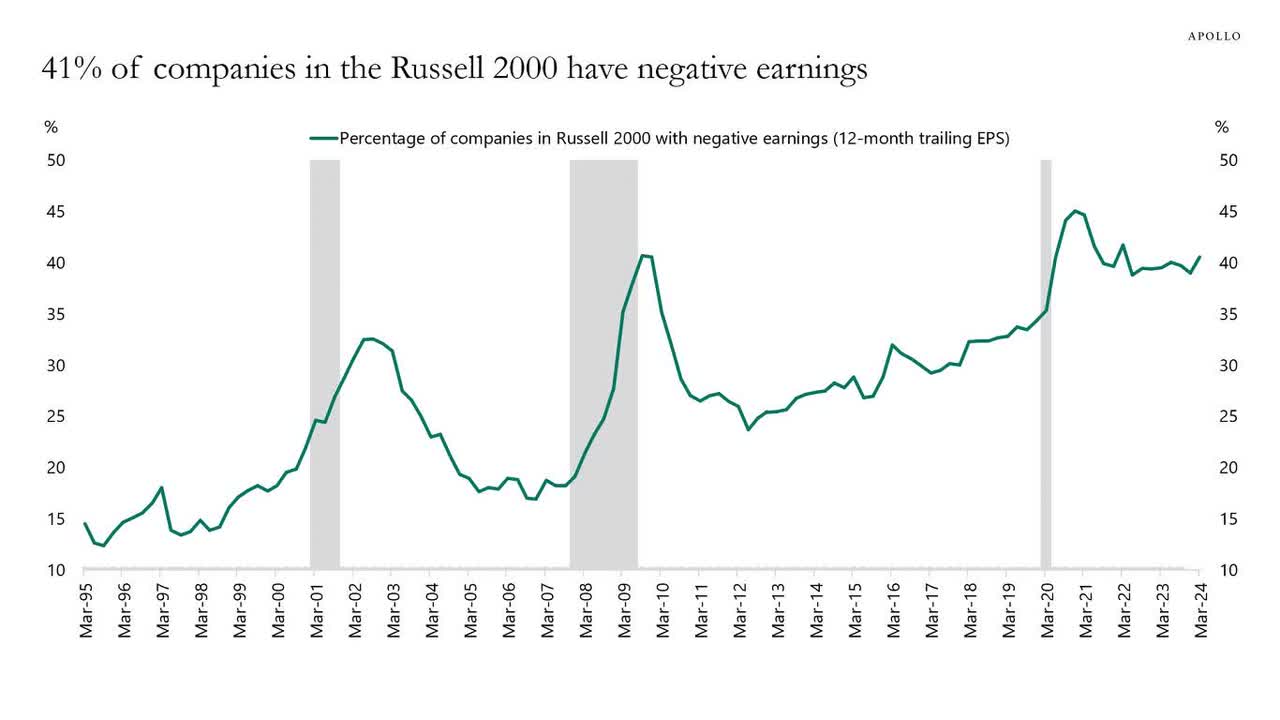

One of the reasons small-caps drag is the extremely high quality of the firms Of training course, you will not locate names like Microsoft or Nvidia in the Russell 2000 or S&P 600 index. The monetary setting of the firms in the small-cap indexes is weak therefore are the revenue margins, which I take into consideration to be among the primary signs of the high quality of firms. Profit margins have actually expanded gradually in big united state services over the previous numerous years, yet have stagnated with changes in little firms. Even as much as 41% of firms in the Russell 2000 index do not generate a normal revenue.

41% of Russell 2000 parts wear ´ t create revenue (Apollo Academy, Bloomberg)

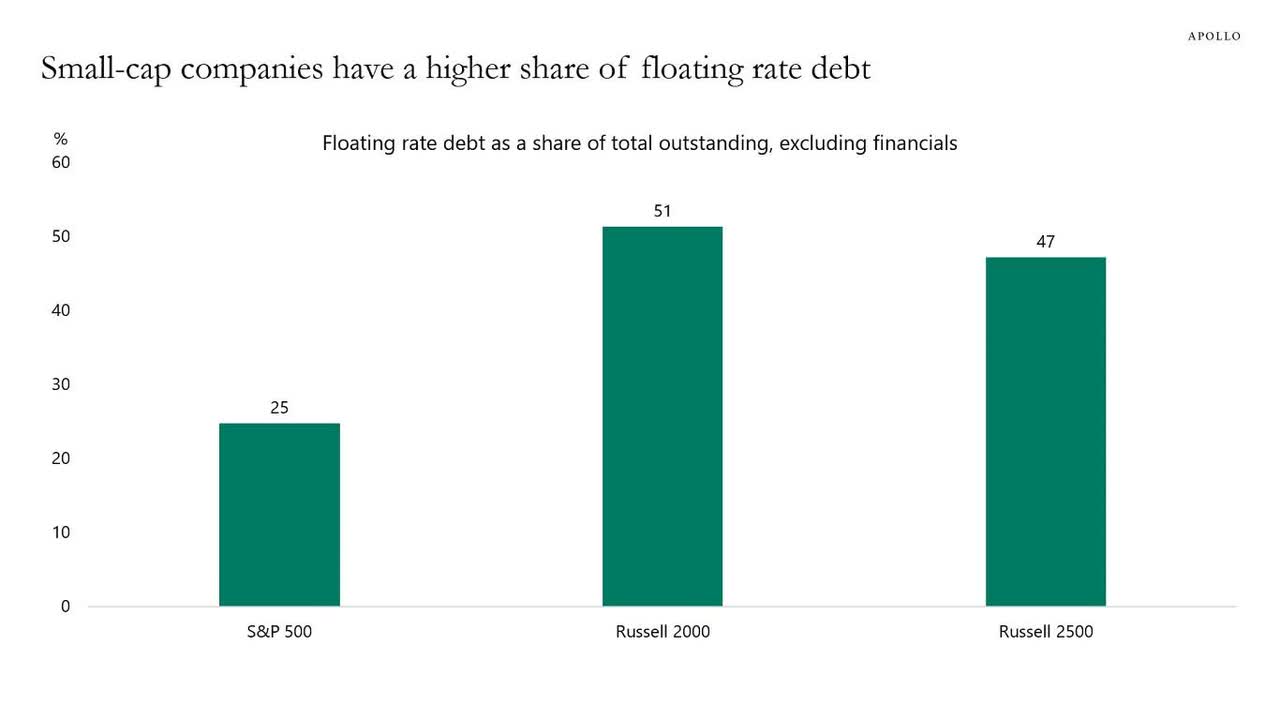

High rates of interest likewise play a crucial duty in the dragging of smaller sized firms. Small- caps are extra conscious their motions due to the fact that they are extra revealed to international funding, to put it simply, they have greater financial debt. The typical web debt/EBITDA for firms in the Russell 2000 is 3.2 x, contrasted to 1.6 x in the S&P 500. Moreover, as much as 51% small-caps have a floating interest rate, in the S&P 500 it is just 25%.

41% of small-caps have a float financial debt (Appolo Academy, Bloomberg)

Last yet not the very least, M&A has traditionally constantly raised the efficiency of smaller sized firms Small- caps are usually the target of bigger firms that make a decision to purchase them. But recently, M&A task has actually diminished as bigger companies have actually concentrated on their organization and price financial savings. This likewise dragged down the efficiency of smaller sized services.

Change is around the bend

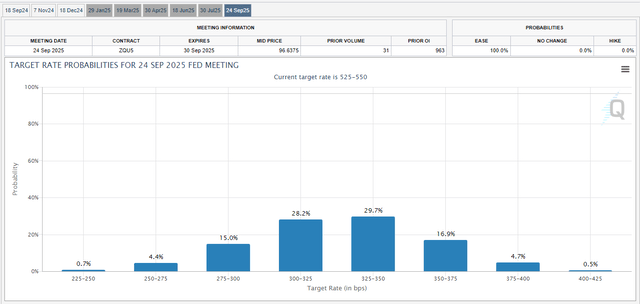

Many think, and I am amongst them, that when it comes to small-caps they can see the light at the end of the passage. The Fed will certainly begin decreasing rates of interest and, based upon market financial information that showed a financial downturn in the United States, the cycle of alleviating financial plan will certainly take a much faster decrease. By completion of the year, I anticipate 3 price cuts of 25 basis factors The liberalization will certainly proceed in 2025 and with it, a big concern will certainly be raised from the shoulders of smaller sized services today.

Probability of rates of interest in United States in September 2025 ( CME Fed View Tool)

Thus, one year from currently, the marketplaces provide the greatest chance to the situation that interest rates in the US will be in the range of 3 to 3.5%, which is 200 basis factors less than today. Cheaper funding will certainly be mirrored in quicker growth strategies of little firms in an initiative to optimize their development possibility, yet likewise in the development of earnings.

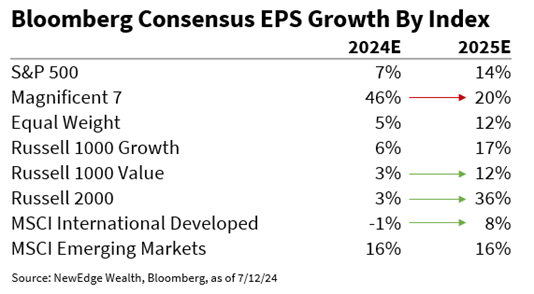

The table listed below programs agreement revenues price quotes for different indices for 2024 and 2025 The Russell 2000’s +3% EPS development price quote for 2024 revenues tracks big cap indices, yet keep in mind the big expectation for a recovery in earnings growth in 2025 to +36%

Consensus of EPS development of significant indexes (NewEdge Wealth, Bloomberg)

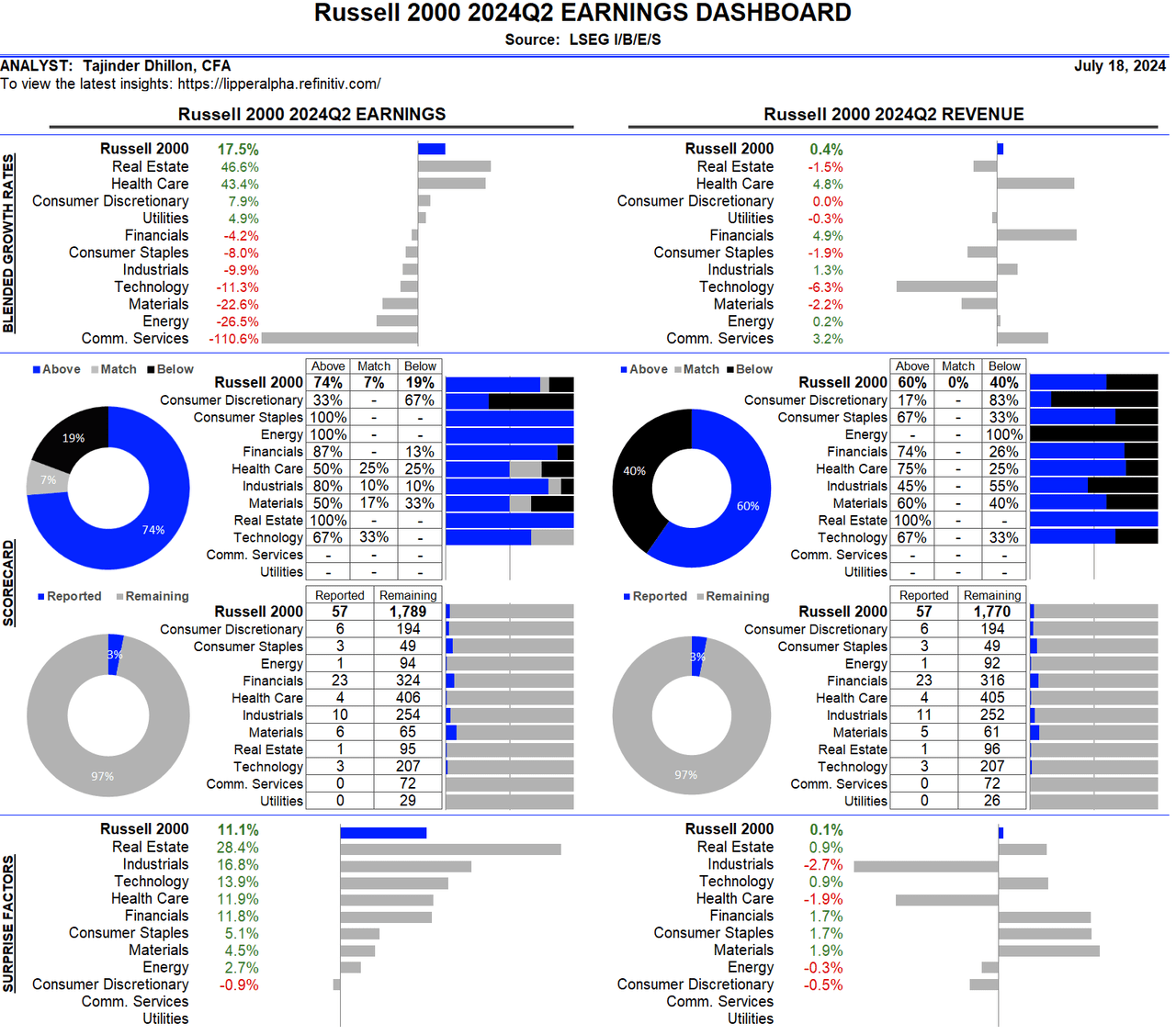

In reality, the earnings of small companies has actually currently started to increase According to information from the London Stock Exchange Group, since August 15, the year-on-year development price of the Russell 2000’s revenues got to 17.5%. This is the greatest boost given that the 4th quarter of 2022.

Excluding the drag out earnings from the power market, the Russell 2000’s year-over-year revenues development is 28.3%. Overall, concerning 60% of small-cap firms that reported their latest quarterly outcomes defeated experts’ assumptions. On the earnings side, 55.9% of these firms defeated experts’ price quotes.

Looking in advance, experts are favorable on little caps. In the 3rd quarter of 2024, the Russell 2000’s revenues are anticipated to expand by 43% year-over-year, while in the 4th quarter, the development price is predicted to raise to 73.8% year-over-year.

Russell 200 Q2 24 outcomes ( LSEG)

A healing in the M&A market must likewise assist small-caps go back to a development trajectory. In Q1 24, the M&A market increased by 30% year-on-year. Moreover, deal volumes could rise by as much as 50% in 2024, after the most affordable task in practically 20 years in 2023.

At the very same time, small-caps can rely upon the air conditioning yet still extremely solid United States economic climate, in which the Russell 2000 generates up to 90% of revenues, unlike the S&P 500 with a share of 60%.

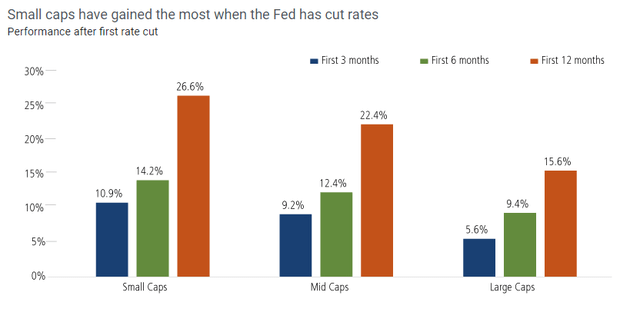

Although previous outcomes are no assurance of future outcomes, background often tends to duplicate itself usually in monetary markets. Especially when speaking about Fed financial plan and market responses. In times of rate of interest cuts, small-caps (Russell 2000) tend to outperform mid-caps and high-caps.

Outperformance of small-caps after Fed cuts (Bloomberg)

In July, Russell 2000 currently attempted one resurgence, yet it was not successful. In action to the rising cost of living information, the index taped its finest 5-day winning touch given that 2020, throughout which it increased 12%. Subsequently, nevertheless, he eliminated a lot of the earnings. In the last days we can see an additional effort and I think that this moment it will certainly be extra effective likewise many thanks to solid information from the 2nd quarter.

Although the Russell 2000 can not match the high quality of the S&P 500 or the Nasdaq 100, I think it can outshine them in the following 18 months.

Finally, I would love to explain that small-cap supplies like the Russell 2000 (IWM) must function as a diversity item in a profile that can assist enhance its efficiency In times like these, it might make good sense to raise the share of small-caps in the profile to someplace in between 15-20%. It depends upon the financial investment method. However, excessive focus in little supplies can be dangerous due to the fact that small-caps are a lot more unpredictable and can do even worse in case of financial troubles.