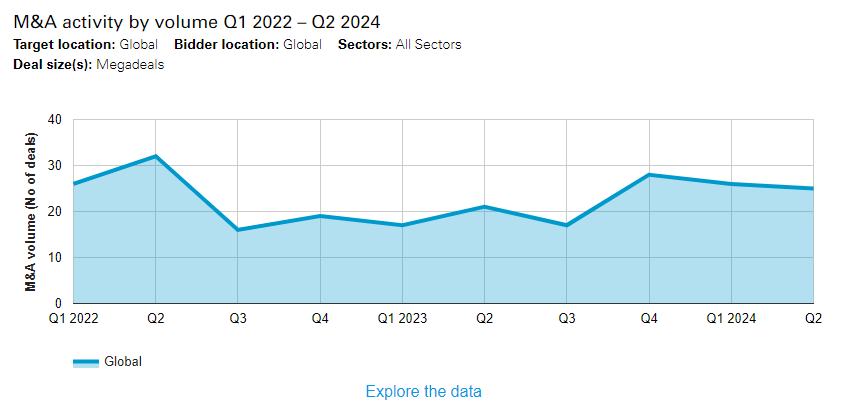

Megadeals were strongly on the program in H1 as even more steady rising cost of living and appealing assessments improved conference room self-confidence. A total amount of 51 deals worth more than US$5 billion each were revealed throughout the very first 6 months of the year– the greatest number in this rate brace because H1 2022.

Effective July 1, 2023, the underlying Mergermarket information sustaining the M&A Explorer was settled with Dealogic information to generate a much more total image of the M&A market. M&A Explorer discourse released prior to July 1, 2023 might reference information that does not show this debt consolidation.

For even more information on the requirements behind bargain incorporation, click here

Global bargain numbers show a concentrate on the leading end of the marketplace. Deal worth was up year on year, while quantity continued to be controlled. In complete, bargains got to US$1.65 trillion during H1— 21 percent greater than in H1 2023. A total amount of 18,010 revealed bargains, on the other hand, was the second-lowest number since the pandemic

The United States bargain market plainly controlled task. Seventeen of the leading 20 bargains of the year until now all targeted United States firms running throughout a series of industries. Three of these bargains were valued at greater than US$ 30 billion, signifying restored self-confidence in transformational deals in spite of governing headwinds.

United States credit score lending institutions sign up with pressures

The biggest critical purchase saw the United States’s 2 most significant credit score lending institutions sign up with pressures, in Capital One’s spots requisition ofDiscover Financial Services The US$ 35.3 billion all-stock acquisition is among the biggest bargains to happen in the economic solutions sector because the economic dilemma. If the bargain finishes, it will certainly produce a financial and financing huge with the ability of taking on competitors JPMorgan Chase and Citigroup.

Regulatory obstacles wait for as Washington increases its examination of industry-defining deals. If the bargain does proceed, it might cause a wave of debt consolidation amongst little to medium-sized financial institutions– a section of the marketplace under boosting stress from increasing competitors and financing prices. M&An offers an appealing alternative for these firms to increase or protect market share.

AI quest drives technology megadeals

The drive to obtain AI capacities sustained one more spots megadeal in the very first fifty percent of 2024: United States chip layout software application business Synopsys’s US$ 33.6 billion acquisition of Ansys, a manufacturer of AI-augmented simulation software application. The bargain, which waits for conclusion, is the biggest to happen in the innovation market because Broadcom’s US$ 69 billion acquisition of VMWare in late 2023.

The tie-up shows need for significantly intricate chip layout innovation utilized by sector leaders such as Advanced Micro Devices, Intel and Nvidia.

The acquisition by Synopsys adheres to one more significant technology megadeal revealed in the very first fifty percent of the year: Hewlett Packard Enterprise’s US$ 14.3 billion acquisition of Juniper Networks, one more bargain driven by the demand to enhance performance with improving AI capacities.

The quest for AI is a significant chauffeur in United States technology M&A now. A total amount of 1,036 transactions worth US$166.4 billion targeted United States technology firms throughout the very first fifty percent, standing for the greatest half-year bargain worth because H1 2022.

United States shale race gas bargains

The United States power market likewise did highly throughout the very first fifty percent. Several expensive deals targeting oil and gas firms altered hands, the biggest of which saw United States oil manufacturer Diamondback Energy accept obtain shale oil competitorEndeavor Energy Resources The bargain comes as services race to develop their visibility in the profitable Permian Basin, which covers Texas and New Mexico and is the biggest oilfield in the United States.

The US$ 26 billion bargain will certainly raise Texas- based Diamondback to the third-largest oil manufacturer in the container, behind supermajors ExxonMobil andChevron It adheres to ExxonMobil’s industry-defining US$ 60 billion requisition of Pioneer Natural Resources revealed last October, which offered to boost competitors for prime exploration places.

The law concern

United States antitrust regulatory authorities have actually made obvious of their objective to secure down on bargains they think about anti-competitive. Navigating a significantly intricate governing atmosphere will certainly for that reason be crucial to pressing bargains over the line.

As a possibly industry-defining bargain, Capital One’s purchase of Discover Financial looks readied to prompt extreme governing examination. The bargain has actually been called the very first large examination for President Biden’s financial institution merging law because the management released an exec order in 2021 that triggered the Department of Justice to think about a wider variety of variables when analyzing antitrust concerns.

Synopsys’s purchase of Ansys likewise looks most likely to get governing examination as a result of the transformational nature of the bargain. China’s antitrust guard dog, the State Administration for Market Regulation, or SAMR, is most likely maintaining a careful eye on the prospective tie-up, which likewise requires authorization from United States, EU and UK merging authorities.

An boosting governing concentrate on bargains is affecting bargain timings. The size in between statement and conclusion is expanding, presently balancing greater than 8 months, according to theLondon Stock Exchange Group Dealmakers will certainly require to obtain a sharper understanding of myriad governing needs to maintain the M&A procedure on course.

Outlook: Will the bull run proceed?

The flurry of megadeals revealed throughout the very first fifty percent of the year speaks with a mix of business self-confidence, solid annual report, climbing up securities market and even more tasty rate of interest. Just as notably, current megadeals are not restricted to a couple of industries yet show clear critical inspiration throughout a series of markets– one more favorable indicator.

While the M&A healing should not be minimized, difficulties stay when traveling in advance. The level to which regulatory authorities might or might not secure down on bargains is a large concern, and the run of expensive deals rests on exactly how the governing landscape advances over the coming year. Some purchasers might remain on the sidelines till the image ends up being more clear.

The upcoming United States political election might likewise trigger dealmakers to pump the brakes till a feeling of political security returns. A concern likewise continues to be regarding whether the significant tie-ups revealed in the very first fifty percent of the year show a continual financial recuperation, or whether they will certainly verify to be standalone bargains. The truth that H1 quantity continues to be soft suggests that task is manipulated towards the leading end of the marketplace, with dealmaking between to reduced parts yet to get rate.

While unpredictability continues to be, the return of the megadeal in the very first fifty percent signifies a restored positive outlook amongst industry and is a favorable indicator for dealmakers aiming to negotiate in the 2nd fifty percent of the year.