Image resource: Unilever plc

Since 9 August, the Unilever (LSE:ULVR) share rate has actually raised by 4% (at 30 August).

This is in spite of Trian Fund Management, the investment company discovered by activist financier Nelson Peltz, unloading 3.82 m shares in the business at a heavy typical rate of ₤ 47.33.

Peltz is additionally a supervisor of Unilever.

The sale produced ₤ 181m. But the truth that such a famous number has actually chosen to minimize his holding does not appear to have actually discouraged others from purchasing.

| Date of sale | Number of shares marketed | Average rate (₤) | Sales profits (₤) |

|---|---|---|---|

| 9 August | 2,931,127 | 47.38 | 138,876,797 |

| 12 August | 738,471 | 47.19 | 34,848,446 |

| 13 August | 155,000 | 47.11 | 7,302,050 |

| Totals | 3,824,598 | 47.33 | 181,027,293 |

The news to the stock market really did not supply any type of ideas regarding the factors behind the sale. It slightly describes “portfolio management” as the key inspiration.

But as the claiming goes, someone’s garbage is an additional’s prize. The business’s share rate has actually been pressed greater as financiers– not resenting the sale– desire an item of the durable goods titan.

A previous investor

I made use of to have a risk inUnilever But I obtained aggravated as the share rate appeared not able to appear the ₤ 43-barrier.

Since after that it’s climbed by about 14%. Despite this, I do not be sorry for marketing– I have actually done much better somewhere else.

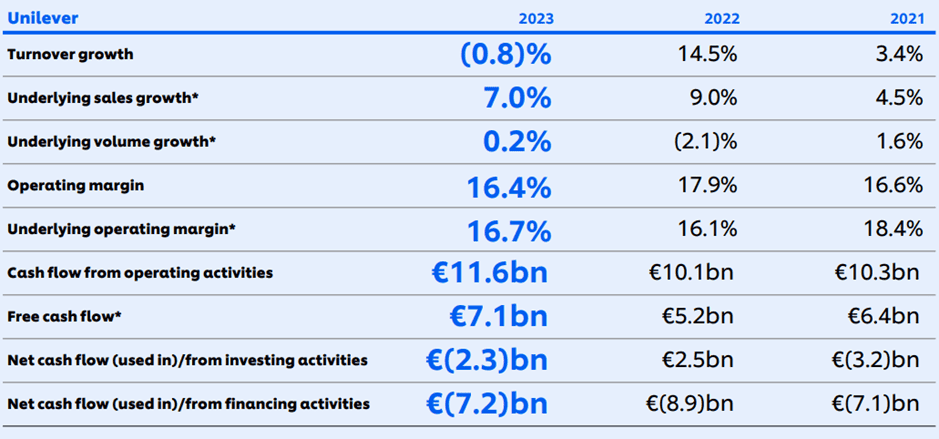

However, Unilever is a top quality business with a remarkable profile of house brand names. It continually produces EUR10bn-EUR11bn of cash money from its operating tasks.

Its results for the very first 6 months of 2024 disclosed sales development, both in regards to rate and quantity. And its operating margin enhanced.

This success is credited to concentrating on the business’s leading 30 brand names, which make up around 75% of turn over.

The team’s proceeding solid efficiency calls into question the concept that customers are coming to be significantly rate delicate and exchanging better-known names for less expensive options.

But definitely there’s reached come a factor when it’s no more feasible to elevate costs without harmful revenues?

I can not think exactly how pricey a few of Unilever’s items have actually ended up being, specifically when contrasted to several grocery store own-brands. Personally, I assume we could be near ‘peak prices’ for much of its items.

Too expensive

Similarly, I assume the business’s shares are pricey.

Analysts are anticipating hidden revenues per share of EUR2.76 (₤ 2.33) for the year finishing 31 December 2024. This suggests aforward price-to-earnings ratio of around 21 This gets on the high side, also for a participant of the FTSE 100

And it’s somewhat over its five-year standard.

Nor does the supply show up to use great worth when contrasted to that of, for instance, Reckit Benckiser, which trades on an onward numerous of 13.7.

Underwhelming returns

Unilever’s returns is additionally frustrating.

In 2023, the business paid 148.45 p a share. If duplicated this year, it suggests acurrent yield of 3% For a revenue financier like me, that’s insufficient, specifically from a firm that’s something of an atm.

When I initially purchased the supply, it was generating near the Footsie standard of 3.8%. For better contrast, Reckit Benckiser’s supply is presently supplying a return of 4.4%.

It’s for these factors– questions over its capability to elevate costs better, a toppy assessment, and a parsimonious returns– that I do not intend to spend.