Photofex- AT/iStock Editorial through Getty Images

In July 2023, I initiated coverage for Jet2 plc (OTCPK:DRTGF) with a buy ranking and the supply has actually been succeeding returning 25.9% contrasted to a 19% return for the S&P 500. In this record, I will certainly be going over one of the most current revenues, give a threat evaluation for the recreation firm and upgrade my cost target for Jet2 plc.

Jet2 Pre-Tax Profit Surges Despite Higher Costs

Revenues expanded by 24% to ₤ 6.255 billion. This was driven by a 10% boost in ability and 9% even more travelers flown. A considerable section of the development was recognized via even more bundle vacations belonging to the mix. The share of bundle vacations in the mix expanded from 64.9% to 68.3%. The variety of bundle vacations clients expanded by 15% while flight-only travelers lowered by 1%. On system earnings, the flight-only prices boosted 14% while ordinary bundle vacation rates boosted by 11%.

Operating expenditures boosted 26% to ₤ 5.8 billion driven by a substantial boost in resort holiday accommodation prices, gas prices, greater upkeep prices and greater personnel prices. The expense development on nearly all expense things was greater than the ability development. That was driven by even more vacation plans being offered, yet additionally was the outcome of boosted gas rates and proceeded labor expense stress. Maintenance boost dramatically because of the lease of aircrafts, which include greater upkeep prices while there additionally was some expense altitude because of the upkeep of older aircrafts. This caused running margins lowering 100 bps to 6.8%. Nevertheless, operating earnings still expanded 9% to ₤ 428.2 million while EBITDA expanded 17% to 680.3 million.

In the FY24 results, I see a sign that business design with set as the core of business is repaying. Jet2 is not actually an airline company, yet it’s a firm that mostly supplies vacation plans and as component of that bundle it flies recreation vacationers to their vacation location.

What Are The Risks And Opportunities For Jet2?

The major danger for Jet2 would certainly be any kind of decrease sought after for bundle vacation offers. In FY24, the ordinary size of vacations lowered from 7.8 days to 7.6 days which, I think, is attributable to boosted prices for vacations driven by rising cost of living and greater expense of living that leaves much less funds to be invested in vacations. Furthermore, the UK economic climate is having a bumpy ride which can additionally influence Jet2.

There are additionally positives. Despite the stress, need for vacation set is high, and while it may appear rather counterproductive, that does make good sense. The set have a tendency to have actually much better prices contrasted to individuals scheduling trips, transport, and resorts themselves. Jet2 is making use of its range and supplies vacation offers at much better rates for recreation vacationers and at much better margins for itself.

Furthermore, the firm is soaking up extra A321neo aircrafts in the fleet, which have exceptional gas shed numbers contrasted to the existing fleet along with reduced upkeep prices. The A321neo aircrafts additionally seat extra travelers, particularly 232 as opposed to the 189 on the Boeing 737-800, which permits the firm to reduced per-seat prices. Over the following couple of years, the ordinary seat matter per plane is anticipated to increase from 195 to 218, which need to dramatically enhance the expense effectiveness of the airline company.

Jet2 Stock Offers A Compelling Investment Case

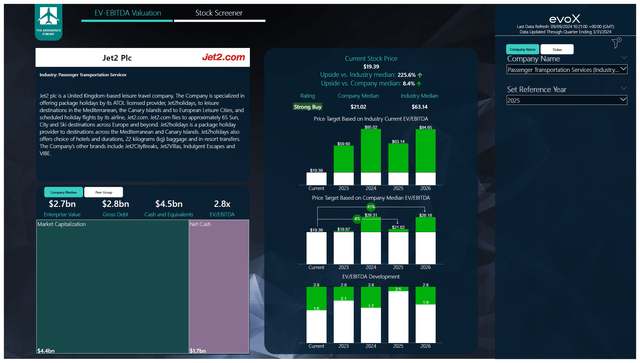

To identify multi-year cost targets, we have actually established a supply screener which utilizes a mix of expert agreement on EBITDA, capital and one of the most current annual report information. Each quarter, we review those presumptions and the supply cost targets appropriately. This information our analysis methodology.

For FY24, the cost target had actually boosted to $28.33. This was driven by the business worth of Jet2 continuing to be fairly unmodified year-on-year while its outcomes remained to enhance. For the years in advance EBITDA will certainly expand at a price of around 5.2%, yet there will certainly be some stress on cost-free capital as Jet2 will certainly proceed soaking up brand-new aircrafts which will certainly boost capex. Nevertheless, I think the supply is a solid buy with a $21.02 cost target for FY25 and a $28.18 cost target in FY26, which I think supplies an engaging financial investment instance.

What Is The Best Way To Invest In Jet2?

I think that prior to I go over any kind of outcomes or upside, it is essential to explain that DRTGF supply is trading OTC (Pink Current Information) and because of an absence of quantity, it could be tough for financiers to deal shares in preferred quantities versus preferred rates. For those that have an interest in buying Jet2 plc supply, I would certainly recommend taking a look at the JET2 ticker on the London Stock Exchange.

Conclusion: Jet2 Stock Is Underappreciated

I think that Jet2 supply continues to be underappreciated at present degrees. The service is dealing with greater capex in the years ahead and presently, there are still some inflationary prices approaching in the expense framework, yet the firm is working with extra effective development in advance, and it is just one of minority airline companies that has an internet cash money setting. With the present assessment and the forward estimates in mind, I preserve my solid buy ranking on the supply.

Editor’s Note: This short article reviews several protections that do not trade on a significant united state exchange. Please understand the dangers connected with these supplies.