Georgian economic climate’s future post-elections

In September and October, the National Bank of Georgia offered roughly $700 million from its international money books– a document quantity never ever seen prior to within such a brief duration. What does this mean for Georgia’s economic climate, specifically after the October 26 legislative political elections?

_________________________________

The October 26 legislative political elections in Georgia have actually increased dangers for the nation’s financial growth.

Local onlookers reported prevalent citizen stress, organized fraudulence, and considerable offenses. Western federal governments show up reluctant to acknowledge the political election results, revealing questions regarding whether they were carried out easily and rather.

The authenticity of the political election results remains in concern, and financial dangers are straight linked to this problem.

A failing by the West to acknowledge the political elections can result in assents. It continues to be uncertain whether these assents will certainly target people, as previously, or intensify to steps separating Georgia, such as withdrawing its visa-free routine with the EU.

Sanctions focused on separating the nation would certainly create better financial damages, yet also targeted steps would certainly leave a mark. This time, the listing of approved people can consist of Bidzina Ivanishvili and high-level Georgian federal government authorities. However, when assents target acting federal government participants, they basically end up being assents versus the whole nation.

Given the unpredictability bordering relationships with the West in the coming months, it is tough to specifically examine the financial influence of this procedure.

During the pre-election duration, it came to be noticeable that unfavorable assumptions controlled amongst the populace– no one expected anything favorable from the political elections. This was mirrored in the stress on the currency exchange rate of the nationwide money, the Georgian lari (GEL).

When individuals anticipate undesirable occasions in advance that can result in the decline of the lari, they begin stockpiling international money and unloading lari. For instance, down payments are transformed from lari to bucks, while financings are transformed from bucks to lari. This leads to an instant rise popular for bucks in the money market and decline of the lari.

This is specifically what occurred in September andOctober There was an extensive idea that the lari would certainly decrease the value of after the political elections. This assumption was based not just on downhearted beliefs yet additionally on unbiased factors. During the summertime traveler period, Georgia obtains even more international money than in the autumn and winter season, which assists sustain the lari’s currency exchange rate.

Additionally, this year (from January to September), compensations from abroad lowered by 22%. In the very first fifty percent of the year, international straight financial investment come by 34%. The united state and EU nations had actually currently introduced suspensions or considerable decreases in help to the Georgian federal government.

On top of that, current months have actually revealed that assents enforced as a result of the fostering of the “Russian law” [referring to the “foreign agents” law] have considerably adversely impacted the lari’s currency exchange rate. Despite the National Bank marketing $190 million in between April and June to maintain the price, the lari still cheapened by 2%.

In September, a new age of assents and lari decline started. However, the National Bank did whatever feasible to avoid the lari’s currency exchange rate from going beyond 2.74. To accomplish this, $107 million was offered inSeptember When the National Bank markets bucks, it raises their accessibility to the populace while all at once getting rid of lari from blood circulation. This normally assists reinforce the lari.

The precise quantity offered by the National Bank in October is still unidentified. It is understood that $213 million was cost money public auctions, yet there is no information yet on just how much was offered via “closed” purchases, the outcomes of which will certainly be released on November 25.

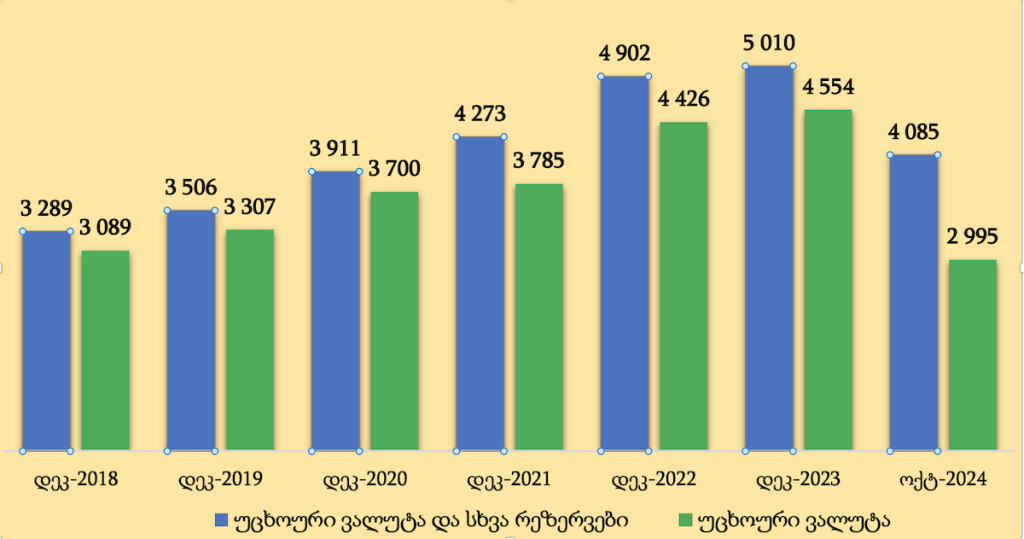

However, it is understood that in October, the National Bank’s international books lowered by $640 million, showing that roughly $400 million was offered via “closed” purchases. Thus, around $700 million was offered in overall throughout September andOctober This is a document quantity– the National Bank has actually never ever offered such a big or perhaps similar quantity in 2 months.

Because the National Bank kept the lari’s currency exchange rate throughout the pre-election duration and as a result of the lowered inflow of international money right into the nation, international books diminished by $800 million over September andOctober

As of October 31, the National Bank had $3 billion aside staying. This is the most affordable degree because November 2018, properly returning the nation to numbers from 6 years earlier.

Foreign money books are usually thought about an assurance of a nation’s financial security. Their usage ought to be warranted just in remarkable situations, such as the 2020– 2021 pandemic.

However, making use of books to sustain the nationwide money’s currency exchange rate throughout the pre-election duration to profit the ruling event is regarded undesirable.

It appears that without treatment, the lari’s currency exchange rate can have considerably decreased. Nevertheless, if this is really a short-lived sensation pertaining to election-driven supposition, as the National Bank insurance claims, the currency exchange rate would certainly have quickly supported by itself.

However, on Election Day–October 26– the lari’s currency exchange rate can have been considerably greater, possibly affecting citizen choices. The federal government prevented this situation, yet the method set you back the nation $700 million aside.

Experts think that the deficiency of books will certainly have a significant unfavorable influence on the nation’s economic climate. It is anticipated to result in a downgrade in Georgia’s credit report ranking and a decrease in capitalist self-confidence, which will, subsequently, adversely influence future financial investment and resources inflows.

The sharp decrease aside additionally suggests that today, the National Bank is considerably much less furnished to take care of outside financial shocks than it went to completion ofAugust This even more weakens self-confidence in the nation and its financial security.

“The two-month criminal political election project of Georgian Dream has actually brought upon better damages on the National Bank’s books than the pandemic. It will certainly take several years to recoup. Over the previous year, books have actually gone down considerably listed below the vital limit.

Compared to outside financial obligation responsibilities, the book degrees are not regular with any type of BB-rated nation. The problem of modifying Georgia’s credit report ranking will certainly quickly end up being pertinent,” claimed resistance MP, previous head of the National Bank, and economic expert Roman Gotsiridze.

If this pattern proceeds and the National Bank’s books remain to diminish at this price, previous Prime Minister of Georgia Nika Gilauri anticipates “a major macroeconomic crisis”:

“We examined the data released by the National Bank and discovered that this is the biggest decrease aside in the nation’s background. $627 million in a solitary month– this quantity has actually never ever been invested by the National Bank, also throughout the battle with Russia, the pandemic, or various other financial and worldwide situations.

Over the last thirty years, no solitary month has actually seen such losses. In 2 months, Georgia’s international money books have actually decreased by 15– 16%,” stressed Gilauri.

According to Nika Gilauri’s projection, within a month or 2, the National Bank will certainly need to enable the lari’s currency exchange rate to drift easily:

“Maintaining the currency exchange rate by doing this is feasible if the National Bank thinks these are temporary variations or seasonal inequalities in supply and need that will certainly quickly maintain. However, it is clear that we are no more in a stage of temporary variations, and the currency exchange rate is obviously looking for a brand-new balance factor.

Very quickly, the National Bank will certainly need to allow the currency exchange rate go. Consequently, the price will certainly locate a brand-new balance degree, and it will certainly emerge that the National Bank thrown away books rather than enabling the marketplace to locate this brand-new balance factor,” kept in mind Nika Gilauri.

What could assents indicate for Georgia?

Georgia’s economic climate has actually verified very susceptible to Western assents, a truth plainly showed over the previous 6 months. Even the intro of private assents by the united state management or Congress has actually triggered the lari to decrease and the supply rates of Georgian financial institutions noted on the London Stock Exchange to go down dramatically. The lari’s currency exchange rate and supply rates strongly highlight just how the economic climate and market individuals respond to such advancements.

Georgia is greatly based on Western economic inflows, making its economic climate vulnerable to both present and prospective assents. In 2023, roughly $7 billion moved right into the nation from Western countries (the united state, EU, and UK). This overall consisted of $2.3 billion from exports of items and solutions, $1.8 billion in compensations, $900 million in straight financial investments, and $2 billion in financings and gives to the federal government. Altogether, Western financing made up approximately one-quarter of Georgia’s economic climate.

Even the most strict assents would certainly not completely stop this $7 billion inflow. However, if 20– 30% of that quantity were to be removed, Georgia’s economic climate would certainly have a hard time to maintain itself– specifically offered the currently diminished international books. Alternatively, the Georgian federal government would certainly require to change Western financing with resources from various other nations, such as China or Russia, as seen in tasks like the building and construction of the Anaklia port.

The collapse of Georgia’s economic climate would certainly initially show up in a substantial decline of the lari, adhered to by high rising cost of living and increasing rates. Stock worths of significant Georgian financial institutions would certainly go down to degrees that can threaten the security of the financial market, possibly setting off panic amongst the populace. The deficit spending and public debt would certainly enhance, and rising cost of living would certainly compel the federal government to dramatically increase rates of interest. This, subsequently, would certainly result in financial tightening, increasing joblessness, and the nation spiraling right into much deeper hardship.

In verdict, the seriousness of Georgia’s financial difficulties will certainly depend upon the West’s response and the actions taken byGeorgian Dream The ruling event needs to determine whether to make giving ins or completely devote to an anti-Western program, without any purpose of reversing it.

Georgian economic climate’s future post-elections