- Disruptive advancement develops a services or product that changes markets and sectors or significantly enhances something that currently existed.

- Cathie Wood is among its leading backers by offering market numerous ETFs that are popular.

- The supplies we will certainly check out are Lilium, Origin Materials, and Aeva Technologies.

- Looking for workable profession concepts to browse the existing market volatility? Unlock access to InvestingPro’s AI-selected stock winners for under $9 a month!

Disruptive advancement improves sectors by utilizing innovative modern technology to revamp existing markets or produce totally brand-new ones. As an outcome, it modifies market characteristics and market frameworks, commonly entailing a high degree of threat and the expedition of brand-new innovations.

Cathie Wood attracts attention as a leading number in this location, mostly with her collection of ETFs referred to as the ARKs, which concentrate on buying turbulent firms. These ETFs have actually obtained tremendous appeal, with some flaunting outstanding returns throughout particular durations.

They are as complies with:

- ETF ARK Innovation (NYSE:-RRB-

- ETF Genomic Revolution (NYSE:-RRB-

- ETF Fintech Innovation (NYSE:-RRB-

- ETF Next Generation Internet (NYSE:-RRB-

- ETF Autonomous Technology & & Robotics (NYSE:-RRB-

These ETFs have actually also prolonged their reach to Europe and are noted on popular exchanges, consisting of Germany’s Deutsche Bӧrse Xetra, the London Stock Exchange, Amsterdam’s CBOE, Italy’s Borsa, and Switzerland’s 6 Swiss Exchange, with a compensation price of 0.75%.

Some remarkable turbulent firms consist of Tesla (NASDAQ:-RRB-, Nvidia (NASDAQ:-RRB-, Roku (NASDAQ:-RRB-, Baidu (NASDAQ:-RRB-, Zillow (NASDAQ:-RRB-, Teladoc Health (NYSE:-RRB-, and so on.

Now, allow’s study a couple of turbulent supplies that use considerable upside prospective out there, albeit with substantial threat. It is a field ideal just for hostile financiers with a well-diversified profile.

1. Lilium

Lilium (NASDAQ:-RRB- is a German aerospace firm noted on Nasdaq that establishes the Lilium Jet, an electric-powered airborne car with the ability of trip.

The firm is changing the city flexibility field with its idea of electrical air taxicabs by providing quick, zero-emission transport while aiding cities remain without blockage.

It just recently elevated $114 million to sustain its procedures and preliminary trip examinations. It has actually additionally finished the very first stage of combination screening for the Lilium Jet’s electrical power system– an essential action towards trip problem authorization.

With extra cash money than financial obligation on its annual report, Lilium delights in monetary versatility as it functions to accredit its item. This cash money placement can be essential, provided the capital-intensive nature of the aerospace market and the recurring growth stage.

Lilium will certainly report its outcomes for the quarter on November 19.

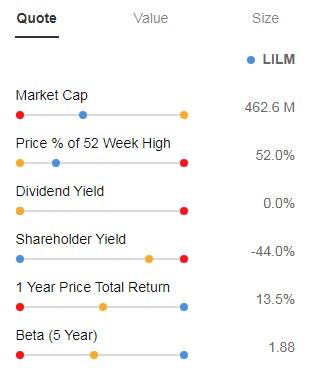

Its Beta of 1.88 mirrors its shares relocating the very same instructions as the marketplace however with substantially even more volatility.

Source: InvestingPro

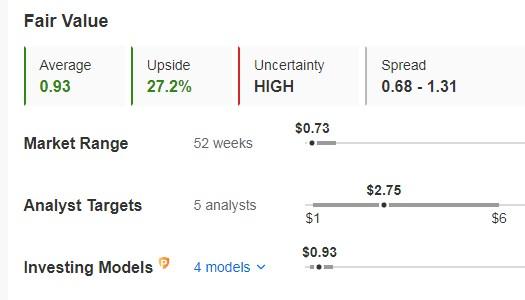

Lilium’s shares are underestimated on a basic basis. Specifically, its reasonable worth is, at the start of the week, 27.2% over the share cost, specifically at $0.93.

The market approximates an ordinary possibility of around $2.75 for these shares.

Source: InvestingPro

2. Origin Materials

Origin Materials (NASDAQ:-RRB- purposes to promote the worldwide change towards lasting products by changing petroleum-based products with decarbonized choices. The firm is dedicated to lowering carbon exhausts and generating products with reduced ecological effect.

A year after it introduced its development in establishing a procedure for 100% recyclable plastic container elements, the firm has actually safeguarded a Memorandum of Understanding (MOU) for 2 years of manufacturing and anticipates this arrangement to create $100 million in earnings beginning in very early 2025.

The firm’s chief executive officer, Rich Riley, showed his self-confidence in the firm’s possibility by acquiring an extra 300,000 shares.

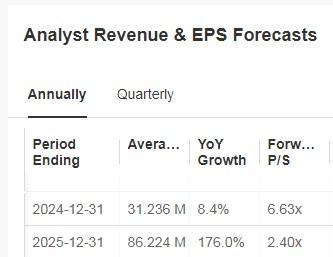

On November 7, it provides its quarterly accounts. Earnings are anticipated to enhance by 8.4% this year and 176% by 2025.

Source: InvestingPro

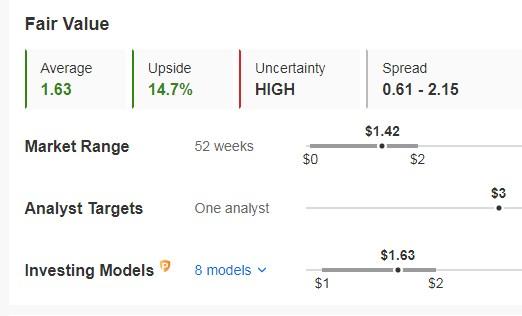

Origin’s shares are basically underestimated, with a reasonable worth 15% over the existing share cost of $1.63 at the week’s begin.

The market approximates an ordinary possibility of around $3 for its shares.

Source: InvestingPro

3. Aeva Technologies

Aeva Technologies (NYSE:-RRB- is a US-based firm that develops, makes, and markets LiDAR picking up systems and picking up software application services.

The firm provides services that are extra reliable and affordable than choices, which can promote mass fostering, placing itself to drive turbulent modification.

Aeva just recently introduced that its modern technology will certainly be made use of by a significant European car manufacturer to confirm its automatic car systems. It anticipates its modern technology to make it possible for fast distinction in between fixed and vibrant items, like pedestrians or automobiles. Furthermore, its modern technology has actually been picked by a leading united state nationwide protection safety company and for Germany’s automated train program.

Source: InvestingPro

It will certainly launch its revenues record for the quarter on November 7. The firm preserved a strong cash money placement, with a total amount of $285.2 million at the end of the quarter.

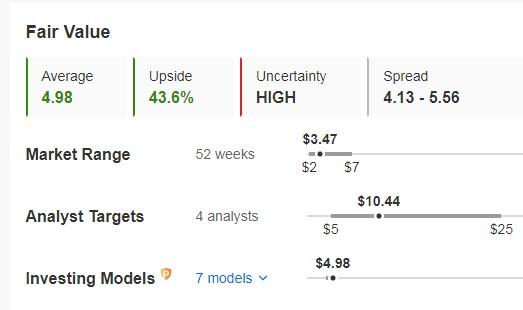

Its shares are trading 43.6% (at the start of the week) listed below its reasonable worth or cost to principles, which would certainly go to $4.98.

The prospective designated by the market would certainly go to $10.44.

Source: InvestingPro

***

Disclaimer: This write-up is composed for informative objectives just; it does not make up a solicitation, deal, guidance, advise or referral to spend because of this it is not meant to incentivize the acquisition of possessions by any means. I wish to advise you that any type of sort of property, is assessed from numerous viewpoints and is extremely dangerous and consequently, any type of financial investment choice and the connected threat stays with the financier.

&w=100&resize=100,70&ssl=1)