IN a cost-of-living disaster the place all our payments rising dramatically, tens of millions of households don’t receives a commission sufficient to dwell comfortably.

But the nice information is that over 15,000 employers have signed as much as the Real Living Wage.

This implies that they voluntarily pay all of their employees greater than the authorized minimal degree.

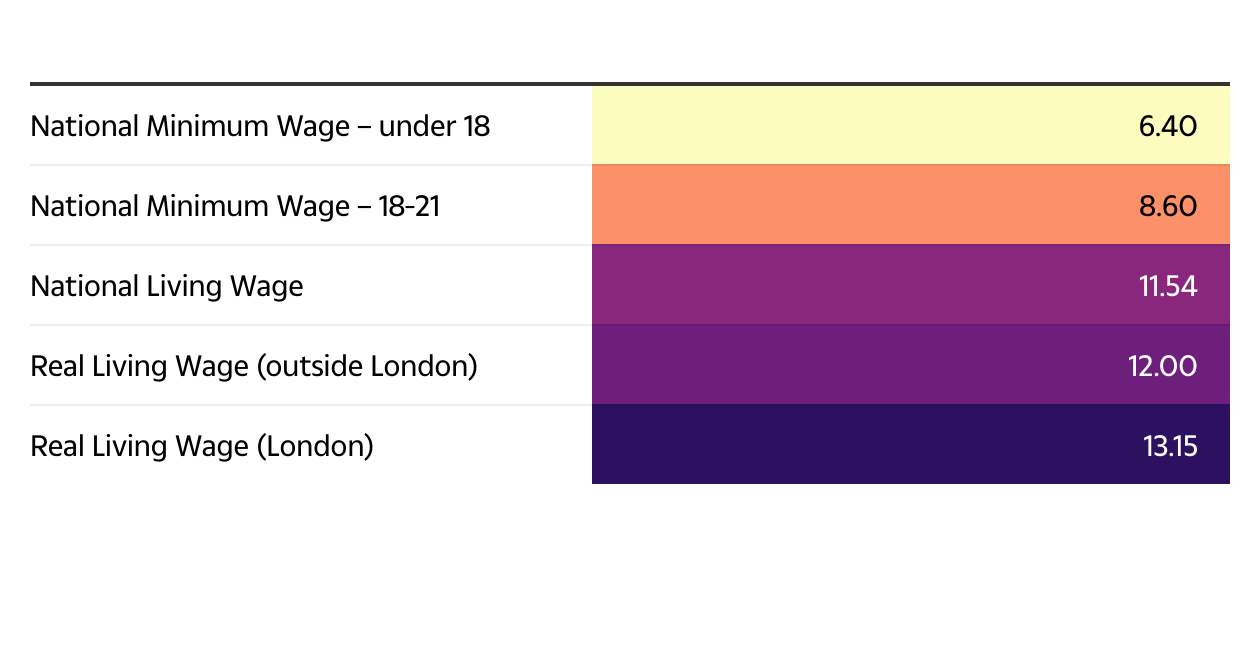

The Real Living Wage, which is calculated based mostly on the price of a basket of family items and providers, is £12 an hour exterior of London and £13.15 an hour within the Capital.

It’s purported to be greater than the authorized requirement because it components in that precise prices are greater than this.

By distinction, the government-set National Minimum Wage, the minimal pay-per-hour for employees aged between 18 and 21, is presently £8.60 an hour.

Workers who’re below 18 solely must be paid £6.40 an hour, as do apprentices.

Once a employee turns 21, they legally must be paid the National Living wage, which is £11.54 an hour.

But that is nonetheless £1,092 a 12 months lower than a employee on the true Living Wage would earn, and £3,334.5 lower than a employee on the London wage would get.

How is the Real Living Wage calculated

The charges are calculated yearly by think-tank The Resolution Foundation and overseen by the Living Wage Commission, based mostly on the most effective obtainable proof about dwelling requirements in London and the UK.

It makes use of a public session technique referred to as MIS to tell the speed. MIS asks teams to establish what folks want to have the ability to afford at least.

This is fed right into a calculation of what somebody must earn as a full-time wage, which is then transformed to an hourly charge.

Living prices are a lot greater in London than in the remainder of the UK , which is why the London Living Wage is greater than the UK charge.

Rent is the first dwelling value that causes the differential between the 2 charges but it surely additionally takes under consideration childcare, journey prices, meals and family bills.

Who pays the Real Living Wage

The Real Living Wage shouldn’t be a government-set wage charge, so companies don’t must pay it. Any corporations which are paying it accomplish that voluntarily.

The Real Living Wage Foundation says that there are over 15,000 Living Wage employers, together with half of the FTSE 100, and family names comparable to Lush, Aviva, Timpson, Ikea and Liverpool Football Club.

There are additionally 1000’s of small companies that select to pay it.

The listing of corporations within the FTSE 100 that pay it are:

- 3i Group

- Admiral Group PLC

- AstraZeneca

- Auto Trader

- Aviva

- BAE Systems

- Barratt Development

- Barclays

- Beazley

- BP

- Burberry

- Convatec

- Croda

- Diageo

- Experian

- Glencore

- GSK

- Haleon

- Hargreaves Lansdown

- HSBC

- Informa

- Intermediate Capital Group (ICG)

- Intertek

- Legal and General

- Lloyds Banking Group

- London Stock Exchange

- M&G

- National Grid

- NatWest Group

- Pearson

- Persimmon

- Reckitt

- RELX Group

- Rightmove

- Sage

- Schroders

- SEGRO Plc

- Severn Trent

- Smiths

- Smith and Nephew

- SSE

- Standard Chartered

- Taylor Wimpey

- Unilever

- Unite Group PLC

- United Utilities

- Vistry Group

- Vodafone

- WPP

If you need to discover out whether or not a selected employer is signed as much as the wage scheme, you could find out simply by typing the corporate identify into the Living Wage Foundation search tool.

How the authorized National Minimum Wage and Living Wages are altering

The Labour authorities is making modifications to the best way the nationwide minimal wage is about, in a transfer that would see tens of millions get a pay rise.

It’s first step was to overtake the remit of the Low Pay Commission (LPC).

The modifications imply that for the primary time, the impartial physique will take the cost of living under consideration when it makes future suggestions to authorities on the minimal wage.

In the election, Labour additionally promised to take away the “discriminatory age bands to ensure every adult worker benefits”.

However, in July, the Business and Trade Secretary and Deputy Prime Minister instructed the LPC to slender the hole between the minimal wage charge for 18–20-year-olds and the National Living Wage.

The authorities stated that this would be the first step in the direction of reaching a single grownup charge.

Finally, the federal government promised to work with the Single Enforcement Body and HMRC and guarantee they’ve the powers to make sure a real dwelling wage is correctly enforced, together with penalties for non-compliance. So far, steps round this haven’t been introduced.

Chancellor Rachel Reeves stated: “Economic growth is our first mission, and we will do everything we can to ensure good jobs for working people. But for too long, too many people are out of work or not earning enough.

“The new LPC remit is an important first step in getting people into work and keeping people in work, essential for growing our economy, rebuilding Britain and making everyone better off”.

When was the minimal wage launched?

THE first National Minimum Wage was put in place in 1998 by the Labour authorities.

It initially utilized to employees aged 22 and over, and there was a separate charge for these aged 18-21.

A separate charge for 16-17-year-olds was launched in 2004, and in 2010, 21-year-olds grew to become eligible for the grownup charge of the National Minimum Wage.

The charge is about by the Government every year based mostly on suggestions by the Low Pay Commission (LPC).

-1748938084015_d.png?w=100&resize=100,70&ssl=1)