The continuous drip, drip of business being taken control of or delisted from the London Stock Exchange, and the absence of a pipe to change them, is making it significantly testing to discover amazing, underestimated chances there. That suggests it’s a lot more crucial for financiers to act rapidly and with sentence when chances emerge.

Filtronic (Aim: FTC) is one such possibility. It is a UK-based developer and producer of high-performance radio-frequency microwave and millimetre-wave elements and subsystems for the aerospace sector. Over the previous years, it has actually taken a world-leading particular niche in this edge of the marketplace, and today it’s profiting.

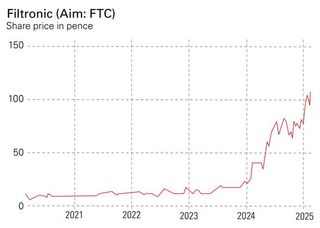

Filtronic’s modification in ton of money

Historically, Filtronic’s 3 primary locations of task have actually been mobile telecoms framework, protection and aerospace, and public security. Orders from these industries gave a stable stream of earnings, yet the company had a hard time to expand and to distinguish itself in a very affordable sector. Revenue gone stale, as did the shares. After Filtronic relocated from the primary market to Aim in 2015, the supply hardly ever traded over 10p per share.

Sign as much as Money Morning

Don’t miss out on the most up to date financial investment and individual funds information, market evaluation, plus money-saving suggestions with our totally free twice-daily e-newsletter

Don’t miss out on the most up to date financial investment and individual funds information, market evaluation, plus money-saving suggestions with our totally free twice-daily e-newsletter

The overview began to alter in 2021 when European nations started elevating protection investing in reaction to Russian aggressiveness. The company additionally began to bring in rate of interest from the space sector, as business such as Elon Musk’s Space X started to release satellite constellations in raising numbers. Space X and various other field innovators have actually transformed to reduced-Earth orbit (LEO) satellite constellations to accomplish international protection at a portion of the price of standard geostationary orbital satellites (GEO). LEO constellations make up countless smaller sized satellites, which can be released in big teams, mass-produced, and utilize each various other to enhance array. Space X started releasing its Starlink LEO constellation in 2019, therefore much it’s placed greater than 7,000 right into orbit. As several as 55,000 LEO satellites might be released in the coming years.

Filtronic introduced its initial collection of agreements to provide LEO satellite interactions tools in 2023. One arrangement was with the European Space Agency, worth a total amount of ₤ 3.2 million, to create multi-frequency transceiver modern technology for satellite haul feeder web links. The collection of smaller sized agreements assisted the business acquire a side in the marketplace while reinvesting money in r & d. These financial investments finished in a transformational long-lasting collaboration arrangement with Space X in April 2024.

Filtronic connecting arms with Elon Musk

SpaceX has actually connected Filtronic right into a bargain to obtain its hands on the business’s E-band strong state power amplifiers. These gadgets aid ground terminals interact with Space X’s Starlink constellations and, because of this, are critical to the procedure.

Under the regards to the arrangement, Filtronic provided warrants to Space X, enabling the last to subscribe for as much as 10% of business with a five-year vesting duration. The warrants vested in 2 equivalent tranches based upon the quantity of orders– the initial after $37 million in orders and the 2nd on the equilibrium as much as a total amount of $60 million. Space X additionally set out prepare for the future generation of these gadgets. The 2nd tranche of warrants is connected to the additional advancement of the modern technology.

In Filtronic’s 2024 fiscal year, earnings climbed 56.3%, and incomes prior to rate of interest, tax obligation, devaluation and amortisation (Ebitda) leapt 280%. In the initial fifty percent of the business’s 2025 fiscal year, earnings climbed by 202%, mainly driven by the Space X agreement. Following 2 years of development, experts at Cavendish had actually anticipated earnings to drop in monetary 2026 as the initial stage of the agreement with Space X finished. Cavendish booked earnings of ₤ 48.4 million in monetary 2025, being up to ₤ 41 million in monetary 2026. It anticipated development to re-accelerate in monetary 2027 as the 2nd stage of the Space X agreement began to settle. But on 10 February, Filtronic stunned the marketplace by revealing it had actually won a brand-new agreement with Space X valued at $20.9 million (₤ 16.8 million) to be met in 2025 and 2026.

Filtronic grabs the celebrities

This bargain was yet one more indication of exactly how transformational the Space X arrangements have actually been and exactly how administration has actually released the cash money to drive additional development. Filtronic has actually spent greatly to fulfill the needs of its significant agreements with Space X, and it remains to do so. The business’s capital spending completed ₤ 2.1 million in the initial fifty percent of the year and is anticipated ahead in at around ₤ 2.4 million in the 2nd fifty percent of the year. Even hereafter development, Cavendish had Filtronic finishing the year with ₤ 10.4 million in internet cash money, up 100% year on year. Thanks to the bespoke exclusive nature of its modern technology, its Ebitda margin was 19.2% in 2024 and anticipated to strike 28.3% in 2025.

Filtronic’s direct exposure to one key consumer is dangerous, yet it is winning customers, leveraging its experience dealing with Space X to gain access to various other components of the LEO market. Profit created from the bargain is additionally moneying substantial r & d to drive development in various other markets. Based on the business’s most recent bargain, the supply is trading at an onward price/ earnings (p/e) ratio of about 20 on a totally weakened basis after removing out cash money. Even though the supply has actually climbed in worth 10 times considering that 2021, its existing worth isn’t also requiring, considering its market recommendation and item base.

The business is additionally a prime procurement target. Compared to various other Space X vendors in the network interactions field, such as Taiwan- based Wistron NeWeb Corp, Filtronic is a minnow and might end up being an extremely appealing bolt-on procurement.

(Image credit score: Aim)

This write-up was initial released in Money Week’s publication. Enjoy special very early accessibility to information, point of view and evaluation from our group of economists with a MoneyWeek subscription.

&w=100&resize=100,70&ssl=1)