Image resource: National Grid plc

Over the previous year, National Grid (LSE: NG) has actually gone up 2% on the London stock market The National Grid share cost is within 6% of where it stood 5 years earlier.

Things can be even worse. At the very least the share cost has actually relocated the ideal instructions.

For some financiers, the share cost might be unnecessary. National Grid is prominent for its returns. Its setting in the energy sector is regarded to supply steady capital that can aid a reward the company intends to expand according to rising cost of living.

As a capitalist however, ought I to take that technique and take into consideration simply the rewards?

Why a share cost issues

if I spend cash in a share and the cost drops, I do not shed anything–unless I sell At that factor, a paper loss crystallises right into a real one.

So also if I purchased National Grid shares today and the cost dropped (it is down 13% considering that May 2022, for instance) I would just shed cash if I cost that cost.

However, many financiers one way or another will certainly take into consideration marketing shares. Even long-term shareholders might transform their monetary goals or sight of a business, for instance.

So a dropping share cost can be a problem if it looks not likely to recoup. Tying cash up for years in shares that have a paper loss can likewise bring a chance price as those funds can not be utilized for various other points.

How safe is the returns?

So I would definitely take note of the National Grid share cost also if I anticipated the rewards to maintain coming.

But energies are not as safe as some investors think when it pertains to preserving their rewards, not to mention expanding them on a regular basis.

Want an instance? Look at SSE Last year’s returns was 60p per share. Back in 2020, it was 80p. In 2015, it was 88.4 p. So a lot for energies being trusted long-lasting returns payers. No returns is ever before ensured.

Increasingly startling financial debt degrees

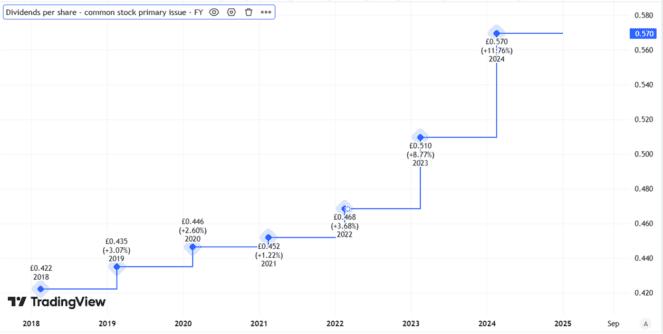

In justness, National Grid has an excellent performance history when it pertains to yearly returns development.

Created utilizing TradingView

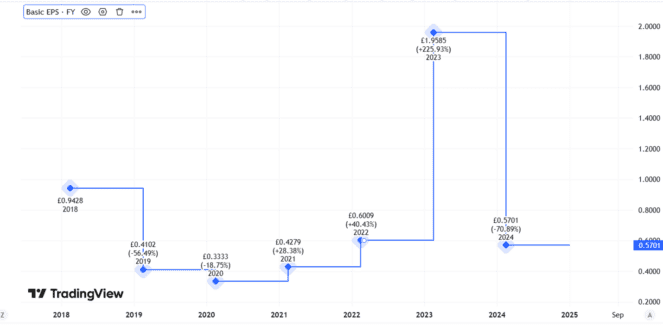

But consider the company’s fundamental incomes per share.

Created utilizing TradingView

They walk around a great deal– and do not constantly cover the returns.

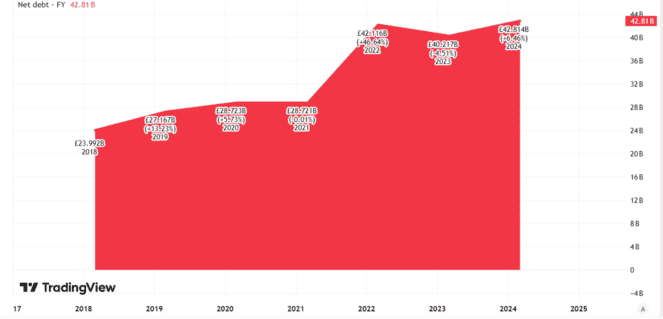

Owning and preserving a power network is expensive service, specifically currently each time when power is being produced and where it is being taken in remain in change contrasted to historic standards.

That implies National Grid needs to invest a great deal to maintain its service running. So its net debt has actually expanded in time.

Created utilizing TradingView

Last year saw a civil liberties concern developed to aid enhance funds offered for things consisting of capital investment. That thinned down investors.

I see a danger of a comparable relocate future if National Grid intends to supply on its objective of maintaining the returns expanding each year according to rising cost of living. An option, at some time, is for the firm to decrease the payment like SSE has actually continuously done. If that took place, it can send out the share cost rolling.

So although its one-of-a-kind network properties can aid produce considerable capital, I have no strategies to include National Grid shares to my profile.