- ASX topples greatly on tasks and profits miss out on

- Fortescue, financial institutions and Super Retail dive; Whitehaven, Telstra surge

- Whitehaven, Telstra amongst the champions

The ASX rolled greatly on Thursday, down 1.3%, proceeding where it ended the other day.

There’s a number of factors for the bloodbath.

First, the January tasks report from the abdominal can be found in hotter than anticipated, with 44,000 tasks included in the economic climate in January.

On paper, that appears excellent, however it pressed bond investors to lower their bank on any kind of hopes of an additional RBA rates of interest reduced in May.

Secondly, profits period remains in full speed, and a few of the huge cap names simply really did not create the items.

Banks copped a damaging once more, with Australia and New Zealand Banking Group’s (ASX:ANZ) down over 3% after it exposed an increase in damaged finances, which is dragging down the entire financial market.

Fortescue (ASX:FMG) likewise obtained wrecked, down 7% after a harsh 53% revenue decrease for the fifty percent year. Despite document iron ore deliveries, profits from hematite tanked 21%, expenses soared 8%, and because of this, acting reward obtained cut by over fifty percent.

Magellan Financial Group (ASX:MFG) had a harsh session, its shares dropped 9.5% after the business’s revenue stopped by 10% in the fifty percent. The business stated it was examining its annual report after introducing the visit of Dean McGuire as its brand-new CFO.

Goodman Group (ASX:GMG) brought the residential property market down after dropping by over 6% on introducing a $4 billion funding raising to improve its concentrate on information centres. It’s been 12 years considering that the business did a cap raising, and it appears capitalists weren’t delighted concerning it.

Global pc gaming business Aristocrat Leisure (ASX:ALL) really did not make out better, pulling back 4% in spite of introducing a brand-new share buyback well worth as much as $750 million.

Then we have actually obtained Super Retail Group (ASX:SUL), the proprietor of Rebel shops, which was simply obtaining baked, down 12% after reporting a 10% decrease in NPAT for the fifty percent.

But not all was ruin and grief, as there were a couple of intense areas.

Wesfarmers (ASX:WES) leapt over 1%, buoyed by solid sales and profits, primarily due its retail brand names Bunnings and Kmart.

Telstra (ASX:TLS) likewise had a strong session, increasing 5% after it published a 6.5% surge in web revenue in H1 and introduced a share buyback program.

Meanwhile, Whitehaven Coal (ASX:WHC) squashed it with a 33% revenue dive to $328m and profits increasing to $3.4 b in H1. The business stated it was reactivating its buyback and paying a 9 cents reward. Shares rose 8%.

And, technology business Megaport (ASX:MP1) increased 14% after it elevated its profits support for the year. Megaport has actually been expanding solid throughout all areas, with profits and gross revenue both increasing by 12% in the fifty percent.

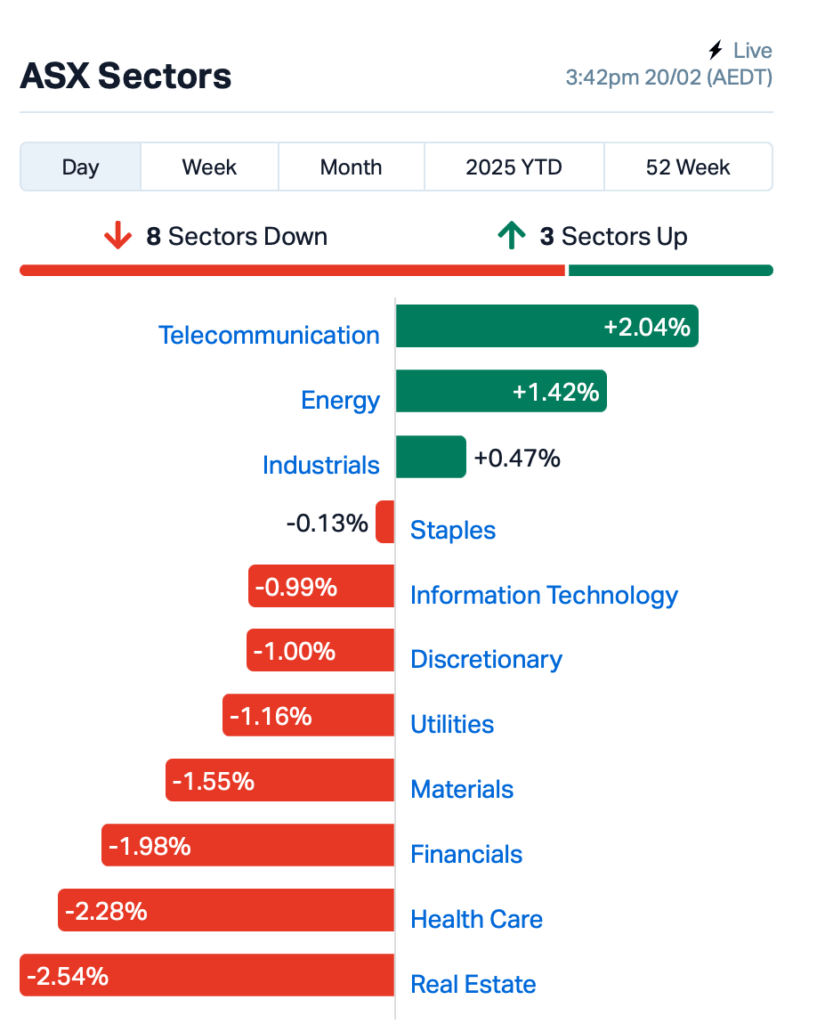

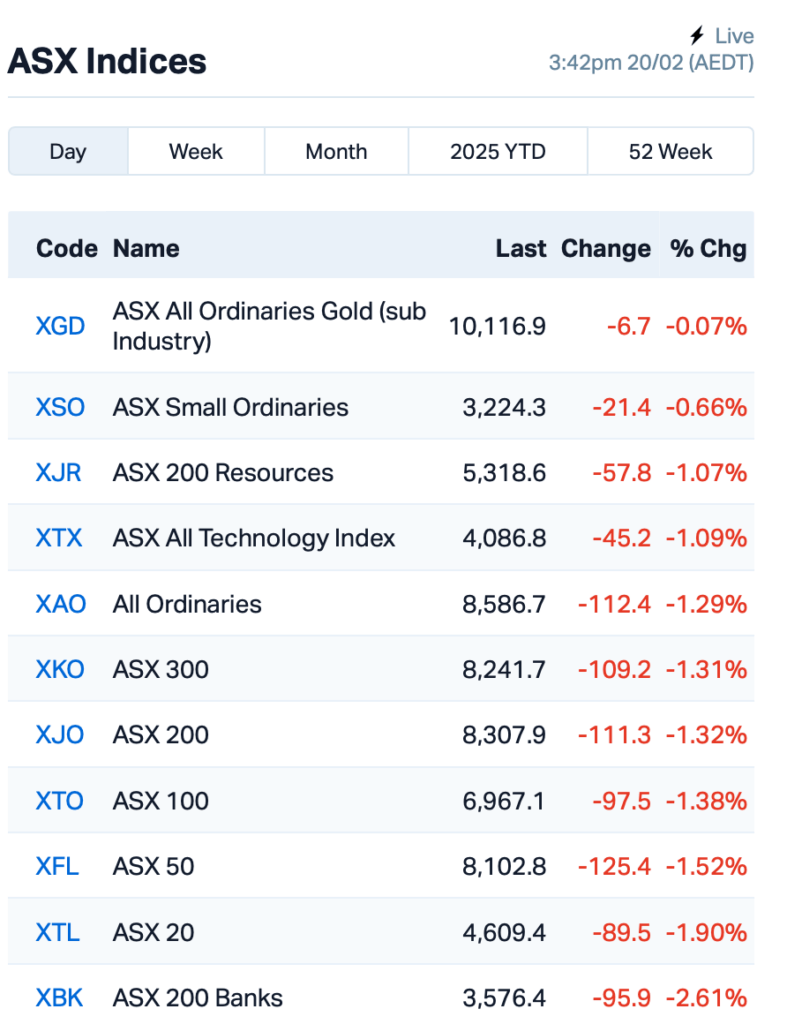

This is where points stood leading up to Thursday’s close:

Meanwhile throughout Asia, supplies primarily went down, also, as capitalists responded to the Federal Reserve’s careful position on rates of interest cuts.

According to the Fed’s mins last evening, authorities aren’t crazy about even more price cuts right now. They wish to see rising cost of living decrease extra initially.

The huge worry, the mins kept in mind, is Trump’s tolls. The Fed’s fretted these tolls can press rising cost of living greater and tinker the development currently made.

ASX SMALL CAP LEADERS

Today’s finest doing tiny cap supplies:

| Code | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| VPR | Volt Group | 0.002 | 50% | 252,355 | $ 10,716,208 |

| PER | Percheron | 0.013 | 44% | 50,247,542 | $ 9,786,939 |

| PVW | PVW Res Ltd | 0.017 | 42% | 4,514,244 | $ 2,386,857 |

| CVR | Cavalierresources | 0.120 | 40% | 793,861 | $ 4,974,431 |

| HLX | Helix Resources | 0.004 | 33% | 9,068,048 | $ 10,092,581 |

| RLL | Rapid Lithium Ltd | 0.004 | 33% | 3,087,133 | $ 3,097,334 |

| ANR | Anatara Ls Ltd | 0.055 | 31% | 76,612 | $ 8,962,117 |

| AVE | Avecho Biotech Ltd | 0.007 | 30% | 7,458,497 | $ 15,846,485 |

| OMX | Orangeminerals | 0.039 | 30% | 518,242 | $ 3,333,068 |

| HMY | Harmoney Corp Ltd | 0.695 | 26% | 354,510 | $ 56,080,281 |

| 1TT | Thrive Tribe Tech | 0.003 | 25% | 427,201 | $ 4,063,446 |

| AGE | Energy Resources | 0.003 | 25% | 4,107,168 | $ 810,792,482 |

| PGO | Pacgold | 0.070 | 23% | 1,443,537 | $ 7,492,897 |

| KTA | Krakatoa Resources | 0.011 | 22% | 4,518,908 | $ 5,311,206 |

| WWI | West Wits Mining Ltd | 0.020 | 22% | 51,170,433 | $ 41,199,687 |

| WC1 | Westcobarmetals | 0.029 | 21% | 20,942,235 | $ 4,221,898 |

| ADY | Admiralty Resources | 0.006 | 20% | 303,442 | $ 13,147,397 |

| BNL | Blue Star Helium Ltd | 0.006 | 20% | 10,854,594 | $ 13,474,426 |

| RNX | Renegade Exploration | 0.006 | 20% | 142,000 | $ 6,420,017 |

| ZMI | Zinc of Ireland NL | 0.012 | 20% | 5,153,703 | $ 5,670,107 |

| CTQ | Careteq Limited | 0.013 | 18% | 50,000 | $ 2,608,306 |

| NAN | Nanosonics Limited | 4.070 | 18% | 1,980,602 | $ 1,050,274,959 |

| MGU | Magnum Mining & & Exp | 0.007 | 17% | 185,841 | $ 4,856,168 |

| NSM | Northstaw | 0.029 | 16% | 1,878,848 | $ 6,816,913 |

| SSR | SSRMining Inc | 16.270 | 16% | 42,947 | $ 49,491,954(* )(* )has actually reported solid arise from its boring program at the |

ão

PVW Resources (ASX:PVW) task inCap Bonito of 32 openings pierced, 29 (94%) returned Brazil (TREO) focus over 500 ppm, with some striking excellent qualities as much as 3,267 ppm. Out mineralisation is superficial, making it quickly obtainable, and the task reveals substantial capacity with mineralisation still open.Total Rare Earth Oxide has actually authorized a non-binding bargain for an US$ 11 million stream money center with The to money the

Cavalier Resources (ASX:CVR)‘s Raptor 1 open pit advancement. Crawford Gold Project funds will certainly likewise sustain piercing to update even more sources right into ore gets. Stage bargain entails supplying up to 11,000 ounces of gold, however The will not need to elevate added equity funding, so no dilution for investors. A 60-day due persistance duration is currently underway prior to relocating to a binding arrangement.The stated it was virtually finished with Cavalier 2 of its GaRP-IBS test, with outcomes anticipated in

Anatara Lifesciences (ASX:ANR) Stage has actually been stopped briefly considering that March, however the last follow-up duration is underway. Recruitment test’s on course with 71 individuals, and the business is readied to evaluate the information quickly.December The- financial institution lending institution reported a solid initial fifty percent of FY25, with

Non NPAT striking $2.3 m, a 350% rise contrasted to 1H24. Harmoney Corp (ASX:HMY) NPAT was $2.0 m. Cash business stated it gets on track to satisfy its Statutory NPAT support of $5m for FY25, with a target of $10m+ for FY26.The has actually simply completed a large aircore boring project at Cash and located an enormous 12km gold anomaly, extending from the

Pacgold (ASX:PGO) to theAlice River Shadows RC boring readied to begin in Victoria Prospect, the emphasis gets on checking these brand-new gold targets and acting on the state-of-the-art locations.With April ASX SMALL CAP LAGGARDS

‘s worst doing tiny cap supplies:

%

Today TX3

| Code | Name | Price | 0.001 Change | Volume | Market Cap |

|---|---|---|---|---|---|

| -50% | Trinex Minerals Ltd | 337,778 | $ 3,757,305 | AOK | |

| 0.002 | Australian Oil -33% | 1,100,000 | $ 3,005,349 | WYX | NL |

| 0.028 | Western Yilgarn -30% | 111,530 | $ 4,952,382 | BMH | 0.050 |

| -30% | Baumart Holdings Ltd | 4,915 | $ 10,276,878 | PKO | 0.003 |

| -25% | Peako Limited | 65,450 | $ 5,950,968 | SFG | 0.002 |

| -25% | Seafarms Group Ltd | 439,936 | $ 9,673,198 | PHL | 0.009 |

| -25% | Propell Holdings Ltd | 482,593 | $ 3,340,057 | RDX | 3.390 |

| -21% | Redox Limited | 1,683,149 | $ 2,263,100,955 | ASR | 0.002 |

| -20% | Asra Minerals Ltd | 99,500 | $ 5,781,575 | CDT | 0.002 |

| -20% | Castle Minerals | 5,100,000 | $ 4,742,035 | CRR | 0.004 |

| -20% | Critical Resources | 101,135 | $ 12,321,106 | PNT | 0.014 |

| -18% | Panthermetalsltd | 3,140,220 | $ 4,218,903 | RFA | 0.019 |

| -17% | Rare Foods Australia | 40,000 | $ 6,255,615 | ALM | 0.005 |

| -17% | Alma Metals Ltd | 517,001 | $ 9,518,072 | HE8 | 0.010 |

| -17% | Helios Energy Ltd | 8,022,429 | $ 31,248,593 | PLG | 0.010 |

| -17% | Pearlgullironlimited | 412,877 | $ 2,454,501 | VFX | 0.003 |

| -17% | Visionflex Group Ltd | 111,115 | $ 10,103,581 | GRV | 0.055 |

| -15% | Greenvale Energy Ltd | 708,126 | $ 31,646,766 | EPX | 0.028 |

| -15% | Ept Global Limited | 100,300 | $ 21,654,864 | ZNO | 0.028 |

| -15% | Zoono Group Ltd | 14,561 | $ 11,729,316 | LAM | 0.595 |

| -15% | Laramide Res Ltd | 72,904 | $ 14,408,342 | NAG | 0.017 |

| -15% | Nagambie Resources | 3,086,560 | $ 16,066,047 | TRM | 0.075 |

| -15% | Truscott Mining Corp | 56,200 | $ 16,847,473 | RWD | 0.052 |

| -15% | Reward Minerals Ltd | 192,243 | $ 16,239,394 | IN INSTANCE YOU MISSED IT |

VHD graphite innovation has actually attained a

, going beyond the market requirement for nuclear and electrode graphite.

Green Critical Minerals’ (ASX:GCM) thickness, together with tried and tested high thermal diffusivity and conductivity, placements it as a perfect product for next-generation air conditioning remedies.record density of 2071kg/m3 of This task in

An independent review has actually validated vital functions of a Zenith Minerals’ (ASX: ZNC) Red Mountain- design intrusion-related gold system, verifying the business’s idea that the task is advancing right into a significant gold system. Queensland is currently looking for a Mt Wright federal government give to increase deep boring and additional geophysical researches.Zenith has Queensland of $14.3 million at 65 cents per share, fulfilling the business’s approximated minimum funding need for a listing on the

Wellnex Life (ASX:WNX)‘s goal. secured binding commitments funds will certainly likewise enhance London Stock Exchange’s monetary setting as it targets worldwide development.The has Wellnex for the

Pursuit Minerals (ASX:PUR) lithium task to sustain scalable, long-lasting manufacturing. updated its phased development plan modular layout will certainly start with Rio Grande Sur 1, which entails transferring the existing 250tpa lithium carbonate plant to the website. The 2 and Phase 3 will certainly broaden manufacturing by 5000tpa at Phase 02 and 10,000 tpa at Phase, eventually raising result to 15,250 tpa.Sal Rio has actually enhanced its money setting with a $751,909 tax obligation debt for R&D tasks in FY24, connected to expedition at its Mito REE and crucial minerals task in WA.

Victory Metals (ASX:VTM) funds will certainly approach continuous advancement at the task.North Stanmore has actually started area programs at its just recently optioned gold-antimony tasks in The’s goldfields, highlighted by a significant geochemical tasting program at the

Bubalus Resources (ASX:BUS) target. Victoria rock chip tasting returned outcomes of as much as 12.1 g/t gold and 2.02% antimony.Crosbie North has actually designated knowledgeable funding markets exec Previous as a non-executive supervisor.

Scorpion Minerals (ASX:SCN) has actually surrendered as non-executive chairman, with Peter Koller prospering her in the duty.Bronwyn Barnes Michael Kitney, we inform it like it is.

,

At Stockhead, While Green Critical Minerals, Zenith Minerals, Wellnex Life, Pursuit Minerals and Victory Metals are Bubalus Resources marketers, they did not fund this post.Scorpion Minerals post does not make up monetary item guidance. Stockhead ought to take into consideration acquiring independent guidance prior to making any kind of monetary choices.

This SUBSCRIBEYou the most recent