After Covid struck 5 years back, numerous UK real-estate investment company (Reits) put on hold or reduced their rewards.

There were alarming forecasts that require for workplaces and stores would certainly be a lot weak after the pandemic that payments would certainly never ever totally recoup. But while realty has actually been influenced by modifications in job and recreation, many Reits have actually seen their revenue stand up better than been afraid.

The 2 huge varied Reits summarize the low and high. Land Securities paid 45.55 p per share in 2018/19, being up to 23.2 p in 2019-2020. It need to pay 40.5 p this year. British Land dropped from 31.47 p to 15.04 p; it’s currently back to 23p.

Sign approximately Money Morning

Don’t miss out on the current financial investment and individual funds information, market evaluation, plus money-saving ideas with our cost-free twice-daily e-newsletter

Don’t miss out on the current financial investment and individual funds information, market evaluation, plus money-saving ideas with our cost-free twice-daily e-newsletter

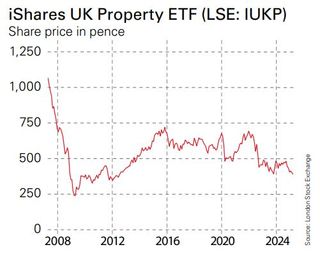

Yet share prices are mainly back to where they remained in 2020 and even reduced. This isn’t simply real for the workplace industry, where one can comprehend why several capitalists stay mindful. It uses virtually throughout the board, and the reasons are clear.

UK Reits: are capitalists also bearish?

Higher interest rates given that 2022 have actually raised the price of financial debt made use of to money most property bargains and additionally raised the returns that capitalists can obtain somewhere else (eg, from federal government bonds). Hence commercial-property worths have actually dropped, which suggests Reits are consistently revealing appraisal write-downs. That never ever produces great headings, also if rental fees maintain rolling in.

For a dual whammy, greater returns somewhere else make the Reits’ very own payments look much less engaging. Pre-Covid, Land Securities produced regarding 4.5%, currently it generates 7.5%. Over the exact same duration, the 10-year gilt has actually gone from regarding 0.75% to 4.75%.

Still, check out current updates and you question if capitalists are also bearish. Shaftesbury, which possesses huge swathes of London’s West End, reported a 7% net asset value overall return for 2024. The shares are down 8% over year. London workplace expert Derwent reported secure worths and strong leasing patterns. It’s off 13% for many years. Logistics companies such as Segro, Tritax Big Box and London Metric– which were market beloveds till very early 2022– reported fine outcomes, yet the shares stay in the red. And so on. Tailwinds might be getting, yet they have actually yet to be discovered.

Except possibly within the industry, where Reits are breaking each various other up or being gotten byprivate equity In the previous month, KKR has actually bid for medical care centers team Assura, and Blackstone has actually bid forWarehouse Reit Specialists plainly see some worth in UK home, at the very least uniquely.

Of program, they might be incorrect– realty is intermittent and in every cycle, experienced capitalists obtain huge telephone calls incorrect. Indeed, the information that Land Securities currently intends to market ₤ 2 billion of workplaces to purchase property is difficult to comprehend– offering cash-generating possessions near a most likely market-bottom to money enthusiastic brand-new growths for an entirely various kind of occupant under a federal government that is extremely eager to interfere in the real estate industry seems like a vibrant relocation, and not always what investors desire. Still, at these degrees and with information improving, the iShares UK Property ETF (LSE: IUKP) industry tracker resembles an appealing contrarian play.

(Image credit history: London Stock Exchange)

This write-up was very first released in Money Week’s publication. Enjoy special very early accessibility to information, point of view and evaluation from our group of economists with a MoneyWeek subscription.