“It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity, it was the season of Light, it was the season of Darkness, it was the spring of hope, it was the winter of despair, we had everything before us, we had nothing before us.”– Charles Dickens, A Tale of Two Cities

Travel retail in Hainan and South Korea, along with a soft Mainland China residential market, remained to drag out L’Or éal’s North Asia area, the French elegance team exposed on Friday throughout a post-annual outcomes profits phone call.

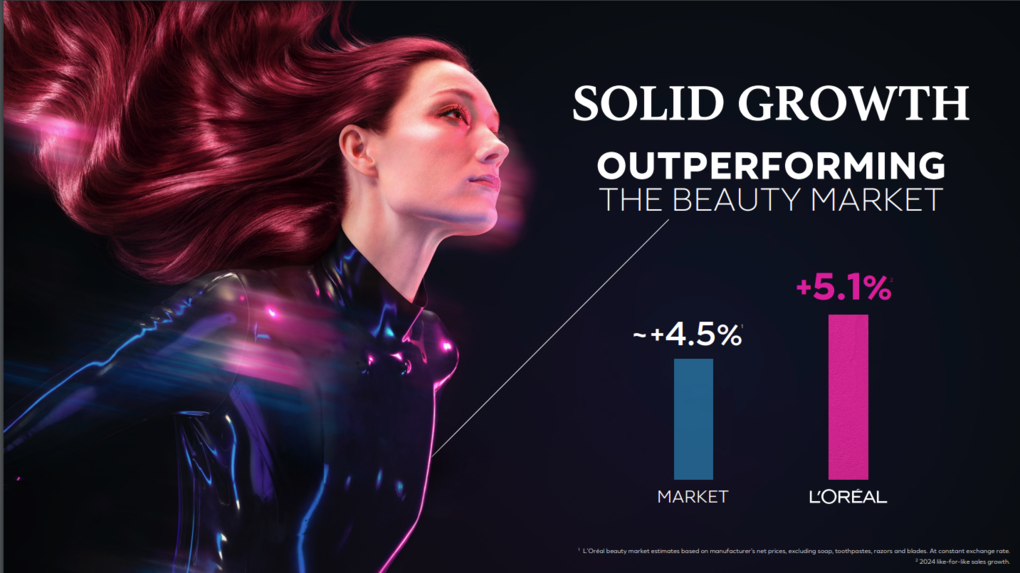

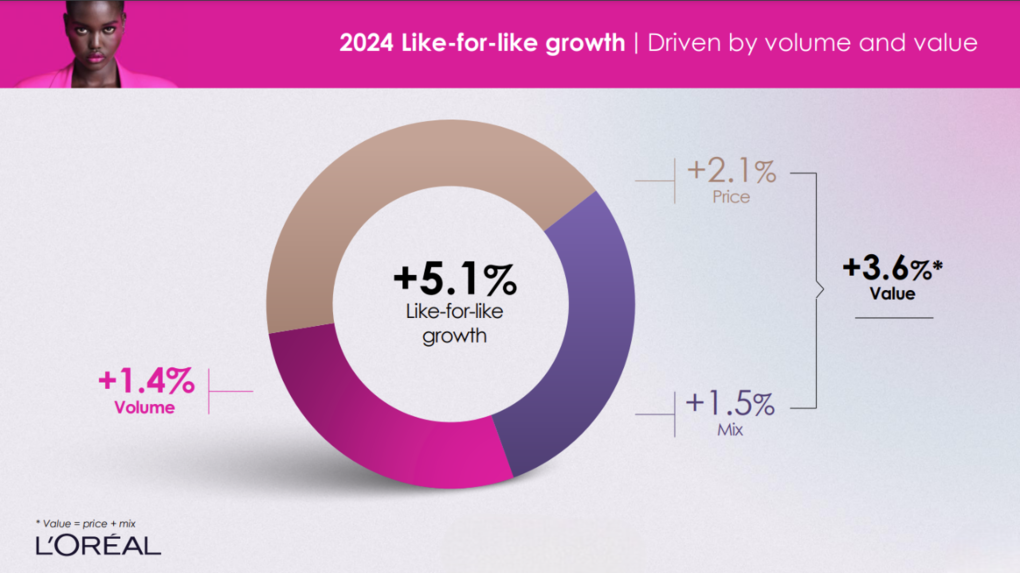

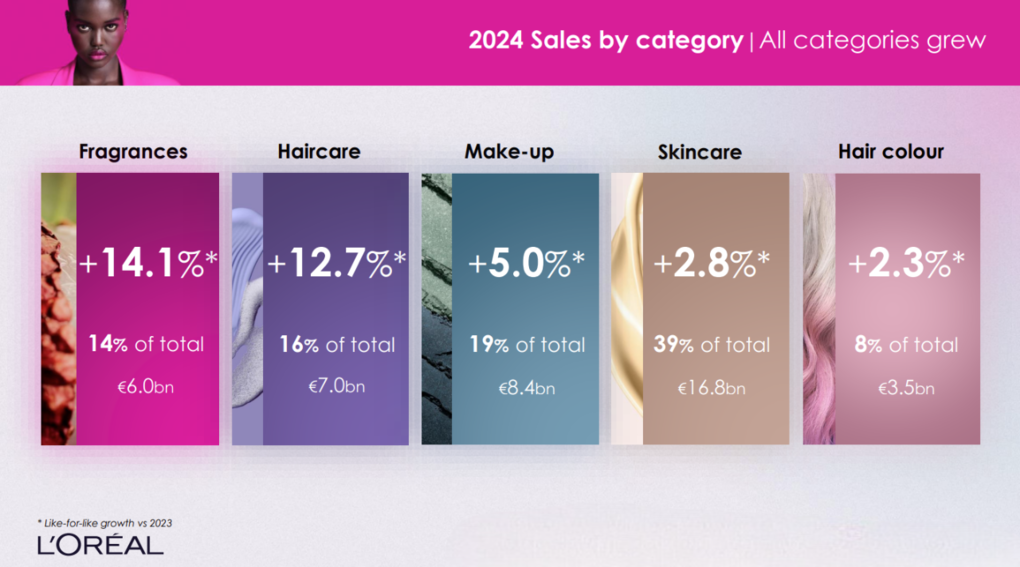

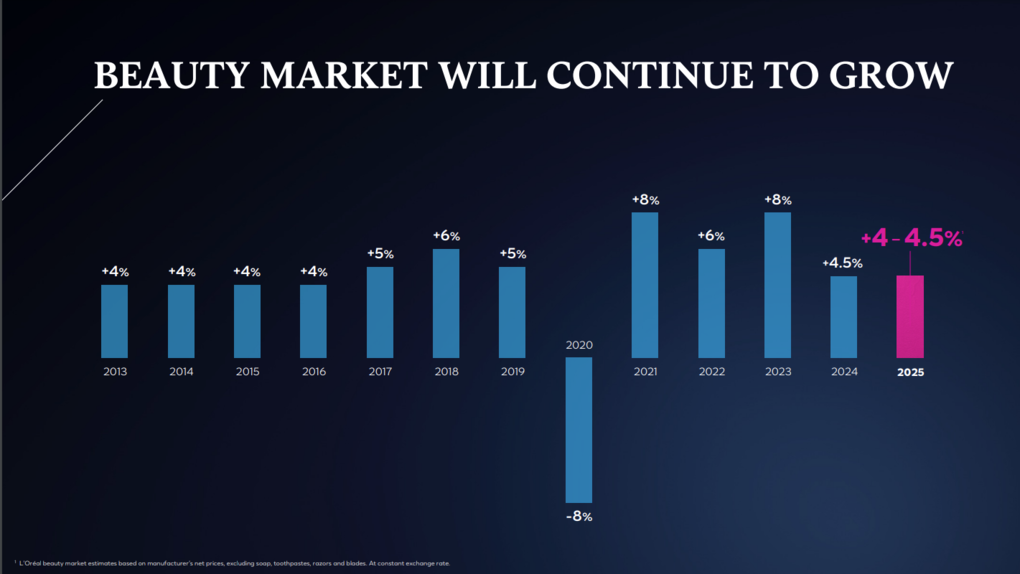

As reported, L’Or éal published +5.6% (reported; +5.1% like-for-like) year-on-year sales development to EUR43.47 billion in what it called“another year of outperformance in a normalising global beauty market” However, Q4 development was simply +4.5% (+2.5% like-for-like) listed below the +4.4% like-for-like London Stock Exchange agreement, according to Reuters.

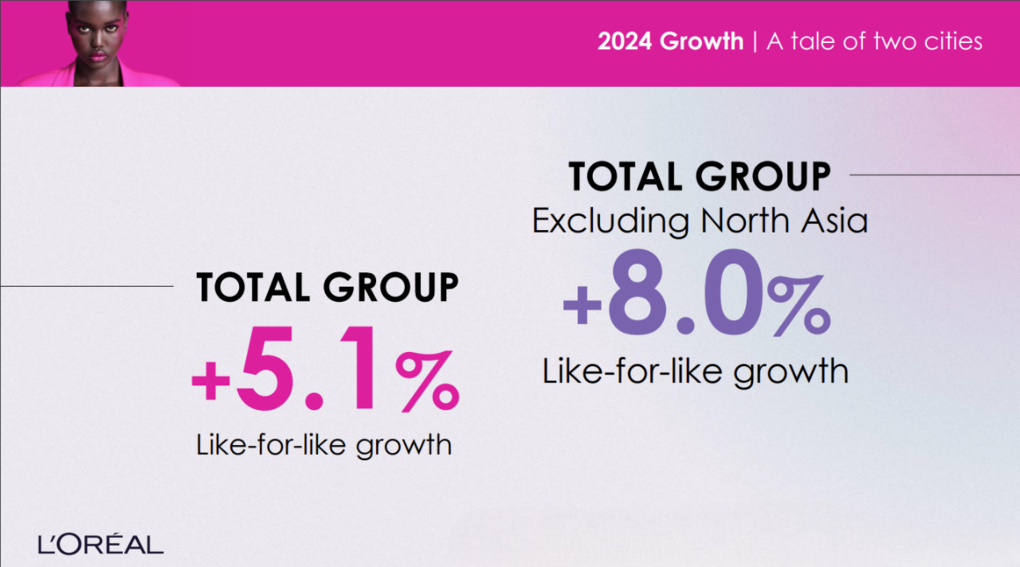

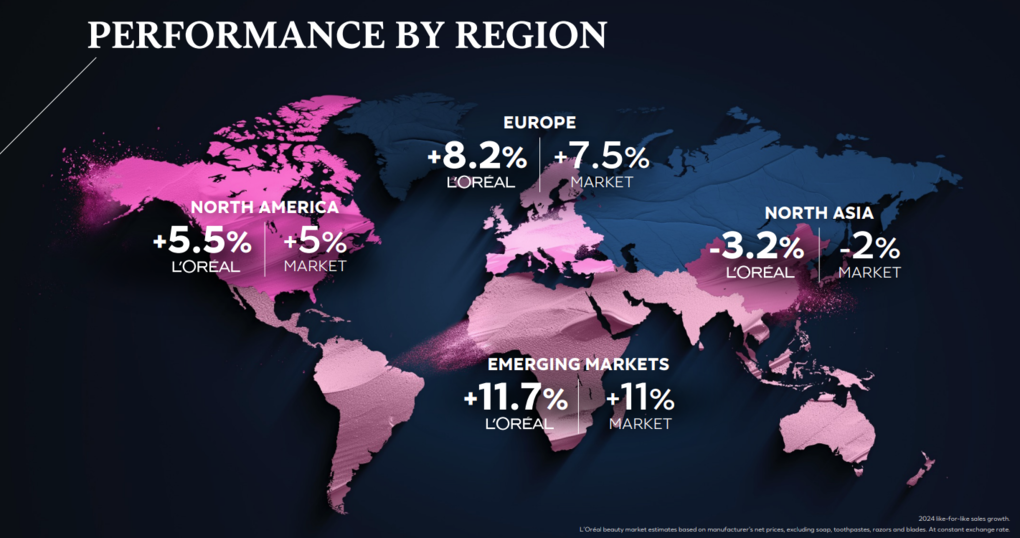

The firm created like-for-like development in all areas other than North Asia (-3.4% for the year; -3.1% Q4), which was adversely influenced by the traveling retail difficulties [both reseller-related] in Hainan and South Korea, the network’s 2 crucial markets of current years.

L’Or éal Executive VP & & CFO Christophe Babule made use of a Dickensian insinuation to define the different lot of money of North Asia et cetera of the globe, commenting: “2024 was the tale of two cities, and our like-for-like growth stood at +5.1%. But excluding North Asia, it amounted to a very strong +8%. All other regions contributed to that growth, led by Europe and our emerging markets.”

And while Dickens’ renowned ‘It was the best of times, it was the worst of times’ opening up line from A Tale of Two Cities really did not rather use, there is little uncertainty exactly how greatly North Asia’s efficiency differed from its geographical equivalents.

“Momentum was strong in three of our regions, helping offset the softness in North Asia… [where] sales declined by -3.2% on a like-for-like basis. This was due to the continued weakness in both Mainland China and travel retail,” Babule stated.

Perhaps the CFO was preparing for the French rugby group’s off-colour second-half efficiency in shedding versus England a day later on when he included: “But ’24 was also a tale of two halves as a strong first half was followed by a softer second.”

Once once again, North Asia traveling retail and Mainland China were indispensable to that variant. Overall development in the international cosmetics market reduced from a “dynamic” +5.5% in the very first fifty percent to a much more modest +4.5% in the complete year, an anticipated stagnation as inflation-driven rates began to loosen up.

But the form of that stagnation varied from what the firm had actually anticipated, Babule stated. “On the one hand, developed markets, especially Europe, held up better than anticipated. On the other hand, the Chinese ecosystem, which we had hoped will at least stabilise, did not.”

Hainan and Korean traveling retail sales plunge from 2022 degrees

In Asia traveling retail, overall elegance market development went from -3% in the very first fifty percent to minus -10% in the complete year, driven by both Hainan and Korea, Babule discussed. “Together, they are down -35% from 2022 levels, and then we chose to accompany this decrease in consumption with a reduction in our stock in trade.

“We believe that the resizing of the travel retail business in Asia is now largely behind us, and I’m happy to say that we are entering ’25 with healthy inventory levels across the region.”

The North Asia difficulties considered on L’Or éal Luxe and especially its crucial skin care profile, according to L’Or éal Luxe President Cyril Chapuy.

“In North Asia, in a still challenging market context at minus -7%, we continued to gain market share evolving at minus -5.5%,” he stated.

Skincare offered a different image, he stated with a tough market context deeply influenced by the scenario in North Asia, stabilized by numerous crucial favorable minutes consisted of the around the world launch of Lanc ôme Genifique Ultimate– “executed to perfection everywhere”– the launch of Kiehl’s on Amazon, and the solid efficiency of current purchases Youth to the People, Takami and Aesop.

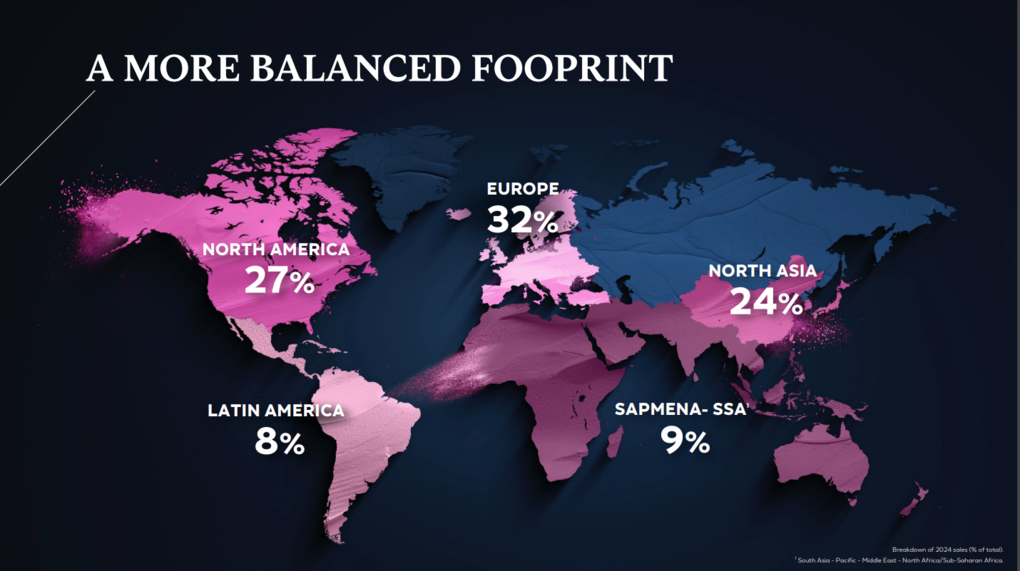

Hieronimus kept in mind the firm’s direct exposure to the Chinese ecological community had actually dramatically decreased over the previous 2 years, currently making up 17% of sales, well listed below the 2022 degree. “We continue to believe in its future but are less dependent on it as our global footprint has become a lot more balanced,” he observed.

That rebalancing has actually been highlighted by the motivating development of arising markets which added to 36% of development and currently represent over 16% of sales, surpassing Mainland China for the very first time, Hieronimus stated.

“The results I’m most proud of this year is our financial performance, our capacity to keep our P&L virtuous and deliver steady improvement in operating profit despite the turbulences in China and travel retail,” he commented.

“Our gross and operating margins reached new record highs. At 20%, our operating margin was up 20 basis points or 40 basis points if we exclude the impact of Aesop [acquired in April 2023]. On a comparable basis, our brand fuel increased by ten basis points.

“As a group, we have once again proven our ability and determination to consistently deliver on our promise to steadily improve our operating margins, all the while providing the fuel for our long-term growth. We are confident in the future, and we increased the dividend to our shareholders by +6%.”

Asked throughout the concern and response session concerning L’Or éal’s “exposure” to the traveling retail network and the firm’s evident cautiousness regardless of the anticipated adjustment of sell-in and sell-out in North Asia, Babule reacted: “You’ve seen that the consumption in travel retail has been decreasing now for more than two years in a row. And of course, the weight of travel retail [internally] now has decreased quite sharply.”

However, he explained, L’Or éal’s traveling retail efficiency in Europe and North America is still boosting and Hainan stands for much less than 1% of team sales.

“So the exposure to those difficult markets has dramatically decreased. That’s why we are confident that in 2025 we should expect – we don’t know when – probably a progressive recovery in the coming semesters.”

Hieronimus discussed that the reality he stayed “not super positive” concerning traveling retail was partially driven by a difference in between traveler web traffic development and customer investing, keeping in mind: “We’re particularly seeing Hainan not growing in terms of sell-out.”

He included: “We see passengers increasing [globally]. The trend of air traffic is very positive. It should grow by +9% again in 2025. We think, by the way, that the market will be very dynamic in the west. In the east, over the holidays, the Hainan sales for all categories, not just beauty, were still negative. Korea is managing their inventory. So… we’re hoping for a stronger rebound.

“We think we can have positive sell-out across the year. We have a healthy inventory, but we don’t see travel retail being a powerful growth engine, particularly at the beginning of the year. The more we move into favourable comparatives, the better it may be. But I would say that one of the bad results of Q4 is that it went back into negative territory when we were hoping it wouldn’t.

“What’s important for us is – and that’s very key – is that we’re paying a lot of attention to inventory management to make sure that we stay always on the healthy side. And that’s where we are today.” ✈