Image resource: Getty Images

I’m looking for high-yield returns shares to get now. I’m additionally seeking to expand my holdings by getting a big-paying exchange-traded fund (ETF).

Here are 3 such financial investments on my checklist today. As you can see, the returns returns on these London Stock Exchange– provided tools cruise over a forward standard of 3.6% for FTSE 100 shares.

| Dividend supply | Forward returns return |

|---|---|

| Greencoat UK Wind (LSE:UKW) | 7.6% |

| Invesco United States High Yield Fallen Angels ETF (LSE:FAHY) | 6.7% |

Dividends are never ever assured. But if projections are exact, a ₤ 15k financial investment spread similarly throughout these shares and this ETF would certainly offer me a ₤ 1,080 easy revenue in 2025.

I’m positive, also, that returns will certainly march greater over the moment. Here’s why I would certainly get them if I had the cash money handy to spend today.

Greencoat UK Wind

Energy manufacturers like Greencoat UK Wind are commonly taken into consideration several of the most safe returns supplies to get.

Keeping generators in great functioning order can be a pricey, earnings-damaging service. But firms similar to this additionally take pleasure in outstanding earnings exposure many thanks to their ultra-defensive procedures. This can make them a lot more secure returns payers than numerous various other UK shares.

Electricity need continues to be secure whatever financial, political, or social dilemma goes along. And so Greencoat UK Wind, which creates power from 49 websites and offers it onto power vendors, takes pleasure in a constant circulation of revenue it can pay to its investors.

While returns are never ever assured, Greencoat’s pledge to pay “an attractive and sustainable dividend that increases in line with RPI” has actually held because its IPO a years earlier.

In truth, returns in 2023 increased practically 30% year on year, skyrocketing previous market price rising cost of living (RPI) of 13.4%. Greencoat has the ability to maintain this document up as most of its agreements are connected to either RPI or customer rate rising cost of living (CPI).

Given the intense overview for renewable resource need, I assume Greencoat UK might be a leading returns payer for several years.

Invesco United States High Yield Fallen Angels ETF

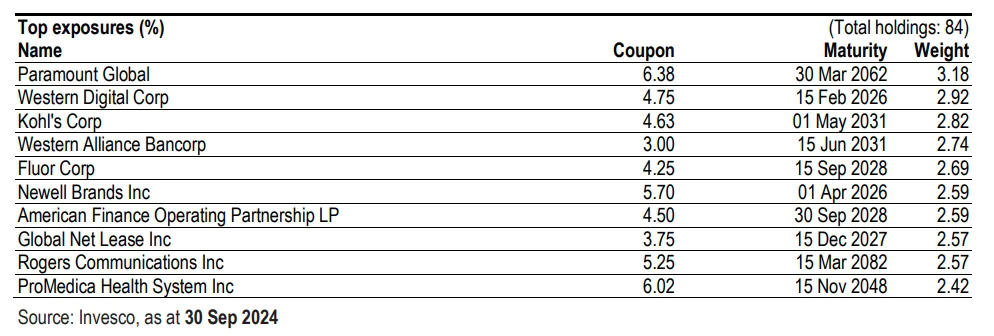

The Invesco United States High Yield Fallen Angels ETF gives a means for capitalists to make money from the bond market. More particularly, it intends to gauge “the performance of ‘Fallen Angels,’ bonds that were previously rated investment grade and were subsequently downgraded to high yield bonds”.

Around 85% of credit scores rankings on its business bonds are ranked BB, with the rest at B.

While rankings go a lot reduced, these sub-investment-grade safety and securities imply that capitalists are still subjected to a greater degree of credit scores threat than various other bond-holding funds. A devalued score signifies troubles with the bond provider’s underlying monetary health and wellness.

However, with this better threat comes the capacity for better benefit. And in this instance the returns return is a hair far from 7%.

What’s a lot more, the fund has a continuous yearly cost of 0.45%, which gives strong worth. It’s one more method I would certainly take into consideration targeting a big passive revenue following year.