Image resource: Getty Images

Looking for returns development supplies? These FTSE 100 supplies are anticipated to provide solid payment development over the following number of years a minimum of.

BACHELOR’S DEGREE Systems

Dividend return: 2.5% for 2024, 2.7% for 2025

The steady nature of arms costs implies support often tends to be a well-founded field fordividends This is particularly the situation today, as cracks in the worldwide order drive quick rearmament in the West.

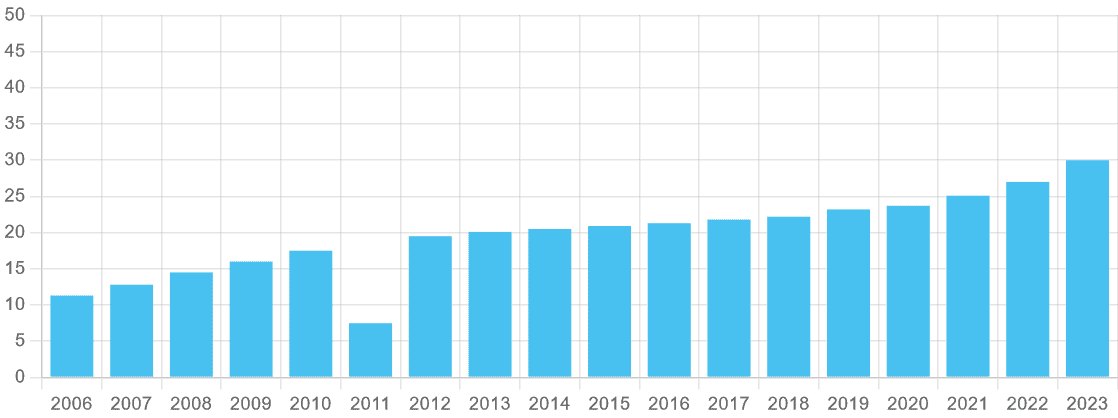

BACHELOR’S DEGREE Systems (LSE:BA.) is one service provider with a lengthy document of notable returns development. It’s elevated investor payments annually considering that 2011. It’s a fad City experts anticipate to proceed, making it worth a close search in my point of view.

Payouts are anticipated to climb 8%, to 32.3 p per share, this year. Dividend development is anticipated to increase to 10% in 2025, leading to a full-year payment of 35.5 p.

Forecasts for following year are sustained by anticipated earnings increases of 7% and 12% in 2024 and 2025 specifically. As an effect, approximated returns for both years are covered 2.1 times by anticipated incomes.

Both analyses are over the safety and security criteria of 2 times, offering returns projections with added steel.

BAE additionally has solid monetary structures to money returns in situation incomes dissatisfy. Profits might disappoint price quotes because of provide chain problems, for example, a substantial hazard to support companies’ yearly incomes today.

The Footsie company had ₤ 2.8 bn of money on the annual report since June.

BACHELOR’S DEGREE Systems’ order stockpile is rising, and it struck a document ₤ 74.1 bn at the middle of 2025. It looks readied to maintain climbing as well, which bodes well for longer-term returns.

Airtel Africa

Dividend return: 5.4% for 2025, 5.5% for 2026

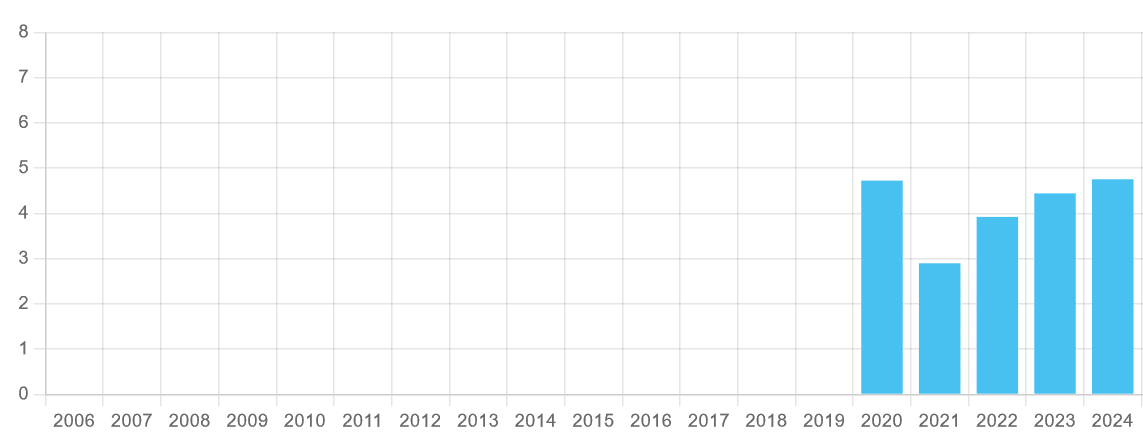

Telecoms supplier Airtel Africa (LSE:AAF) does not have a lengthy document of returns development like BAE. It’s just been provided on the London Stock Exchange for 5 years. It additionally reduced the yearly payment in 2021 as it rebased returns to reduce financial obligation.

However, money payments have actually risen ever since, and by greater than double-digit portions from time to time. It’s a fad that City brokers anticipate to continue.

For this fiscal year (to March 2025), a complete returns of 6.52 United States cents per share is anticipated, up 10% year on year. An additional 3% increase is expected for monetary 2026, to 6.70 cents.

However, I need to advise that Airtel’s projections aren’t as durable as I ‘d preferably such as.

Profits are skidding reduced because of negative money motions (EBITDA went down 16.5% in between April and September). And take advantage of degrees are dramatically expanding, with net-debt-to-EBITDA climbing to 2.3 times since September.

Falling incomes additionally imply returns cover transforms adverse for this year, with anticipated incomes of 46.7 United States cents per share projection. On the plus side, City experts anticipate earnings to rebound highly in monetary 2026, leaving durable returns cover of 2.7 times.

Yet regardless of the unclear near-term overview, I still think Airtel Africa shares deserve major factor to consider by risk-tolerant capitalists.

What’s extra, I think the lasting image right here stays very appealing. Telecoms need for Africa remains to rocket, with Airtel’s consumer base climbing 6.1% year on year to 156.6 m in September.