Some of our friends are permabears. They are clever financial experts and planners that often tend to be bearish. We aim to them for a complete evaluation of what can fail for the economic climate and the stock exchange. They are really singing and gas great deals of pessimism regarding the future amongst the monetary press and the general public.

In action, to offer some equilibrium, we analyze what can go right. Often, we locate that the permabears have actually missed out on something in their evaluations. Since they emphasize the downsides, they frequently stop working to see the positives, or they place unfavorable rotates on what’s basically favorable.

We seldom have anything to contribute to the bearish situation since the bears’ evaluations often tend to be so thorough. So our efforts to offer equilibrium frequently create us to emphasize the positives while still recognizing the downsides. Not remarkably, we obtain slammed for being as well favorable when it pertains to the overview for the United States economic climate and stock exchange and obtain called “permabulls.”

That’s alright with us, considering that the United States economic climate frequently expands at a strong rate, and the stock exchange has actually gotten on a favorable lasting uptrend consequently. Consider the following:

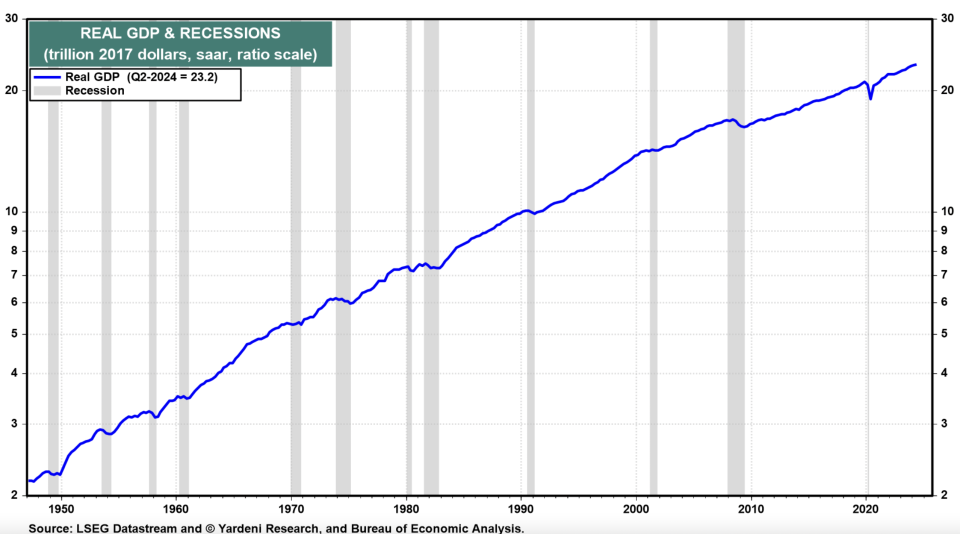

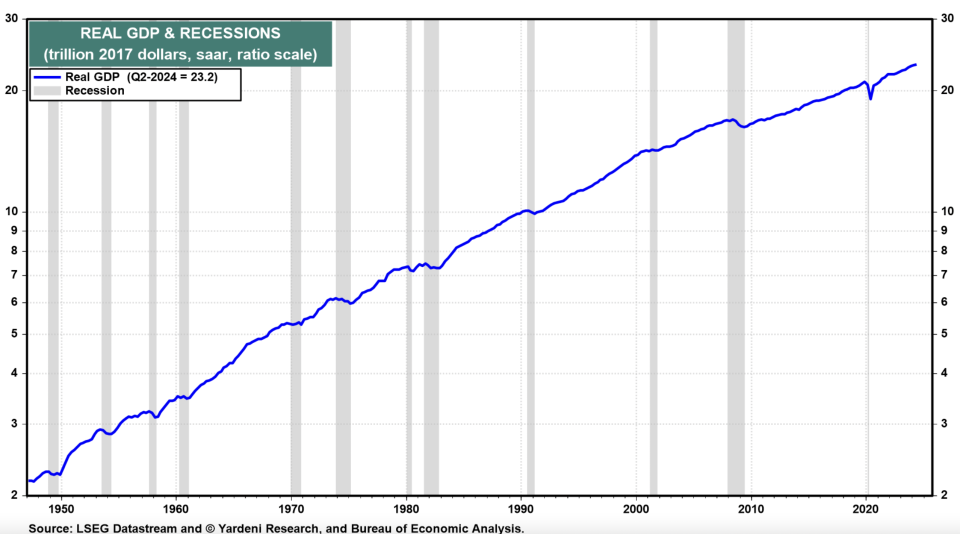

1. Recessions are irregular and do not last long

In the United States, the National Bureau of Economic Research (NBER) is the authority that specifies the beginning and finishing days of economic downturns. According to the NBER, the ordinary United States economic downturn over the duration from 1854 to 2020 lasted around 17 months.

In the article-World War II duration, from 1945 to 2023, the ordinary economic downturn lasted around 10 months. Since 1945, there have actually been 12 economic downturns that happened throughout simply 13% of that time period.

2. Bear markets are additionally irregular and do not last long considering that they often tend to be brought on by economic downturns

There have actually been 28 bearishness in the S&P 500 considering that 1928, with a typical decrease of 35.6%. The ordinary size of time was 289 days, or approximately 9.5 months. ABC News reported that considering that World War II, bearishness typically have actually taken 13 months to go from top to trough and 27 months for the supply rate index to recover shed ground. The S&P 500 index has actually dropped approximately 33% throughout bearishness over that time framework.

3. United States Economy: Significant Upward Revisions Show No Landing

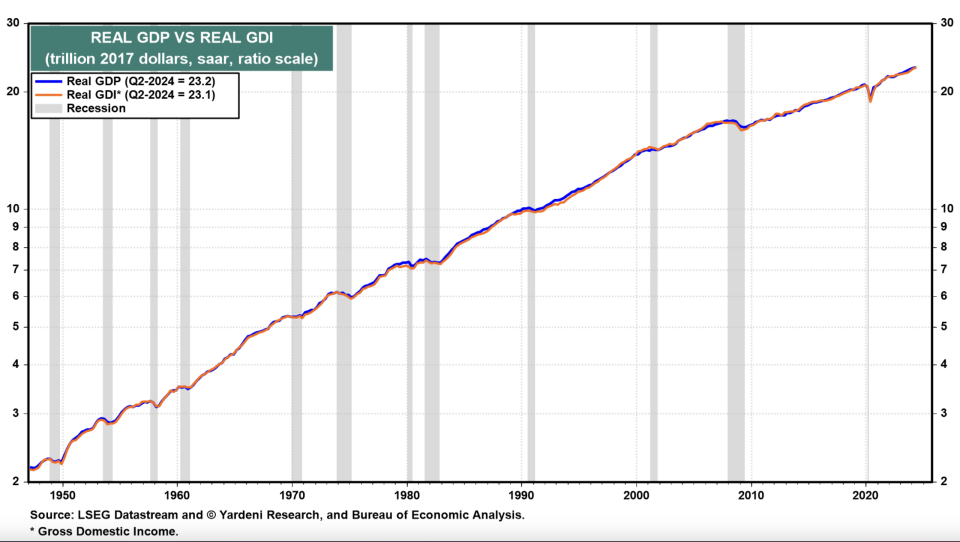

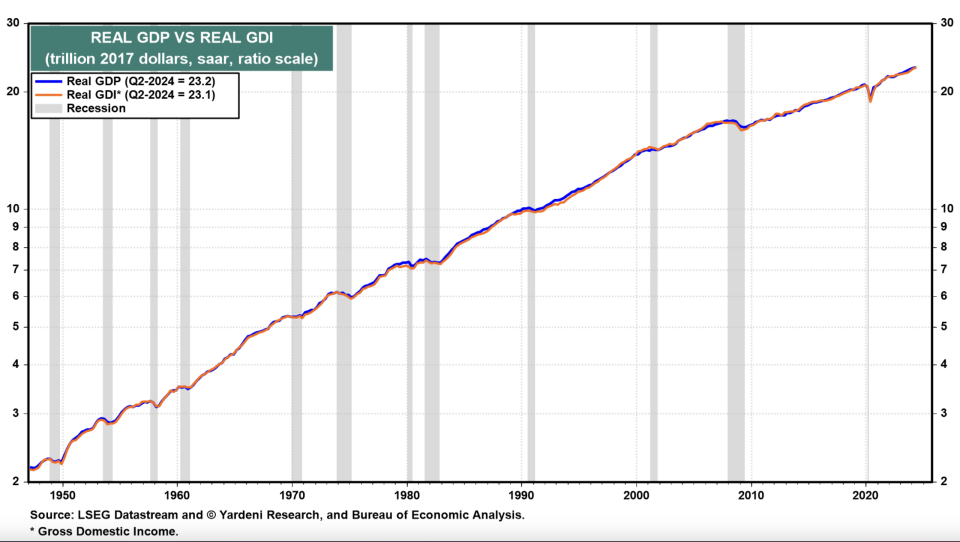

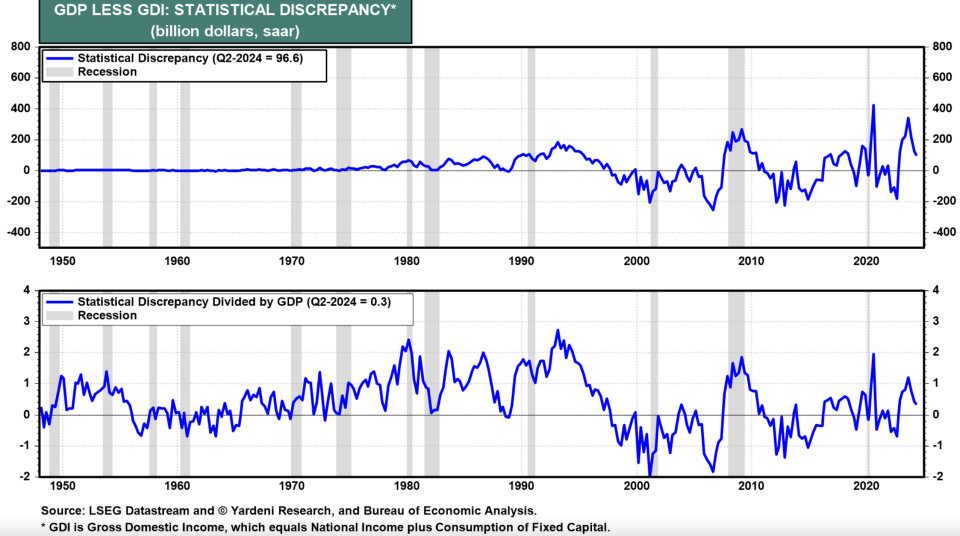

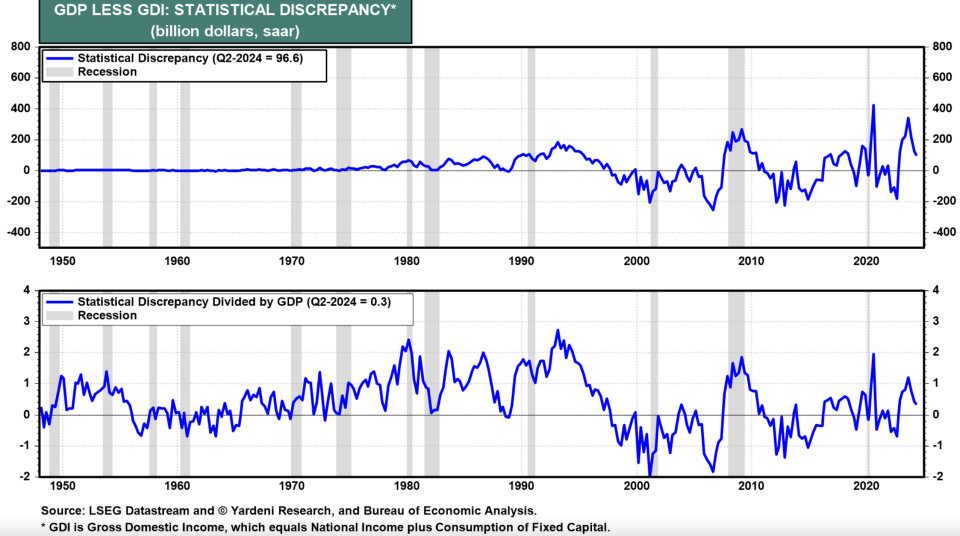

Among the current cynical circumstances of the permabears is that actual Gross Domestic Production (GDP) has actually been expanding quicker than actual Gross Domestic Income (GDI). The 2 alternate actions of the United States economic climate have significantly diverged, recommending that something is incorrect with the actual GDP information which it is bound to be changed downward, constant with the cynics’ pessimism. They have not discussed why they consider the GDI information to be a much more exact step of financial task than the GDP information.

Indeed, the Bureau of Economic Analysis (BEA), which puts together both collection, prefers GDP over GDI: “GDI is an alternative way of measuring the nation’s economy, by counting the incomes earned and costs incurred in production. In theory, GDI should equal gross domestic product, but the different source data yield different results. The difference between the two measures is known as the ‘statistical discrepancy.’ BEA considers GDP more reliable because it’s based on timelier, more expansive data.”

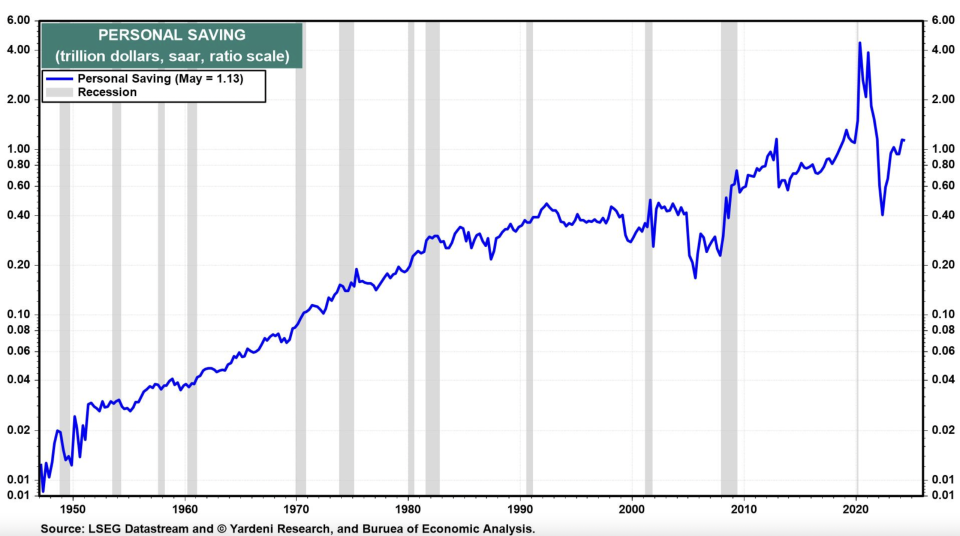

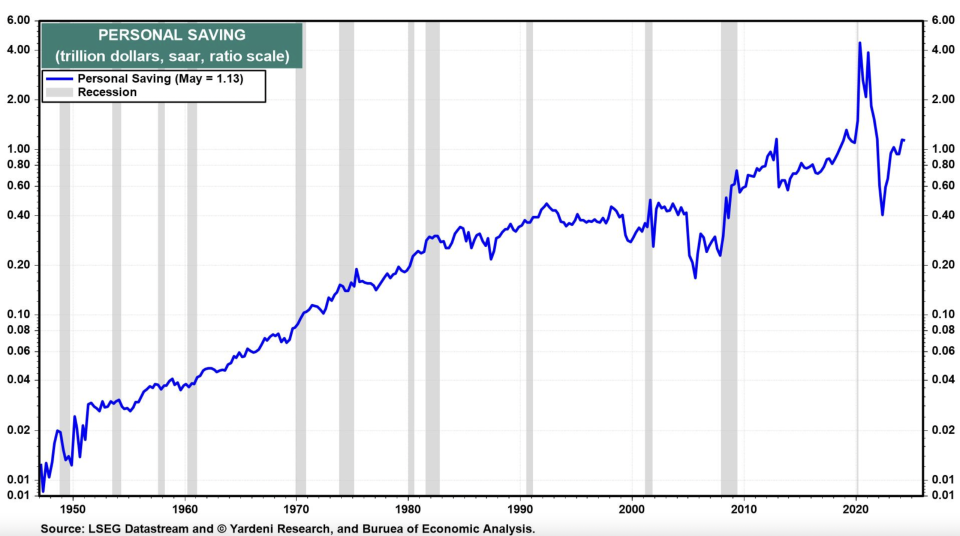

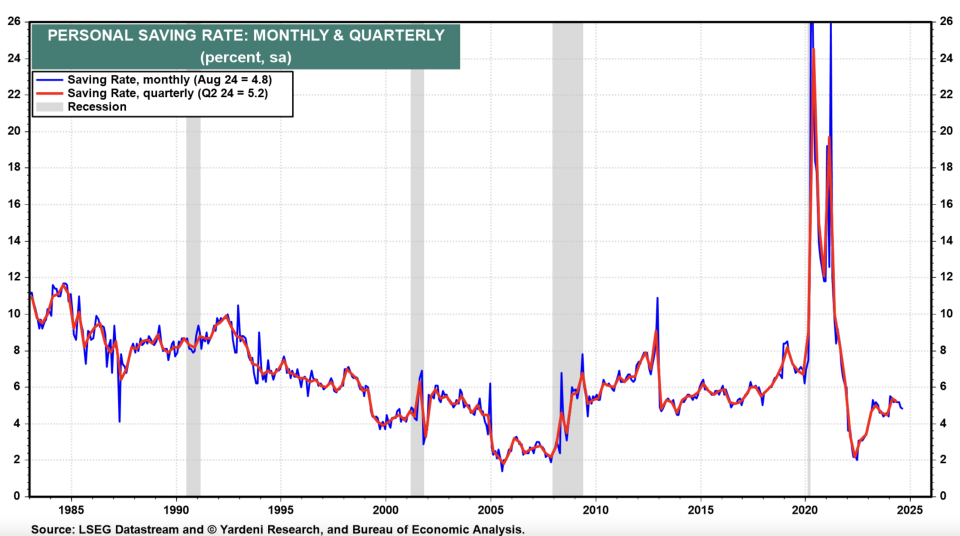

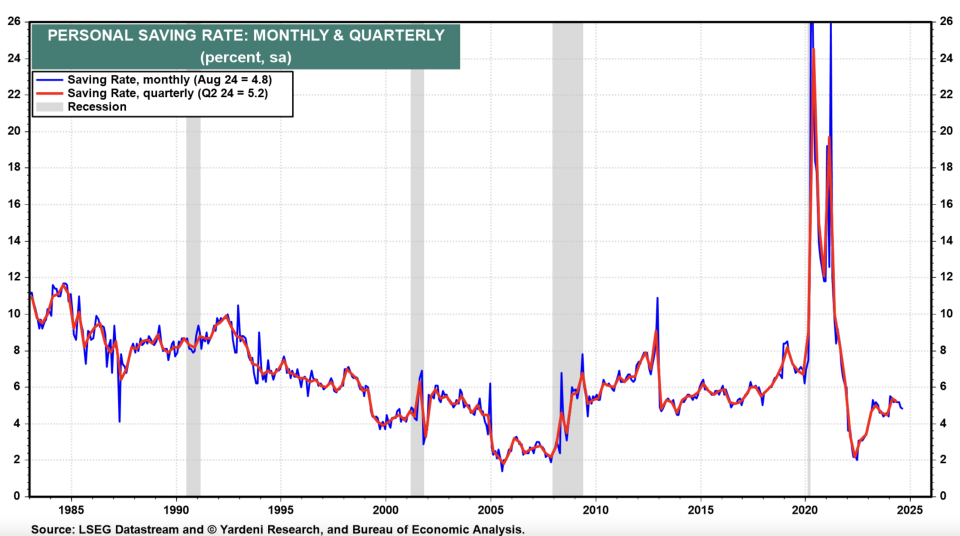

Meanwhile, the permabears have actually additionally been calling the alarm system bell regarding the individual conserving price recently. It had actually gone down to 3.3% throughout Q2-2024, according to the previous price quote, the most affordable considering that Q3-2022. One permabear composed on September 25 that “history suggests when the SR sinks this low, it usually proves unsustainable with a subsequent rise triggering a recession.

The slide in the SR from 4% at the start of this year was not due to households dipping into to their pandemic-era excess savings, which have been long since spent. But it seems that households have become used to running down their savings and can’t break the habit.” His verdict was that “the super-low US saving ratio [is] a ticking economic timebomb.”

The really following day, on September 26, the BEA launched its newest modifications of Q2-2024 GDP and GDI. Much to the shame of the permabears, actual GDI was changed substantially greater, led by a higher modification in earnings and wages– which additionally created a substantial higher modification in the individual conserving price!

Here is the delighted information from the BEA:

( 1) GDP & & GDI.

Real GDI enhanced 3.4% (saar) in Q2, a higher modification of 2.1 ppts from the previous price quote.Real GDP climbed an unrevised 3.0% throughout Q2. The standard of actual GDP and actual GDI– a supplementary step people financial task that just as weights GDP and GDI– enhanced 3.2% in Q2, a higher modification of 1.1 ppts from the previous price quote.

Even Q1’s numbers were changed greater, also much to the bears’ shame. Real GDP was changed up from 1.4% to 1.6%, and actual GDI was changed up from 1.3% to 3.0%. The standard of the GDP and GDI was increased from 1.4% to 2.3%.

The analytical disparity in between both actions of the economic climate is small currently. In existing bucks, it was changed to 0.3% from 2.7% throughout Q2.

( 2) Personal cost savings

Personal conserving was $1.13 trillion in Q2, a higher modification of $74.3 billion from the previous price quote.

The individual conserving price– individual conserving as a percent of non reusable individual earnings– was 5.2% in Q2, compared to 5.4% (changed) in Q1. The previous quotes for the conserving price were 3.3% in Q2 and 3.7% in Q1.

( 3) Wages & & wages(* )upwards modifications to both the GDI and the individual conserving price showed a higher modification in small earnings and wages settlement.

The customer investing was solid throughout the very first fifty percent of the year, while the individual conserving price stayed fairly high, and definitely more than the So projection.“timebomb”( 4)

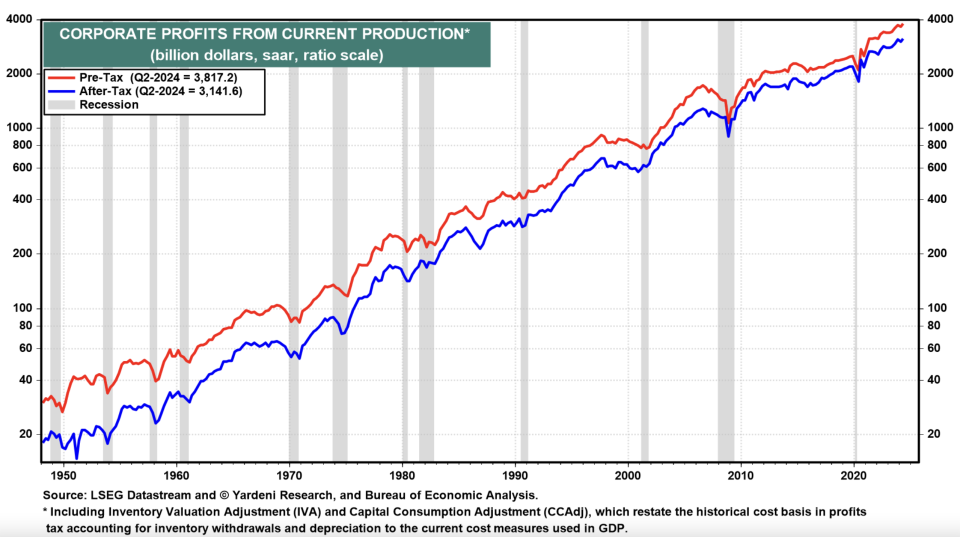

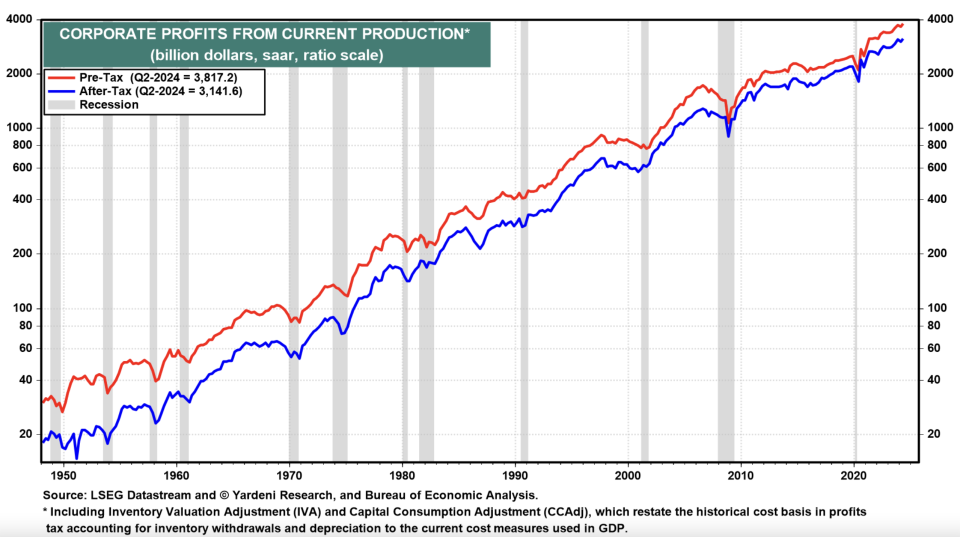

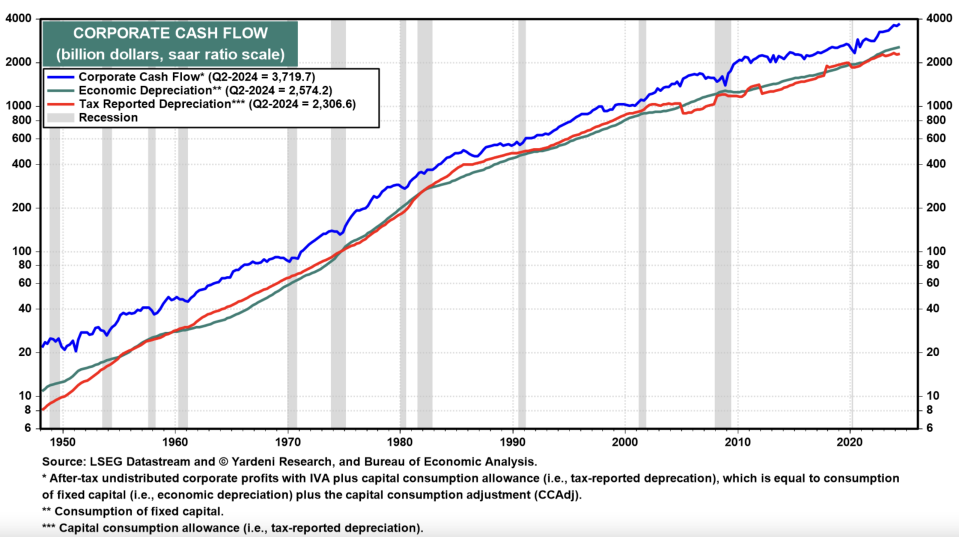

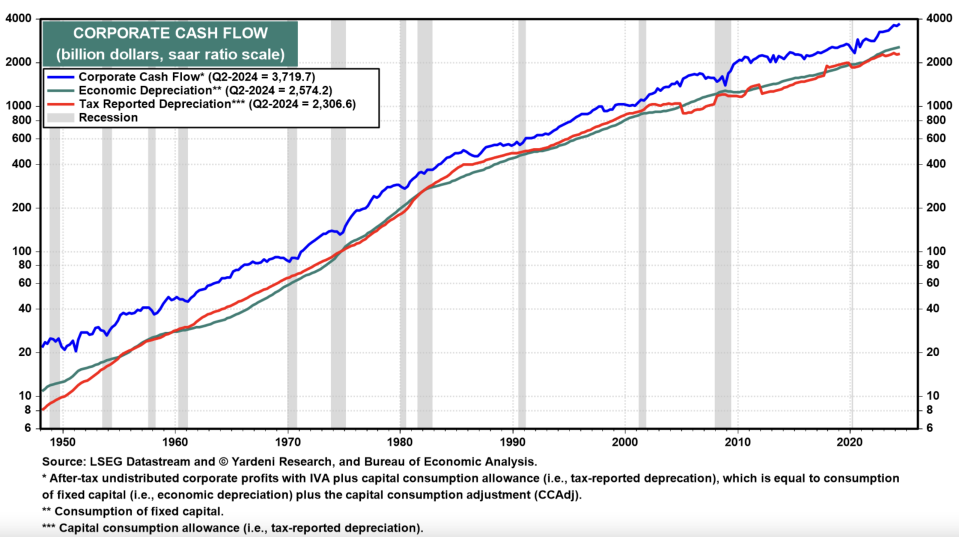

earningsCorporate’s much more:

There- tax obligation business benefit from existing manufacturing (business earnings with supply evaluation and funding intake changes) was changed up by 3.5% to a document $3.1 trillion (saar).After/

So increasing to a brand-new document high of $2.0 trillion was business returns.

Also( 5)

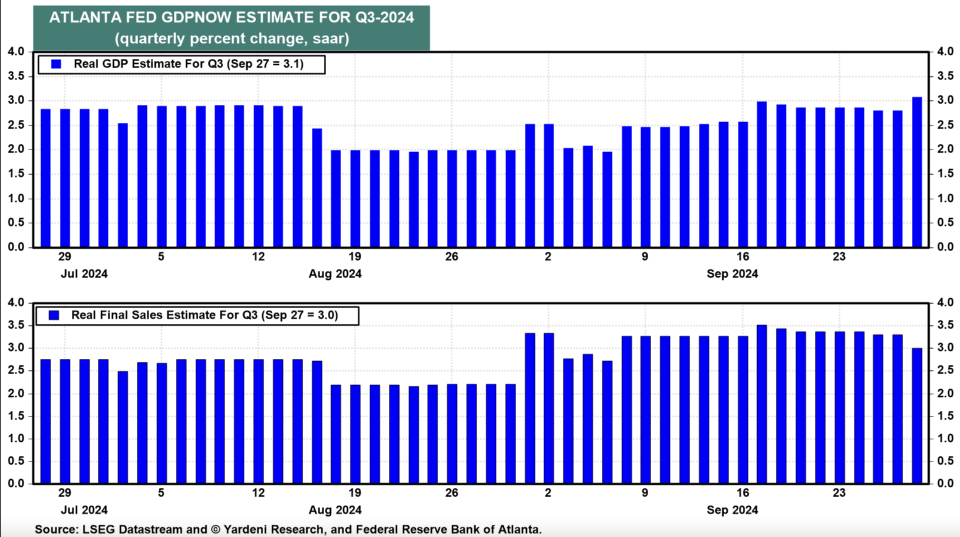

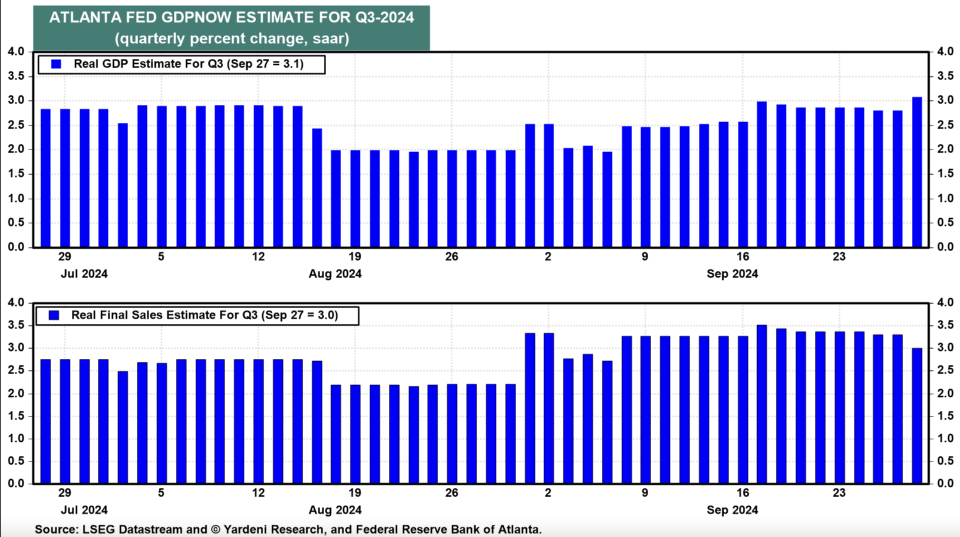

Q3’s GDP. existing quarter will certainly remain to irritate any type of staying hard-landers.

The’s The Atlanta Fed version reveals actual GDP up 3.1% (saar) throughout Q3. GDPNow‘s a higher modification from 2.9% on That 18.September GDP

Real( 6)

touchdown. No newest BEA modifications also got rid of the technological economic downturn throughout H1-2022 when actual GDP dropped 2.0% and 0.6% throughout Q1 and Q2 of that year.

The 2 numbers were changed to -1.0% and 0.3%.Those proceeds not to appear.

The “Godot recession”, a moving economic downturn has actually struck a couple of markets that were most conscious the tightening up of financial plan. Instead the general economic climate has actually stayed durable and much less interest-rate delicate than in the past.But an outcome of the most recent criteria modifications, Q2’s actual GDP and actual GDI are 1.3% and 3.8% higher than formerly approximated.

As’s no tough or soft touchdown in the modifications. There economic climate is still flying high, as it has actually been considering that the two-month pandemic economic downturn throughout The and March 2020!April,

So the Why Did? Fed Ease’s a great inquiry provided all the above.

That solution is that

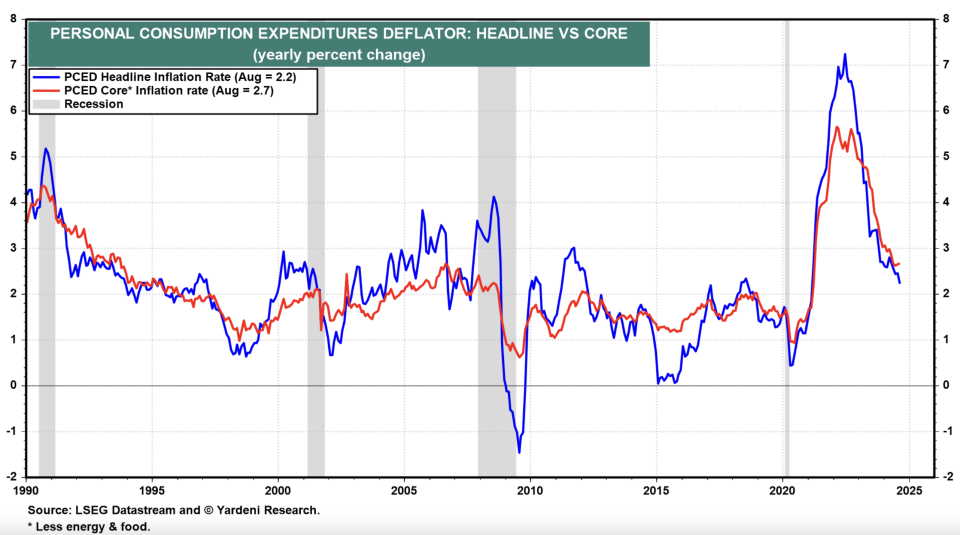

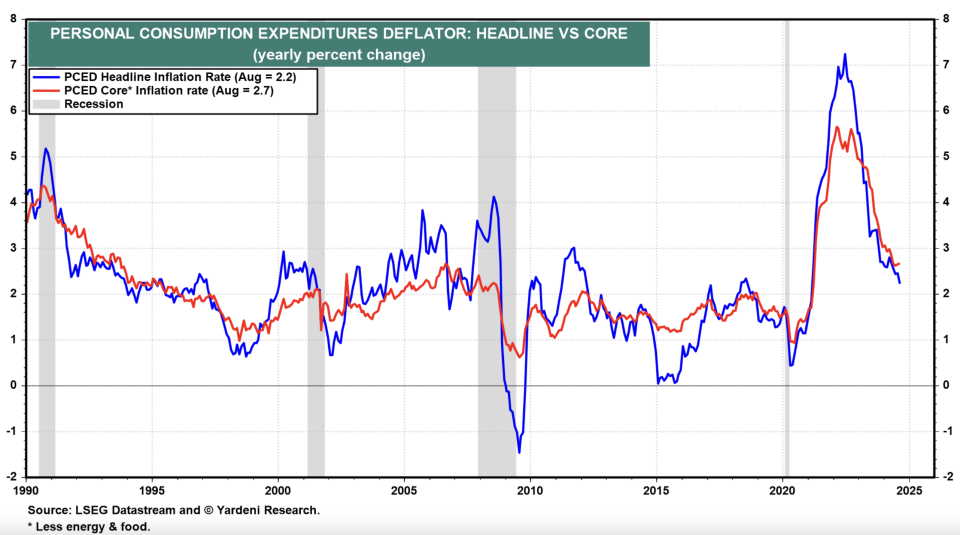

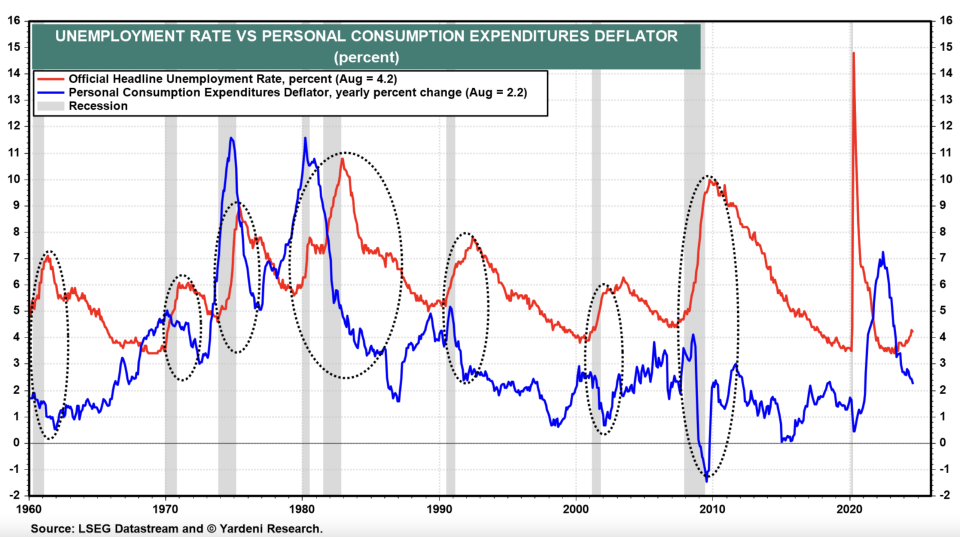

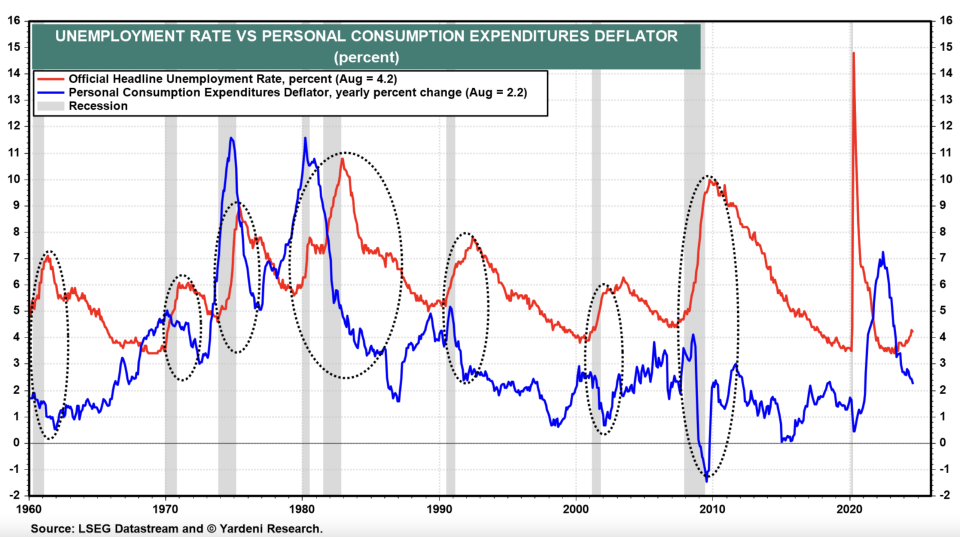

The informed the Congress to reduce by mandating that financial plan needs to intend to maintain both the rising cost of living and the joblessness prices reduced. Fed authorities can definitely declare that they have actually accomplished this amazing harmonizing act. Fed, the joblessness price was just 4.2%, and heading and core PCED rising cost of living prices were to 2.2% and 2.7%.In August PCE

Fed it was accomplished without an economic downturn as was needed in the past to do the task.“Mission accomplished!” And PCED

However andApril January’s the major factor that That & &Powell made a decision to reduce the government funds price by 50bps recently.Co picked to overlook

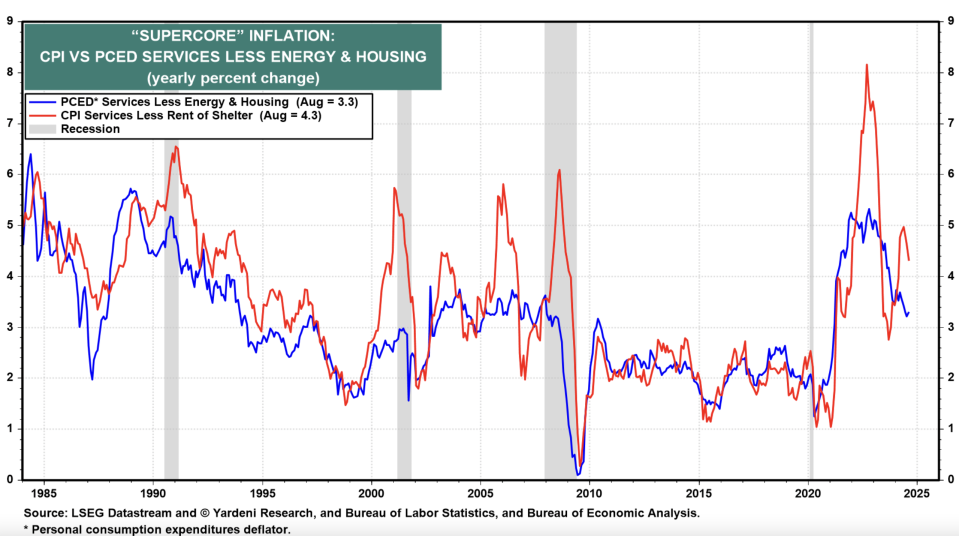

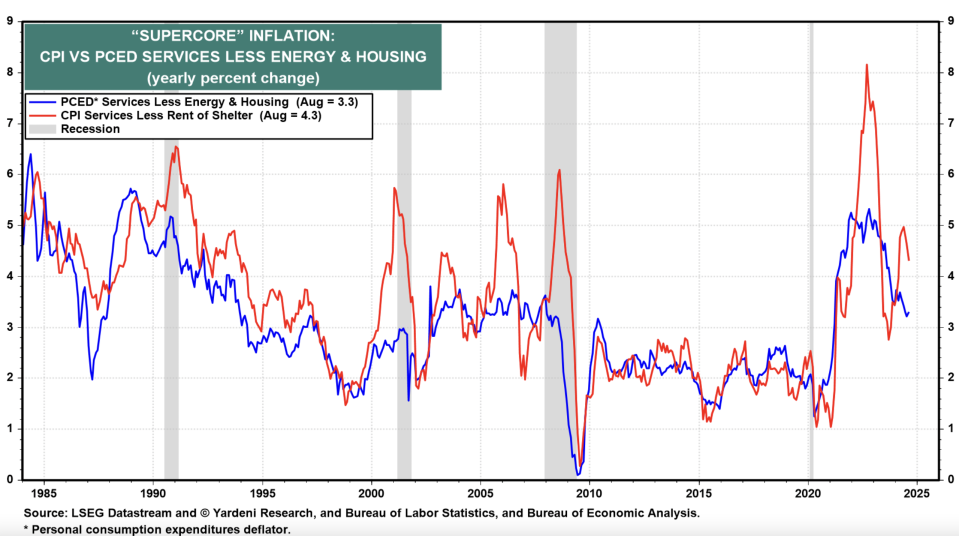

They’s sticky analyses of the August rising cost of living price (i.e., customer rate rising cost of living for solutions leaving out power and real estate), which was 3.3% for the PCED and 4.3% for the CPI.“supercore” their goal isn’t entirely achieved considered that

So very first discussed Fed Chair Jerome Powell rising cost of living in his speech at the “supercore” on Hutchins Center and Fiscal at the Monetary Policy back on Brookings Institution 30, 2022. November made a large offer regarding it. He observed that it made up over half of the core PCE index. He no more discusses it.He, discharges continue to be restrained, as shown by the newest preliminary joblessness asserts information.

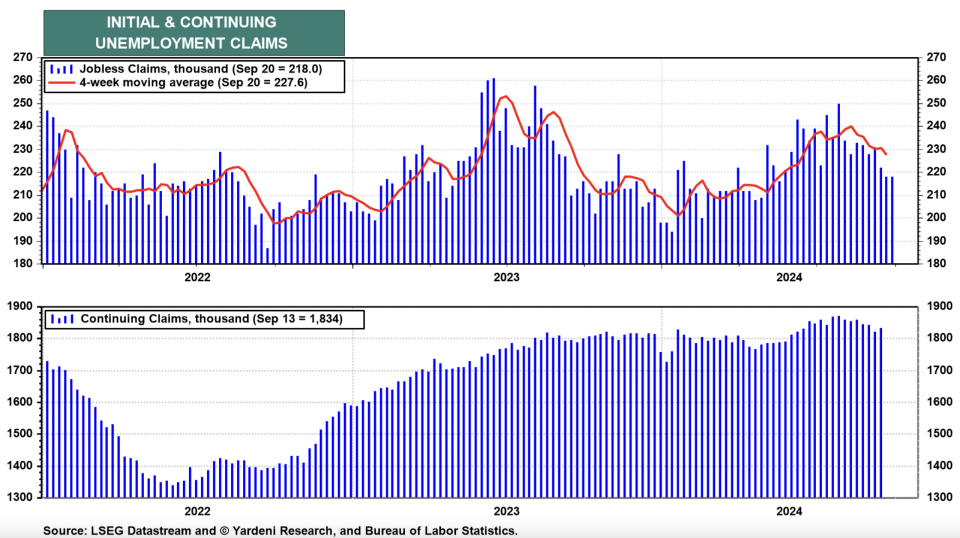

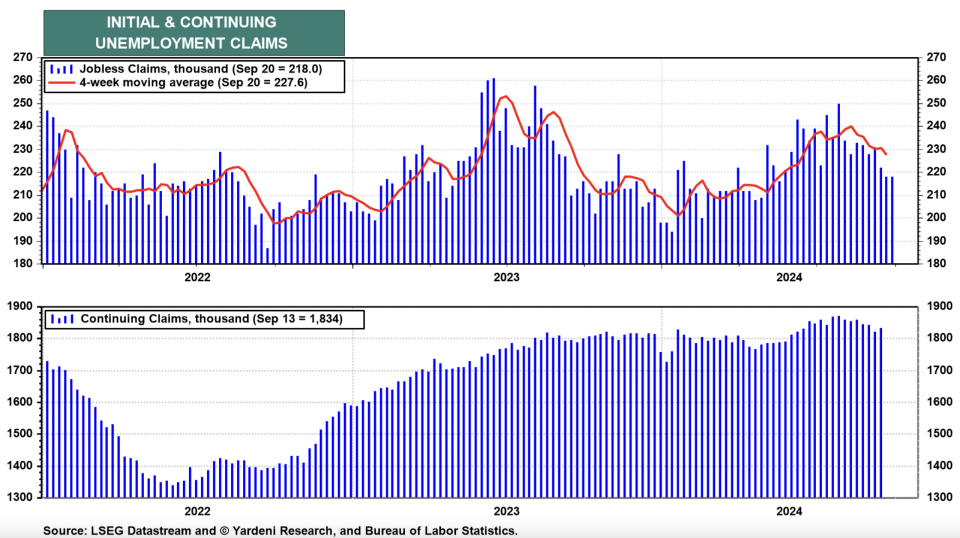

Meanwhile & &

Fed their easing of financial plan is focused on increasing financial need and the need for labor, i.e., task openings, which stayed over the pre-pandemic degrees in

So.July/

That can warm up rising cost of living. That can the monetary plans of the following resident of the So.White House why did the

So authorities choose to reduce? Fed why might they remain to reduce?And want to do so to prevent an economic downturn and to develop even more task openings.

They want to take the chance of blowing up customer costs along with possession costs. They desire them good luck. We any type of occasion, any type of staying diehard hard-landers need to keep in mind the old expression: In.