SBI Saving Account Holders ALERT! The State Bank of India is among the globe’s biggest banks in regards to consumer base. The SBI is usually called the lender of every Indian as it offers over 50 crore consumers. With consumers going electronic, the financial institution has actually likewise been altering its financial design – be it its application YONO or electronic banking centers. The State Bank of India has actually been functioning to enhance its consumers’ financial experience and hence has actually been turning out several centers. Just like any kind of various other financial institution, the SBI likewise gives its consumers with Debit Cards, widely called bank card. An bank card makes it possible for individuals to take out money from Atm machines and make on the internet settlements for buying. However, providing a bank card and guaranteeing its correct capability is extra intricate than it appears.

Have you ever before inspected your SBI passbook specifically? When you will certainly examine the entrances in your passbook or examine the message gotten from the financial institution periodically, you will certainly discover that the financial institution has actually debited Rs 236 from your savings account without you doing any kind of such purchase. If yes, after that we have its response for you. Actually, the cash obtained subtracted from your account under the yearly maintenance/service cost for the Debit/ bank card you have actually been making use of.

SBI gives a selection of debit cards to its consumers, with a lot of being Classic, Silver, Global, or Contactless cards. The financial institution bills a yearly upkeep cost of Rs 200 onwards for these cards. Now, you may ask yourself if the AMC cost is Rs 200, why the SBI deducted Rs 236 rather? This is since the federal government levies 18% GST on the deals performed by the financial institution. So, rather than paying GST from its pocket, the financial institution subtracts the GST from the consumer’s cost savings financial institution account. So, Rs 200 +18% of Rs 200 = Rs 200+Rs 36 = Rs 236. Hope, all your uncertainties are removed currently and you need not check out the financial institution for the exact same.

.

.(* )the SBI consumers having

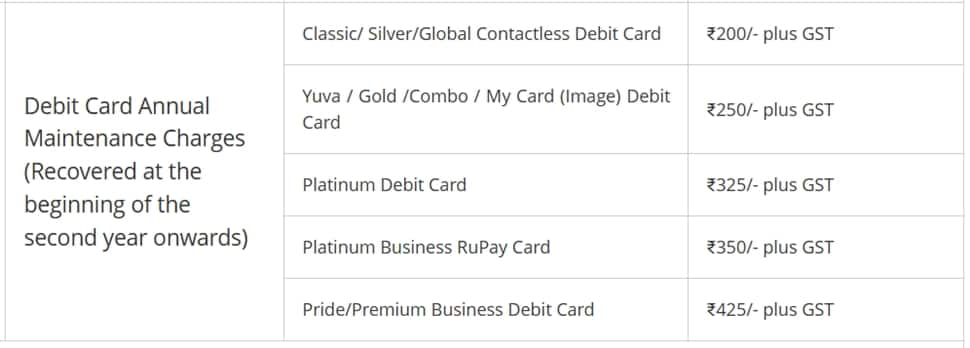

While/ Classic/Silver are billed Global Contactless Debit Card 236, those having costs debit cards are billed extra according to the offered table (Rs leaving out GST of 18%). Amounts ought to likewise keep in mind that the yearly upkeep cost is

You 250+ GST for Rs/ Yuva/Gold/ Combo (My Card) Image, Debit Card 325+ GST for Rs, Platinum Debit Card 350+ GST for Rs/Pride and Premium Business Debit Cards 425+ GST for Rs/PridePremium Business Debit Cards