Boosting production, rationalizing obligations and making it possible for convenience of organization mark are most likely to be the emphasis of Budget 2025

found out more

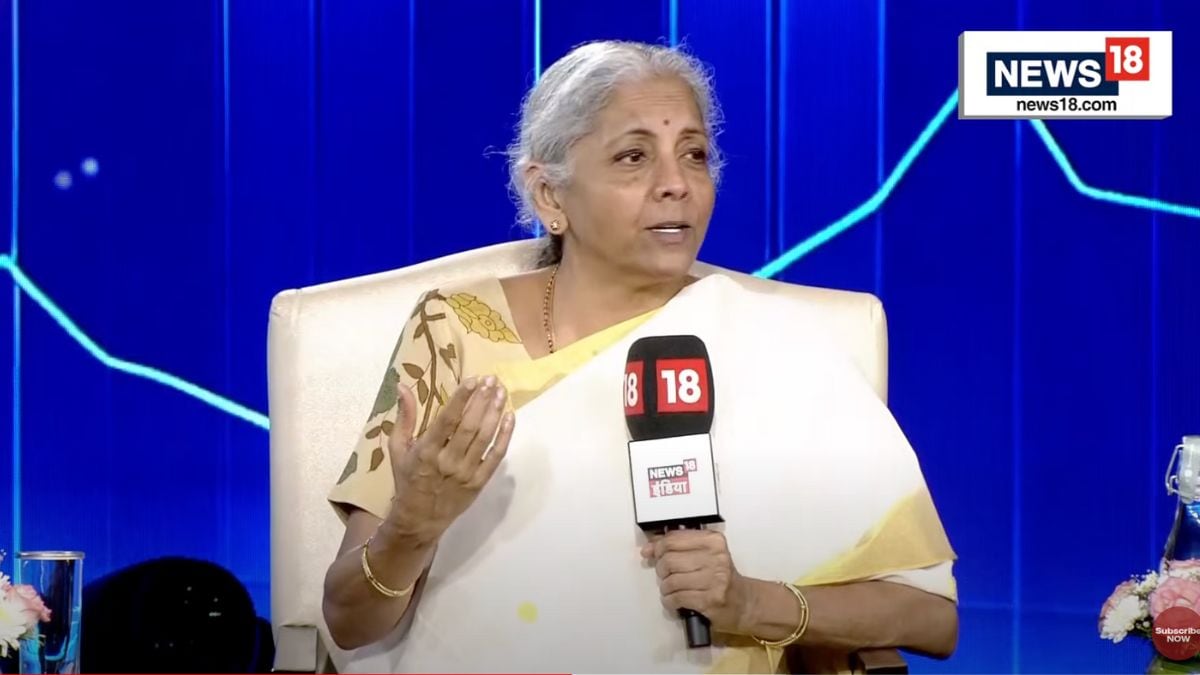

Finance Minister Nirmala Sitharaman is arranged to provide the Union Budget 2025 in the Lok Sabha on 1 February 2025. This will certainly be the money preacher’s 8th budget plan (consisting of acting spending plans) and market stakeholders, capitalists and the whole nation, are anticipating a multitude of actions to be introduced, particularly taking into consideration the wellness of the rupee, climbing center course prices and a basic impact of torpidity of development in the economic situation.

The Budget assumptions can extensively be separated right into 3 significant containers– for the general advancement of the economic situation, convenience of doing organization for the market and re-look at task prices/ exceptions for numerous items and solutions.

The general advancement of facilities requires in the nation has actually advanced continuously given that the turn of the years in 2020. There has actually been initiation of facilities hallways, PLI systems to advertise residential production, and various other systems to relieve basic market development. Two popular assumptions this time around attribute around the MOOWR system [Manufacturing in Warehouse Scheme] under Customs regulations, and as constantly, enhancing or brand-new/ re-introduction of PLI systems.

The MOOWR system offers incentive to residential production and provides exemption/deferment of task relevant on resources items and inputs at the time of import. A considerable suggested adjustment in the MOOWR system (although not effectively) is items can be imported under the MOOWR system, offered that the relevant Integrated GST (IGST) are paid at the time of import. While IGST is praiseworthy, ahead of time repayment of IGST can impact functioning resources. Thus, the brand-new arrangement needs to remain to remain in abeyance for fulfilment of the Make in India vision of the federal government.

With regard to PLI systems, there have actually been rated success given that their intro. Teething issues exist particularly in locations of step-by-step conformity under residential worth enhancement, extraordinarily stringent accreditation and dispensation of motivations. PLI systems need to be re-looked right into to improve procedures, particularly where conformity and accreditation is rigid, and problems of dispensation to guarantee more success of the systems. New systems favouring sunlight industries [growth of MSME(s), manufacturing of EV passenger cars] where there is energetic possibility to boost and incentivize production, need to additionally be taken into consideration.

Ease of operating is an expression that is listened to today in all hallways with rather staggered functional application. The amnesty system for pending Customs situations has actually been ask currently for nearly 3 Budget speeches with little grip from theGovernment Automation of Customs entrances and intro of innovative technical procedures, particularly in ICEGATE, to improve with various other on the internet features, are an additional conclusive ask. The federal government needs to currently provide severe idea to executing such actions (particularly the Customs amnesty system) to relieve the demands of the market. The Special Valuation Branch procedure of Customs remains in the demand of severe overhaul as SVB situations go means past the suggested SOP( s) and remain on for years mostly as a result of the lethargy of the Branch policemans. New SOP( s) consisting of correct furniture of examination records to all stakeholders is a major demand of the hour. Another considerable ask is the expansion of FTA advantages (offered for typical imports) to clearance( s) from SEZ( s) to Domestic Tariff Area [where the goods are eligible for FTA benefit] and the exact same need to additionally be seriously taken into consideration. Payment of IGST as a responsibility of personalizeds, social well-being additional charge and so on with task debt scrips need to additionally be taken into consideration.

Ease of operating needs to additionally be prolonged by releasing information on controversial problems. For instance, irreversible transfer of intangibles like copyright, carbon debts and so on are taken into consideration a supply of items. However, for export and import of items, the GST regulations recommend physical motion of items right into/ outdoorsIndia There need to be making it possible for stipulations for such intangibles (where physical motion is difficult) which give up the demand of physical motion and rather depend upon transfer of title. This would certainly make it possible for export advantages to be offered for residential providers. Similarly, for imports, comparable stipulations like reverse cost repayment (like import of solutions) need to be made the standard. Payment of GST The Government needs to bear in mind that“ease of doing business” Setting up restricted information centres, and worldwide assistance centres in India have actually just recently obtained grip. These centres mainly delight in export of solution entering considerable forex right intoIndia Excluding Net Foreign Exchange factors to consider for them (if established in SEZ and STPI) like IFSC devices and making it possible for repayment of any type of residential GST relevant on import of solution, with input tax obligation debt (rather than repayment in cash money), can be a substantial development enabler for this field.

A discussion on the re-look of task prices/ justification of toll have to constantly begin working frameworks. There are several items where the import of completed items undergoes NIL task (either by toll or with FTA) whereas import of resources for residential manufacture undergoes relevant personalizeds obligations. There requires to be assessment with market to advertise residential manufacture, where the import of resources need to be incentivised to NIL or really reduced prices of task, and the import of completed items based on greater prices of task. This would certainly additionally quit the flooding of the residential market with economical sub-standard imports of completed items from adjoining nations and advertise residential production, particularly amongst tiny sectors.

Other price rationalisation actions need to consist of the discussion around consistent GST pieces where biscuits and confectionary need to not be dealt with to the exact same GST prices as specific type of tires and the center course is saved from impractical GST repayments on home items. The proposition to minimize GST on clinical insurance coverage to 5% need to be truly executed. Other actions need to consist of information and extensive checklists provided to streamline category of specific telecommunications and IT items [where goods – merely because they talk about certain technology (like LTE etc.) are denied applicable customs duty exemptions as the authorities deem them to be complete machines having access to technology, even when they are imported as “parts”. This would be in line with Supreme Court judgments striking down this interpretation of the Customs authorities.

An eighth Budget is almost the end of the tether where the trend has been speculative and hit and miss policy decisions without any practical implementation to alleviate the economy. Time has come to really understand the needs of the Indian industry, economy and domestic households and make practical decisions which could truly help in ease of doing business instead proposals ending up as incomplete lip service after a few months.

Rajat Bose is Partner and Neeladri C is Consultant – Shardul Amarchand Mangaldas and Co. Views expressed in the above piece are personal and solely those of the author. They do not necessarily reflect Firstpost’s views.

&w=696&resize=696,0&ssl=1)