Investing in the National Pension System (NPS) is a long-lasting dedication, however life does not constantly wait till retired life. What if you require funds for a clinical emergency situation, your youngster’s education and learning, or perhaps to begin a service? While NPS has a rigorous lock-in duration, the Pension Fund Regulatory & & Development Authority (PFRDA) permits partial withdrawals under particular problems– using a method to access a few of your cost savings without damaging the long-lasting retirement.

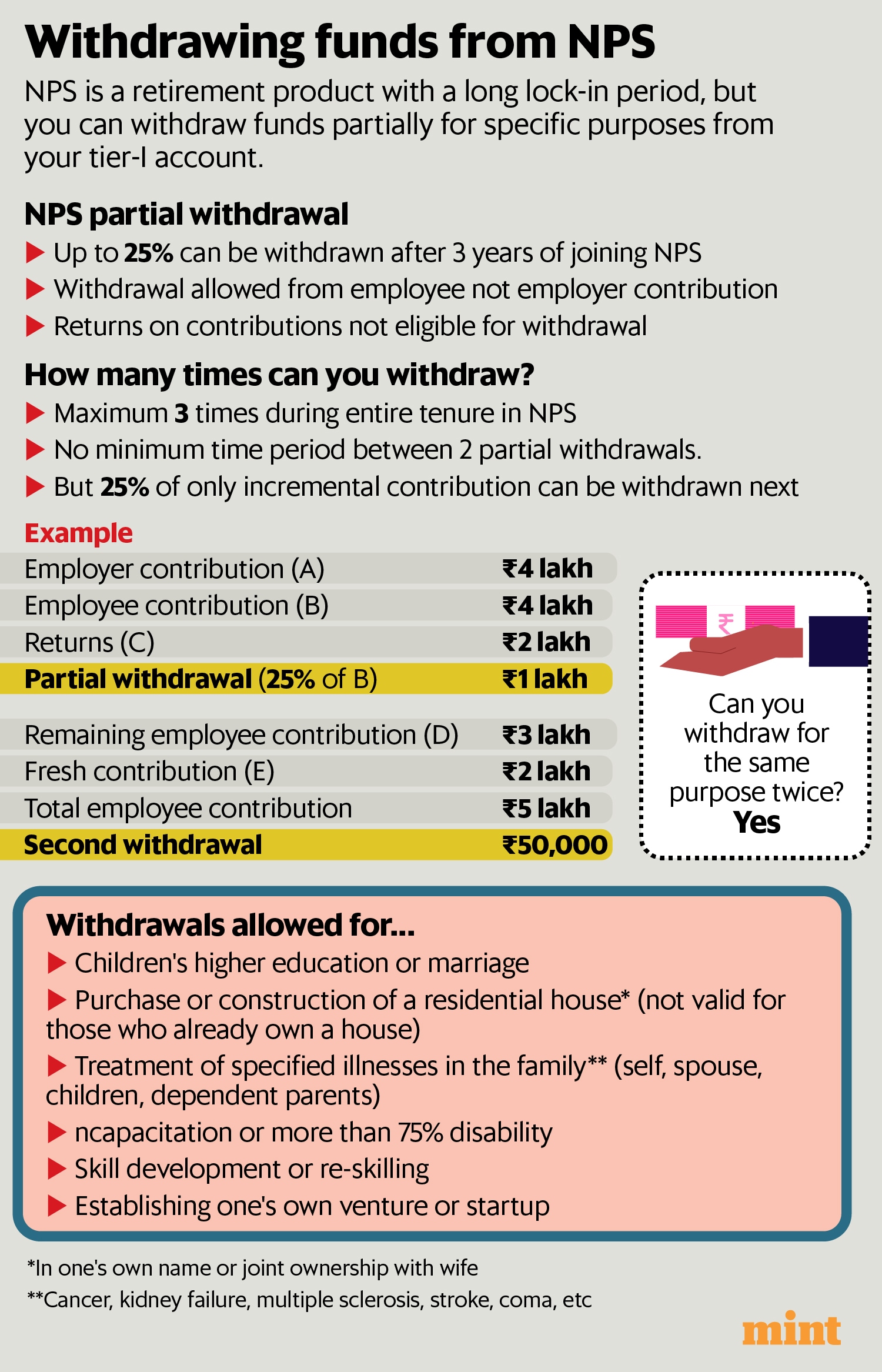

Subscribers can take out as much as 25% of their very own payments after finishing 3 years in the plan. This can be reconstructed to 3 times prior to leaving NPS. However, there’s a catch: just the primary quantity added by the person is qualified for withdrawal, while the company’s payments and financial investment returns continue to be unblemished. Understanding exactly how these withdrawals job can aid you prepare your financial resources far better and prevent unanticipated obstacles.

Read this|Should you go with both NPS and EPF in the brand-new tax obligation regimen?

Take an instance: if your individual payment to NPS is 4 lakh and your company has actually included the very same quantity, with returns on both payments amounting to 2 lakh, you can take out just 25% of your very own 4 lakh– significance 1 lakh. The company’s share and the financial investment gains remain secured.

Subsequent withdrawals are determined based upon extra payments made after the very first withdrawal. If, after taking out 1 lakh, you add an additional 2 lakh, just 25% of that brand-new payment– 50,000– will certainly be offered for the 2nd withdrawal.

View Full Image

When can you take out?

PFRDA has actually described particular factors for which these withdrawals can be made.

These consist of moneying a youngster’s college or marital relationship, acquiring or building a residence (as long as you do not currently have one, leaving out genealogical residential property), and covering clinical expenditures for crucial diseases such as cancer cells, kidney failing, or significant surgical procedures.

Additionally, funds can be taken out to sustain ability advancement, self-improvement programs, or perhaps to develop a service or start-up. Interestingly, the very same objective can be pointed out for several withdrawals, as long as they drop within the total restrictions.

For those with an NPS Tier- II account, withdrawals are a lot more versatile. There are no limitations– funds can be taken out completely or partly at any moment, making it a much more fluid alternative for those that desire the tax obligation advantages of NPS while preserving ease of access. However, it is very important to keep in mind that Tier- II payments and gains do not get tax obligation advantages.

Read this|Slow and constant: How an easy technique to spending safeguarded this Mumbai- based chief executive officer’s retired life future

In the unfavorable occasion of the customer’s fatality, the whole corpus is offered for withdrawal by the candidate or lawful successor.

View Full Image

How to take out funds

The withdrawal procedure itself is uncomplicated.

Log in to your NPS account utilizing your PRAN (Permanent Retirement Account Number) and password, browse to the withdrawal area, and start a demand. The system needs confirmation of your name and savings account information with OTP or eSign, however no sustaining files are required– simply a self-declaration specifying the objective of withdrawal.

For those choosing an offline technique, PFRDA-appointed factors of visibility (PoPs) can promote the procedure.

What concerning early leave?

If you’re taking into consideration leaving NPS prior to transforming 60, be planned for some limitations.

Premature departures are permitted just after 5 years of subscription, and also after that, just 20% of the corpus can be taken as a round figure. The continuing to be 80% needs to be made use of to buy an annuity, making sure a constant revenue stream. The just exemption is if the overall corpus is much less than 2.5 lakh, in which situation the whole quantity can be taken out.

Also review|Why Sumit Shukla has actually funds bound in NPS tier-II, not MFs

Understanding these regulations can aid you prepare your NPS withdrawals sensibly, guaranteeing you take advantage of your retired life cost savings while preserving economic versatility forever’s significant expenditures.