Even as China presses to restore customer need, experts continue to be hesitant. Citic Securities anticipates a moderate 0.3 percent increase in customer rates this year, with manufacturing facility rates not turning up in environment-friendly, yet just tightening their decrease to 1.4 percent in 2025

learnt more

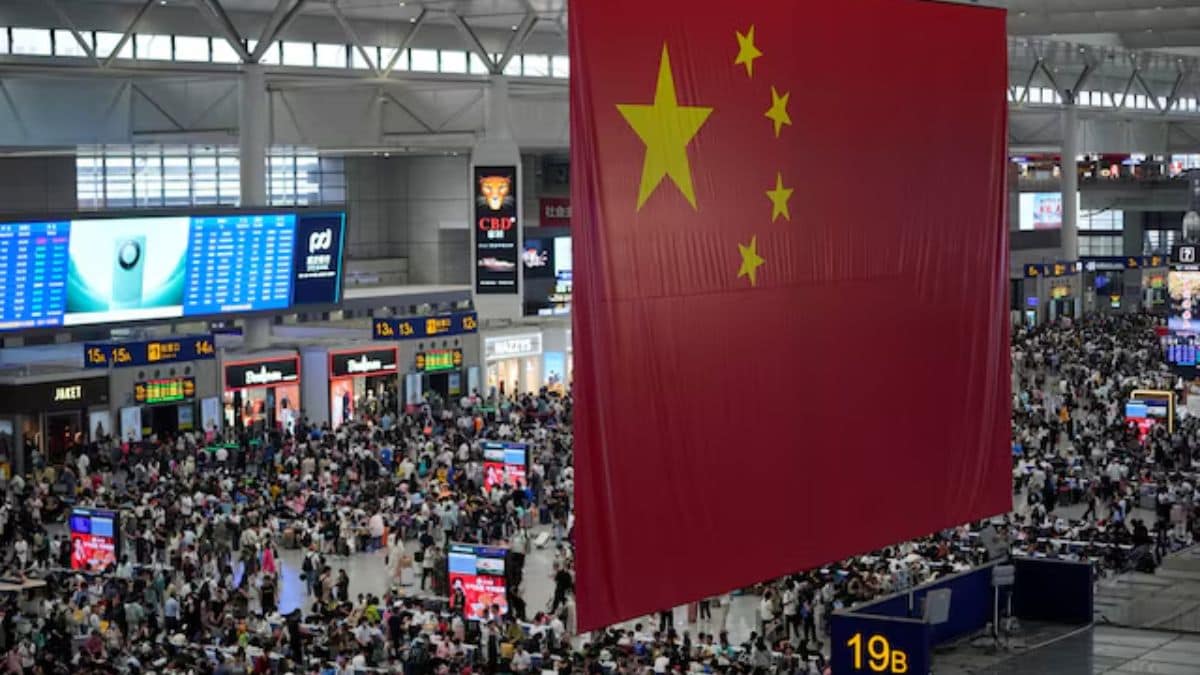

A seasonal increase from Lunar Year costs was anticipated to bring wish to China’s economic climate, decreased by numerous institutional issues.

However, despite the fact that the joyful period offered an increase customer rates, pressing them up in January, it’s no place near sufficient to promise.

With changes in United States plan under President Donald Trump developing brand-new financial unpredictabilities, the anxiety of the Chinese economic climate not prospering throughout 2025 continue to be. In reality, regardless of the much waited for rising cost of living uptick, experts claim the nation still deals with deflationary stress and weak residential need, South China Morning Post reported.

Consumer rates increased 0.5 percent year-over-year in January, China’s National Bureau of Statistics reported Sunday (February 9), adhering to a 0.1 percent rise inDecember The number remains in line with financial experts’ assumptions, yet it additionally demonstrates how vulnerable residential need continues to be.

Even the biggest rise in rates in over 3 years was a meagre 0.7 percent, tape-recorded in the month prior. That as well, was just subordinate as a result of vacation costs.

On the various other hand, manufacturing facility rates proceeded their long term decrease, with the manufacturer consumer price index (PPI) dropping 2.3 percent inJanuary That noted the 28th successive months of tightening. It was additionally even worse than experts’ assumptions. Those surveyed by monetary information supplier Wind had actually forecasted a 2.07 percent decrease.

Since April 2023, near-zero CPI development has actually sustained issues concerning depreciation. Last month, durable goods rates inched up simply 0.1 percent year-over-year, while solutions increased 1.1 percent. Food rates boosted by 0.4 percent, and non-food rates climbed up by 0.5 percent.

Amid these weak signs, a lot of Chinese districts have actually reduced their rising cost of living targets for 2025 to around 2 percent, below the standard 3 percent. Nationally, customer rates increased simply 0.2 percent in both 2023 and 2024– the tiniest yearly rises because 2009.

In December, Beijing recognized the threat of constantly weak rates, listing “promoting a reasonable rebound in prices” as a vital goal.

SCMP reported that Li Chao, primary financial expert at Zheshang Securities, created late in Janaury that the federal government’s declaration signified a concentrate on the consistent descending fad in rates.

Yet also as Beijing presses to restore customer need, experts continue to be hesitant. Citic Securities anticipates a moderate 0.3 percent increase in customer rates this year, with manufacturing facility rates not turning up in environment-friendly, yet just tightening their decrease to 1.4 percent in 2025. It warned that demand-side stress linger, mentioning a having a hard time real estate industry and weakening worldwide need for Chinese exports.

“To see a sustained recovery in PPI and a return to positive growth, more supply-side policies in terms of ‘de-involution’ may be required,” Citic Securities claimed, asking for federal government steps to resolve too much commercial competitors and overcapacity.

For currently, China’s financial overview continues to be dirty, with seasonal costs incapable to mask much deeper architectural difficulties.

&w=696&resize=696,0&ssl=1)