New Delhi: Gold is thought about a safe house for capitalists that depend a lot more on conventional financial investment tool. The yellow steel has normally seasoned significant variations with higher pattern in cost throughout the Diwali celebration, as it is a time when many individuals in India acquisition gold for its auspiciousness.

The social relevance of gold throughout Diwali guarantees that there is a constant degree of need. However, a much deeper evaluation discloses that the volatility observed throughout this duration is greatly driven by more comprehensive international macroeconomic elements instead of Diwali itself.

Amit Goel, Co-Founder and Chief Global Strategist at Pace 360 in an unique meeting with Reema Sharma of Zee News shared the expectation on gold, exactly how the yellow steel has actually made out in the last ten years.

1. How much return has gold given up the last ten years?

.

.

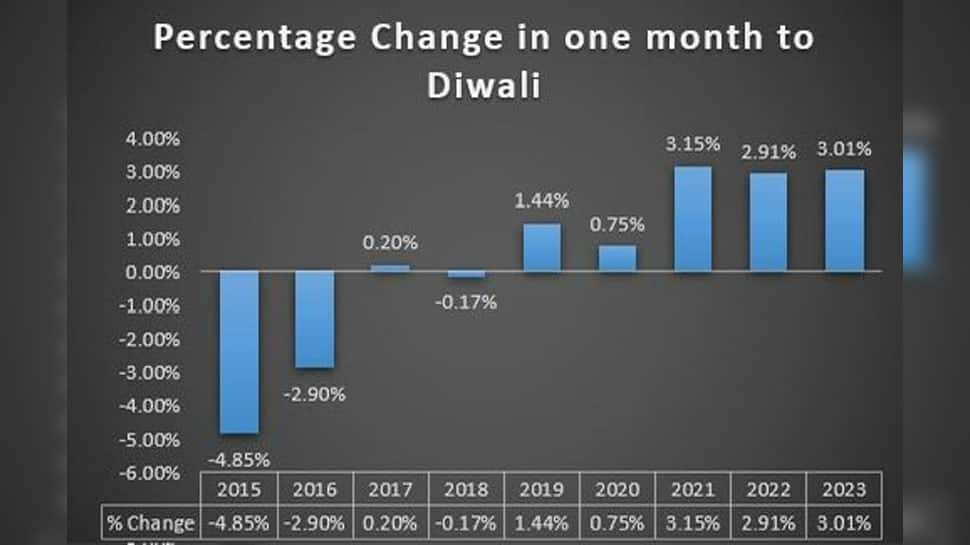

Gold has traditionally seasoned sharp volatility in the pre-Diwali duration. However, a lot of this is not as a result of Diwali yet as a result of international macro elements. Over the last ten years the ordinary return in the one month to Diwali has actually been just gently favorable. Most of that favorable return is as a result of last 3 years when gold went up wisely in the run-up toDiwali

.

.(* )each of the last 3 years gold made a base in between

In and August and all-time low was made as a result of sharp increase in United States bond returns and the October index. Dollar, a research study of last ten years suggests that Hence is no more a large impact on global gold costs and the exact same is affected by massive property courses like Diwali bond returns and the Global.

.

.

Dollar

.

2. gold still a profitable financial investment alternative, taking into consideration various other conserving tools?Is

.

. can be a profitable financial investment, relying on market problems, rising cost of living, and specific objectives.

Gold works as a bush versus rising cost of living by maintaining worth throughout cost boosts and works as a safe house throughout market volatility. It gold in a profile assists branch out threat, as it normally reveals reduced connection with supplies and bonds. Including alternate financial investments like supplies, bonds, realty, and cryptocurrencies might use greater returns as they feature various dangers. While, gold is deemed a much better lasting financial investment, whereas supplies may produce greater temporary gains.

.

.(* )3.(* )is the expectation on gold for this monetary?Generally

.

.

.What gold cost rally is driven by geopolitical unpredictability and capacity of more rates of interest cuts. the residential front, need for physical gold is anticipated to rise as a result of the imminent

and wedding celebration period. Recent anticipate gold costs to diminish over following couple of months as it is very overheated as a possession course prior to resuming their lasting bull run.On