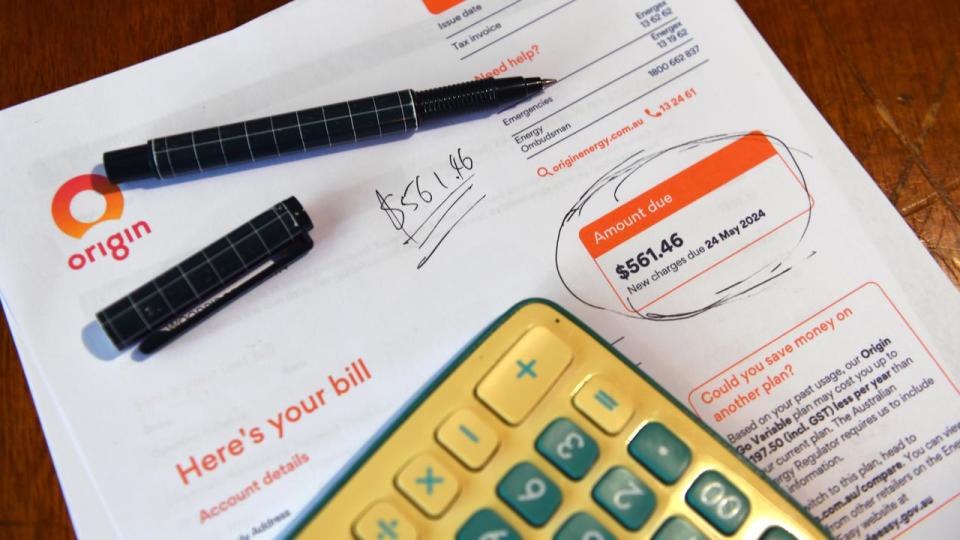

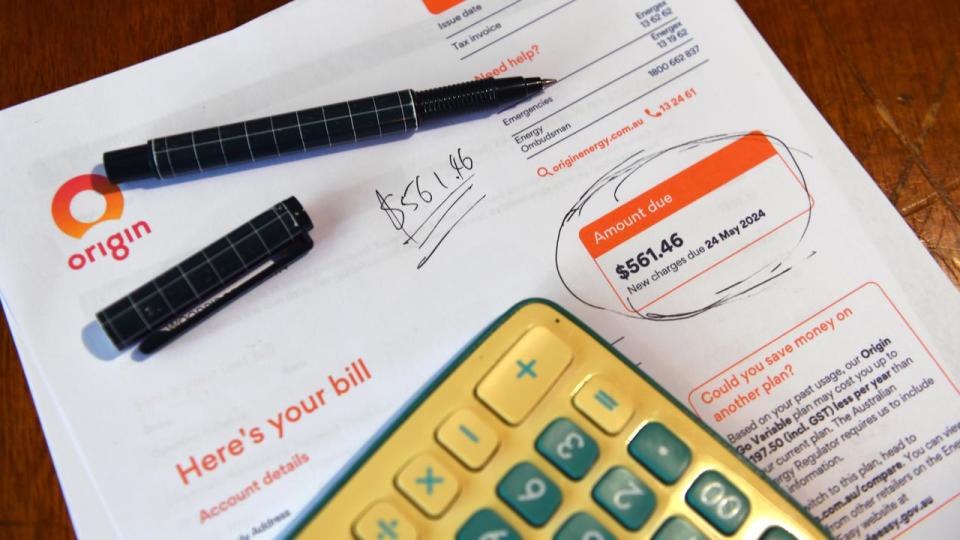

A large decrease in power costs has actually decreased regular monthly rising cost of living back right into the reserve bank’s target, as home loan owners hold on to hopes of a price cut.

Inflation cooling down to 2.7 percent in the year to August, below 3.5 percent in July, brought it to its floor in almost 3 years, mainly off the rear of power aids.

Federal and state power aided bring power expenses down 17.9 percent, the biggest yearly autumn on document.

Electricity expenses would certainly have leapt 16.6 percent given that June 2023 without the refunds, according to the Australian Bureau of Statistics.

While rising cost of living is tracking in the best instructions, it’s not all excellent information for home loan owners, with the cut mean – a number that removes uneven or momentary costs adjustments – can be found in at 3.4 percent in August.

Although below 3.8 percent in July, it’s still over the Reserve Bank’s target band and the reserve bank pays even more focus to this scale of underlying rising cost of living when making prices choices.

The yearly cut number left out the drops in gas and power.

The volatility of the regular monthly number made it much less prominent than the quarterly one, next due in October, RBA guv Michele Bullock stated.

Alcohol and cigarette costs climbed 6.6 percent, food and drinks 3.4 percent, and real estate 2.6 percent in the year to August, however transportation dropped by 1.1 percent.

Fuel sank 7.6 percent.

Interest price walks have actually looked for to take the wind off the rear of the economic situation and slow-moving rising cost of living however a price cut isn’t anticipated up until 2025 after the RBA held prices at 4.35 percent on Tuesday.

National Australia Bank elderly economic expert Tapas Strickland anticipated the heading regular monthly number will not make any kind of distinction to the probability of the reserve bank reducing prices

He anticipates the initial cut in May, while economic experts at ANZ and Westpac have actually penned one in for February.

&w=100&resize=100,70&ssl=1)